What is Layer 1? Layer 1 is one of the important platforms in the crypto market that plays a role in promoting the market’s diverse development. One of the most popular Layer 1 Blockchain platforms in the crypto market today is Ethereum, besides BNB Chain, Solana, Polygon,… So what is Layer 1 and is there anything interesting for everyone to find? Please understand in the article below.

To better understand Layer 1, people can refer to some articles such as:

- Crypto Panorama 101 | Episode 3: What is Ethereum?

- What is Solana (SOL)? Solana Cryptocurrency Overview

What is Layer 1?

Background of Ethereum’s birth

Why is it the birth context of Ethereum and not the birth context of Layer 1 in the crypto market? Because Ethereum is the first Layer 1 Blockchain of the crypto market, it took a long time for the next Layer 1 platforms to be born, but up to now 99% of the Layer 1s at that time have gone into gold and silver. Only Ethereum continues to lead the market.

- Ethereum: Born in 2013

- Monero was born in 2014.

- NEO was founded by Da HongFei and Erik Zhang in June 2014.

- Cardano was founded in 2015 by founder Charles Hoskinson.

- Polkadot was founded by Garvin Wood and was born in the 2020s.

Vitalik Buterin built Ethereum with the goal of creating a more flexible and scalable blockchain platform than Bitcoin. The highlight of Ethereum is the smart contract feature, which allows parties to make agreements directly on the Blockchain without the need for intermediaries. This opens up great possibilities for future trends such as DeFi, NFT, Gaming, Social,…

Clearly, integrating Smart Contract into Blockchain has created the second biggest turning point for the entire cryptocurrency market after the birth of Bitcoin.

Overview of Layer 1

Layer 1 is an infrastructure platform that connects Blockchain technology and Smart Contract to help build the above decentralized protocols and applications.. Some prominent Layer 1s in the crypto market include: Ethereum, Solana, Near Protocol, Cardano,…

In addition to Layer 1, in the Crypto market there are many different ways to call Layer 1 such as Platform Blockchain, Smart Contract Platform, Smart Contract Platform, Blockchain Layer 1,… There are many different ways to call it, however The most common, short and simple way to call it is Layer 1. For example:

- Ethereum is a Layer 1. On Ethereum, there are many decentralized protocols and applications built such as AAVE, Uniswap, Sushiswap, Metamask, Lido Finance,…

- Solana is a Layer 1. On Solana there are many decentralized protocols and applications including Raydium, Orca, Marinade Finance, Solend, Apricot,…

- Near Protocol is a Layer 1. Near Protocol is also a diverse ecosystem of DeFi, NFT, etc. Gaming,…

Some advantages and disadvantages of Layer 1

Layer 1 was born as a turning point for the entire market and Layer 1 has a number of advantages as follows:

- Layer 1 is a Blockchain so it inherits all the characteristics of Blockchain technology such as security, decentralization, safety and scalability.

- Layer 1 has Smart Contract integration, so for activities deeply related to finance such as DeFi, users do not need to trust a third party because it is all automatically executed by Smart Contract.

- Layer 1 is highly customizable depending on the vision & mission of the development team.

It can be seen that Layer 1 Blockchains have many advantages and benefits, however, they also have many disadvantages. One of the disadvantages of Ethereum is its scalability with slow transaction speeds and high transaction fees, making it difficult for Ethereum to mass adopt. Some of the solutions proposed to solve the scaling problem on Ethereum are:

- Layer 2 has the goal of bringing implementation out of the chain, but Layer 2 itself also needs a lot of time to decentralize its network.

- High-performance Layer 1s like Solana or Internet Computer have solved the expansion problem, but the bigger problem is that the decentralization of the network is very low.

- Layer 0 such as Polkadot, Cosmos or Avalanche were born, but they also have many shortcomings such as extremely complex models, interactions between protocols or applications are not thorough, creating an inconsistent user experience. really well.

It can be seen that the problem of Ethereum is being solved by many participating parties with different approaches, but up to now there is no solution that is considered comprehensive because the solutions are different. new problems arise.

