Circle is the issuer of USDC Stablecoin, which is 100% collateralized by real assets such as dollars and government bonds. Circle is headquartered in the United States and is licensed to support the Crypto industry.

Circle recently developed the Cross-chain Transfer Protocol, also known as CCTP, which is a Cross-Chain protocol that allows USDC to flow naturally across blockchains, unifying liquidity in Web3 and simplifying the user experience. use. So what is CCTP? Let’s find out together in the article below.

To understand more about Cross-Bridge, you can read the following articles:

- What is LayerZero? LayerZero Cryptocurrency Overview

- What is Wormhole? Wormhole Cryptocurrency Overview

- LayerZero & Wormhole: Some people are eight ounces, some people are half a pound

- Wormhole Ecosystem: Backed by Whales & All in on the Solana Ecosystem

- LayerZero Ecosystem: The Number of Projects Is Constantly Growing. Will It Open Up A New Trend?

- What is Axelar Network (AXL)? Axelar Network Cryptocurrency Overview

Overview of CCTP Technology

What is CCTP?

Cross-chain Transfer Protocol, also known as CCTP, is a Cross-chain protocol that allows USDC to flow naturally across blockchains, unifying liquidity in Web3 and simplifying the user experience.

The protocol uses cross-chain message passing platforms such as LayerZero, Wormhole, LIFI, Celer, Multichain, Hyperlane, Router Protocol, Socket, Axelar,… And leverages Circle’s USDC issuance infrastructure to create protocol for transferring USDC back and forth between chains according to the Mint and Burn mechanism.

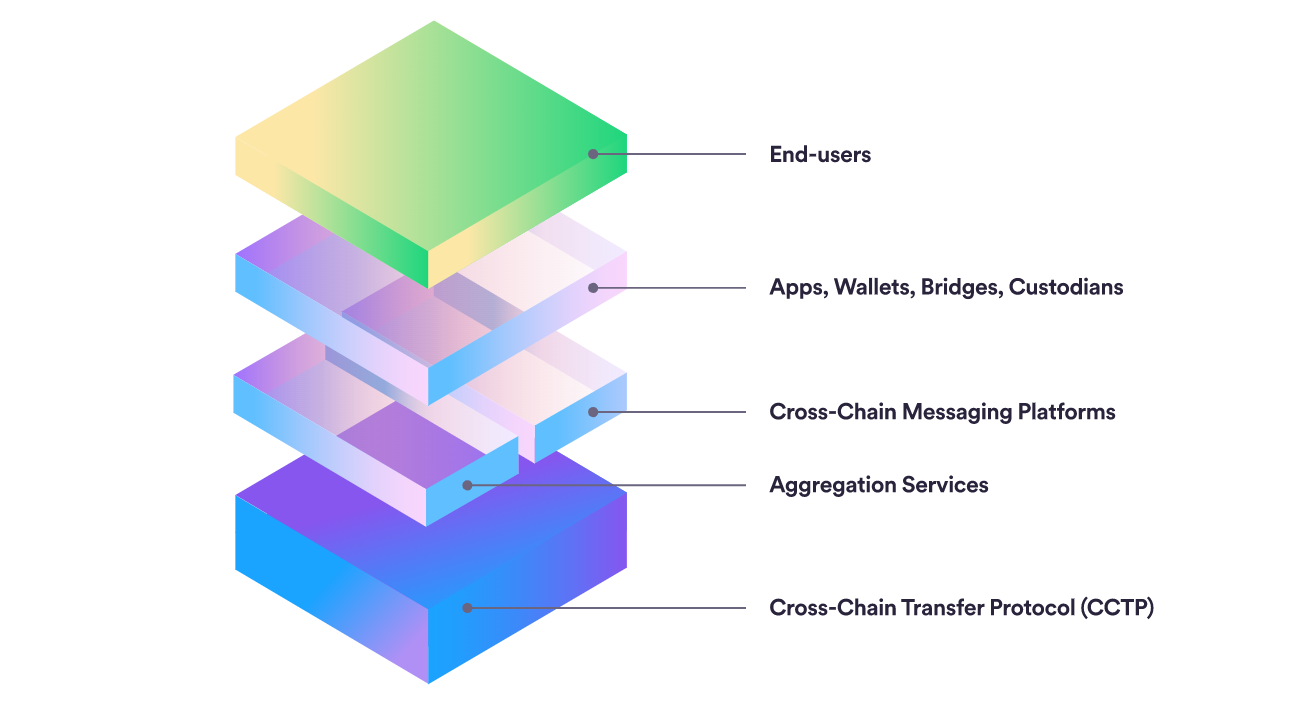

Architecture of CCTP

- End-users: End users need to transfer assets across the chain or interact with dApps using Cross-chain Transfer Protocol.

