Liquid Staking is joining DEX and Lending & Borrowing to lead the Crypto market during the cold winter season. So will Liquid Staking or projects in this field continue to develop in the future and the reason why? Let’s find out together in the article below.

Liquid Staking And The Solution It Brings To The Market

Normally when you own a platform coin (for example: Etherreum, Polkadot, Near Protocol, Cosmos, Avalanche,…) and you want to get more profit from these idle assets, you will take it away. stake (similar to traditional savings deposit activities).

However, there will be some problems when you participate in this regular stake:

- Assets are locked on smart contracts and cannot be used.

- Wanting to withdraw sometimes takes time (for example, wanting to unstake Near takes about 2 days, wanting to unstake Cosmos takes up to several dozen days, and even with Etherreum, it cannot be withdrawn after about 6 – 9 months after The Merge is successful. This sometimes makes users unable to cope with unexpected events when Luna crashes or cannot withdraw money in time, leading to lost investment opportunities.

For the above reasons, Liquid Staking was created to solve the above problems. We will take the example of Lido and how Lido works is similar to 90% of Liquid Staking platforms on the market.

The user has ETH and wants to stake on Beacoin Chain, but the user does not have enough 32 ETH, so the user sends 5 ETH to Lido to stake on Ethereum with an APR ranging from. 8 – 10% and Lido will return to the user 5 stETH representing the 5 ETH the user deposited into Lido Finance.

With stETH, it has the same value as ETH because the price of stETH is pegged to the price of ETH and users can use stETH to participate in Lending & Borrowing on AAVE, Maker DAO,… or trade on Uniswap, Sushiswap, Curve Finance and many more activities.

Since then, the problem of locked liquidity has been resolved in a relatively concrete way.

