Real Builder in Winter | Lido Finance is a project in the Liquid Staking segment that has always maintained a top position since its inception in the crypto market. Lido Finance has done many things beyond users’ expectations to successfully go from zero to one. And now we will look back at Lido Finance’s development journey and see how Lido Finance crushed major competitors in the industry?

What is Lido Finance?

Lido Finance is a project in the Liquid Staking segment. Lido Finance was born to solve users’ problems when participating in staking on Ethereum 2.0. Normally, if a user participates in staking on Ethereum 2.0, the user’s ETH will be locked and will only be gradually opened after 9 months from the time Ethereum successfully converts POS.

But with Lido Finance, users participating in staking through Lido Finance will receive stToken derivative assets of equivalent value. With stToken, users can participate in DeFi on Ethereum or cross-chain to other blockchains to optimize assets.

Lido Finance’s Development Journey

Off to a smooth start

The first article published on Lido Finance’s blog was released on October 15, 2020, 2 years and 2 months ago, almost identical to the time when Ethereum allowed users to stake a minimum of 32 ETH into the network. Ethereum 2.0. But 32 ETH at the time of launch was a relatively large amount for all users and prevented users from participating in staking to protect the network.

Lido Finance appears, users can stake ETH into Ethereum 2.0 through Lido to receive APR, besides users receive stETH and can use it on popular DeFi platforms such as collateral on Maker DAO , AAVE,… besides providing liquidity on Uniswap, Curve Finance,…

November 26, 2020: Lido Finance launches testnet on Goerli Testnet network. Lido Finance has tested the network for 5 years from November 25 to November 30, 2020.

December 28, 2020: Lido Finance officially launches stETH and mainet on the Ethereum network. And Lido Finance also promises to soon expand the stETH ecosystem. Besides, Lido Finance will launch Lido DAO so that all Lido holders can contribute to the development of Lido Finance through creating proposals or voting on the platform.

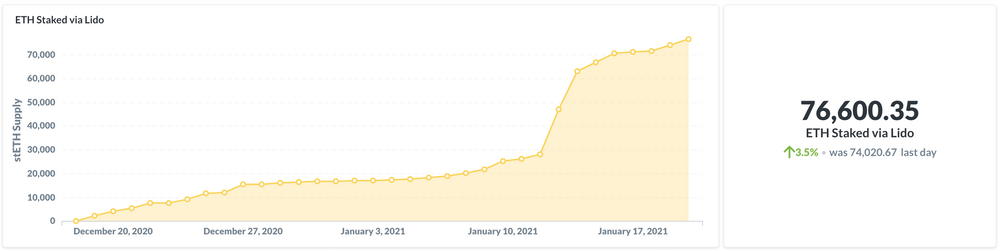

Results after 1 month of construction and development

Lido Finance has successfully integrated with Curve Finance, Uniswap and Sushiswap. Users can provide liquidity to the stETH/ETH pair to receive additional LDO rewards. First, a total of 1,816 users deposited 76,630 ETH into Lido Finance equivalent to approximately $94M. Besides, Lido Finance paid out 21.64 stETH to its investors.

However, fluctuations in stETH’s exchange rate have appeared since the first days.

In terms of integration

- Lido Finance has successfully integrated with Curve Finance, Uniswap and Sushiswap. Users can provide liquidity to the stETH/ETH pair to receive additional LDO rewards.

- stETH on wallets such as imToken, Trust Wallet, Zerion and Argent. With this integration, users can participate in staking from these wallet platforms.

- stETH has been proposed as collateral on AAVE and Maker DAO.

- Besides, stETH has also been successfully integrated into KP3R and Yearn Finance – the Yield Aggregator platform that stands out in the summer of DeFi 2021 and both of these projects were built by the genius hands of Andre Cronje.

