Recently, Curve has continuously announced information about crvUSD – Decentralized Stablecoin with a completely new operating mechanism developed by Curve itself. This has attracted huge attention from the Curve and DeFi community.

So What is the role of crvUSD for Curve? Where are these? investment opportunity if crvUSD is successful? Let’s find out through the article below.

To understand more about this article, people can refer to some of the articles below:

- What is Curve Finance (CRV)? Curve Finance Overview of Cryptocurrencies

- Curve Finance (CRV) Operating Mechanism

- Curve Wars Is Coming Back. Which Projects Will Benefit & Grow?

Why Curve Finance Needs to Develop crvUSD

First, there is the CDP stablecoin model like MakerDAO’s DAI The goose lays golden eggs that every project wishes to have. You build a platform that allows users to mint an amount of stablecoin with the assets they own and collect a % fee from borrowing, mint/repay on that amount of money while doing almost nothing else.

For example: With an Aave Lending protocol they are lending an average of $1B stablecoins, if their new stablecoin $GHO only needed to account for 30% of the above amount along with 2% assorted fees, this protocol could collect $6M revenue per year. This number will be much more terrible during the up-trend period.

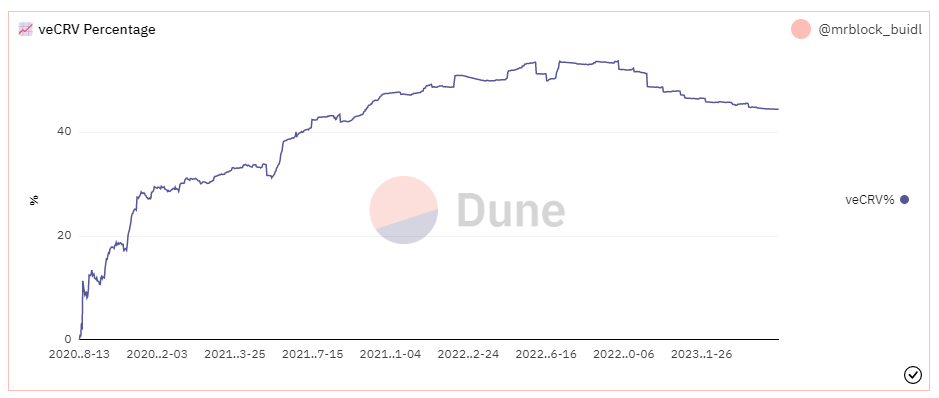

Along with that, Curve uses a veToken model that shares veToken Holder collected fees and the inflated CRV amount with liquidity providers. When the market grows well, we have the following cycle:

High transaction demand –> BIG fees –> Encourage investors to buy CRV to lock into veCRV –> CRV increases –> Increase rewards for liquidity providers –> Increase TVL — > Attract more users –> ….Repeat

However, from the beginning of 2022 until now the market has come into its own reduced cycle causing the above loop to turn in the opposite direction when trading decreases -> CRV decreases -> TVL decreases… and for an AMM, the amount of TVL is likened to blood in the body, a decrease in TVL will cause the AMM to operate ineffectively. result and lead to failure.

A large protocol like Curve will not be able to sit still and wait for the uptrend season, especially for a field with a lot of competition like Crypto, so they must find a way to do it themselves. increase trading volume and TVL on the protocol right in the middle of a gloomy time in the market. Then, crvUSD is given and is the most reasonable answer