Why Liquid Staking Will Continue to Develop in the Future

Layer 1 Forever Trends

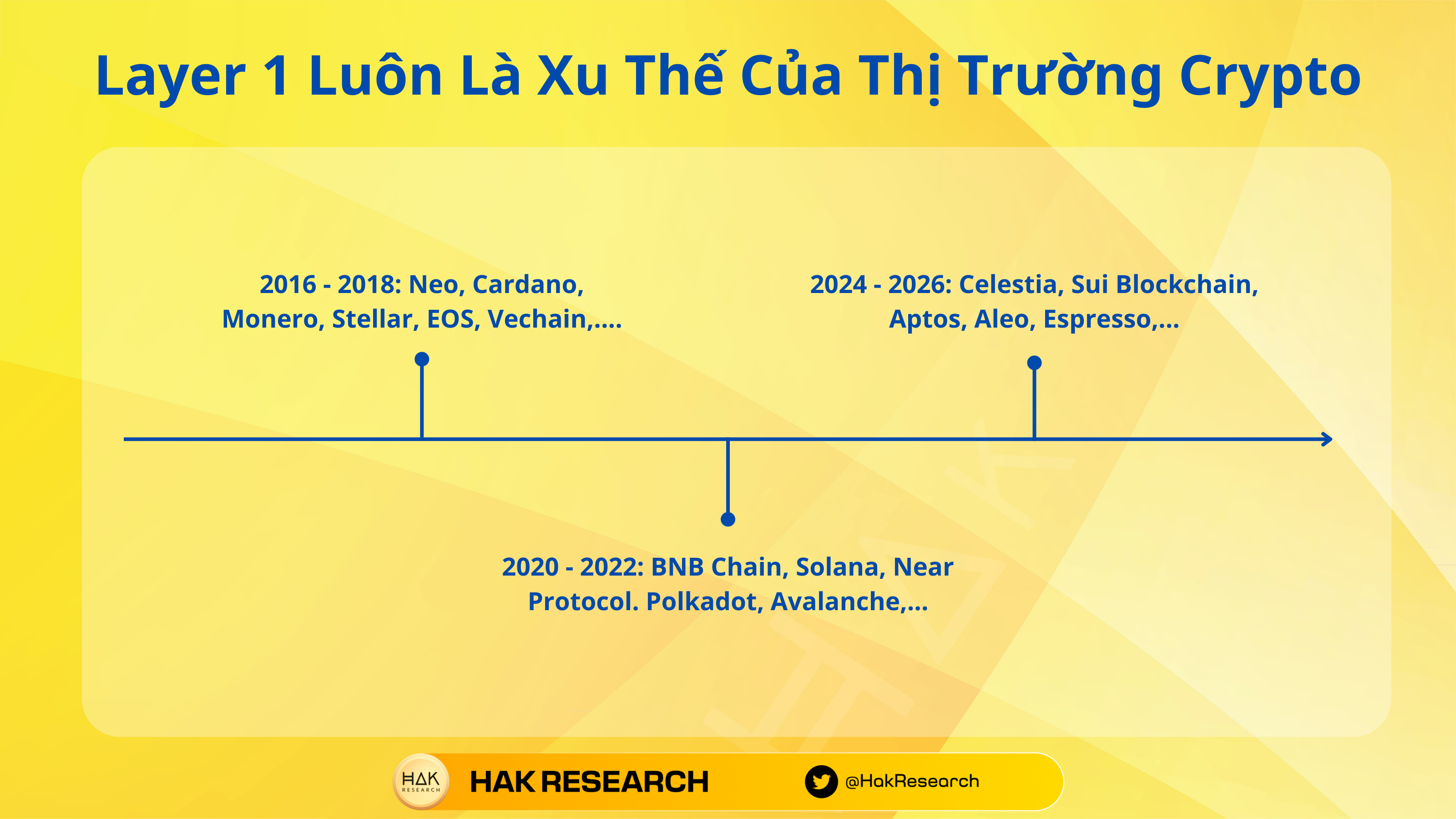

We cannot deny that Layer 1 has always been a market trend since its inception. Typically we can look back:

- L1 in 2016 – 2018: Neo (Chinese Ethereum), Cardano (Ethereum Killer), Monero, Stellar, EOS, Vechain,…

- L1 in 2020 – 2022: Solana, Near Protocol, Polkadot, Avalanche, Fantom, Cosmos, Mina Protocol, Celo, BNB Chain,…

- L1 next cycle: Aptos, Sui Blockchain, Celestia, Aleo, Espresso,…

Most of the L1s created focus on solving existing problems on Ethereum such as transaction speed and transaction fees in different ways. Although no ecosystem has surpassed Ethereum, that does not mean that The number of L1s is becoming less and less.

The number of L1s being built and developed is increasing, and the valuation of L1s is also increasing, such as Aptos and Sui Blockchain, although they are not mainnet yet or the ecosystem is still very new, but have been valued at high levels. a.

Many people believe that Ethereum 2.0 will be the end of the L1 war, but even if Ethereum 2.0 is successfully promoted, newer problems will still appear and at that time we will have L1s moving in the same direction. newer.

Because most Liquid Staking projects are tied to L1s, if L1s continue to proliferate and develop, projects in the Liquid Staking segment will continue to launch new products and move forward. before.

Leverage is always the weapon of investors

Using products from Liquid Staking projects essentially means investors are using leverage because in addition to the APY/APR investors receive when staking on the platform, they use derivative assets that the platform returns. for them (can be considered as IOUs of the protocol to investors) to continue investing in DeFi to earn more profits.

We cannot deny the risks of leverage, but without leverage the market cannot develop quickly and investors who do not use leverage will not be able to make as much profit.

Without leverage, we would never have Three Arrow Capital, Alameda Research or FTX. However, because of leverage, all three of these organizations have gone bankrupt or are close to bankruptcy.

Therefore, if projects in the Liquid Staking segment provide effective leverage for investors, they will continue to exist and develop.

