The market in the early days of 2023 is experiencing extremely positive growth as Bitcoin has grown strongly from the price of $16K and has exceeded $25K. However, Weakhand’s team still believes that the market will continue to grow even stronger in the near future.

So where is the motivation and what are the opportunities? Let’s go through this article!

Looking Back at Projections for the First Period of the Year

Disclaimer

Weakhand team itself does not rely on Technical Analysis to analyze prices and market trends. Besides, the team relies on Fundamental Analysis, looking back at historical performance and some potential trends to market speculation. Therefore, the Weakhand team wants to remind the community a few of the following:

- This article is only considered as personal opinion and viewpoint and should not be considered investment advice for any individual in the market.

- Weakhand team is not responsible for your investment following the group’s article and subsequent losses. Besides, we also do not charge any fees if you make a profit in your investment story based on insights from Weakhand.

Looking back at the beginning of the year

Crypto market forecast in 2023

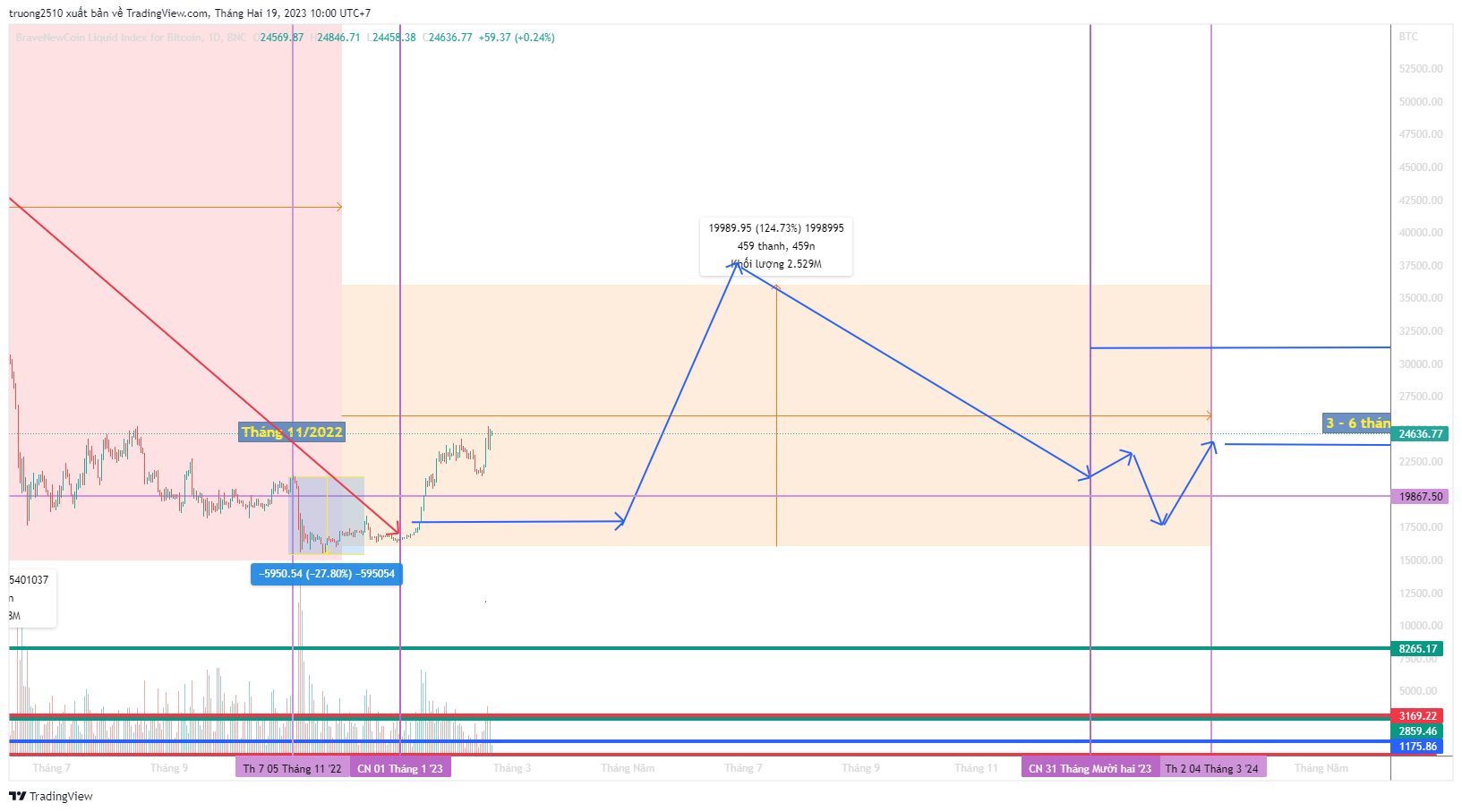

In the early part of 2023, Weakhand’s team published the article Crypto Market Forecast 2023: The Market Will Have a Big Rebound. In that article, I made some predictions as follows:

- The 2016 – 2020 market cycle peaked 1 month later than the 2020 – 2024 cycle, so the 2023 market will likely run 1 month earlier than 2019.

