During the ETHDenver event, we received too much positive news, especially the big players in the crypto market simultaneously launching new products. Each giant has different products and approaches to the market.

So in this article, everyone joins us in contemplating what big guys like Coinbase, Metamask or Uniswap are really planning behind the products they just announced.

Coinbase Launches Base Blockchain

Overview of Base Blockchain

February 24, 2023: After teasing with Optimism, Coinbase also officially launched Base Blockchain with the following features:

- Base Blockchain is a Layer 2 built on Ethereum, so Base inherits security and decentralization from Ethereum.

- In solutions for Layer 2, Base Blockchain will develop towards Optimistic Rollup instead of zkRollup.

- Base Blockchain built on Op Stack can be considered a fork version of Optimism and all future technological upgrades of Base will have to rely on Optimism.

In fact, Base Blockchain’s development based on Optimism’s OP Stack also benefits Optimism when Base Blockchain commits that a portion of the fee revenue from the platform will be shared with Optimism Collective.

Why did Coinbase develop Base Blockchain?

Diversify revenue sources

During the period from 2020 until now, we have seen that Coinbase’s business loss or profit depends on the market and especially the transaction fees on the Coinbase exchange. When the market grows strongly, revenue and profits on Coinbase grow strongly and vice versa. This is essentially true for all markets, but perhaps Coinbase is too dependent on one source of revenue.

Therefore, the launch of Layer 2 helps Coinbase have a more diverse revenue source without spending too much effort and can immediately take advantage of hundreds of millions of users on its own platform similar to the way BNB Chain is doing.

Developing Layer 2 to generate revenue, everyone imagines that in the operating mechanism of Layer 2, there are positions such as Squencer – the person who arranges transactions into a block and places them on Layer 1, then this position is can take advantage of their power to arrange different transactions to gain maximum profits, be it transactions with higher fees, arbitrage transactions,… or like Proof-er – evidence maker. All of the above positions can generate revenue of up to tens of millions of dollars each year.

At the present time, Squencers are mostly self-deployed by Layer 2s, so Layer 2s are quite concentrated at this point, but in the future, the possibility is still relatively far away to be able to decentralize the Squencer position. . And that’s one of the ways you can make money from Layer 2!

Optimize resources

Coinbase has a customer base of up to hundreds of millions of customers (according to the tests of some large and unverified KOLs in the market), however, with Coinbase being the most reputable Crypto exchange in the US, the That number is completely within their capabilities, so it is understandable that they have an additional product ecosystem to convert users from CeFi to DeFi.

The important thing here is whether Base Blockchain is an ecosystem that can both attract users to come, use and retain them the way Arbitrum is doing?

Blockchain development, Decentralization is the trend

Coinbase is not the first company to develop its own blockchain platform, the most successful before that was Binance with Binance Smart Chain recently changed to BNB Chain – up to now BNB Chain is 1 of 3 blockchains. The platform has the highest TVL in the crypto market. Besides, Okex – a reputable crypto exchange, has also just merged their blockchains and in the future there will certainly be many exchanges building their own blockchains.

Surely Coinbase, with its position, will not let other exchanges surpass in key areas like this!

When centralized platforms like 3AC, Celsus, Voyager, FTX collapsed or giants like Binance and DCG faltered, everyone flocked to DeFi. We will not claim that DeFi will replace CeFi, but having a choice between DeFi and CeFi helps users more comfortably participate in the crypto market. In the future, DeFi will gradually eat CeFi’s piece of cake, so Coinbase building a Layer 2 blockchain is also a trend and a way to save yourself when a black swan occurs.

Base Blockchain’s smooth start

Although newly launched, the number of public projects that will be deployed on Base Blockchain is already relatively large such as Rainbow Wallet, Ribbon, Layer Zero, Axelar, Magic Eden,…