- Wallet, Bridge, Customers, Apps: dApps integrate the SDK provided by CCTP to easily integrate CCTP and create solutions that optimize user activities.

- Cross-chain Messaging Platforms: This layer is platforms that support cross-chain message passing such as LayerZero, Wormhole to support passing messages back and forth between chains.

- Cross-chain Transfer Protocol (CCTP): The layer that will receive the dApp’s USDC to send to the Smart Contract USDC on the source chain for burning. Or vice versa, the Smart Contract USDC on the destination chain will Mint USDC and send it to CCTP for transfer to the dApp. Thanks to this infrastructure layer built by Circle to monitor and confirm, the money transfer system is secure and safe.

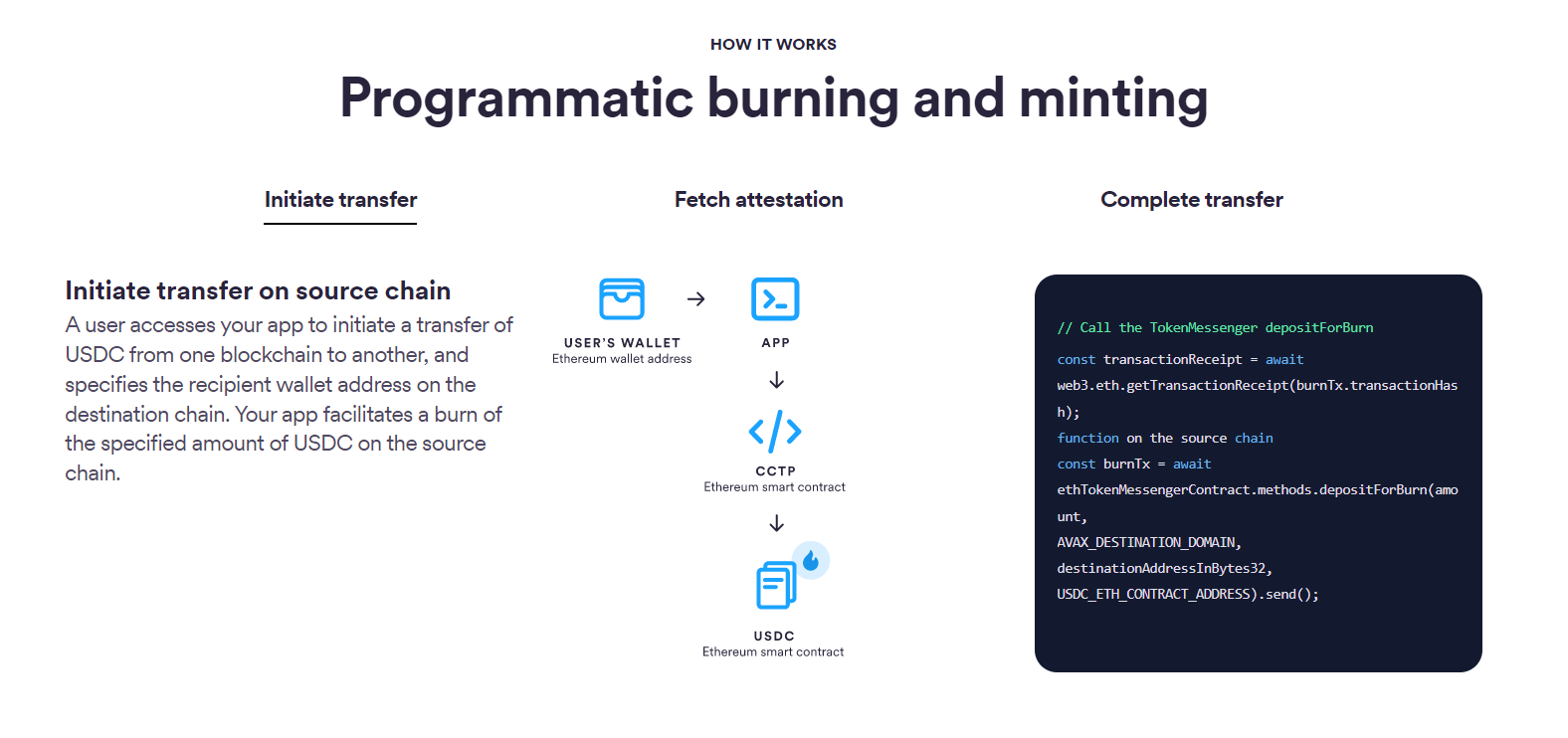

Mechanism of action

The operation of the Cross-chain Transfer Protocol to support the transfer of USDC across the chain is very simple and easy to understand. I will concretize this process in… the following steps:

- Step 1: The user’s wallet interacts with the dApp interface on the source chain and transfers USDC to the dApp.

