What is Astroport? Astroport is an AMM platform that allows users to buy and sell different types of tokens built and developed on the Terra ecosystem. So what is special about Astroport? Let’s find out with Weakhand through this article.

For a clearer view, people can refer to some of the articles below:

- What is DeFi? All About DeFi

- What is Decentralized Exchange (DEX)? The Role of Decentralized Exchanges in DeFi

Astroport Overview

What is Astroport?

Astroport is an AMM platform that allows users to buy and sell different types of tokens built and developed on the Terra ecosystem. In addition, Astroport is also supported by one of the major investment funds in the market, Delphi Digital.

The Astroport difference

Currently, Astroport not only provides users with a place to buy and sell tokens, but Astroport also offers passive ways to make money through its Pools. Currently Astroport is supporting 3 main Pools:

- Constant Product pools

- StableSwap Invariant formula pools

- Liquidity Bootstrapping (LBP) Pools

Constant Product pools

This is a liquidity pool model with a similar structure to the Uniswap V2 liquidity pool model. Constant Product pools are easy to create and require little effort to manage. In this Pool, everyone will add 2 tokens to form a trading pair to become a liquidity provider for the Pool.

Although it is easy to use, users have to face temporary loss (Impermanent Loss) because Tokens can decrease in price during the liquidity provision process, and liquidity providers cannot optimize usage. capital by holding this Token number to participate in transactions to make profits.

StableSwap Invariant formula pools

StableSwap Invariant formula pools is a liquidity pool with the same structure and operating mechanism as the liquidity pools of the Curve Finance platform. This pool is supported by Astroport to serve Traders who want to trade Tokens with a 1:1 exchange rate such as Stablecoins, Synthetic, Warrped Tokens,…

Providing such fixed value Tokens also helps liquidity providers avoid Impermanent Loss.

Liquidity Bootstrapping (LBP) Pools

This is a product that Astroport’s team got the idea from Balancer’s LBP. When a user wants to create a market for a new Token.

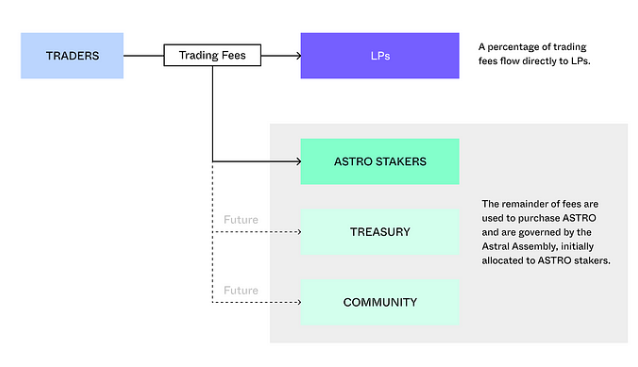

Transaction fees on Astroport

The transaction fees allocated by Astroport to the Pools are as follows:

- Constant Product Pool (0.3%): 0.2% of the fee will be divided between Liquidity Providers. 0.1% will be divided into Astral Assembly (Astroport DAO), this 0.1% will be used to buy ASTRO and then staked in xASTRO and vxASTRO Pools.

- Stableswap Invariant Pool (0.05%): 0.025% of the fee will be shared with Liquidity Providers, the remaining 0.025% will be sent to Astral Assembly.

- Liquidity Bootstrapping (LBP) Pools: This Pools are deployed independently so the fees will be set by the Pool creator and there will not be any fees sent to Astroport DAO in this case.

Astral Assembly

Astroport is governed by Astral Assembly (Astroport DAO). xASTRO holders will have the right to vote on proposals, disbursements to Astral Assembly or through upgrades to Astroport smart contracts.

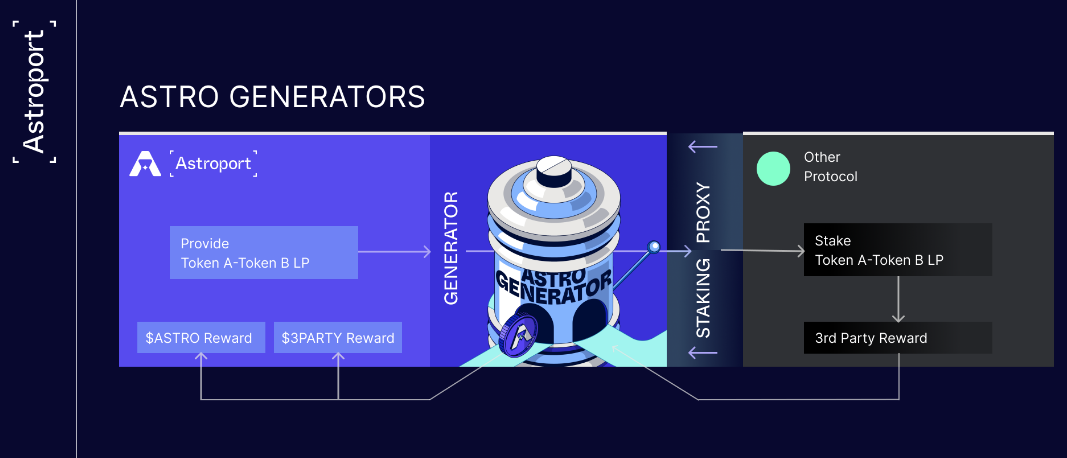

Astroport Generators

Here Astroport offers a pretty good strategy and product that helps users earn more profits from providing liquidity.

