Forecasting the trends of the crypto market helps us be somewhat prepared for everything that happens because the crypto market is inherently unpredictable. No one could have expected that a little-known project like StepN could open up a Move to Earn trend or put photos on the blockchain, also known as NFT, and those photos could be bought and sold for a value of up to hundreds. ETH. Therefore, prepare carefully for the upcoming year 2023 full of surprises.

Together we have gone through the article Crypto Market Trends In 2023 | Part 1, everyone can read it again and now we will go to part 2 together.

Crypto Market Trends In 2023

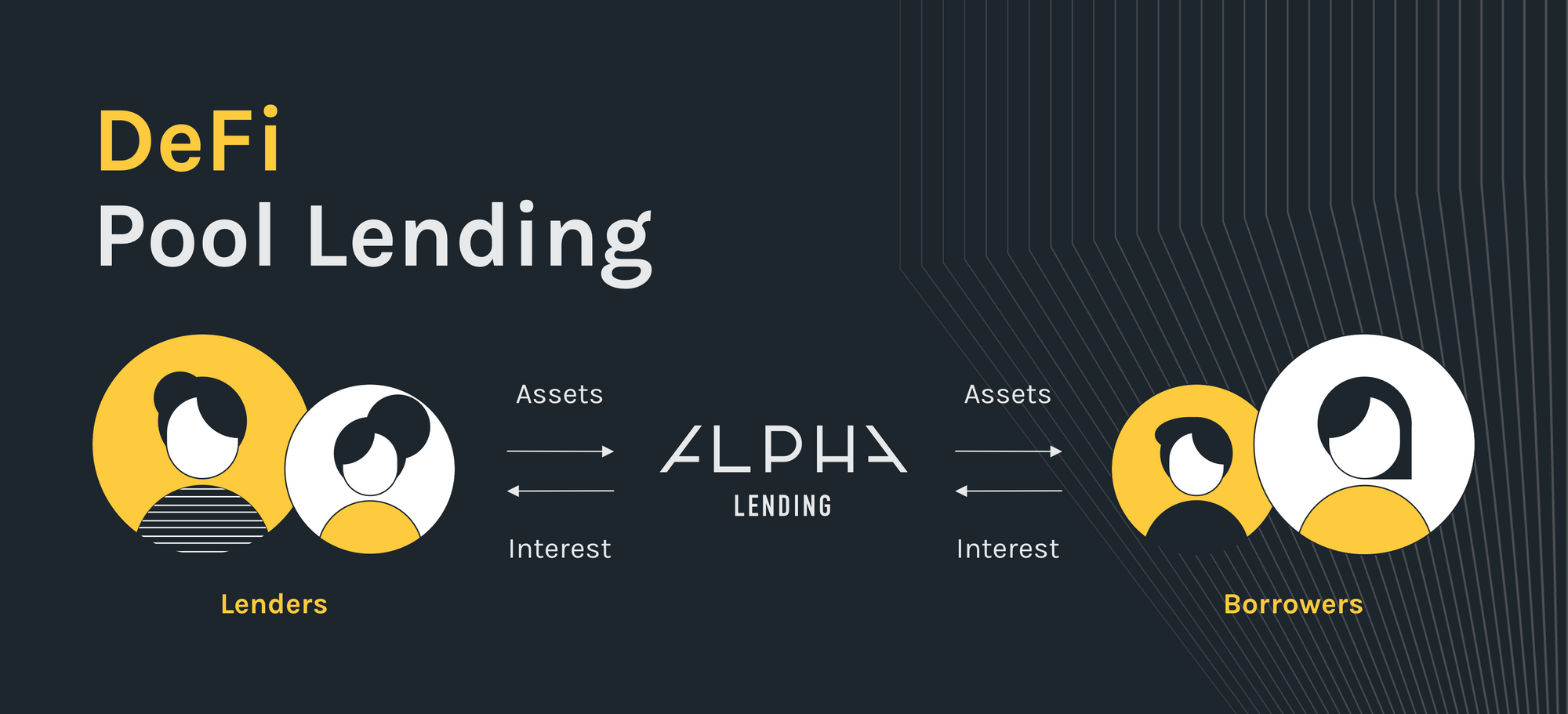

Lending projects combine P2P and Lending Pool

Outstanding issues with Lending Pool projects

Some outstanding projects in this field are AAVE, Compound, Solend, Apricot, Jet Protocol, BenQi, Bastion Protocol, Aurigami,…

The operating mechanism of these projects is relatively simple: users will deposit assets together into one pool, then each asset will have independent pools to get interest. In addition, people who need to borrow will deposit collateral into the platform then go to the pools that have the assets they want to borrow and borrow the assets at a loan level of 60 – 85% of the mortgage value.