- Step 2: The dApp will continue to transfer users’ USDC to Smart Contract CCTP on the source chain.

- Step 3: CCTP forwards USDC to USDC Smart Contract and burns that amount of USDC on the source chain.

- Step 4: The cross-chain message relay platform will confirm the amount of USDC burned on the source chain and send the message to USDC Smart Contract on the destination chain.

- Step 5: USDC Smart Contract on the destination chain will Mint the exact amount of USDC burned on the source chain and transfer it to Smart Contract CCTP.

- Step 6: CCTP will forward USDC to the dApp.

- Step 7: The dApp will send USDC to the user’s pre-announced destination chain wallet address.

Application of CCTP

CCTP has been combining with cross-chain message passing protocols to build bridges that enable cross-chain asset transfers. For each communication protocol, CCTP will combine to build a different bridge.

Each bridge used by each different communication protocol will have different characteristics, demonstrating the advantages and disadvantages of each communication protocol. The factors that are always fixed regardless of the bridge of any communication protocol are network fees, USDC contract fees. Each communication protocol will have a different protocol fee, security level, and speed.

In addition to the CCTP application for cross-chain money transfer, there are other applications such as cross-chain purchases and cross-chain swaps. dApps can integrate CCTP as cross-chain communication protocols to build user solutions such as:

- Borrow-Lend Protocols: Address fragmented liquidity by enabling USDC borrowing and lending across chains.

- Decentralized Exchanges: Improves trade execution by allowing USDC holders on a separate chain to provide liquidity.

- Yield Aggregators: Make yield markets more efficient by deploying USDC liquidity across chains.

Advantages and Disadvantages of CCTP Technology

Advantage

Some of the advantages of CCTP technology include:

- Infinite liquidity on chains connected to CCTP.

- High security through the CCTP layer developed by Circle, which is the relay layer and monitors all activities during the money transfer process.

- Transactions do not slippage, which is a big problem that protocols in DeFi have not yet been able to solve.

Defect

Besides the advantages that can help change the entire face of the Crypto market, CCTP technology also has some disadvantages such as:

- Not completely decentralized yet because CCTP Smart Contract and USDC Smart Contract are managed by Circle.

- If Smart Contract is attacked, causing Mint USDC to be uncontrolled, it will lead to protocols and bridges being affected, and especially USDC, there is a possibility that USDC will lose its Peg.

Combined With Some Popular Bridge Platforms

- Stargate: In the case of CCTP connecting LayerZero to create a cross-chain USDC transfer bridge, we can compare it with Stargate. Compared to Stargate, CCTP stands out with deep liquidity, no price slippage and much cheaper fees. But Stargate will have the advantage of being integrated across multiple networks and supporting cross-chain asset exchange.

- Portal: In the case of CCTP connecting Wormhole to create a cross-chain USDC transfer bridge, it can be compared to Portal Bridge which also uses the Mint and Burn mechanism. CCTP will be more prominent with the point that it will let users use the original USDC asset instead of having to wrap it like Portal. And wrapped assets will not be widely applicable. In addition, CCTP will have cheaper fees than Portal.

Personal Projection

At the user level, Circle’s CCTP is a great solution, solving major problems in the Cross Bridge segment. The product gives users a very good experience with low fees, no price slippage and unlimited liquidity. With such an optimal product, surely the upcoming Dex cross-Chain or Bridge will integrate CCTP and most people will use CCTP.

Circle created CCTP with the original purpose of supporting DeFi and its users. But looking further, Circle is ambitious to take over the market share of Stablecoins and soon USDC will take over the number 1 position of USDT. When CCTP succeeds and becomes an indispensable product in the market, that ambition will certainly succeed.

Summary

Cross-chain Transfer Protocol is the optimal solution in Cross-Chain Bridge. Brings many benefits to users and dApps. In addition, Circle develops CCTP with the ambition of making USDC the largest Stablecoin in the Crypto market. Hope this article helps people understand what CCTP is?