- The crypto market in Q1 will mainly go sideways, but at the time of writing, there has been a breakthrough to about $21,000/BTC.

- The market will truly explode in Q2 and if BTC regains 80% of its price from ATH, the peak in 2023 will be around $55,000/BTC. However, in a market where the macroeconomy is still relatively bad as it is now (inflation has decreased but is still high, the FED has reduced the speed of interest rate increases but interest rates are still high), so the price I expect it to be around $40,000 – $50,000.

- Quarter 3 and Quarter 4 are similar to the crypto market in 2019, the market will decrease and return to a price slightly better than the opening price at the beginning of the year.

I think the market’s driving force for the upcoming growth period will revolve around some selling points as follows:

- L2 launches tokens and implements incentive programs or subsequent incentive rounds.

- Real Yield Movement.

- Delta Neutral strategy in areas such as Stablecoin, Yield Farming, AMM,…

- AI (an area that I’m still quite vague about, so I see it as somewhat similar to the Fan Token trend that has failed quite a bit recently).

Inaccuracies in the forecast

Besides the accurate forecast that Arbitrum and its ecosystem will pull the entire market up, we still forget about the Shanghai update of Ethereum and Liquid Staking projects. Not only that, the market has also recovered faster than what Weakhand’s team expected.

And one more time I continue to maintain my view that the market will continue to grow and there is a possibility that we will see Bitcoin return to the price level of $40,000 – $50,000.. In this article, I will continue to present in more detail the two main growth drivers for the market in the near future and what are the opportunities for retail investors?

Key Growth Drivers for the Upcoming Market

The most obvious motivations

Ethereum Shanghai Update and Liquid Staking Expectations

For Ethereum at the present time, the most notable thing is Ultra Sound Money. After the EIP – 1559 update combined with Ethereum switching the network from Proof Of Work to Proof Of Stake consensus mechanism, Ethereum is officially entered the deflationary phase. Remember that at the present time even Bitcoin is still in a low inflation phase and among the coins with the highest market capitalization and decentralization, only Ethereum is in the solution phase.

I firmly believe that “deflation” will be an extremely good story for the growth of Ethereum in particular and the crypto market in general. Besides, with the Shanghai update there is an extremely important factor for the Ethereum network and Liquid Staking projects:

“After Shanghai, users can withdraw ETH from Beacon Chain when they have participated in staking since 2020”

In fact, in 2020, when users deposit assets into Beacon Chain, they do not know when they will be able to withdraw Ethereum, but only know that when Ethereum 2.0 is successful, they will be able to withdraw and currently somewhere, Ethereum 2.0 gradually appeared in the mist. So thanks to Shanghai, Ethereum’s network will become even more decentralized when investors confidently put their ETH into the Beacon Chain and can withdraw it at any time. From there, Ethereum’s network will become even more decentralized.

As for Liquid Staking projects, it is really different when up to 87% of the total supply of Ethereum is still outside the market. This 87% of total supply equates to 87% of Ethereum’s capitalization which equates to $177B meaning it is 3 times larger than the entire DeFi industry which is only around $50B and more than 15 times larger than the Derivatives industry. A small comparison lets us see that the Liquid Staking market ahead has an extremely large piece of cake.

People can read more articles to compare current platforms such as Lido Finance, Rocket Pool, Frax Finance or Coinbase:

So what should we think about Ethereum’s growth leading up to the story of Liquid Staking projects?

Curve Wars and Convex Wars are coming back

There are two main reasons why Curve Wars and Convex Wars will return soon: their story Stablecoin Wars and Liquid Staking Wars with the liquidity war.

Stablecoin Wars

First we will move on to the story of stablecoins. You can read the article below to get an overview of the upcoming stablecoin war: Curve Wars Are Coming Back. Which Projects Will Benefit & Grow?. In the near future, platforms will jointly launch their satblecoins, the largest of which is Curve Finance launching crvUSD and AAVE launching GHO. The liquidity bootstrap battle on Curve Finance is relatively easy to understand.

Liquid Staking Wars

Next is the liquidity bootstrap battle of Liquid Staking platforms on Curve Finance. We know that building a liquidity pool for the xxxETH/ETH pair of Liquid Staking projects is extremely important, for example Lido Finance has the stETH/ETH pair, Rocket Pool has the rETH/ETH pair or Frax Finance has the fxrETH/ETH pair.

