What is MEV? MEV stands for Miner Extractable Value which is the profits that miners earn based on their own powers. So everyone, let’s find out what’s interesting about MEV in the article below.

To better understand MEV, people can refer to some of the articles below:

- What is Mempool? The Importance Of Mempool In Blockchain

What is MEV?

Overview of MEV

In the past, MEV stood for Miner Extractable Value means profits generated by miners in the past creating blocks in the blockchain. MEV will include each block reward, transaction fees, and user tips for miners to get their transactions into the blockchain faster.

However at the present time MEV means Maximal Extractable Value means profit, the maximum benefit that can be earned by miners or validators in the process of bringing transactions from the mempool to the blockchain. This power comes from miners seeing all information of a transaction.

Note: In this article, instead of calling it miner or validator, I will call it the same term miner (of course miner is different from validator) but I want the article to be more concise.

The reason MEV was born

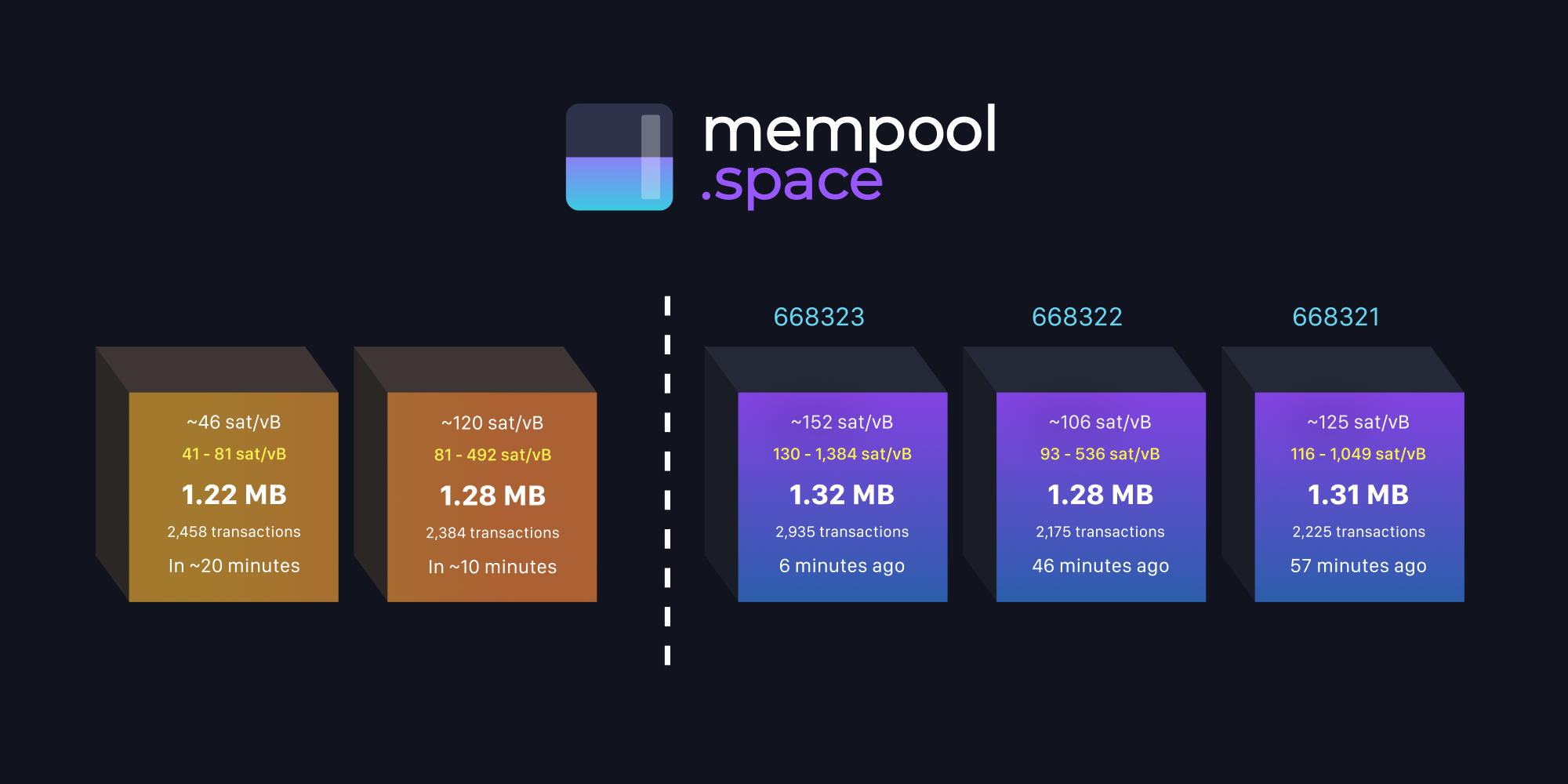

To understand what MEV is, we need to review the structure and operating mechanism of Bitcoin or some blockchains that use Mempool. Everyone can read the article What is Mempool? The Importance of Mempool in Blockchain to understand Mempool.

- Step 1: The user creates the transaction and will sign it on his own wallet.

- Step 2: Will nodes on the blockchain check whether the transaction is valid or not?

- Step 3: If the transaction is valid it will be sent to mempool.

- Step 4: At mempool, miners or validators will select transactions based on a number of criteria, mainly transaction fees, to include in the blockchain.

The key point here is that miners see all transaction information and they have the power to sort transactions in order of maintization priority. This is what created MEV.

The Benefits That MEV Brings to Miners

Profiting greatly from network congestion

There are many reasons leading to a congested or crowded network such as users being FOMO or FUD over certain information, participating in IDO, Free Mint,… all of this combined with the Mempool model pushing up prices. Transaction fees are sky-high and of course, Miners will choose the transactions with the highest fees to place in the block first, thereby earning profits in addition to possible tips like on the Ethereum network.

Besides, those who come later and want to transact first continue to push up gas fees, making them higher and higher, and of course, Miners are the ones who benefit the most from the Mempool model and the power to arrange transactions into their blocks. Surname.

