What is Bitcoin ETF? Bitcoin ETF stands for Bitcoin Exchange-trader Fund, created with the purpose of minimizing risks for retail investors and increasing liquidity in the crypto market. Up to now, there have been countless times when the SEC has refused to approve a Bitcoin ETF, so let’s find out what the reason is in the article below.

To better understand Bitcoin ETF, people can refer to some of the articles below:

- Crypto Panorama 101 | Episode 2: What is Bitcoin?

What is a Bitcoin ETF?

Bitcoin ETF landscape in the US

Currently, there are a number of countries accepting Bitcoin ETF such as:

- Canada has approved and allowed the listing of Bitcoin ETFs since February 2021. Currently, Canada has many Bitcoin ETFs operating on the country’s exchange.

- Brazil approved a Bitcoin ETF in April 2021

- Germany allows a Bitcoin ETF to be listed on its exchange from July 2021. This is the first time for a European country to allow the listing of a Bitcoin ETF.

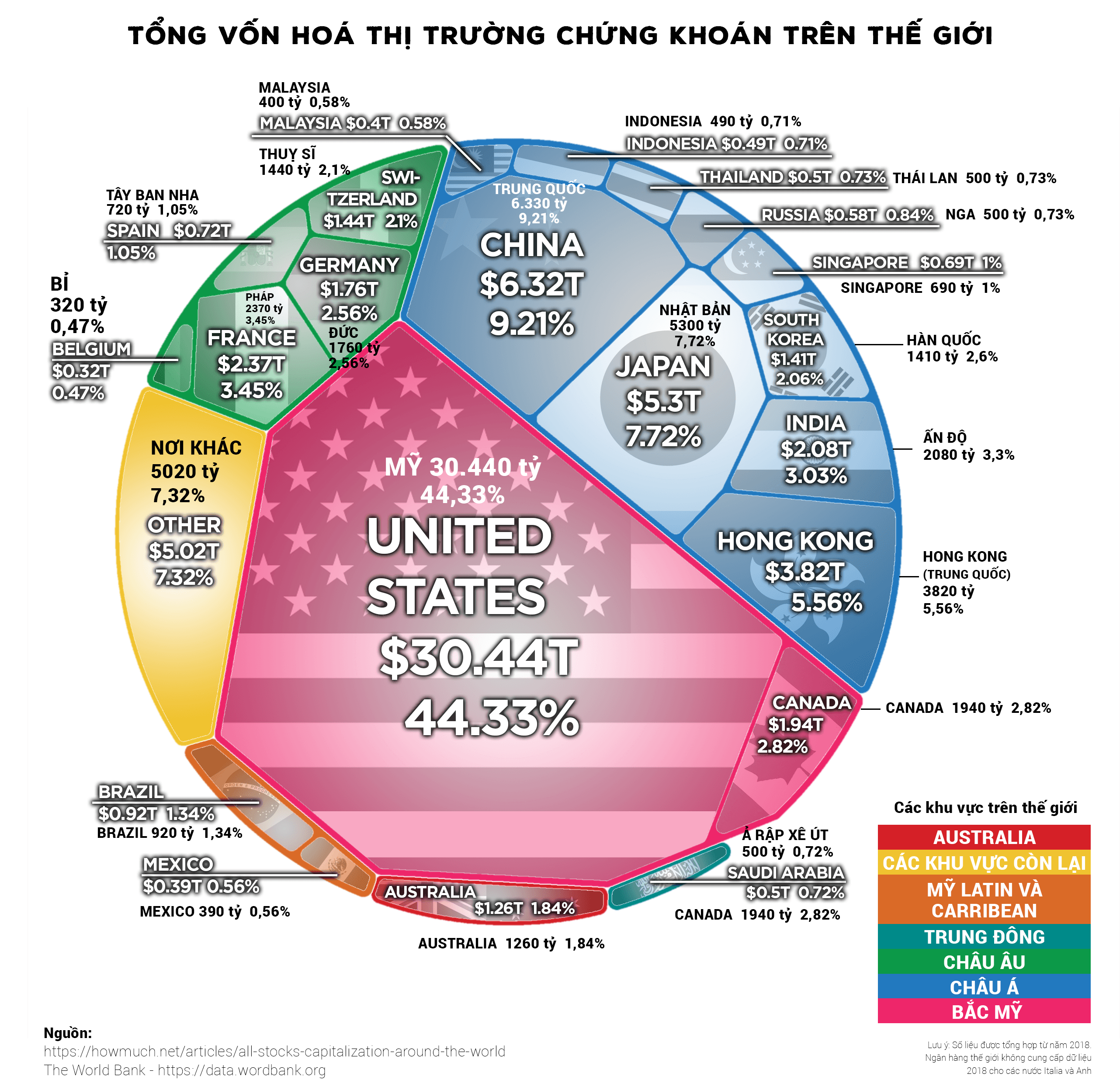

But why does everyone, the entire community, look forward to the Bitcoin ETF in the US? A very simple reason is that the data in the key shows that the US stock market accounts for nearly 45% of the total global stock market and shows signs of increasing over the years.

