Many decentralized finance (DeFi) protocols have emerged to erase the financial borders between the real world and the blockchain world. One of them is Lido Finance.

The project aims to remove significant financial participation barriers to Ethereum staking (as becoming a validator requires up to 32 ETH) and make it possible to run nodes on the Ethereum blockchain. Authentication becomes technically easier.

In today’s article, we will learn together what Lido Finance is, what Lido Finance’s operating model is, and how Lido can help you create passive income? And how is it that a single DeFi protocol accounts for over 30% of all ETH staked on Beacon Chain? Please continue reading below!

What is Lido Finance?

First we will briefly talk about the Lido Finance project: This is a decentralized application (Dapp) that provides liquid staking features. Lido currently has a total value locked (TVL) of nearly $6 billion on the platform with over 199k protocol-secured stakers. Lido has been secured by some of the industry’s leading blockchain security companies, including Quantstamp and Mixbytes.

Essentially, Lido Finance is a liquid staking protocol, allowing users to stake proof-of-stake cryptocurrencies like Ethereum and Solana without must lock them. This means that the tokens (or rather, the version issued by Lido) can be freely traded while still being staked into the protocol.

Lido’s Mechanism of Action

One of Lido’s biggest advantages is that it lowers the barriers to entry for ETH staking, as running a validator node on Ethereum requires a minimum staking amount of 32 ETH, worth approximately $42k at current prices.

With Lido, users can stake a small portion of Ether tokens without the technical difficulties of setting up their own validator node. The staked tokens can still be freely traded on the open market, hence the term liquid staking. But how does Lido do this?

Users who stake their ETH with Lido will receive an equivalent amount of Lido Staked Ether (stETH). They can be freely traded and transported between DeFi protocols, increasing capital efficiency for stakeholders. Lido Finance currently supports Ethereum’s Beacon Chain (also known as Ethereum 2.0), Solana, Polkadot, Kusama and Polygon. Staking rewards depend on the cryptocurrency value, starting from an annual rate (APR) of 3.8% for liquid Ethereum staking, up to 16.5% APR for liquid Polkadot staking.

With that feature, the Lido Finance platform makes it easy for users to participate in Ethereum activities. Therefore, it makes Ethereum more decentralized and inclusive for all users regardless of the amount of money they have.

Design goals and constraints

Staking in the first phase of Ethereum 2.0 means taking the risk that your ETH will be frozen until transactions can ship in Ethereum 2.0 (Phase 1.5 or Phase 2), which is expected to happen. next year at the earliest. Until that time, no one could withdraw staked ether or staking rewards and sell them on an exchange, for example.

To validate Beacon Chain, stakers need to deposit 32 ether, specify a validating public key, and confirm a withdrawal address where the staker’s assets and rewards will be frozen until shipping. transfer is enabled. Until then, the only two operations you can perform on the beacon chain are authenticate and unauthenticate. During this time, stakers must run the validation infrastructure, facing the risk of stake reduction in case of misconfiguration.

If a validator commits a violation, they run the risk of being locked out or losing their reward. For example, this can happen due to errors in the validator node scripts or due to connection problems. This risk makes staking Ethereum especially unattractive in Phases 0 and 1, when stakers must bear market risk and receive little reward while not being able to cancel staking.

Lido aims to allow users to stake ether without losing the ability to trade or use their tokens. Lido will be a decentralized infrastructure for issuing liquidity tokens with a degree of flexibility compared to users staking themselves.

Lido’s main goals are:

- To allow users to earn staking rewards without completely locking up their capital;

- To provide flexibility for users to earn rewards for deposits smaller than 32 ether and unrestricted deposits other than multiples of 32 ether;

- To reduce the risk of losing staking funds due to software errors or malicious third parties;

- To provide stETH tokens as building blocks for other applications and protocols (e.g. as collateral in lending or other transactional DeFi solutions);

- To provide an alternative to exchange staking, self-staking, and other decentralized protocols.

Lido is designed as an easy-to-use, community-governed protocol. The protocol is subject to changes in the underlying blockchain mechanism.

