Maverick Protocol is the 34th project deployed on Binance Launchpool but what is worth noting here is that Maverick quickly launched its veToken model to provoke a war that is not only DEX Wars but also LSDfi Wars. So, let’s find out where the potential and investment opportunities of Maverick Wars are in the article below.

To understand more about Maverick Wars, people can refer to some more articles such as:

- What is Maverick Protocol (MAV)? Overview of Cryptocurrency Maverick Protocol

Overview of Maverick Protocol

Brief introduction to Maverick Protocol

Maverick Protocol is one of the AMMs with real innovations in the crypto market. Next to Uniswap’s lead are Trader Joe and Orca with their own liquidity centralized models, Liquidity Pool and Whirl Pool, respectively. However, in the above models, every time the price of the token changes, users must establish a new liquidity provision strategy to optimize profits.

If you want to change the range less when providing liquidity, users are required to provide over a wide range, and a wide range affects the ability to use capital. That’s why Maverick Protocol was born to solve such an outstanding problem.

It can be said that Maverick allows ranges to be run automatically based on the liquidity providers’ strategies. It can be simply understood that if Uniswap, Trader Joe or Orca provide Centralized Liquidity solutions, Maverick Protocol is a Dynamic Centralized Liquidity model.

Maverick Protocol’s operating mechanism

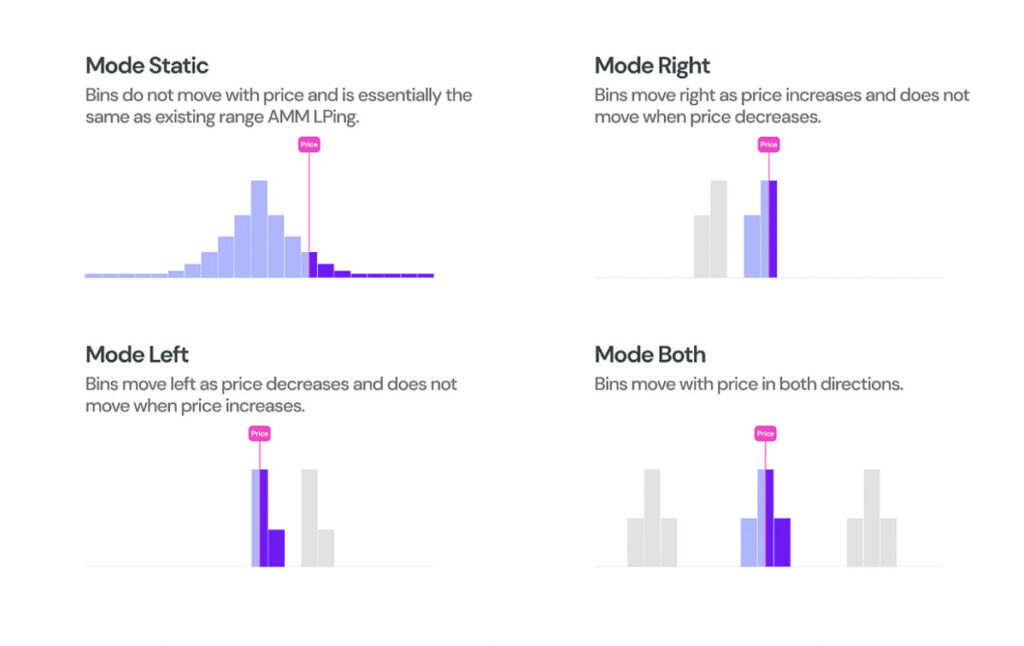

There are 4 automatic operating mechanisms on Maverick Protocol including:

- Mode Static: Range will be fixed and will not move when the price goes beyond the liquidity zone. This model is similar to Static Centralized Liquidity of Uniswap, Trader Joe or Orca.

- Mode Left: Range moves to the right when price decreases and does not move when price increases. This is used when LPs predict market and native token price drops.

- Mode Right: Range moves to the right when price increases and does not move when price decreases. This is used when LPs predict market and native token price increases.