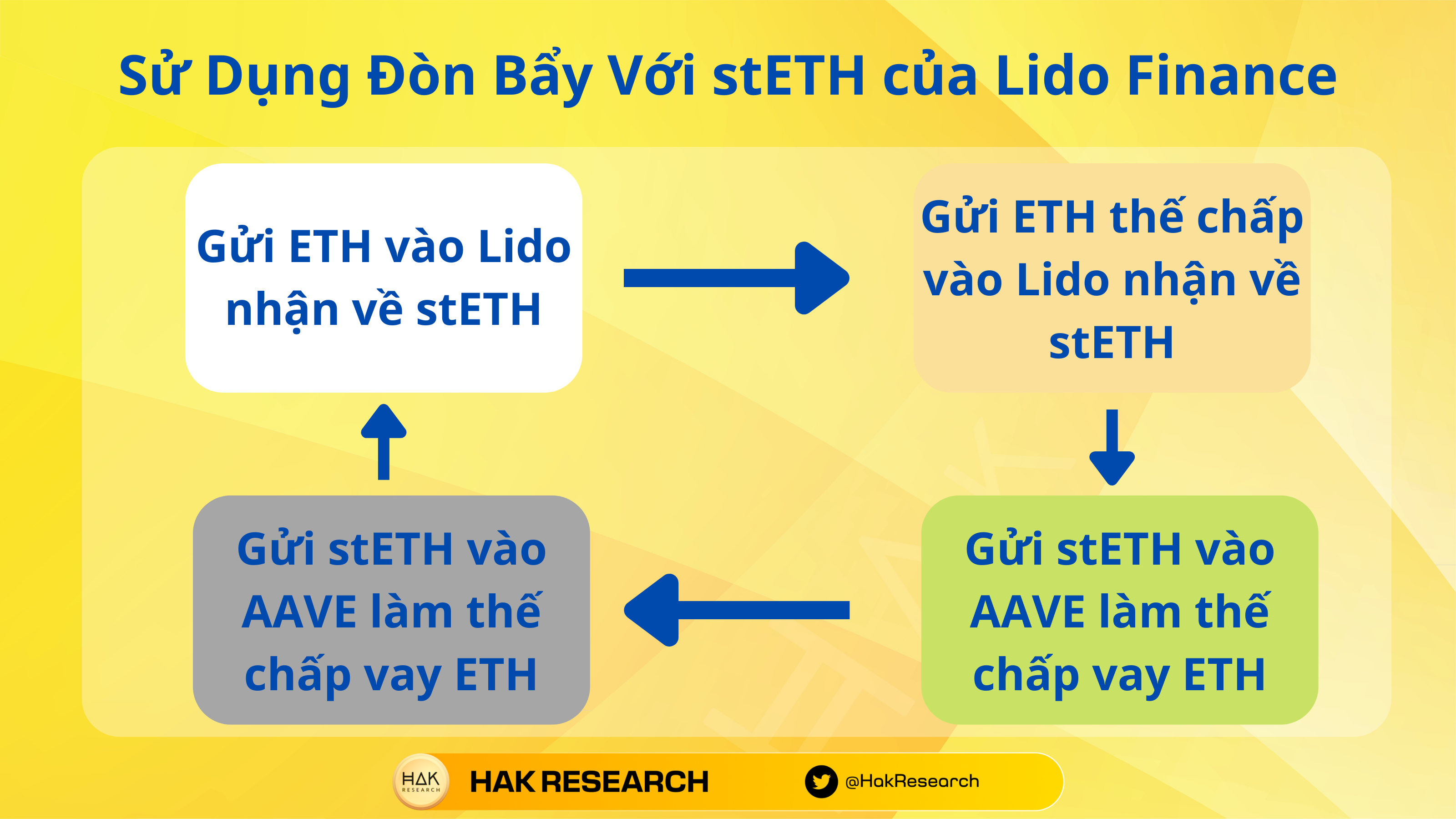

Leverage example with stETH by Lido Finance

Normally, you hold 32 ETH and stake it on Beacoin Chain, giving you an APR of about 10%.

But instead you deposit 100 ETH into the Lido Finance platform and receive 100 stETH to receive an APR of about 8%. The story will continue as follows:

- Bring 100 stETH to AAVE as collateral to borrow 80 ETH with an interest rate of 2.8%, then deposit these 80 ETH to Lido Finance with an APR of 8% and receive 80 stETH. Total profit is 8 – 2.8% which is 6.2%.

- Bring 80 stETH to AAVE as collateral to borrow 64 ETH with an interest rate of 2.8%, then deposit these 64 ETH to Lido Finance with an APR of 8% and receive 64 stETH. Total profit is 8 – 2.8% which is 6.2%.

- Bring 64 stETH to AAVE as collateral to borrow 64 ETH with an interest rate of 2.8%, then deposit these 51 ETH to Lido Finance with an APR of 8% and receive 51 stETH. Total profit is 8 – 2.8% which is 6.2%.

- Bring 51 stETH to AAVE as collateral to borrow 51 ETH with an interest rate of 2.8%, then deposit these 40 ETH to Lido Finance with an APR of 8% and receive 40 stETH. Total profit is 8 – 2.8% which is 6.2%.