Lido’s structural components:

first. Staking pools: protocol for managing deposits, staking rewards, and withdrawals

- Node operators registry

- Withdrawal credentials

- Oracles

- Rewards

2. stETH: liquid staking tokens maintain a 1-to-1 balance with the ether portion of your beacon chain

3. KNIFE: Aragon DAO adjusts protocol parameters

Below is a general description of the main components of the Lido staking protocol:

Staking pools

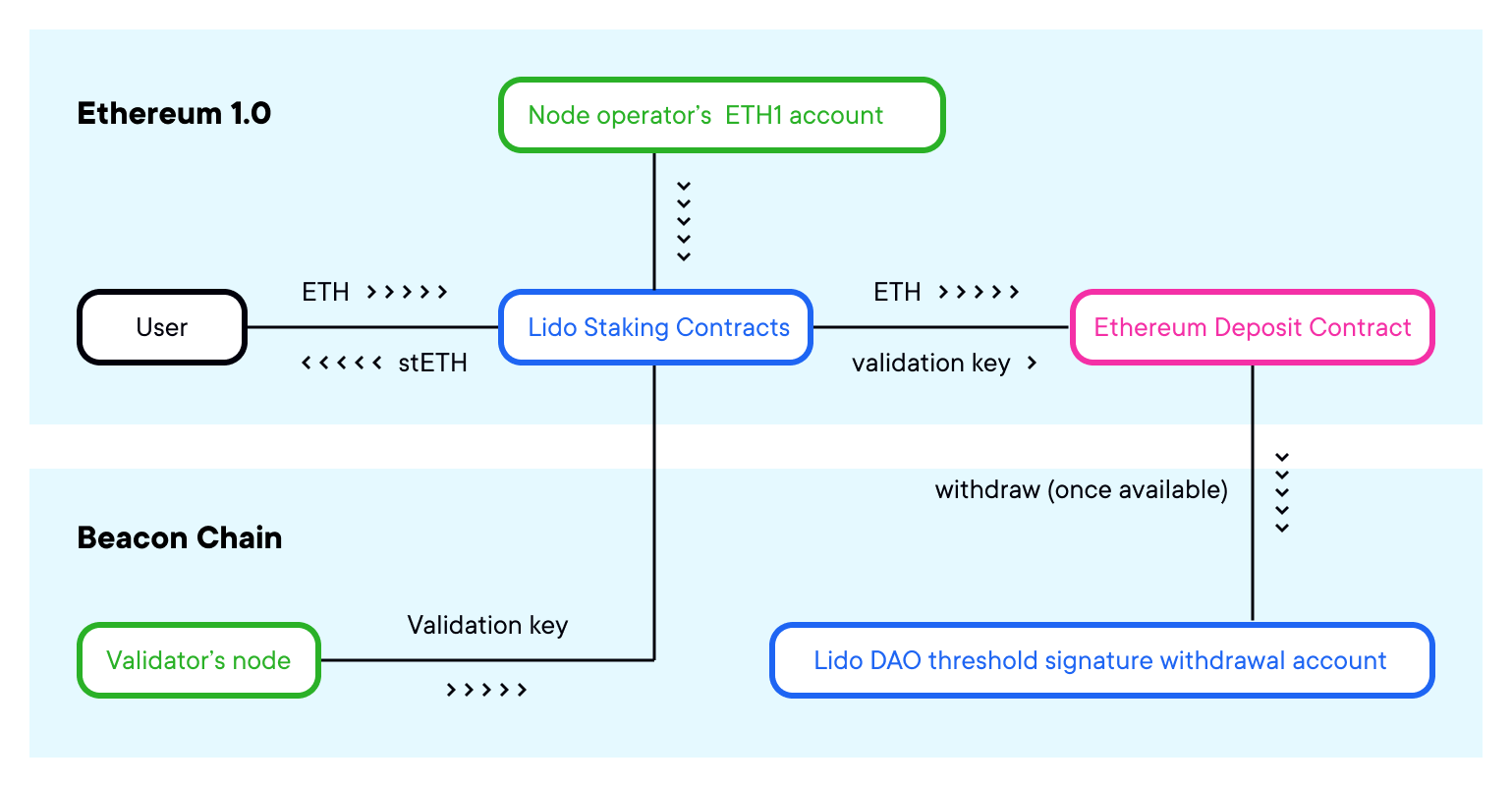

Staking Pool is Lido’s core smart contract. The contract is responsible for ether deposits and withdrawals; mint and burn stETH tokens; delegate funds to node operators; apply fees for staking rewards; and accept updates from the oracle contract. The management logic of Node operators is extracted into a separate contract called NodeOperatorsRegistry.

Users will send ether to the Staking Pool contract to receive stETH tokens. That ether will be distributed among node operators to maintain consistency and deposited to be validated by their validators. The withdrawal credentials for that ether will be set to a distributed custodian signature threshold or, if withdrawals to an eth1 address will be accepted by the community, become an upgradable smart contract will process withdrawals when they are activated.

Node operators will also validate transactions on the beacon chain. The DAO will select node operators and add their addresses to the NodeOperatorsRegistry contract. Authorized node operators must generate a set of keys for authentication and they will be provided with a smart contract. When ether is received from users, it is distributed in blocks of 32 Ether among all active node operators. The staking pool contract contains a list of node operators, their keys, and logic for distributing rewards between them.