- Mode Both: With this mode, the Range will move both up and down and out of the liquidity zone. But the risk of permanent loss (Impermanent Loss) is very high.

This is the main difference in the operating model of Maverick Protocol. In essence, there is a difference, but when Maverick Protocol’s model actually operates, it still has some problems that cause quite large Impermanent Loss for users. However, we will not discuss it within the framework of this article.

What makes Maverick Wars

According to the latest information from the Maverick Protocol development team in the article Introducing Maverick Protocol’s Voting-Escrow Model, the team has introduced to the community the veToken model for the native token MAV. Maverick Protocol’s veMAV model has many similarities with Curve Finance.

According to Maverick Protocol’s development team, veMAV will improve decentralization in project management before important project decisions, targeting users who are committed, long-term companions with the project and for a sustainable future for Maverick.

Some of the benefits for Maverick Protocol to encourage users to participate in MEV keys to receive veMEV include:

- Participate in governance on Maverick to decide which Pool receives the most incentives from the protocol.

- Receive the main reward which is the MEV (inflation) of the project.

- Get a share of the protocol’s revenue.

- Receiving Bribes from third parties.

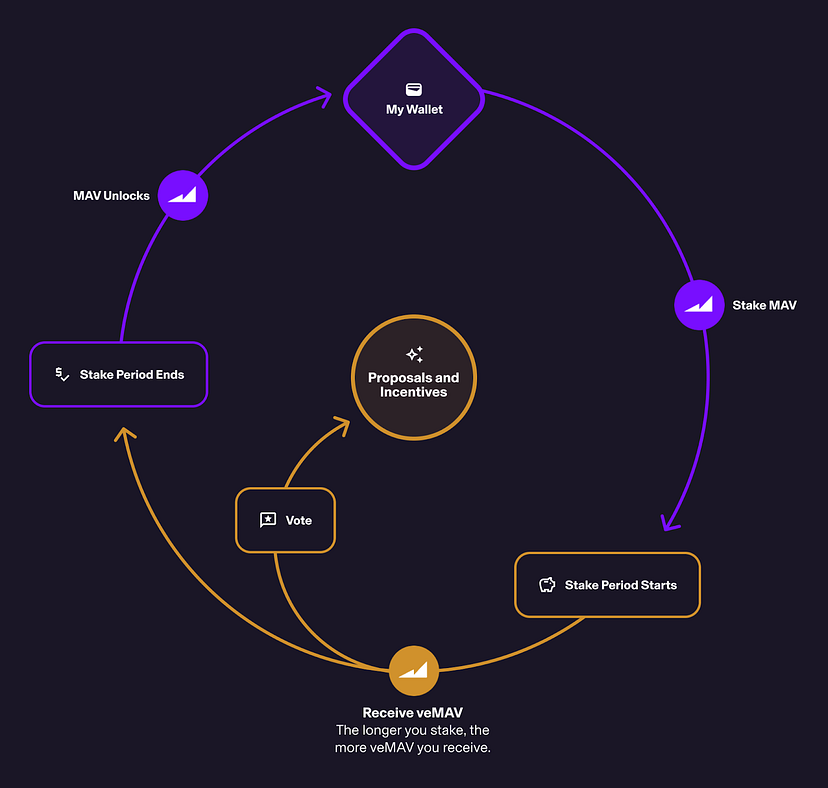

Users can lock MAV to receive veMEV. To receive veMEV, it depends on two factors: the number of MEV and the lock time. The longer the number and the longer the lock, the more veMEV there is.

The Flyweel that Maverick Protocol is trying to build is as follows:

- Step 1: Users who own or buy MEV will lock the maximum time on the protocol to receive the benefits I shared above.

- Step 2: Because the rewards on Maverick are attractive and the more veMEV you have, the more beneficial you are.

- Step 3: Incentive is the MEV that the user receives and will immediately be locked and locked for the maximum time to optimize the profit they receive.

This Flyweel is nothing special or different from current veToken models. The problem with these models is whether Incentive from the protocol, voting and bribing is attractive enough for users to be motivated to lock up their rewards or not. With this, we will go to the next part of the article.

