What is EthereumPoW? EthereumPoW is a hard fork of Ethereum, born after ETH 2.0 and retaining its old characteristics. So what is special about EthereumPoW? Let’s find out with HAK Research in this article.

To better understand what EthereumPoW is, people can refer to some of the articles below:

- What is Proof Of Work (POW)? Advantages, Disadvantages and Core Operating Mechanism of Bitcoin

- What is Ethereum? All About Ethereum

Overview of EthereumPoW

What is EthereumPoW?

EthereumPoW is a hard fork of Ethereum, born after ETH 2.0 (The Merge Event) and retains its old characteristics. Specifically, after The Merge event was successfully held, Ethereum was switched to operate by the Proof of Stake mechanism. This hard fork version will continue to operate under the Proof of Work mechanism.

It was initiated largely by mining groups in China, Justin Sun, and a number of Crypto exchanges based in this country such as MEXC, Gate.io or Poloniex. After a while, the Crypto community gradually accepted the parallel existence of these two different Ethereum chains. See it as a speculative opportunity.

What is EthereumPoW?

Working mechanism of EthereumPoW

1. Hashrate parameters

With the POW mechanism still retained, the number of primary concern is the hashrate rate and rewards for miners. A simple explanation of hashrate, it reflects the mining performance of mining hardware and is measured in seconds.

Each solution performed on the network is called a hash. That mining efficiency is measured in h/s. The parameters are converted similarly to the following:

- 1 Kh/s = 1 000 h/s

- 1 Mh/s = 1 000 Kh/s = 1 000 000 h/s

- 1 Gh/s = 1 000 Mh/s = 1 000 000 Kh/s = 1 000 000 000 h/s

- 1 Th/s = 1 000 Gh/s = 1 000 000 Mh/s = 1 000 000 000 Kh/s = 1 000 000 000 000 h/s

Solution roughly translated as calculation solutions or algorithmic solutions. A GPU or mining device has different computing parameters. From there, Miners or Users can consider and build suitable, high-performance equipment to participate in the mining network to earn profits. For small individuals, we can preview mining profits with the number of available devices through the calculation website 2CryptoCalc or Whattomine.

ETHW uses the ethash algorithm. As of 2023, ETHW has a few on-chain parameters as follows:

- Network hashrate: 9.2 TH/s

- Network difficulty: 127.55 T

- Block reward: 2 ETHW

- Block time: 13.87 Sec

- Daily emission: 12459 ETHW

- Return 1 Mh/s: 0.00135 ETHW

Everyone can refer to hashrate.no or ethwmine to update hash rate in the fastest and most accurate way.

2. Notable features of EthereumPoW

EthereumPoW inherits the old features of Ethereum before The Merge event. Besides, it also has a few more differences such as:

- Removing the EIP-1559 mechanism will cause Miners to have more Block rewards but will subject ETHW to higher inflation.

- The Core team will be more decentralized and anonymous than its predecessor. The advantage is that ETHW is less controlled by the leader, but the disadvantage is that scammers easily appear.

- Open source client nodes, mining software, and wallet applications to support the network.

- Get support from exchanges and they will also get full hash rate.

- The original assets on Ethereum are duplicated at a 1:1 ratio, however, due to not receiving support from the issuance team of Circle, Tether, Chain Link, Aave…, they are all worthless and ETHW network developers will need to rebuild from scratch.

- ETHW Bridge allows users to transfer assets from Ethereum to EthereumPoW. However, Tether and Circle do not support this chain, once users bridge to EthereumPoW they will not be able to bridge again.