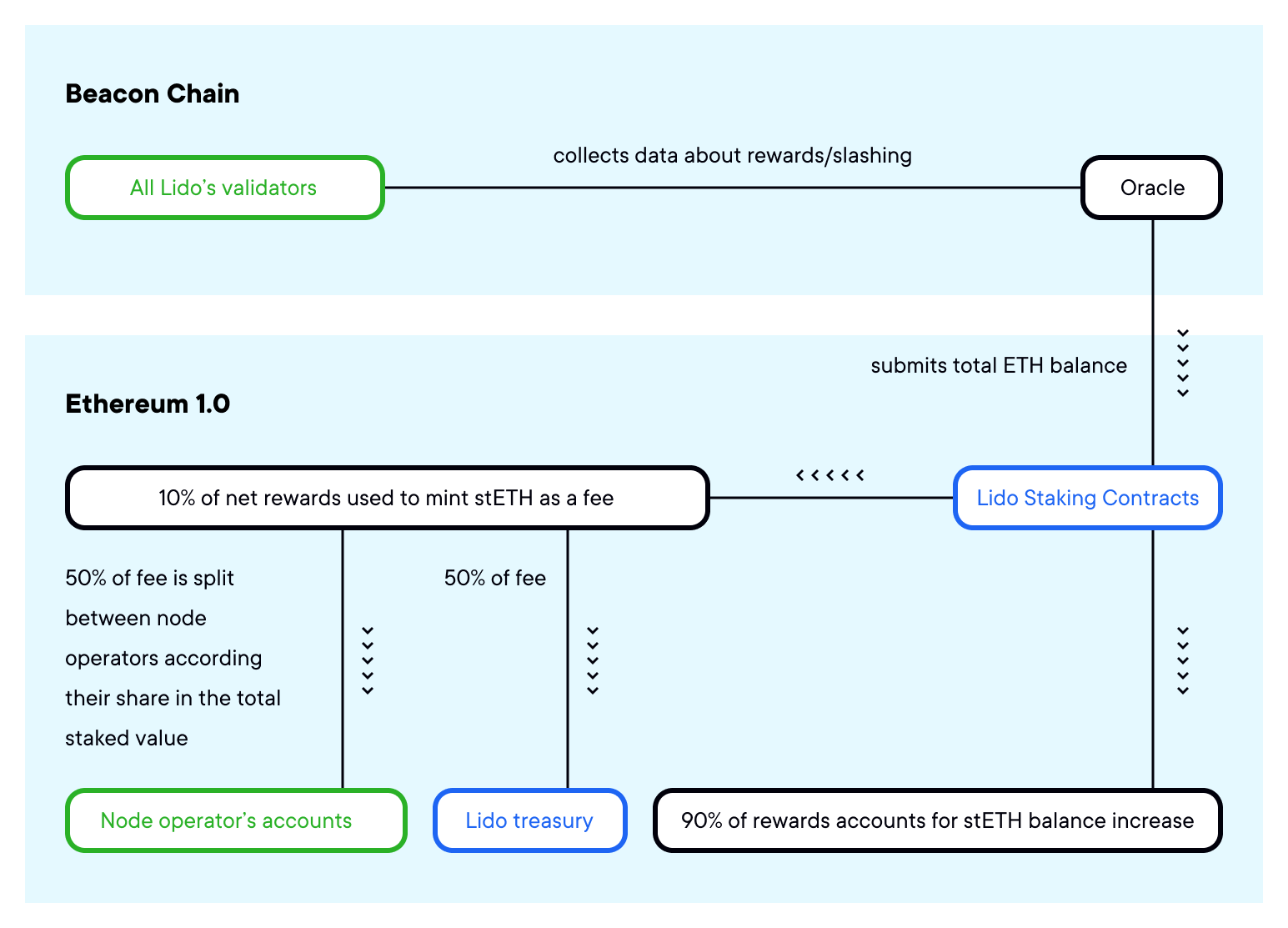

Oracle is a contract that tracks the balance of the DAO’s validators on the beacon chain. The balance can increase due to reward accumulation and can decrease due to slashing and staking penalties. Oracles are specified by DAO. Data is sent daily and is used to provide accurate balances of stETH tokens to users. On reward days, a small amount of stETH sex tokens are minted for node operators and the DAO’s development and insurance fund, representing a reward fee.

stETH tokens

stETH is an ERC20 token that represents ether staked in Lido. The stETH token balance is fixed 1:1 with ethers staked on Lido. The balance of stETH tokens is updated as the oracle reports changes in the total number of shares each day.

Lido DAO

We believe that DAO is the optimal structure for launching Lido. If Lido is launched without decentralized governance, users will doubt the ability to maintain a 1:1 ratio of ETH to stETH — similar to how Tether requires trust that USDT is backed 1 :1 in dollars.

Instead, we believe that by distributing the management of those parameters to a decentralized community, the risk to users will be reduced to a minimum.

Furthermore:

- Lido depends heavily on the design and limitations of the beacon chain;

- Ethereum 2.0 staking protocol is subject to change and thus Lido may be upgraded;

- An insurance provider must be selected and coverage reduction terms must be negotiated;

- DAO governance is better than a single person or team of developers to make decisions about changes in Lido;