What Makes Maverick Wars So Attractive

Maverick Protocol is one of the major AMMs in the market

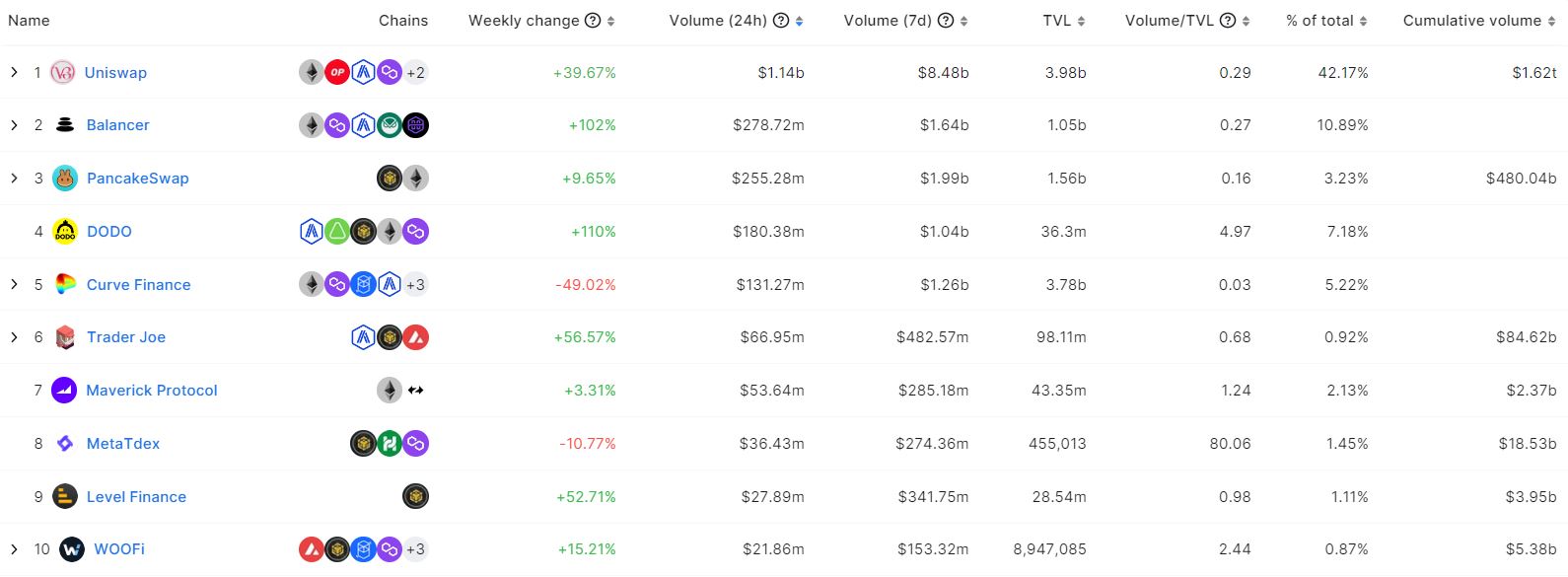

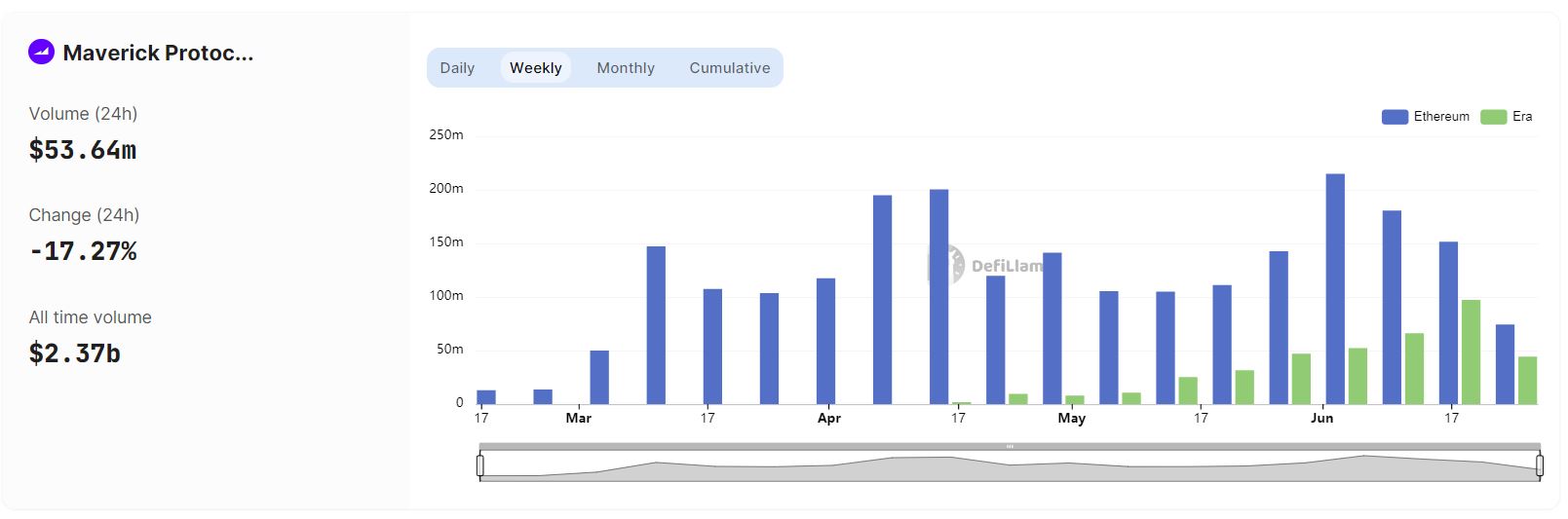

According to updates from DeFiLlama, Maverick Protocol is currently in the TOP 7 AMM platforms with the largest trading volume in the market. One extremely interesting thing is that although Maverick Protocol’s TVL is relatively low, the transaction volume is not inferior to the above platforms.

Currently, Maverick has a much larger trading volume than other AMMs that were very prominent in the past such as Sushiswap, Hashflow, Orca or the largest AMM on Optimism at the moment, Velodrome.

Not only that, if only on Ethereum, where there is the largest number of AMMs in the market, Maverick ranks 5th, 4 times more than 6th place PancakeSwap. If calculated on zkSync, Maverick ranks No. 1 with Voluem trading 10 times more than second place Mute.io.

Although it just started launching in early 2023, Maverick Protocol’s trading volume has grown rapidly thanks to its innovations. As soon as Maverick started developing on zkSync, it had the highest positions in this ecosystem. Through the above parameters we can confirm that Maverick Protocol is one of the largest AMMs in the crypto market.

Besides such a large volume, Maverick Protocol has certainly accumulated a large amount of transaction fees and if this momentum continues, Maverick will certainly create an extremely attractive revenue stream for holders. keep veMEV in the future.

However, in terms of Volume we need to have clearer observations in a few aspects:

- Compared to major AMMs in the market, only Maverick has not issued tokens yet and many people use Maverick to hunt for airdrops/retroactives.

- Maverick is available on zkSync, so many people use it to hunt retroactives on zkSync.

Therefore, there will be two times for us to know the true performance of Maverick when the above two conditions disappear: when Maverick issues tokens and zkSync issues tokens. At each time we need to observe whether Maverick’s Volume has decreased significantly? From there, we have clear assessments of the project.

Redirecting LSDfi makes perfect sense

When Maverick Protocol started, it was aimed at an open market, but when Shanghai Upgrade was successful, the number of LSD protocols skyrocketed, along with the number of LST assets also growing strongly, leading to the market needing a platform. While AMM focuses on the LSDfi segment, Maverick has changed direction.