Countries that have accepted Bitcoin ETFs such as Canada and Germany only account for nearly 3%, Brazil only accounts for about 1.34%. With the size and influence of the US stock market, if there is a Bitcoin ETF on the US stock exchange, it will affect the world, not simply stopping in this country.

In June 2021, the SEC officially approved the Bitcoin ETF Future and this created a strong boost for the crypto market before it entered the Crypto winter not long after. The acceptance of Bitcoin ETF Future means that investors expect that the SEC will soon approve the Bitcoin ETF, but that has not yet come true.

The SEC continuously rejects Bitcoin ETF Spot applications from many companies such as Valkyrie, Kryptoin, Wisdomtree, ARK Invest,… and many other companies. This has created a wave of outrage in the community. Most recently there are rumors that Blackrock is preparing to submit a proposal for a Bitcoin Spot ETF.

Overview of Bitcoin ETF

Bitcoin ETF (Exchange-Traded Fund) is a type of investment fund listed on an exchange, allowing investors to buy and sell bitcoin through the fund instead of buying and holding bitcoin directly. Bitcoin ETF aims to reduce investor risk and increase the liquidity of the bitcoin market. Some of the benefits of a Bitcoin ETF include:

- Convenient: Buying and selling Bitcoin through ETFs is convenient and fast, helping users avoid having to manage electronic wallets and avoid facing risks related to storage.

- Diversify your investment portfolio: Having a Bitcoin ETF helps investors have more variety in choosing assets, crypto, stocks,… that they want to invest in.

- High liquidity: ETFs can be bought and sold on exchanges, which increases Bitcoin liquidity and reduces dependence on Bitcoin exchanges like Coinbase or Binance.

- Easy to access: Users can buy and sell Bitcoin through traditional exchanges without having to have in-depth knowledge of encryption and Blockchain technology.

- Security and safety: ETFs are managed by professional investment funds and protected by strict regulations and laws.

- Juridical:Investors, investment funds and organizations can freely invest in Bitcoin without legal worries.

Difference between Bitcoin ETF and Bitcoin ETF Future

Bitcoin ETF Spot (can be shortened as Bitcoin ETF) are ETF funds managed by companies that will buy Bitcoin. Investors can participate in Bitcoin investment through buying shares of ETF funds, these shares represents the Bitcoin that the company holds. This means that investors do not need to worry about storage, security and risks surrounding self-storing Bitcoin if buying directly on exchanges.

Bitcoin ETF Future is a type of futures contract linked to the price of the Bitcoin ETF. Similar to other Bitcoin futures contracts, the buyer of a Bitcoin ETF Future contract will commit to buying or selling the Bitcoin ETF at a fixed price at a specific time in the future.

The biggest difference here is that behind Bitcoin ETF Spot, there must be a real amount of Bitcoin to guarantee the amount of shares issued to the market. As for Bitcoin ETF Future, there is no need for that. Therefore, Bitcoin ETF Future does not have a big impact on the price and supply of Bitcoin in the market and that is also the reason why everyone is waiting for Bitcoin ETF Spot.

Some disadvantages of Bitcoin ETF

Besides the advantages and benefits it brings to the financial market, Bitcoin ETF still has some risks as follows:

- Transaction fees: Like any other ETF, Bitcoin ETF will also charge transaction fees. These fees can affect an investor’s profitability.

- Market risks: As with any investment, the value of a Bitcoin ETF can decrease and investors may lose their money. If the Bitcoin market declines for external reasons, the ETF will be affected.

- Security risks: Bitcoin ETFs must store their Bitcoin balances on exchanges. If these platforms are hacked or something goes wrong, the ETFs could lose Bitcoin or experience a decrease in value. For example, there is a high possibility that Blackrock will use Coinbase’s custody service and what if there is a problem with Coinbase Custody?

- Transaction time: Crypto is a sleepless market but with Bitcoin ETF it will operate according to stock market time.

The Future of Bitcoin ETF in the US

Obviously if we see a Bitcoin ETF in the US it will be one of the biggest growth drivers ever for the crypto market. However, the problems with Bitcoin ETFs in the US are still too much as the SEC has not thought too much about rejecting Bitcoin ETF proposals for a long time. The SEC is not afraid of organizations’ threats to sue in court.

In my opinion, the Bitcoin ETF story is just a sooner or later story of the entire market and it will definitely happen.

Summary

Bitcoin ETF will be a landmark event for the crypto market in general and the entire financial industry in particular. But the Bitcoin ETF is still on the threshold of history with annoying guards called the SEC.