- A DAO will be able to cover the costs of developing and upgrading the protocol from the DAO token treasury.

The DAO will accumulate service fees from Lido, which can be used in the insurance and development fund distributed by the DAO.

Conclusion Lido/LDO

We have learned what Lido Finance is, how it works and how to create more profit for staking your assets. Each application may have some unique risks. Therefore, please do your due diligence before staking your assets.

Lido Finance has played a key role in the Ethereum network, accounting for 30.3% of ETH staked on Beacon Chain. It is also one of the most popular DeFi protocols, with a total of over 181,000 stakers and $7.6 billion in total staked assets.

Future adoption of the protocol will largely depend on its roadmap and the other proof-of-stake tokens that will be supported by Lido. Looking at Lido’s admin page, there have been proposals to add staking support to AVAX and NEAR – which would lead to staking holders adopting more protocols.

As for Lido’s roadmap, decentralizing the validator selection process will also mean more validators and lower risk of penalties – as the protocol completes its path to decentralization.

Ultimately, the capital efficiency afforded by Lido’s stETH and other such tokens will be hard to ignore for institutional investors, as they can simultaneously earn staking rewards while still deploying stETH as collateral for other profit-generating products. This could be the main reason why Lido already accounts for 30% of staked ETH and is on track to reach over 50% in the near future.

Let’s wait and see if Lido Finance will develop as expected in the near future!