Penpie is competing fiercely with Equilibria in the recently initiated Pendle Wars. So what strategies does Penpie have to make a difference compared to its competitor Equilibria? Let’s find out together in the article below.

To better understand this article, people can refer to some of the articles below:

- What is Magpie XYZ (MGP)? Magpie XYZ Cryptocurrency Overview

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- Penpie – Pendle Finance has the opportunity to become Convex Finance

Pendle Wars overview

Pendle has created a new market in the Crypto market, which is DeFi Yield – Trading Protocol. With Pendle, users can build strategies to generate profits from their own future profits. Currently, the assets that Pendle is targeting are LST (Liquid Staking Token) such as sfxrETH, stETH.

It can be said that up to now, Pendle is one of the platforms leading the LSDfi trend recently.

Pendle’s TVL has not stopped after the successful Shanghai Upgrade opened a new trend for the crypto market. Currently, Pendle Finance’s TVL is at $112M, 16 times higher than the period of late 2022 and early 2023, it can be seen that currently the cash flow is pouring very strongly into LSD in general and LSDfi in particular.

However, the fun continued to heat up when Pendle recently launched the vePENDLE model. Pendle’s veToken model has some of the following characteristics:

- vePENDLE will be locked for a maximum of 2 years, the value of vePENDLE will gradually decrease over 2 years.

- Voters use vePENDLE to boost yield from LPs and share revenue with the protocol.

- Participating in voting voters will receive additional incentives & transaction fees from voting pools.

It can be seen that the vePENDLE model has many similarities with the veCRV model. The key point here is that Pendle must have a large revenue source, which is currently being proven when TVL and Volume on Pendle are still growing very well.

This opened up a real war, the Pendle Wars. In this war, there are currently two names that are competing fiercely: Penpie and Equilibria. Now we will carefully analyze this war to see who is winning and which project’s strategy will help them win in Pendle Wars.

Penpie & Strategic Position in Pendle Wars

Pendle Wars overview

Pendle Wars is featuring two platforms including Penpie and Equilibria. A brief introduction to Penpie and Equilibria is as follows:

- Penpie is a Yield Farming platform launched to optimize profits for PENDLE holders. Penpie was built by Magpie – a project that has fought quite successfully in Wombat Wars on both BNB Chain and Arbitrum.

- Equilibria is a Yield Farming platform built for PENDLE holders to profit from vePENDLE without worrying about their assets being locked in the protocol.

The missions of these two projects themselves are relatively similar and in a war there will be a number of factors that determine the winner of this war including:

- APR from participating in the PENDLE course on the platform.

- Peg holding level when user wants to switch back to PENDLE on AMM.

- The remaining amount of Native Tokens is for use as Liquidity Mining.

- The development team has experience in similar battles.