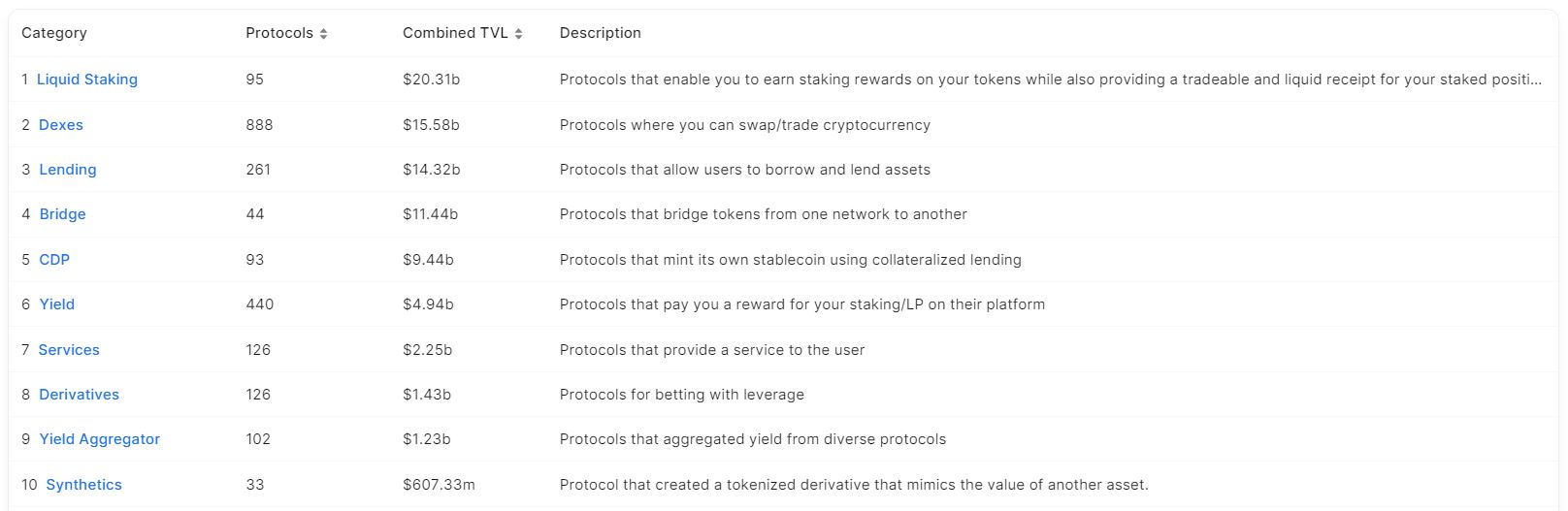

Today, when looking at the TVL statistics of all protocols in the DeFi market, Lido Finance is leading with $14.03B, then Coinbase Staking service is also over $2B and Rocket Pool is nearly $2B. This is such a big market. The total TVL of the Liquid Staking industry is $20B, leading the industry followed by DEX with $15B and Lending at $14B.

Along with that, the LSDfi trend is exploding with many names such as Pendle Finance, Lybra Finance, Frax Finance,….

Compete directly with Curve Finance

Obviously, when we touch LST, we are talking about assets at par and this is the development focus of Curve Finance. Curve not only focuses on liquidity pools of Stablecoins but also liquidity pools of peer-to-peer assets, so when Maverick enters the LST market, it will definitely have to confront Curve. Previously, we had very large pools of stETH or rETH on Curve Finance.

In the past, when Uniswap built the V3 version, it also aimed to compete with Curve Finance’s Stablecoin pools, but reality proved that x^3*y + xy^3 = k is still better than centralized liquidity. And in Maverick’s strategies there has been innovation with strategy Mode Both It may be possible to bridge this gap.

However, we still need to wait for the results.

The Future of Maverick Wars

At the time of writing, there are still no first projects participating in Maverick Wars, partly because the project has not yet deployed tokens. However, if Maverick works really well then we will have a real battle.

However, that also depends on the general situation of the market. Remember when Trader Joe introduced veJOE, that was also the time when the market collapsed even though Joe Wars was very competitive, the price of JOE still dropped miserably, so we need to pay attention. look at more than just the project.

Summary

Although no side has yet fought, Maverick Wars is expected to bring a great opportunity for investors who dare to face high risks.