However, the amount of ETH on the market is limited, so Liquid Staking platforms must make their liquidity pool as thick as possible because redeeming ETH on Beacon Chain will take a lot more time than trading. on Curve Finance. So it is entirely possible that Liquid Staking platforms will participate in Curve Wars to direct incentives to their pools the most and at the present time Frax Finance is the project with the advantage that this platform holds. 7% of vlxConvex, remember that whoever owns Convex will own Curve Finance.

With the above two cases, from my perspective, Curve, Convex Wars can absolutely return and if it returns, Convex will certainly grow very strongly if the war continues to take place on participating platforms. entering the Convex war such as Frax, Redacted Finance, Level or a number of other projects.

Go deeper into Convex Wars

Most of the Convex Tokens at the present time are not included in the protocols participating in Convex Wars, so these protocols still have many opportunities to unify Convex Wars. Let’s take a look at some of the projects participating in Convex Wars including:

- Frax Finance is holding a total of 7% of CVX’s total supply.

- Pirex – a project belonging to Redacted Finance’s ecosystem, holds 4%.

- Clever holds 4% of total supply equivalent to Pirex.

- Badger DAO is holding 3% which is 1% lower than Pirex and Clever.

- Redacted Cartel holds 2% with Pirex, this ecosystem holds about 6%.

- Mochi Inu holds 2% equivalent to JPEG’d.

- Olympus, KP3R and Bent Finance together hold 1% of Convex’s total supply.

It can be seen that there is still nearly 40% of CVX stock still floating in the market and not yet attracted to a protocol. So who will be the winner in Convex Wars this time and whether Convex will grow or not? We need to review the operating mechanism and tokenomics of each project participating in Convex Wars to evaluate the pros and cons from there. Winning project forecast.

Remember that Yearn’s starting point is much better than Convex in Curve Wars, but Convex is the winner, so at the moment Frax is the platform that holds the most advantage, but that doesn’t mean it will definitely win. win. And if the project wins, will its token grow strongly?

Arbitrum continues to drive the market

Weakhand’s team has many articles about the Arbitrum ecosystem that people can read again to avoid repeating information.

- TOP 5 Outstanding Projects on the Arbitrum Ecosystem | Part 1

- What is Delta Neutral? When The Game Is Built Around GMX

- Arbitrum W3/2023 Ecosystem: Be careful with new projects showing signs of fraud

- Summary of Potential Projects on the Arbitrum Ecosystem

Recently, projects on Arbitrum have had strong growth, especially DEX projects such as Camelot’s GRAIL token, which has grown from about $200 to more than $3,000. Besides, there are many other projects. other. As for myself and Weakhand’s team, we will continue to monitor this ecosystem to find more investment opportunities in the future.

Hopefully Arbitrum will be one of the main pulling forces for the crypto market in the near future!

Unclear motivations can be FOMO

zkEVM – The truth is still nothing

The whole crypto community was in an uproar when Binance’s CZ mentioned a lot about zk (zero-knowledge) technology and then a series of projects such as Mina Protocol, Loopring,… had the community’s attention. Besides, the fact that zkEVM was simultaneously launched on the testnet by zkSync, Polygon, Scroll,… made the community very fomo. However, from my perspective, I have some opinions as follows:

- zkEVM is still in development and doesn’t even have an official full mainnet schedule yet

- The ecosystem of zkEVMs is still very primitive and will take about a year to complete the infrastructure from which new projects can begin to be deployed.

- The number of projects with innovations is unprecedented. Currently, most projects at the moment fork existing models on Ethereum

With the above unclear things, it will be difficult to have a sustainable cash flow flowing to any zkEVM, so with this trend I just stop at observation.

NFTfi -When NFT and DeFi come together

Compared to zkEVM, I see that NFTfi has stronger growth potential in the near future as NFTfi models are mostly forks from existing DeFi models. Besides, the fact that NFTs continue to explode is also a reliable detonator for the NFTfi industry.

The number of NFTfi projects is exploding more and more, the number of projects launching tokens is also increasing, so I think this is the startup phase for this industry. Currently, NFTfi needs a Launchpad platform to create fomo for the industry, then this industry will definitely explode.

Regarding the NFTfi segment, you can read some of the articles below to get more multi-dimensional perspectives on this segment such as:

- What is NFTfi? Overview of Cryptocurrency NFTfi

- Potential Projects In NFT Finance Industry | Part 1

Summary

With some of the clear trends above, I see that the crypto market has enough motivation to grow in the near future. With just enough stimulation, the old cash flow will return to the crypto market.