3. EthereumPoW ecosystem

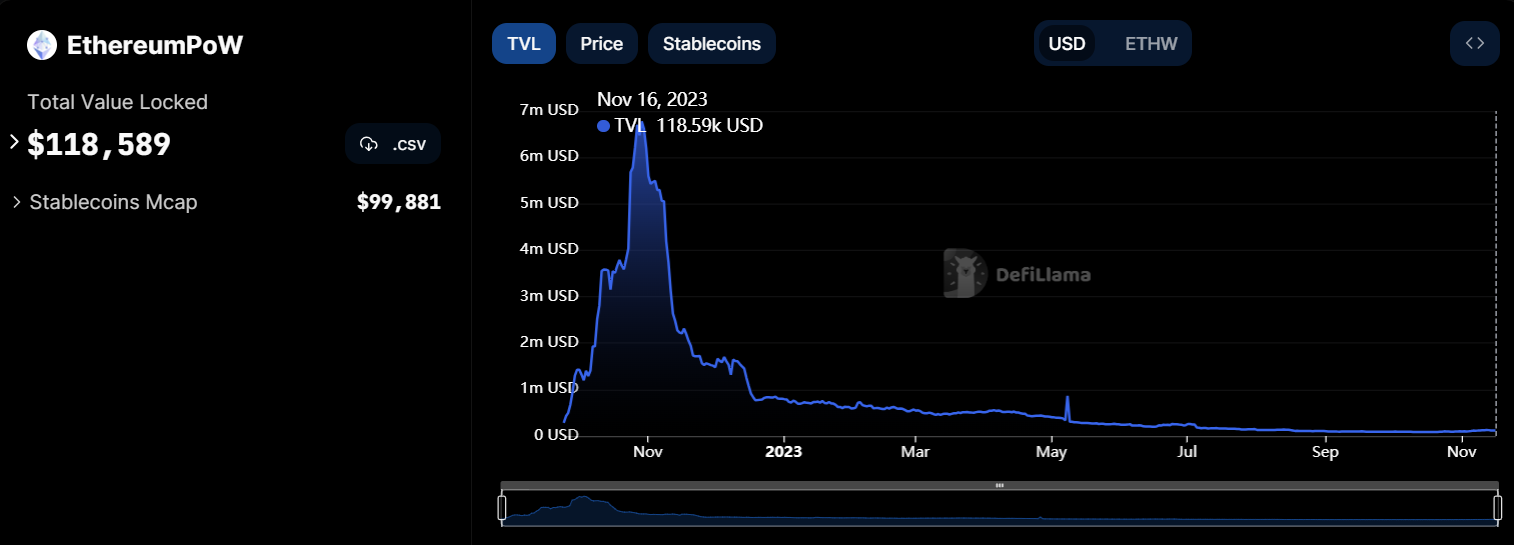

Bright and then fade, that’s what can be said about the EthereumPoW ecosystem. By October 2022, the ecosystem with full features such as Dexes, Yield, Lending, NFT has a not too bad amount of liquidity and TVL. But now, it seems that all of them have stopped working. Especially there is no User.

TVL EthereumPoW

Development Roadmap

Like some other hard fork versions, these chains are often born spontaneously and do not really have a clear direction. The project has never announced an official roadmap.

Core Team

Miner ChandlerGuo

As mentioned above, this is a project with anonymous and decentralized developers, so they only introduce that they belong to the Pro-PoW community. The person who stood out to promote and call for the council was him Chandler Guo. In essence, he is just a famous miner in China with many years of experience mining coins.

Investor

EthereumPoW has no investors.

Tokenomics

Basic information about ETHW token

- Token Name: EthereumPoW

- Ticker: ETHW

- Blockchain: EthereumPoW

- Standard: Native token

- Total Supply: 107,818,999 ETHW

Token Allocation

All ETHW is allocated to users holding ETH on wallets or on exchanges during the snapshot before The Merge event takes place at a ratio of 1:1, except for cases staking on Binance or Lido Finance. This also reduces some of the ETHW supply.

Token Release

ETHW has been fully allocated to users who own ETH at the time of snapshot. Besides, as a mining coin, 12,459 ETHW will be born every day. Each year, the number will reach more than 4.5 million ETHW available on the market.

Token Use Cases

- Pay transaction gas fee.

- Participate and buy and sell on EthereumPoW’s marketplace and dApp.

- Miners are rewarded for participating in transaction validation and network security.

Exchanges

Currently ETHW is present on exchanges: Kucoin, OKX, Bybit, HTX, Gate.io, MEXC….

EthereumPoW Information Channel

- Website: https://ethereumpow.org

- Twitter: https://twitter.com/EthereumPoW

- Telegram: https://t.me/ethereumpow_official

- Discord:

Summary

EthereumPoW is a hard fork that marks a major transformation for Ethereum after The Merge event. When it first launched and introduced a new ecosystem to the Crypto community, it attracted a large number of users at that time. However, up to now, it has gradually cooled down and gone into oblivion.

In the context of the having BTC event gradually approaching in April 2024, it may still have some growth opportunities as it is a PoW coin. More specifically, large exchanges like Binance are still launching mining pools from the time ETHW launched, and a large amount of ETHW is held by whales when it is Air Dropped 1:1. Maybe, that small bright spot will be the driving force for price increases for ETHW in the near future.