Biggest disadvantage The problem of these models is that because there are too many deposits into the platform but too few loans, the small amount of interest is shared with everyone, leading to the assets deposited by users not being real. optimized. Besides, the supply – demand difference in interest rates between borrowers and lenders is too large, simply meaning that depositors receive interest rates that are too low while borrowers have to pay high interest rates.

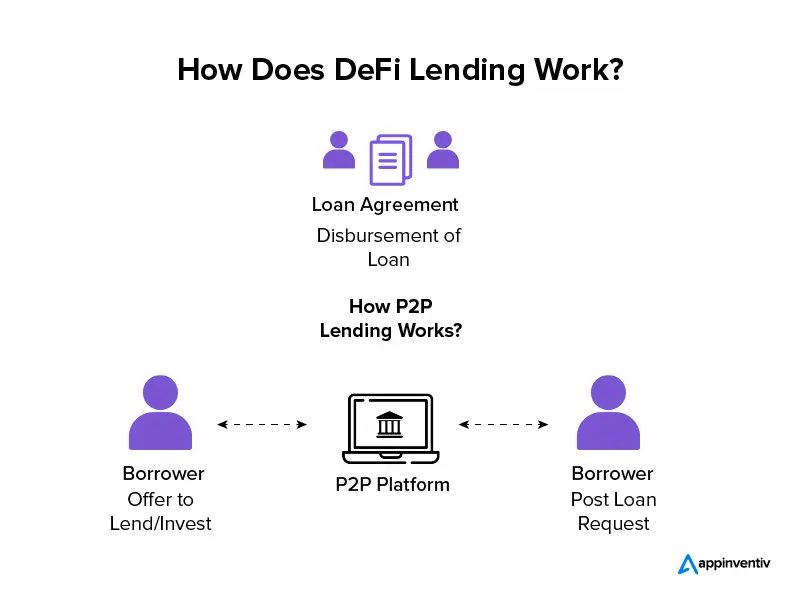

Outstanding problems with P2P Lending projects

For the P2P Lending segment, users will provide information about their needs including expected interest rate, collateral they want to receive, payment method, maturity date and other information. Because there are so many conditions, matching loan orders with P2P Lending platforms is extremely difficult while DeFi liquidity is still very limited.

Because of this limitation, we have the Lending Pool solution born.

Lending projects combine the Lending P2P and Lending Pool models

The most prominent project in this segment is: Morpho Labs has completely resolved the outstanding problems of Lending Pools and P2P Lending. The project applies the P2P model, simply understood as Oderbook in which the borrowers absorb the loans of the security asset provider in addition to taking interest rates above the interest rates of AAVE and 1 is forever the trend of the crypto market

NFT Finance – The next important piece in the development trend of NFT

NFTs led the crypto market to invest in the period when GameFi started to explode, but at that time the footprint of NFTs was not too much until the Move to Earn trend began to decline, then at this time the collections The new NFT officially leads the market in the late Q2 period until the end of 2022.

It can be said that the NFT puzzle is one of the puzzle pieces that helps Crypto and Blockchain get closer to human life. Reality has proven that popular social networking platforms such as Twitter, Facbook, Instagram have integrated NFTs into their platforms, in addition to many big real-life brands such as Nike, Adidas,… into the NFT space as it releases its own NFT collectibles. Even Cristiano Ronaldo has released his NFT set on the Binance platform.

However, largely due to the new market being in a starting position, with NFT products, users can simply hold and use the accompanying features of NFT (if any). However, when held for a long time, especially with high-value NFT sets, users begin to want to lend, wanting NFTs to be able to become assets on many collateral platforms to get more. many financial-related activities so as not to waste resources when investing in NFTs.

That’s why many projects with the trend of NFT Finance or NFT 2.0 or NFT Interactive have been born. And below are some outstanding projects in this segment:

- BenDAO, NFTfi,…: Are the first P2P Lending platforms for bluechip NFT collections (referring to collections with high capitalization and liquidity). With these platforms, users can simply deposit their NFTs to earn interest and borrowers can borrow NFTs. Even AAVE has shared that they are researching using NFTs as collateral on their platform.