crvUSD kills 3 birds with one stone

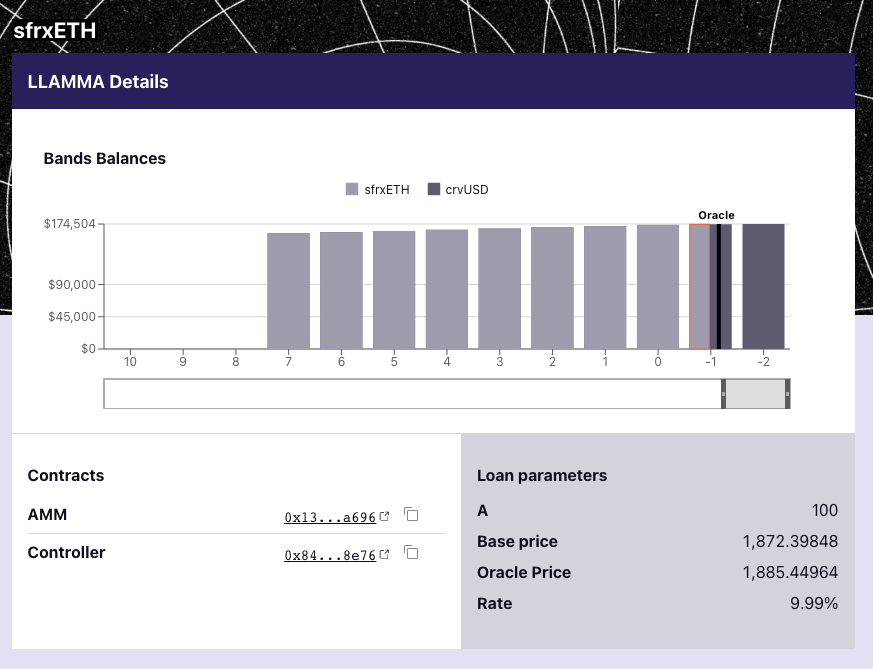

crvUSD is developed on a new, unique mechanism of Curve Finance called LLAMMA (Lending-Liquidating AMM Algorithm).

You can learn details about crvUSD’s operating mechanism through this article.

Basically, LLAMMA has 2 major improvements:

- The first: Liquidity when the asset price is guaranteed, LLAMMA will liquidate each part of the asset at a certain price frame and in case the asset price increases again, this mechanism will use stablecoin to buy back the asset. This is the biggest improvement compared to the current CDP, with a mechanism to liquidate all assets when the price drops below the threshold and when the price increases again, users will not receive the collateral assets back.

- Monday: Keep peg for crvUSD using the mint/burn uncollaterized crvUSD mechanism along with regulation from flexible interest rates of borrowing interest.

In this article, we will focus a lot on the benefits that the first improvement of the LLAMMA mechanism brings to Curve. Allowing liquidity (selling collateral to buy crvUSD) in parts and buying back collateral in crvUSD when the price increases will help Promote and maintain transaction activities on Curve Finance.

In addition, crvUSD will also be created by Curve Finance to create liquidity pools with other stablecoin assets, which will partly generate additional needs for swaps and LPs between these assets.

Finally, during the operation, the collateral prices in the Curve Finance pool and the prices from Oracle will often have differences, creating opportunities for arbitrage transactions. In other words, increase transaction volume at Curve Finance.

