What is Stella? Stella is a protocol that allows users to use leverage on their loans to seek profits with an interest rate of 0%. Stella offers profitable strategies, built on top dApps in the DeFi world.

To understand more about the project, people can refer to the articles below:

- What is Lending & Borrowing? The Essential Borrowing and Lending Puzzle in DeFi

- What is Yield Farming? Make Profits As People Become “Farmers” In DeFi

- What is DeFi? All About DeFi

Stella Overview

What is Stella?

Stella is a protocol that allows users to use leverage on their loans to seek profits with an interest rate of 0%. Stella is a link between lenders and borrowers, the core product is to provide strategies for individuals who want to use leverage on their loans to create profits.

A special feature of Stella is that borrowers do not need to pay any interest to the protocol or the lender. Instead, lenders will share in the profits from the loans. The more profits earned, the greater the rewards shared and this is called the PAYE (Pay-As-You-Earn) model from Stella.

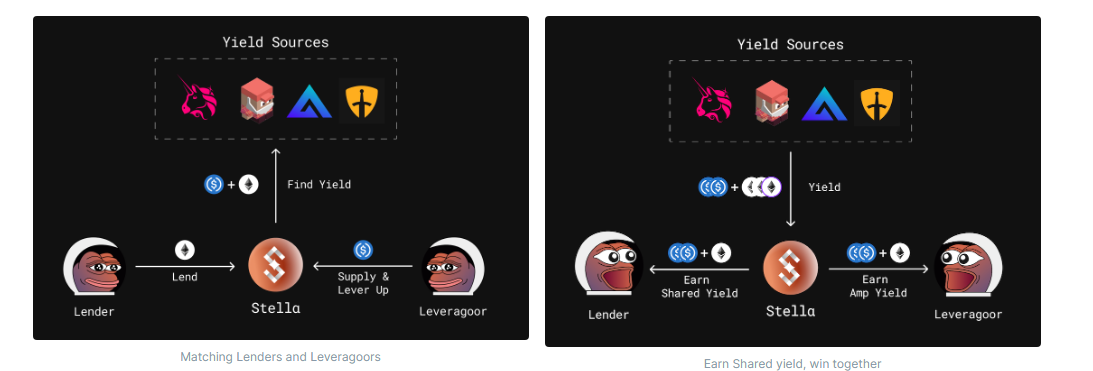

Mechanism of action

Stella’s mechanism of action

- For Lender (lender): They can lend their assets in the Lending Pool and earn profits from it. Although APY is the profit divided from the Leveragoors, there is no limit to the APY in this case (The more profit is generated, the same amount of bonus is divided).

- For Leveragoor (borrower): They need to mortgage a certain amount of their assets to Stella to use leverage for loans. Stella will provide biological strategies built on top reputable protocols in the DeFi world. After receiving profits, a portion will be shared with Stella and the lender.

Liquidation

Loan liquidation takes place when one of the following two situations occurs:

- The position is underwater: This is based on a parameter called DebtRatio. Calculated based on the formula: Total loan amount/Total mortgage amount. If the index is greater than 100%, it means the position can be liquidated.

- The position expires: This mechanism was created to ensure Lender’s rights. Orders opened on Stella will expire within 30 days from the date of opening the position. After expiration, loans can be liquidated regardless of the DebtRatio. Interest will be calculated and divided to the Lender when a loan expires according to the PAYE model. This mechanism helps Lender protect its interests and also reminds Leveragoor about the position of loans to avoid falling into unwanted situations.

A liquidated loan will be liquidated in USDC and a sum will be sent to the Lender for contributions in the protocol.

Collateral

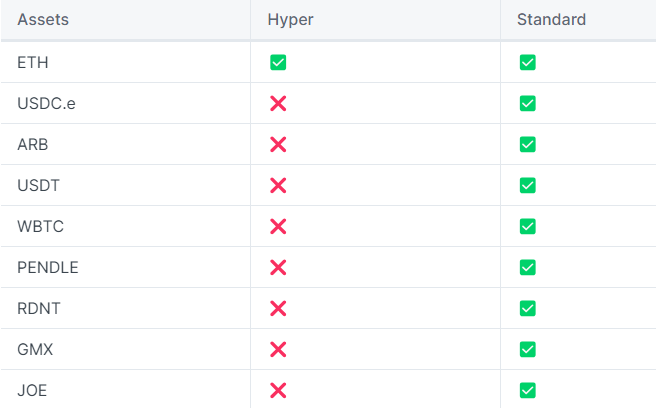

Stella Supported Assets

The assets supported by Stella are based on the assets included in Stella’s profitability strategy:

- Hyper: will be for investors who like high profits with risks.

- Standard: This strategy is for those who like certainty about their loans.