- sudoSwap: Dubbed the first AMM for NFTs instead of NFT Marketplaces. Uniswap has also officially announced a partnership with SudoSwap to jointly build a specialized AMM for NFTs. Uniswap showed a deep interest in the NFT segment when it acquired the NFT Marketplace Aggregator Genie exchange and recently officially launched it.

- NFTperp: Perpetual platform for bluechip NFT collections when users predict the price of NFT collections but do not have enough finances to invest, they can play Long – Short NFT collections on this platform .

- Some new platforms allow users to open Option contracts for NFT projects. However, Options and DeFi still have many problems related to liquidity, so in a much smaller market, it will be relatively difficult for these platforms to succeed soon.

If we are familiar with the term DeFi, then the term NFTFi will also become popular. If in the DeFi industry we have prominent names such as AAVE, Uniswap, Curve Finance, Compound, Maker DAO,… then in the NFTFi industry which names will lead? Familiar industries in DeFi such as Yield Farming, CDP (instead of accepting crypto assets as collateral to mint stablecoins, what happens when accepting NFTs to mint stablecoins?), Leverage Farming,…

It can be said that the NFTFi industry will grow very strongly in the near future if NFT collections can maintain their position in the market. Weakhand’s team once had an article about NFT Finance that you can read here

Layer 3: Inherit and promote from Layer 2 puzzle pieces

Layer 3 is a phrase mentioned by many Layer 2 platforms recently. Although the reading is the same, the way Layer 3 is deployed for each Layer 2 is clearly different. Up to now, there are Layer 2 platforms including ZkSync, StarkWare and Optimism that have shared their vision of Layer 3, only Arbitrum has not had much information yet.

The project that shares the most information about Layer 3 currently is the ZkSync platform when they announced that they will release the first testnet version for Layerr 3 in the first quarter of 2023. However, with my habit of delay, I think it won’t be until Q3 or even Q4 at the earliest that we will see the first shapes of Layer 3.

However, I think Layer 3 will play a stronger role in promoting the Layer 2 trend than creating a trend on its own in the crypto market. However, at the time of launch, many platforms such as Uniswap, AAVE, Compound, Lido Finance,… announced that they would develop on a separate chain on Layer 3 of ZKSync, it will truly create a Layer 3 fever. .

So be prepared for all possible future situations.

Credit Protocol: Where DeFi and TradFi intersect

Credit Protocol is no longer a fantasy about a land where DeFi and TradFi intersect, but it has somewhere become a reality in 2022. When

- Maker DAO provides a loan from $100M DAI to $1B DAI to large and established banks in the US with collateral from the real world.

- Goldfinch has provided more than the first $100M to startups in Asia and Southeast Asia.

- Maple has provided over $1B in loans to companies operating in the crypto market.

- TrueFi is similar to Maple Finance, but in addition to lending to companies in the crypto market, this project also lends to famous individuals and is authenticated by the platform.

However, in recent times Credit Protocol platforms involved in lending to companies related to the crypto market have actually been directly or indirectly affected. When FTX and Alameda collapsed, there were parties who borrowed from Maple and then lent to Alameda. Because Alameda was unable to repay, those other units also declared a “debt burst” with Maple, causing the platform to bear a debt. bad in the future.

However, this problem occurs mainly due to the subjective assessment of Pool managers when there is no move to liquidate collateral early and is too lenient in accepting loan conditions. Therefore, Credit Protocol platforms still have a lot of work to do to be able to solve most of the risks related to bankrupt borrowers.

Recently, Goldfinch is one of the interesting units as they do not lend to companies in the crypto market, but rather lend to startups in Asia in general and Southeast Asia in particular. Besides, they started spending money to build their own ecosystem with two projects: AlloyX – which helps improve platform liquidity and Caparace Finance – an insurance project for loans to investors. Small investments on Goldfinch. These two projects have both called for capital from reputable investment funds in the market

Summary

So we have gone through part 2 of the crypto market trends that may take place in 2023.

With a year 2023 that is not highly appreciated in terms of economics and inflation, the financial market will usually recover sooner than the real-time production economic market. Therefore, if the FED succeeds in safely landing the market, it is likely that the market will soon return at the end of next year.

Besides optimism, we also need to be prepared for the worst cases if the market continues to collapse.