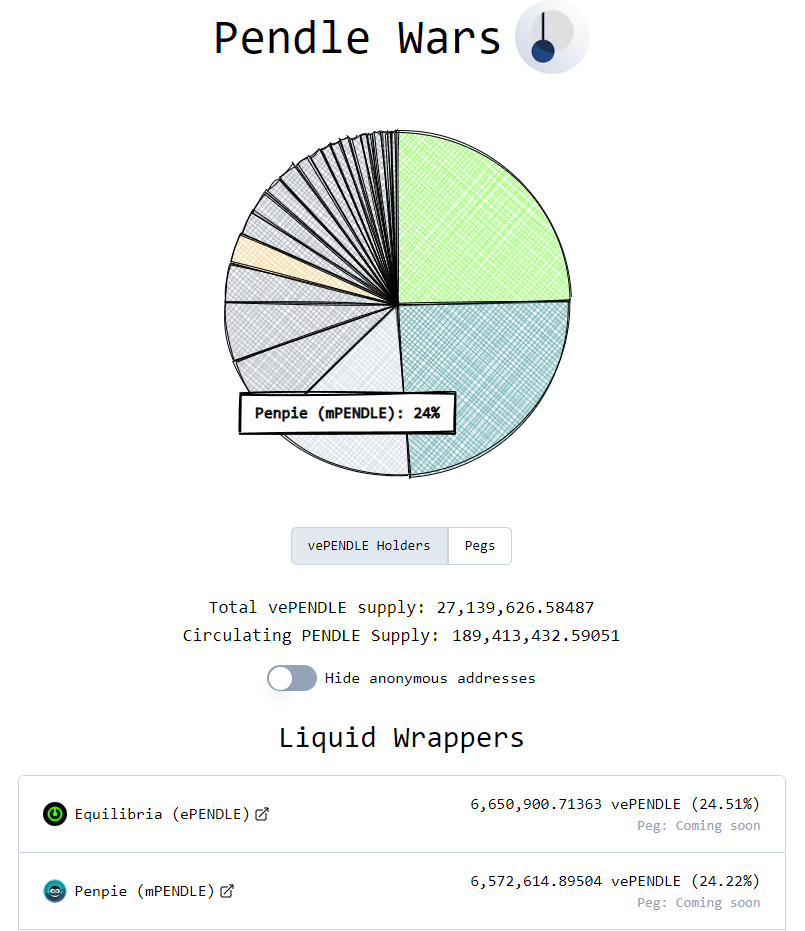

And now, we will sit down and study in detail each factor from which we can predict the outcome of the Pendle Wars. Preliminary update at the present time, the amount of vePENDLE that both platforms are holding is equivalent.

APR on PENDLE lock

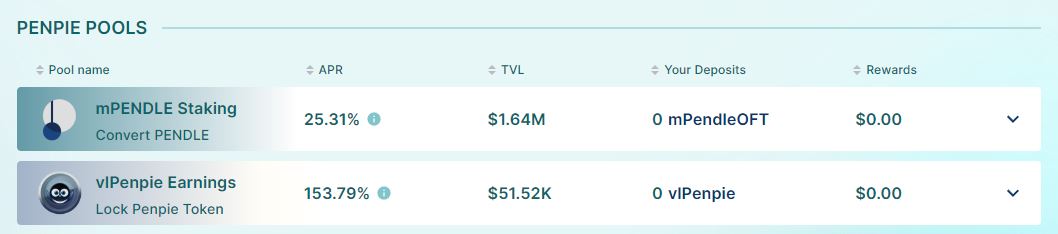

At the present time with both Penpie and Equilibria we have some statistical data as follows:

|

Protocol |

With Pendle |

With Native Token |

|---|---|---|

|

Penpie |

APR: 25.31% |

APR: 153.79% |

|

Equilibria |

APY: 25.71% |

APR: 111.99% |

In terms of profitability figures for those depositing PENDLE into the protocol, it is clear that Penpie has clear advantages over Equilibria. Not only that, Penpie is also a very successful Launchpad project on Camelot – the most prestigious Launchpad platform on the Arbitrum ecosystem today and currently PNP has also grown x5 compared to the IDO price, so it has partly created positive effects for users.

However, if investors decide to compound Pendle’s profits, the Equilibria option is a little better but not too much. Both projects have just deployed launch tokens, so the number of tokens used as incentives to attract users and TVL is the same. But in terms of APR when locking the platform’s native token, Penpie is superior to Equilibria.

Degree of peg retention when switching mPENDLE or ePENDLE to PENDLE

At present, Penpie’s mPENDLE – PENDLE or Equilibria’s ePENDLE – PENDLE liquidity pools have not yet been deployed, but we can still make some projections as follows:

- The liquidity war on the Ethereum system is a balanced battle between Penpie and Equilibria.

- In the liquidity war on the Arbitrum system, Penpie will have an advantage because it owns a large amount of veWOM from Wombat Exchange. If mPENDLE – PENDLE is deployed on Wombat Exchange, this will be a big advantage in Penpie’s liquidity. Equilibria does not have this advantage.

Regarding the liquidity war, Penpie has certain advantages over Arbitrum in general and Wombat Exchange in particular.

Development team

It is no exaggeration to say that development team is one of the keywords to help a project succeed. For Equilibria, this is the first war they have participated in, but not for Penpie:

- Magpie is the first product of the Penpie team built to join the fight on Wombat Wars on BNB Chain.

- Not only stopping at BNB Chain, when Wombat Exchange decided to develop multichain to Arbitrum, Magpie continues to be one of the leading platforms. Overall, Magpie is the second ranked project and in terms of liquidity, Magpie does better than Quoll Finance and Wombex.

Obviously, in terms of experience of the development team, Penpie has many advantages compared to Equilibria.

The Future of Pendle Wars

With the strong rise of the Liquid Staking Derivatives industry, LSDfi will certainly explode even more and it can be said that Pendle Wars will be one of the central events of LSDfi in the near future. Not only that, the growth in TVL and Pendle’s price growing strongly day by day is also a great attraction to the community.

Going deeper, it is clear that in all aspects of profits for PENDLE holders, the battle to build future liquidity and the experience of the development team, Penpie is a project with a clear advantage. clearer in this war.

However, when the war has not ended, we cannot say anything yet. Facts have proven that a strong Yearn Finance in terms of users, products and community still lost in Curve Wars to an emerging Convex.

Summary

Pendle Wars is an extremely interesting war. Is anybody going to be the winner? Penpie or Equilibria.