Revenue is one of the factors that determine whether projects will experience a crypto winter in this cycle or not. So where does the revenue of projects come from and where can we check project revenue? Everyone, please join us in referring to the article below!

Where Does Project Revenue Come From?

What is revenue?

Revenue (English: Revenue) is the cash flow that the project earns from user activities such as transactions, purchases, loans,… on the project platform or the cash flow coming from Projects sell products and it comes from users using the products.

Why does the protocol need revenue

DeFi protocols are similar to non-traditional businesses and companies, they also provide products to users similar to business activities outside of traditional financial markets. So the fact that a protocol is working effectively means that the protocol has users and revenue that proves it is working effectively.

Besides, protocols still have operating costs such as development team salaries, developers’ salaries, marketing costs, etc. Although in the beginning the project can sell a portion of tokens in the tokenomic supplement. It is still possible to maintain protocol development, but the tokens cannot be sold forever, so in the long term the project must generate revenue to maintain the project and develop new products.

In short, the protocol in DeFi is similar to a company outside TradFi that wants to survive, it must generate revenue and profits.

Where does project revenue come from?

In the Crypto market, there are many types of protocols in different segments such as DEX, Lending & Borrowing, Derivatives, Yield Farming, Liquid Staking,…

- AMM: The revenue of AMMs mainly comes from transaction fees. Transaction fees are usually 0.3% but can be higher or lower depending on the protocol with different strategies.

- Lending & Borrowing:

- Derivatives: Comes from fees for opening leveraged orders.

- Infastructure: Projects in the infrastructure segment have revenue coming from projects using their services. For example, projects must pay USDC for Chainlink’s service.

- Liquid Staking: Revenue of projects in this segment comes from user service fees.

As mentioned above, projects in DeFi are also continuously expanding their products to gain more users and revenue. For example, AMMs must deploy additional areas such as Launchpad, Prediction, Lending & Borrowing,… This also happens with different projects in different areas.

Projects that continuously launch new products to attract users and generate revenue or projects that can develop multichain to search for new lands ultimately for the purpose of having more people. and revenue.

In addition, some projects will have revenues that users rarely pay attention to and are relatively difficult to check, for example: Lending & Borrowing projects also have fees for liquidating user assets.

Criteria for evaluating whether a project is operating effectively

For each project we have different criteria to evaluate whether it is working effectively or not. Let’s go into the details of each piece together.

- The project’s TVL is growing, flat or declining. Reason?

- Is the number of active users per day small or large? Is there growth?

- Does the project regularly update and improve the product? After each update, is there a large number of supporters on social networks? Is the number of daily users increasing?

Some common criteria for all projects for us to apply and then we will go to each criterion and the different pieces of the puzzle:

With projects under DEX array We have some criteria as follows:

- How does the transaction volume of that project compare to competitors in the same chain and industry? Is it big? Is it maintained regularly?

- Are the project’s liquidity pools thick? Is there a lot of price slippage when trading? If the transaction price slips up a lot, it means that the LP is abandoning the project and if the price slips up a lot, of course users will not use this product.

For projects in the Lending & Borrowing segment, there are some criteria as follows:

- What is the total loan amount/Total amount in the protocol? A low percentage shows that the protocol is not working effectively when there are many lenders and few borrowers.

- How much collateral does the project support and what is the interest rate compared to competitors in the same industry?

With projects in the infrastructure segment, we find out whether the project has many customers or not? What is the % of market domination?

Where to Find Project Revenue?