DEX Arbitrage is also known as Arbitrage Trading on DEX

This story goes like if two DEXs are offering a token at two different prices, miners can buy tokens at the DEX with the low price and sell at the DEX with the higher price. With DEX Arbitrage, almost anyone can participate, but Miners have the advantage that when buying and selling they can put 2 transactions in the same block to optimize profits.

It can be said that arbitrage business has very little risk but it takes time to find information, determine liquidity pools to avoid Impermanent Loss,…

Liquidations – Liquidation

When users participate in Lending & Borrowing, their mortgaged assets are always on the threshold of liquidation and if their assets are liquidated, the borrower will normally have to pay a relatively large fee, a part of the fee. that will be paid to the liquidators. This is the moment when MEV appeared.

Miners must use their ability to find sources of liquidation. If they execute that transaction, a huge source of fees will flow into their pockets.

Sandwich Trading

An easy-to-understand example is as follows, a Miner sees a transaction that there is a whales preparing to collect $10K BTRFLY on Uniswap and when checking the liquidity pool, with such a large volume, the price of BTRFLY will definitely increase. chief. At that time, Miner will place a BUY order before the whales’ order to buy BTRFLY at a cheap price and place a sell order for BTRFLY after the whales’ buy order.

However, Sandwich Trading has much greater risk than DEX Arbitrage.

NFT MEV

Miners with their power can be the first to buy Public Sales of a certain NFT collection or they can buy the entire set. Sometimes Miners can buy NFT sets at super cheap prices when the sellers list the wrong prices

Pros And Cons Of MEV On Blockchain

Advantages of MEV

MEV has a number of advantages for the network such as:

- The larger the MEV, the more miners there are, the more decentralized and secure the blockchain will be.

- The emergence of DEX Arbitrage helps users determine which DEX platform is better.

- MEV shows the weaknesses that DeFi needs to overcome.

Disadvantages of MEV

MEV has some disadvantages for the network such as:

- MEV contributes to high transaction fees.

- The benefits that MEV brings to Miners mean it causes a bad experience for users.

MEV is not completely bad nor completely good, but it cannot be denied. MEV promotes decentralization, one of the most important features of every blockchain. So in general, the benefits still outweigh the disadvantages because if there were no great benefits, no one would do it.

Summary

MEV is one of the areas with many mysteries and hidden corners in the crypto market. Hopefully through this article everyone can understand what MEV is?