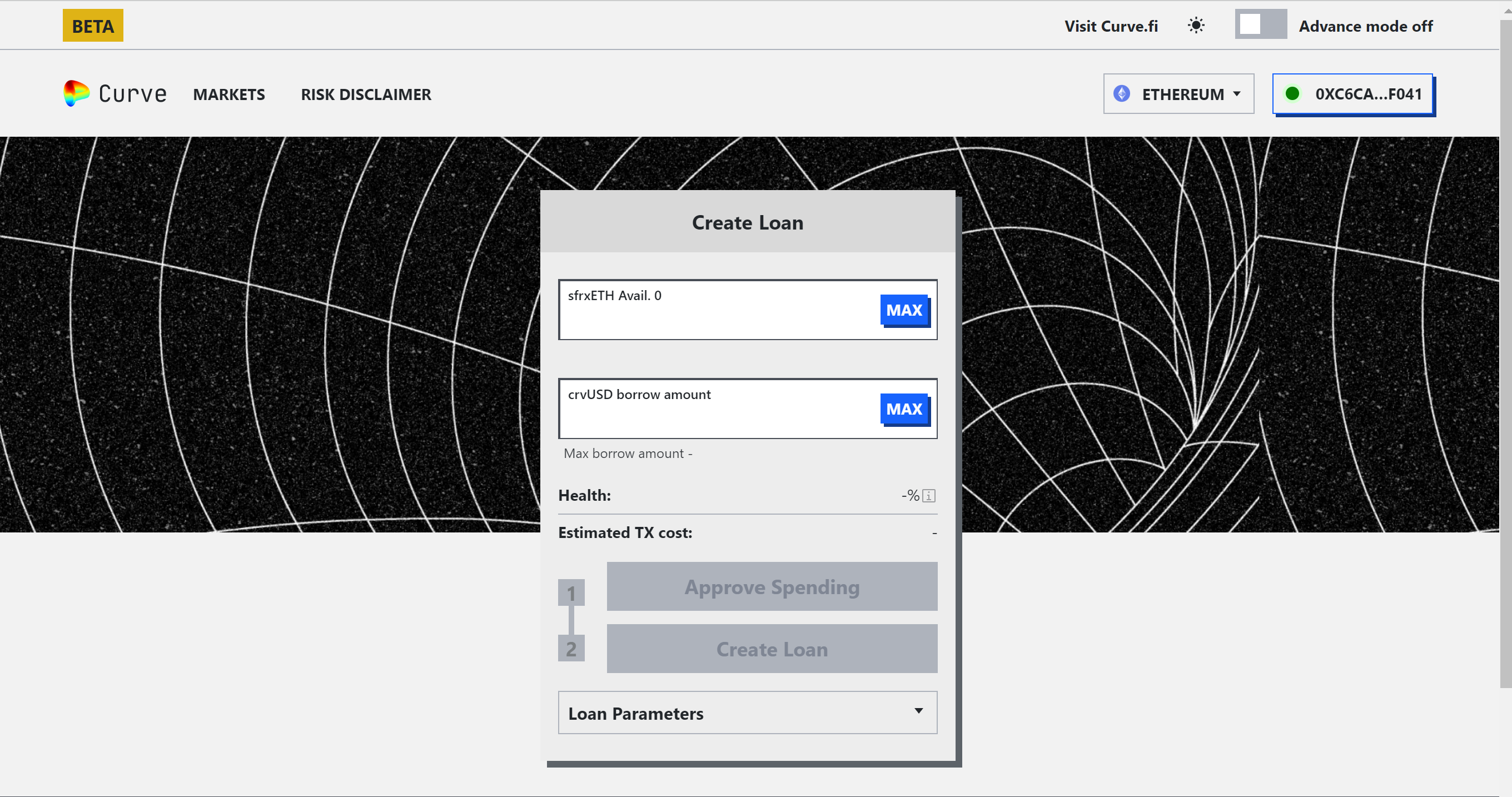

Next, when considering crvUSD, the question is what will be the collateral assets that are allowed to be used to mint this stablecoin. Currently in the beta UI we only see sfrxETH, in the future it will expand to include LSTs and ETH.

Along with that, a hypothesis that is likely to happen is that the 3crv pool will also be used soon. Provide Stablecoins make liquidity and enjoy profits and use the LP token itself to mint another stablecoin for further use in DeFi. This is a bargain that Curve will serve to attract TVL for the platform as well as helping crvUSD dominate the market.

Finally, crvUSD may be the answer to the problem reduce the circulating supply of CRV. As mentioned above, the amount of veCRV is decreasing as the trend goes down, mainly because Curve’s yield is no longer attractive. The birth of crvUSD will add to that yield source a large amount of fees from LLAMMA and borrow fees earned when minting this stablecoin. This will encourage users to buy and lock CRV to enjoy sharing fees from Curve.

In summary, crvUSD when launched will help Curve:

- Increasing trading volume generates more fees

- Attract more TVL

- Reduced circulating supply of CRV

Projects that benefit from crvUSD

Besides Curve Finance itself benefiting if crvUSD is successful, the following project groups will directly or indirectly have more development opportunities from this stablecoin.