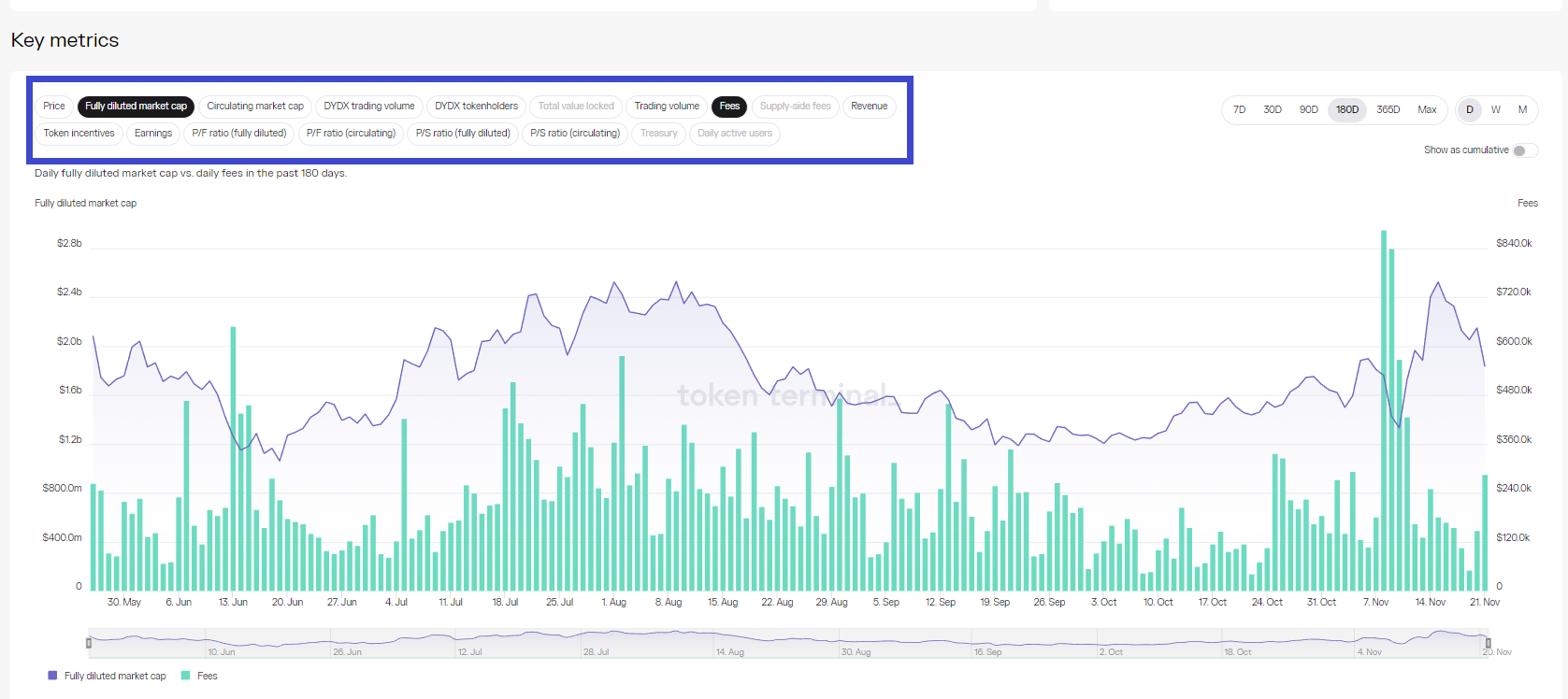

Usually I will check the project revenue at the website: Token Terminal On this website you can not only check the project protocol but we can check many other criteria. Some important criteria include:

- Total Value Locked: Total assets locked in the protocol.

- Volume: Trading Volume (For DEX, Derivatives it is Trading Volume, for Lending & Borrowing it is Borrow Volume,…)

- Revenue: Protocol revenue.

- Treasury: Protocol budget,

- Daily Active Users: Number of active users per protocol day.

Currently, Token Terminal does not support many different blockchains, so if you cannot find projects, you can check information about TVL, Transaction Volume,…

Flexibility in Assessment

At the present time, when the crypto market is in a cold winter, if the projects you are investing in have revenue and the number of daily users still growing steadily, that would be great. But if the project where you are observing all the parameters of TVL, Revenue or Daily active users are decreasing, we will evaluate on the following criteria:

- Does the project regularly update and upgrade products?

- Does the project launch new products? What was the community’s reaction like?

- Was the project successful in raising capital and will that money help them survive the winter?

Market Reality

According to some of the projects I am monitoring at the present time such as AAVE, Maple or Goldfinch, these projects also generate revenue, but according to the quarterly financial reports of these projects, they all report negative profits. because they incur more costs than the revenue they generate.

Currently, most of these projects rely on money from investment funds poured into them. As for projects like Uniswap or Maker DAO, it seems they are making real profits, but this information cannot be verified at this time, I only speculate based on their business activities.

Summary

Revenue is an extremely important factor for projects in the downtrend. It can be said that money is the blood of business, then it is similar to DeFi projects. The fact that projects have revenue in a downtrend proves that the project still has certain appeal to the market.

I firmly believe this factor will be one of the extremely important factors in choosing projects to observe in 2022 and 2023.