We have had an explosive DeFi summer 2020 and 2021 with one of the highlights being the Yield Farming puzzle when AMM, Lending & Borrowing, Derivatives,… projects provide thousands of % APR While making users confused, Yearn Finance appears as a savior to help users find high and safe sources of profit.

After Yield Farming, we have Leverage Yield Farming and currently Yield Derivatives are rekindling to bring Yield Farming back. And in this article we will go through some main content such as:

- What are Yield Derivatives?

- Take a look at the development history of the Yield Farming industry

- Main mechanism of action of Yield Derivatives

- Outstanding and potential Yield Derivatives projects

And before getting into the content, people can refer to some articles to reinforce their basic knowledge:

- DeFi Panorama 101 | Episode 4: What is Yield Farming? When People Become “Farmers”

- What is Convex Finance (CVX)? Overview of Cryptocurrencies Convex Finance

- What is Yield Yak (YYAVAX)? Yield Yak Cryptocurrency Overview

Overview of Yield Derivatives

Yield Farming’s development roadmap in the past

Yield Farming was born in the context of the booming DeFi market with a series of AMM, Lending & Borrowing, Stablecoin,… projects accompanied by an explosion in the number of projects, most of which choose Liquidity Mining. to deploy launch token and liquidity bootstrap for the project. In that context, users, investors and LPs cannot know where to bring the highest returns for their idle assets.

Besides the profit issue, there were a lot of scam and rugpool DeFi projects at that time, so investors themselves were also in chaos with the market.

That’s why Yield Farming protocols were born And leading that trend is Yearn Finance. Yearn Finance is a protocol that owns many OG Crypto & DeFi they create strategies to make money in DeFi through many activities such as Lending, Farming, Staking,… but still ensuring the safety of people’s assets use. The user’s job is simply to deposit their assets into Yearn’s vault.

After a period of development, Yield Farming projects began to enter the saturation phase at that time Leverage Yield Farming was born. As a combination of Lending & Borrowing and Yield Farming, users will borrow without collateral directly on the protocol and farm through the protocols that the Yield Farming protocol has integrated. In essence, money does not leave the protocol.

And Yield Derivatives is the next generation.

What are Yield Derivatives?

Yield Derivatives are projects that allow users to use future profit sources in advance to seek additional profits through Lending & Borrowing, Staking, Farming,… A relatively simple definition. The problem that Yield Derivatives poses is: “Somehow, with a relatively sustainable source of future profit, how can we use it without having to wait?“.

So how to determine future profits, take it back to the present and use it to continue to generate profits? Let’s find out through some of the projects operating in the market today. Please.

Overview of outstanding projects in the Yield Derivatives direction

Clever – Apply Yield Derivatives for a competitive advantage in Convex Wars

Clever is a protocol within the Aladin DAO ecosystem that was born with the goal of becoming the winner of Convex Wars, thereby holding both Convex Finance and Curve Finance. Not only participating in Convex Wars, Clever also participates in the Curve Finance and Frax Finance markets.

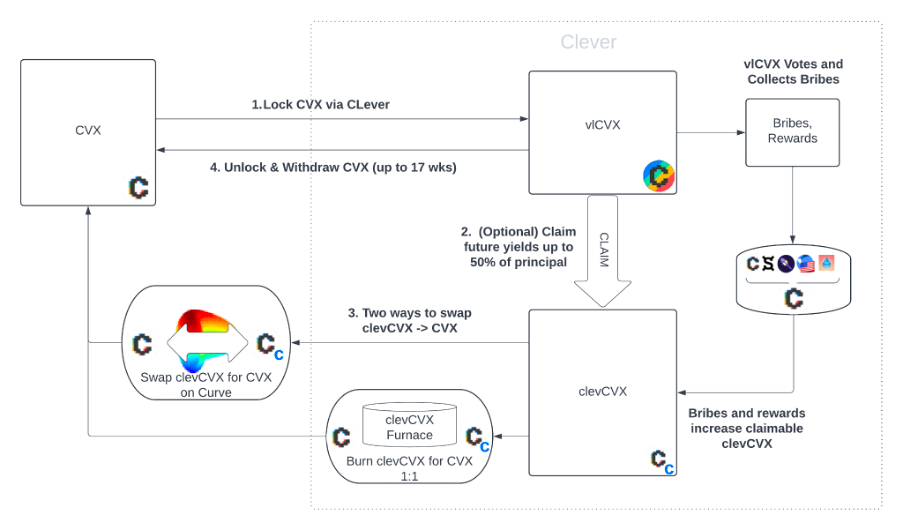

Clever’s operating model will take place as follows:

- Step 1: Users deposit assets that can be CVX, FXS or CRV into the Clever platform. We will take CVX as an example.

- Step 2: The platform will deposit CVX into Convex Finance to receive vlCVX in addition to users receiving clevCVX – the asset representing the user’s future profits.

- Step 3: Users can continue to deposit this clevCVX back to the platform to get profits from this asset in the future (form of leverage) or provide liquidity for the clevCVX – CVX pair to earn more profits.

- Step 4: Users can exchange clevCVX to CVX through 2 ways: swap on Curve Finance through the clevCVX – CVX liquidity pool or burn clevCVX to exchange for 1 CVX in The Future.

Clever’s model allows users to reap future returns of up to 50% of the principal. If we repeat this, we will have leverage based on the following example: Buu has $1,000 CVX and Buu wants to deposit it into Clever for 16 weeks, equivalent to 4 months, with an APR of about 10%.

- Step 1: Buu deposits $1,000 CVX and based on the APR of about 12%, within 4 months Buu will earn $40 (can exist in the form of CVX or many other tokens) however Buu can only earn a maximum of $20 ( 50% of the future profit of the principal amount).

- Step 2: Buu will swap clevCVX to CVX through Curve Finance.

- Step 3: Buu continues to send CVX to Clever and repeat from step 1.

Buu will continue to do so until the possible profit is lower than the cost. With this model, the larger the initial amount, the more the loop will be, and the smaller the initial amount, the opposite will be true. This is the model that Clever created to create a competitive advantage on Convex Wars and does not have much liquidation risk.

Pendle Finance – Apply Yield Derivatives to LSD

Unlike Clever’s implementation, Pendle chooses a relatively different approach when Pendle Finance will wrap Yield – Bearing Tokens in the form of SY. SY will be divided into 2 types: PT (Principal Token – Original Token) and YT (Yield Token – Yield Token).

So Pendle Finance will divide the tokens users deposit into the protocol into PT, the original token, which can help users reclaim their original assets in the future, and holding YT, which can help users claim rewards at any time. Pendle Finance will help users earn more profit from YT through strategies such as Yield Trading – Your future profits can be bought, sold, traded or continued to compound for more profits.

Subjective perspective on Yield Derivatives

It can be seen that the operating model of projects working on exploiting profits from future profits seems to operate quite simply, but the functions in projects in this field are still relatively risky when The crypto market is one of the most volatile markets, so future profits will also fluctuate greatly.

Besides, the sources of profit that are considered safe and have low volatility do not seem to be too big for users to focus on. But the source of higher profits seems more volatile and risky.

If a Yield Derivatives project is combined with a Lending platform, the user’s profit potential will be higher thanks to the use of additional leverage sources.

Summary

Yield Derivatives is a fairly new piece in the crypto market in general and DeFi in particular but is still a land with many risks.