- The loop will continue like that until you can no longer borrow ETH. Have you seen the incredible power of using leverage in general and leverage in Liquid Staking in particular.

At the market time before May 2022, everyone is very assured that these loans have no risk because the collateral asset is stETH and the borrowed asset is ETH always have the same value so there will be no risk. Now there is a liquidation story.

The above actions and thoughts above were the common thoughts of most large VCs and investors at that time in the direction of NO RISK HIGH RETURN.

However, the critical weakness here is that stETH cannot be redeemed into ETH at that time and if you want to convert from stETH to ETH, you must trade the stETH/ETH pair on Curve Finance to see that weakness. Alameda Research dumped a large amount of stETH on Curve Finance. Of course, the need to buy back ETH is too great, the amount of liquidity is not enough, leading to stETH depeg and the assets of VCs are at risk of liquidation. During the panic sell, stETH lost peg too deeply, leading to liquidation and the more liquidation became, the worse it became.

Finally, we have events that have a huge impact on the crypto market, especially the bankruptcy of 3AC.

The above example shows us the huge benefits and equally huge risks when using leverage.

User needs

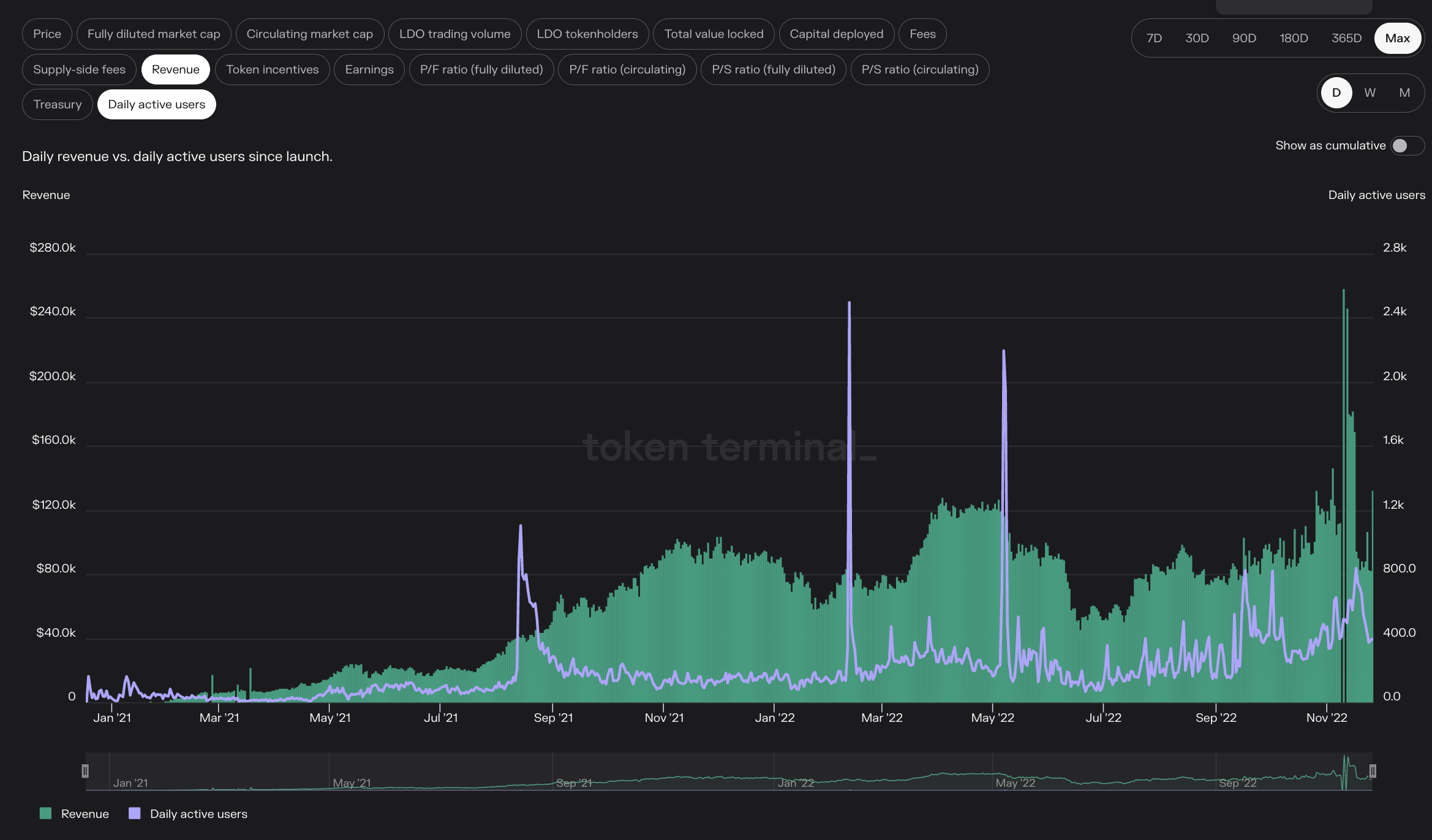

We will not mention TVL because the TVL of the entire market in a downtrend, the general trend is a downtrend. However, when we look at Lido Finance’s revenue and daily users, they are both growing relatively well in the downtrend.

This proves that Lido Finance still has very strong appeal to investors at the present time. Because when the trend is down, users tend to convert their altcoins to Bitcoin and Ethereum, and if it’s Ethereum, the best way to take advantage of it is to use Lido Finance’s services.

Some Risks With Liquid Staking Projects

The biggest risk for DeFi projects is vulnerabilities in smart contracts, although there are projects that have been carefully audited but still get hacked as usual.

For example: Recently, taking advantage of a vulnerability on Stader Near, a hacker minted billions of NearX and then dumped all NearX on the NearX/Near pool, resulting in relatively large losses to users.

Besides, if the project is not clear in your platform, it can easily lead to projects minting more than what you have. This often happens with centralized Liquid Staking units such as exchanges. .

As for depeg, in most cases users do not need to worry because they can redeem assets 1 to 1 instead of trading on AMMs.