Uniswap Launches E-Wallet

Overview of the event of Uniswap launching its own e-wallet

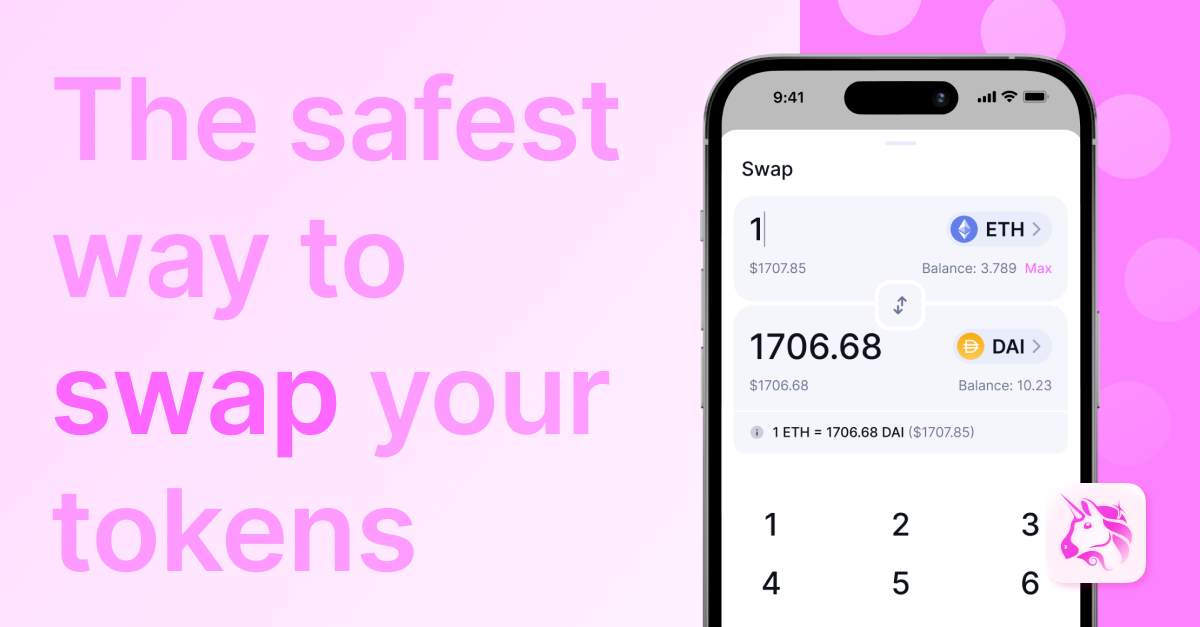

March 3, 2023: During the ETHDenver event, Uniswap officially launched Uniswap Mobile Wallet. Similar to other popular wallet platforms, Uniswap’s wallet has the following features:

- Buy and sell coins/tokens on different blockchains such as BNB Chain, Polygon, Ethereum,… or Layer 2. Send and receive ERC 20 types

- Follow your favorite ERC 20, NFT or wallet addresses. Allows users to view capitalization, price chart or volume of all ERCs.

- Explore all possible projects through Wallet Connect.

- Get notified when a transaction is complete, even if it happened elsewhere (similar to a bank account).

- Increased security can use Face ID and there are many ways to store Seed Phare.

The launch of Uniswap’s Mobile Wallet surprised the community. Many major KOLs were disappointed as they expected Uniswap to release version v4 when v3 was about to open source. With Uniswap launching Mobile Wallet somewhere there has been a shift from depth-based development to horizontal development to gain more users. But we will not go into this issue in this article.

Why did Uniswap develop Mobile Wallet?

Limitations in product development

Uniswap V3 has been extremely successful in providing the definition of “centralized liquidity”, but Uniswap V3 is only suitable for altcoins, tokens with large capitalization and relatively stable prices. As for altcoins with high volatility, Uniswap V2 still cannot completely solve the problem of Impermanent Loss.

Regarding IL, as far as I can see, Uniswap does not directly solve it, but comes from 3rd parties that integrate LP Tokens on Uniswap and then use their own strategies to eliminate or even earn profits from IL such as Synthr, Smilee Finance , Gamma Stragetis,… Uniswap itself also supports these projects through granting grants to the project, AMA to develop the community for the project,…

It can be seen that Uniswap is still focusing on solving outstanding problems with its own products, but to solve them, Uniswap will give them to its partners. It can be seen that launching Uniswap V4 is quite difficult for Uniswap at the present time.

Grow horizontally

Of course, wallet has not necessarily become Uniswap’s core product at the present time when most of the platform’s businesses and users are still in Uniswap V3, so Uniswap developing another product, wallet, is similar to that. Coinbase is taking advantage of the resources we have available, besides having more products also helps Uniswap have more revenue.

Uniswap itself is not the first DeFi platform to develop, but previously 1 inch also developed its own wallet.

Besides, Uniswap can completely turn its Mobile Wallet into an All in one DeFi platform in the future where users can trade, borrow & lend, farming, staking,… directly on their wallets. Uniswap.

Little known benefits

That is MEV (Miner Extractable Value), which means that with their power, miners can earn profits by prioritizing the arrangement of transactions with high fees instead of arranging by transaction time or time. Arrange your own trades first for arbitrage.

So if transactions on Uniswap’s wallet have a separate mempool (where transactions are arranged before being posted to the blockchain), this will be an extremely delicious piece of cake in both downtrend and uptrend.

Metamask Enters the Web3 Gaming Market

Overview of Metamask launching SDK for the Gaming market

March 1, 20223: Metamask has combined with Unity – the world’s leading game publishing platform, to officially cooperate so that games can easily integrate Metamask into their platform. Besides Metamask, Unityy also has many other big partners in its store such as Infura, Immutable X, Flow SDK, Aptos SDK,…

This is also a step that marks Metamask’s move deeper into the Gaming market.

Why does Metamask go deeper into Gaming?

In fact, this cooperation does not cause Metamask to bet too much because if Gaming continues to develop and return to its peak, Metamask will definitely win, but if not, Metamask will not affect too much, it can be said to be Low Risk. High Return.

Summary

Big players in the crypto market are still extremely active in developing broader projects after successfully conquering their niche market. However, horizontal development can bring the project more customers and revenue sources, but invisibly it also consumes a certain amount of resources if it is not successful?

Therefore, it is not possible to confirm 100% that Coinbase’s Base Blockchain will be as successful as the current Arbitrum or that Uniswap’s Wallet will gradually take over Metamask’s market share.

Through the above events, we can see that although everything from news, crypto legality, and macroeconomics are very bad, projects in the market are still actively building and developing to wait until the market School is officially back.