- Step 1: Users deposit LP tokens into ASTRO Generator

- Step 2: ASTRO Generator will automatically deposit these tokens into the 3rd party Staking system via Staking Proxy.

- Step 3: When a user needs to claim a reward, Staking Proxy will receive the Staking reward from a third party and send it to the user.

- Step 4: ASTRO Generator will also send an amount of ASTRO tokens to users.

In this case, users do not need to send their Tokens to many platforms, which would take up a lot of their time. This form is called Dual Liquidity Mining.

Development roadmap

Update…

Core Team

Update…

Investors

Update…

Tokenomics

Basic information about ASTRO token

- Token name: Astroport

- Code: ASTRO

- Blockchain: Terra

- Token classification: CW20

- Contract address: terra1nsuqsk6kh58ulczatwev87ttq2z6r3pusulg9r24mfj2fvtzd4uq3exn26.

- Total supply: 1,100,000,000

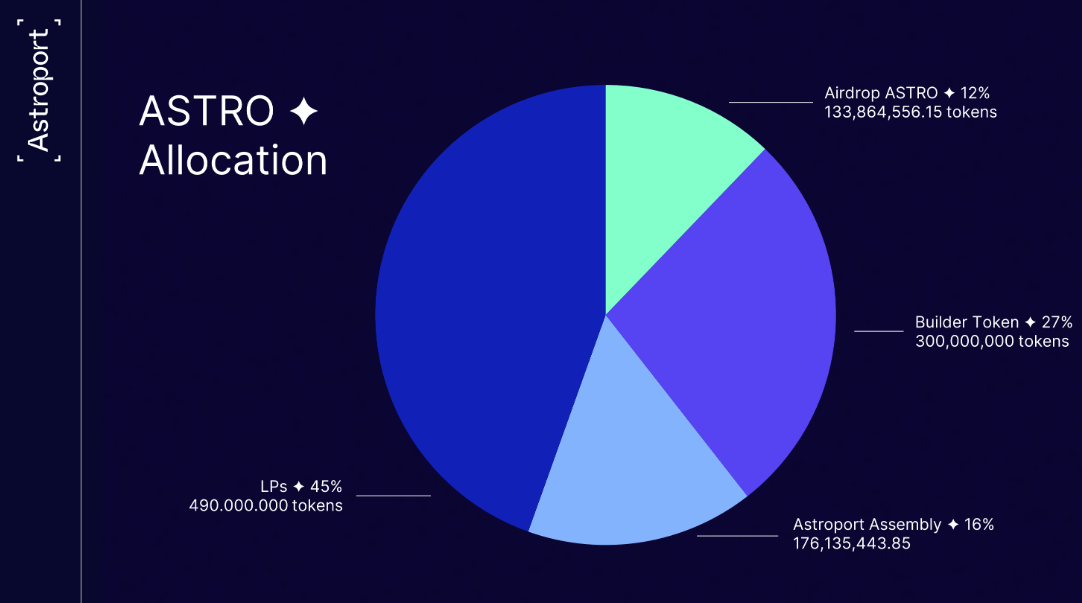

Token Allocaiton

Token Allocation Astroport

- Airdrop: 12%

- LPs: 45%

- Builder Token: 27%

- Astroport Assembly: 16%

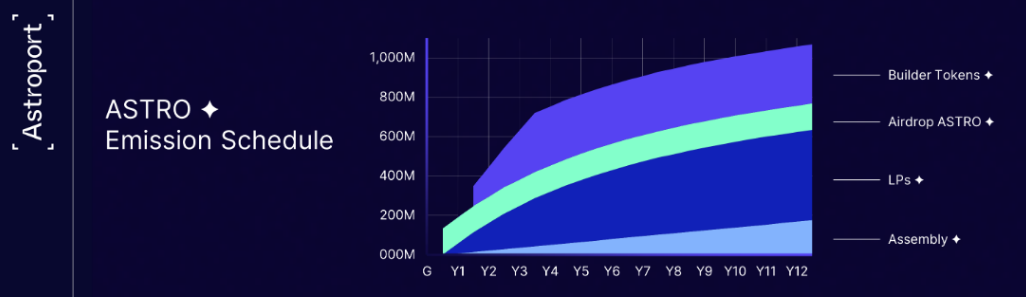

Token Release

Token Release Astroport

Token Usecase

Astro’s Hodler can use tokens to do two main things.

- Staking ASTRO in xASTRO pool: ASTRO holders can stake ASTRO into the xASTRO pool to receive xASTRO tokens, gain management rights and receive a portion of the transaction fees (take half of Astral Assembly’s transaction fee rate).

- Lock xASTRO to vxASTRO pool: xASTRO holder can lock xASTRO in vxASTRO pool to receive vxASTRO points, activate management rights and receive an additional portion of transaction fees (take the remaining half of Astral Assembly’s transaction fees). The longer the lock is, the more vxASTRO the user will receive, equivalent to large Voting Power.

Exchanges

Currently, users can buy and sell ASTO on CEX exchanges such as Coinex and DEX exchanges such as: Kujira Fin, AstroPot V2.

Astroport Project Information Channel

- Twitter: https://twitter.com/astroport_fi

- Website: https://astroport.fi/en

- Telegram:

Summary

Above is general information of the Astroport project. DEX is an important product in any ecosystem, it is necessary for the development of all ecosystems. Through this article, I hope everyone has the necessary information before making an investment decision for themselves. Weakhand team will try to update everyone with the latest information about the project.