Development Orientation of Liquid Staking Projects in the Future

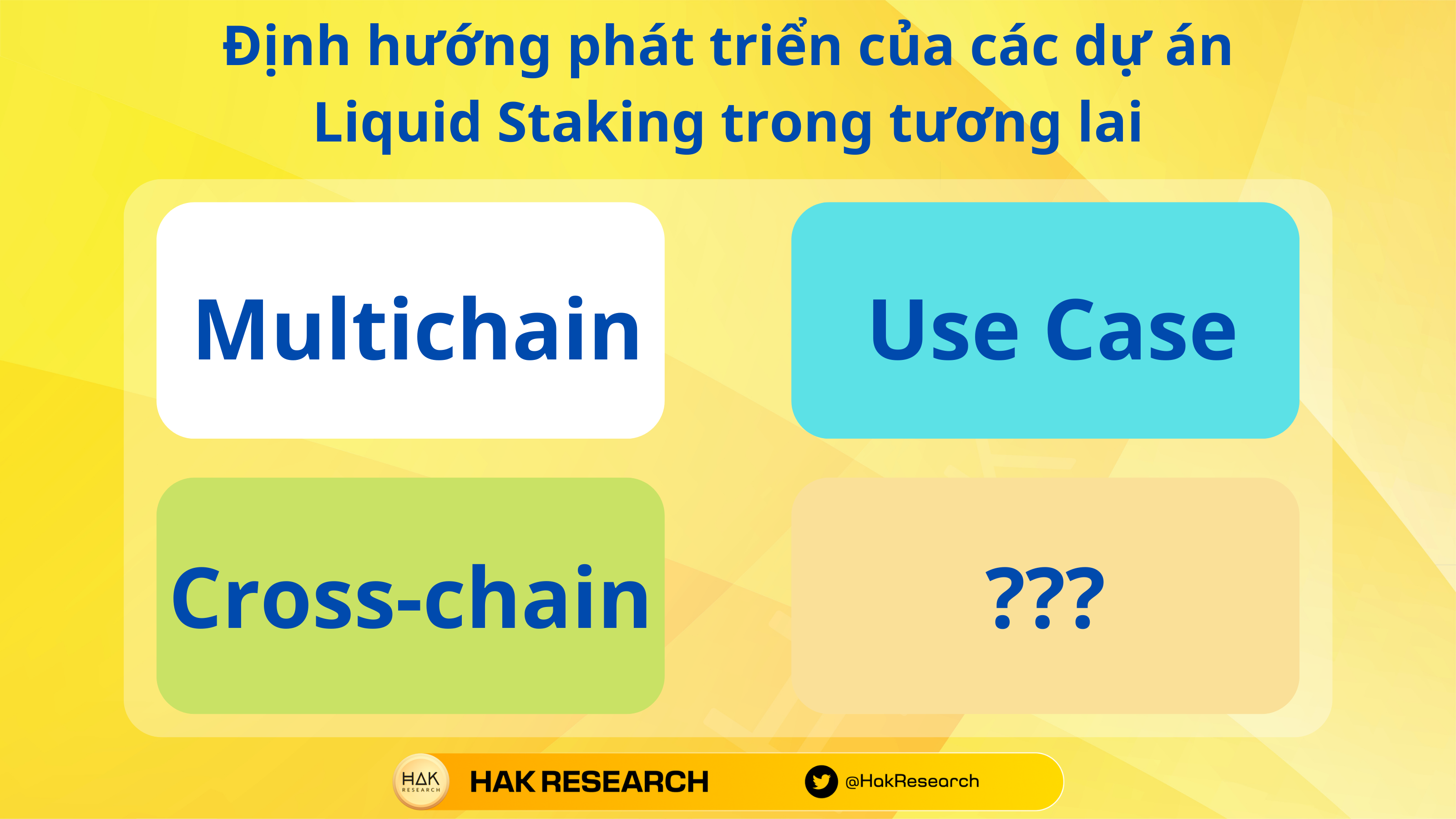

There are 3 main development directions for Liquid Staking projects including multichain, use case integration for derivative assets and cross-chain.

Multichain

Multichain is the general trend of all Liquid Staking projects at the present time. Usually, after each growth cycle, most L1s wither away and providing a product from a dead blockchain is really ineffective because the users are gone.

So the multichain trend of the entire Liquid Staking industry is inevitable. Besides, product development for new blockchains helps the project have more users and more revenue.

We will take a look at how Liquid Staking projects are developing through the statistics in the following table.

|

Project |

Blockchain Is Supporting |

|---|---|

|

Lido Finance |

Ethereum, Solana, Polkadot, Kusama, Polygon Future: Avalanche, Near Protocol, Aptos |

|

ANKR |

BNB Chain, Ethereum, Avalanche, Polkadot, Fantom, Kusama |

|

Stader Labs |

Hedera, Ethereum, BNB Chain, Terra 2.0, Fantom, Near Protocol Future: Aptos, Sui Blockchain,… |

However, there are also many projects that have not yet developed multichain such as Marinade on Solana, Metapool on Lido Finance, BenQi on Avalanche or Rocket Pool on Ethereum.

Use-case integration

In addition to the profit factor, use case is one of the issues that investors choose to use the Liquid Staking service from and it is also the key to victory for Lido Finance with stETH. The truth is, the more use cases a project’s released derivative product has and the more it is integrated into more DeFi projects, the more investors like it.

For example, stETH is present and collateralized on the largest Lending platforms on Ethereum such as AAVE, Maker DAO,… Besides, users can trade stETH on many AMM platforms such as Uniswap, Curve Finance, Sushiswap,…

So integrating use cases for derivative assets of platforms is extremely important. The more use cases a project creates for its product, the higher the project’s chance of success.

Cross-chain development

If it is considered an asset, it must be circulated between many different ecosystems because in the crypto market, money flows and trends can come to any blockchain.

Starting the cross-chain trend, Lido succeeded when it announced it would deploy stETH on Arbitrum and Optimism in the form of wstETH. With this strategy, stETH holders, or in other words using Lido Finance, can optimize their assets instead of mortgaging stETH to borrow ETH and then still transferring to Layer 2.

I am sure this will also be a trend for Liquid Staking projects in the future, however, using bridges also has many rug pool risks.

Summary

Based on the above reasons, I believe that Liquid Staking projects will continue to develop in the long-term future along with the crypto market. However, this battle will be extremely fierce at the present time Lido Finance is a project that is taking advantage of the opportunity while doing very well, but if Lido does not develop and dominate the market soon, Lido’s position will be very difficult. to make sure.