Development Roadmap

Update…

Investor

Update…

Core Team

Update…

Tokenomics

Overview of ALPHA tokens

- Token name: ALPHA

- Code: ALPHA, on Avax it is ALPHA.e

- Blockchain: ETH, BNB, AVAX, ARB

- Token classification: ERC-20

- Contracts: 0xa1faa113cbE53436Df28FF0aEe54275c13B40975

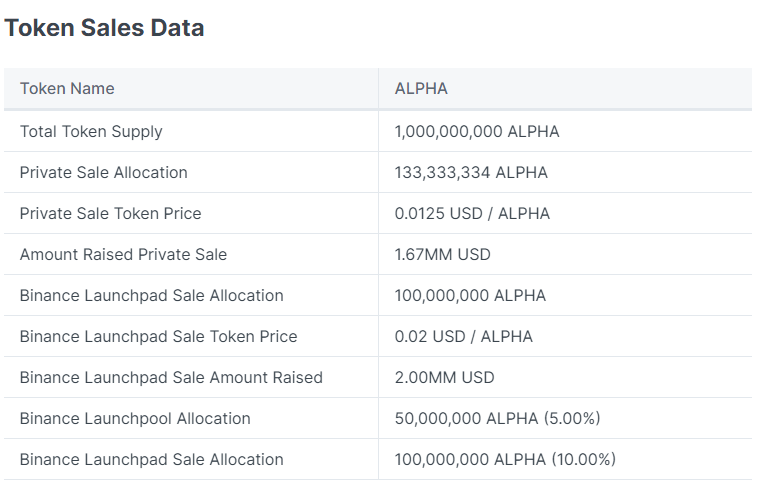

- Total supply: 1,000,000,000

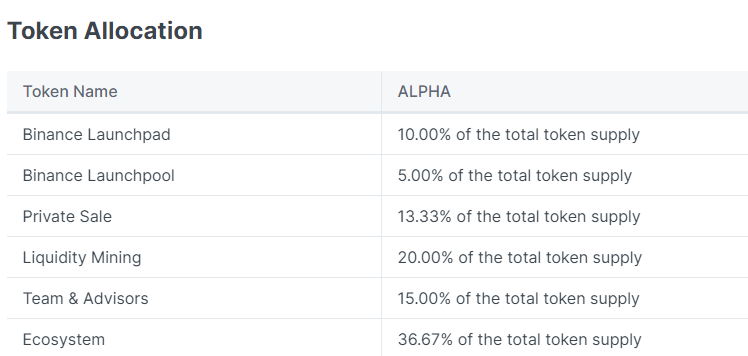

Token Allocation

Token Allocation Stella

Token Allocation Stella

- Binance Launchpad: 10%

- Binance Launchpool: 5%

- Private Sale: 13.33%

- Liquidity Mining: 20%

- Team & Advisors: 15%

- Ecosystem: 36.67%

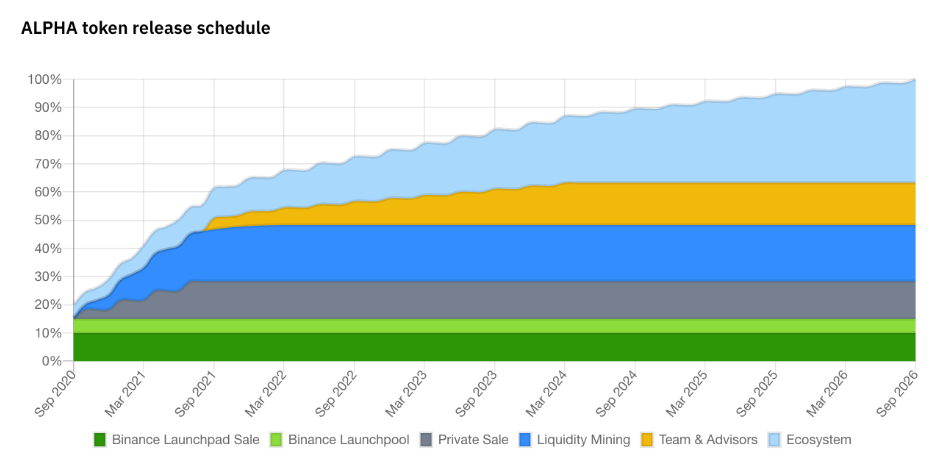

Token Release

Stella Token Release

Token Use Case

ALPHA holders can do the following:

- Stake to secure the network and they will receive a bonus from Stella’s revenue.

- Vote for protocol related changes

Exchanges

People can currently buy ALPHA tokens at CEX exchanges such as: Binance, OKX, Bitget… and DEX exchanges such as: UniswapV2.

Project Information Channel

- Twitter: https://twitter.com/stellaxyz_

- Website: https://stellaxyz.io/

- Telegram:

Summary

Through this article, I hope to have provided everyone with general information about the Stella project. This is a project with improvements in the product as well as the uniqueness it brings. The PAYE model has also brought a new breeze to the Lending market in particular as well as DeFi in general. HakResearch’s team will continue to update everyone with the latest information about the project.