Yield Farming

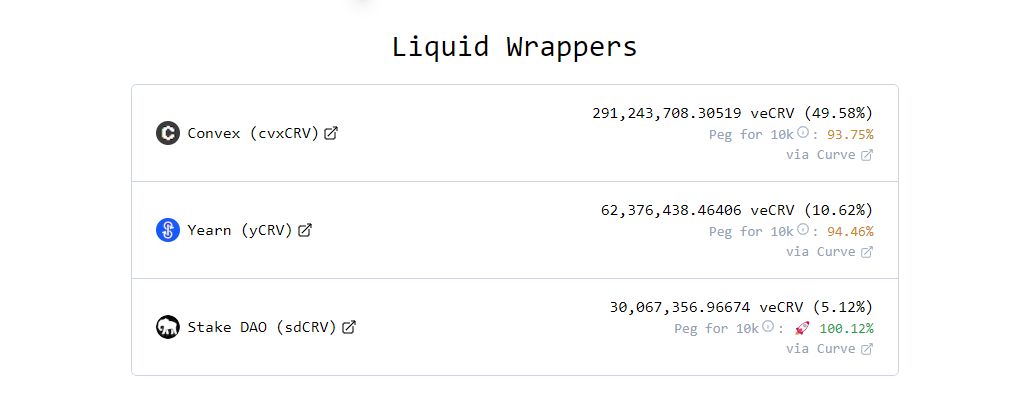

This is a group of projects built on Curve and participating in Curve Wars. By owning the majority of veCRV, these projects will directly benefit from increased CRV prices.

In addition, when CRV increases, it means incentives for liquidity pools will increase in value, and projects will spend a lot of money on brides. Thereby indirectly helping to increase the governance token of these projects.

This group currently has 3 leading names: Convex Finance, Yearn Finance and Stake DAO, whose position has been stable for a long time and is not expected to have much disturbance.

Liquid Staking

As mentioned above, sfrxETH is one of the collateral assets to mint crvUSD. I believe that in the near future, major Liquid Staking protocols such as Lido, RocketPool,… will also soon be integrated into Curve. As I analyzed in an article about LSDfi, creating more usecases for LSTs (stETH, rETH) is the race that LSD protocols are participating in after ETH Shapella.

Integrating with Curve, Liquid Staking protocols will benefit:

- Increase use cases for LSTs, easily attract new users

- Lock LSTs reduce the rate of Redeem users switching to other protocols

- Investors perform Looping (Dep LST –> Borrow crvETH –> buy ETH –> stake LST –>…) thereby increasing the amount of ETH staking and increasing revenue for the protocol.

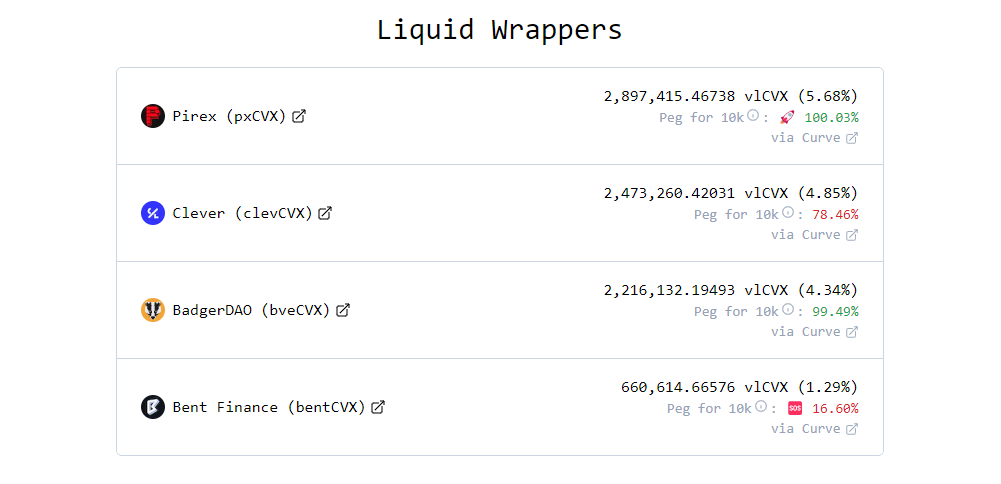

Top Liquid Wrapers by Convex Finance

Among the Yield Farming projects above, Convex Finance is currently number 1 and unique in holding nearly 50% of veCRV. This means that Convex can dominate decision-making power at Curve.

But in reality, at Convex itself, a battle for governance tokens is taking place for the simple reason that Convex dominates Curve Finance and whoever dominates Convex will have voting advantage.

However, unlike Curve Finance, the battle at Convex Finance has not yet found a winner. Therefore, crvUSD will probably be the fire that helps this war become hotter, or in other words, CVX value may be pushed up due to increased demand.

Details about Convex War you can read more in this article.

Summary

Hopefully this article provides some more information for you to evaluate crvUSD’s impact on Curve in particular and DeFi in Ethereum Generally speaking. If successful, crvUSD will unlock a large amount of liquidity back into the market, thereby warming up Crypto in the middle and end of 2024. Follow HAK Research to update data on crvUSD in the near future.