However, such a difficult problem has created major trends in the Crypto market such as Layer 1 Wars – which happened twice in the last two growth cycles of the entire market, or Layer 2. Wars – just happened in Optimistic Rollup between Arbitrum and Optimism, in the future it will be a story of zkRollup between zkSync, StarkNet, Scroll, Taiko or Linea.

Some new technologies are introduced into Layer 1

zkRollup – Extremely potential Layer 2 technology

Optimistic Rollup recently and is currently the best technology for Layer 2 solutions. However, in the long term zkRollup will be the best Layer 2 solution of Ethereum, but building zkRollup takes a lot of time because complexity of this technology/. Some advantages of zkRollup over Optimistic Rollup include:

- The scalability of the zkRollup solution gives an index of 1000x compared to Layer 1, much higher than the 10 – 100x of Optimistic Rollup solutions.

- The time to withdraw money from Layer 2 to Layer 1 of zkRollup only takes a very short time compared to other Optimistic Rollup platforms. In this case, Optimistic Rollup solutions are also actively changing from 10 days to less than 1 hour.

- With ZKP technology, ZkRollup platforms enable privacy to become a customized right for developers and users.

This difference mainly comes from the use of transaction proof while Optimistic Rollup solutions use Fraud Proof, zkRollup solutions use Validity Proof. However, zkRollup solutions need to improve many features in the future such as EVM compatibility, user experience,…

Parallel Execution – Solution used by new generation Layer 1s

In conventional Blockchains, transactions are often processed sequentially, but with new generation Blockchains such as Sui, Aptos, Monad, Linea or Fuel Labs, these projects choose the approach of parallel execution. With parallel execution, it is possible to increase the TPS of a blockchain exponentially and solve the scaling problem on Ethereum.

I have presented in great detail about Parallel Execution in the article What is Parallel Execution? Advantages, Disadvantages & Working Mechanism of Parallel Execution. I believe that parallel execution or Parallel Execution will become a “hot keyword” in the next boom cycle of the market, so don’t forget to follow projects using this solution.

Some of the factors that help a Layer 1 succeed

There is no general formula for a successful Layer 1 protocol, however successful Layer 1s often possess some of the following characteristics:

- Layer 1 must be backed by a major force inside or outside the Crypto market like the story of BNB Chain backed by Binance, Solana backed by Sam FTX and Alameda Research,…

- Layer 1 must grasp the market trend (understand which direction the market will go, what developers need) that is the story of EVM Blockchain in 2021 with BNB Chain, Polyogn, Avalanche, Fantom, …

- Layer 1 must have strategies to attract developers such as Grants, Hackathons, Offline,… to develop a comprehensive ecosystem, full of puzzle pieces.

- Layer 1 must have a new technology or practice that creates a story that is good enough for all users to understand easily. Like Near Protocol with Sharding, Celo with Mobile Blockchain, Casper with Enterprise Blockchain,…

A successful Blockchain needs to be a comprehensive combination of two factors: Business and Technology. No matter how good a project is, without a suitable and strong marketing strategy, the likelihood of success will be very low or it will take a lot of time to succeed. A Blockchain that is too Business-oriented is very difficult to develop long-term in the crypto market when you do not have too many differences.

Some Layer 1 Platforms In The Upcoming Cycle

Ethereum – The throne is maintained

It is a fact that if Bitcoin is expected to continue to dominate the entire crypto market in the long term, Ethereum, too, will continue to dominate the Layer 1 segment for a long time to come. To maintain its position, Ethereum must constantly upgrade and change itself to fit the times. Some outstanding upcoming updates include:

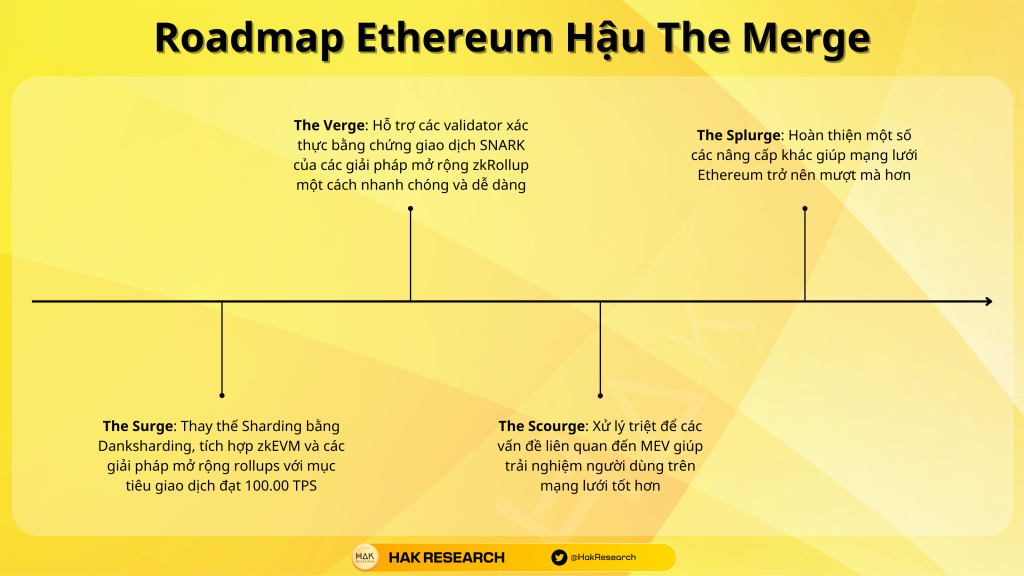

- The Surge: This update will replace the old development roadmap Sharding to EIP-4488 with the focused technology Danksharding. Integrate zkEVM from ZkSync, Scroll, Polygon,… and Rollup expansion solution with the goal of reaching 100,00 TPS in the future.

- The Verge: Supports validators to validate SNARK transaction proofs of zkRollup scaling solutions quickly and easily.

- The Scourge: Thoroughly handling issues related to MEV helps improve user experience on the network.

- The Splurge: Completed a number of other upgrades to make the Ethereum network smoother.

Aptos – Sui: The next names to challenge Ethereum

Aptos and Sui are next generation Blockchain platforms with many improvements. While Aptos solves the scaling problem through Block-STM Algorithm with parallel execution, Sui chooses the approach of Narwhall and Bullshark. to solve the Mempool dilemma by separating the data transfer and consensus processes.

It’s not natural that Aptos and Sui always go together like that, there are some brief reasons as follows:

- They all come from Facebook, especially with the Diem project. After Diem failed, the project construction team split up to do different things in the crypto market, including building Sui and Aptos.

- Both projects raised hundreds of millions of dollars before mainnet.

- Both projects use Move as the programming language on their Blockchain platform.

With the above factors, Sui and Aptos quickly became Layer 1 Tier 1 in the crypto market. Both projects were valued at billions of dollars when they first appeared on the trading floor.

Some other notable names

In addition to Aptos and Sui, we also have many notable Layer 1 names in the crypto market including:

- Aleo: Is a Blockchain platform that has successfully raised nearly $200M with Zero-knowledge core technology bringing privacy to users.

- Celestia: Bringing the Modular Blockchain revolution with the separation of Execution and Consensus to solve the scalability problem.

- Monad: EVM Blockchain platform uses parallel execution with a commitment of up to tens of thousands of TPS in the near future.

- Linera: With the concept of Microchain and background from Facebook, it is expected to bring a new breeze in the crypto market.

- Espresso System: Privacy-oriented blockchain platform with self-developed technologies.

Investment opportunities with Layer 1 are often associated with safety and security, so people can observe the formation of underlying blockchains to find their own investment opportunities.

Summary

Layer 1 plays an indispensable role in the crypto market. Hopefully through this article, everyone can understand more about what Layer 1 is and the potential of new generation Layer 1 Blockchains.