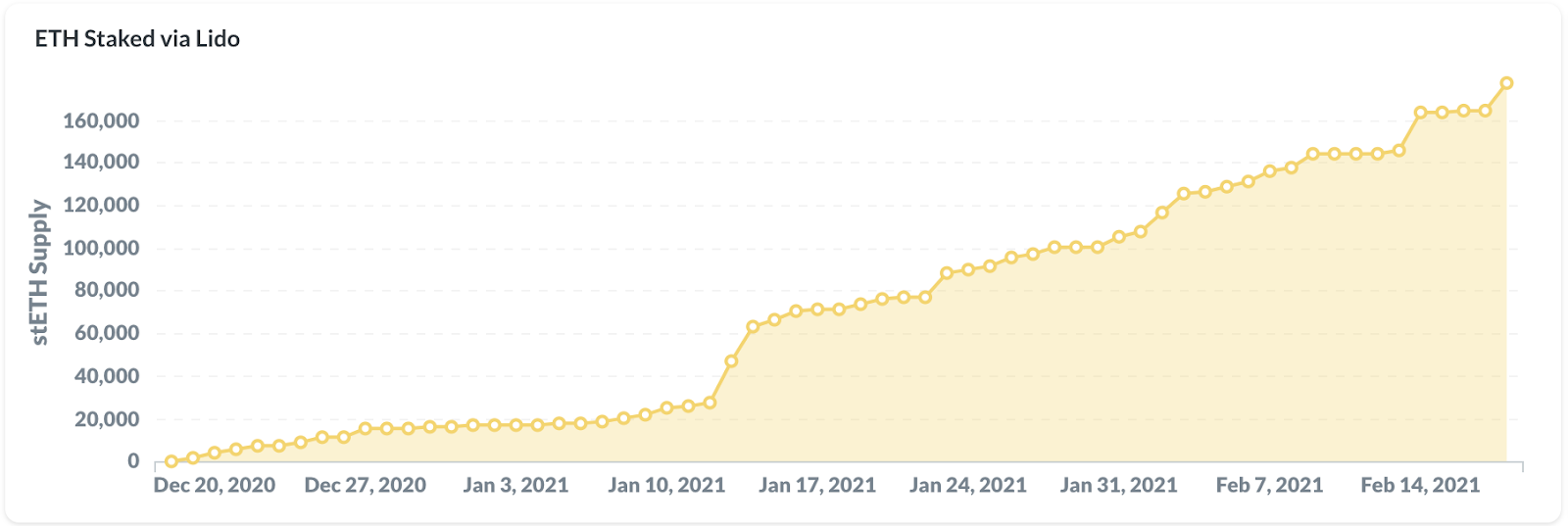

Results after 2 months of development

Lido Finance has seen growth 136.29% Within 1 month, from 76,630 ETH it increased to 180,998 ETH with 3,361 participants.

About the integrated eye

Over the next month Lido Finance promotes liquidity integrations of LDO or stETH on thicker platforms through Liquidity Mining programs.

- 500,000 LDO becomes a reward for those who provide liquidity to the stETH/ETH pair on Curve Finance.

- 250,000 LDO are allocated to the Qrado Farming program for LPs providing liquidity to the stETH/LDO pair.

- Lido Finance successfully integrates with the Harvest Finance – Yield Aggregator platform, helping users, after providing liquidity on Curve Finance for the CRV/stETH trading pair, to deposit LP Token into Harvest Finance to receive APY up to 35% .

- Launch of the Sushiswap Onsen program with users providing liquidity to the LDO/ETH pair earning up to 25% APY.

March 17, 2021: Lido Finance’s first multichain move, this move of Lido Finance is both right and wrong when choosing a civilization to develop because bLUNA very quickly took up a large proportion of Lido Finance’s TVL, which has partly helped Lido Finance won TOP 1 TVL in 1-2 short days of Maker DAO, but when UST depeg and Luna returned to zero, all those TVLs also evaporated.

After only 2 weeks when bLUNA launched to the community, 21,847,632 bLUNA were minted, bringing more than $400M TVL to Lido Finance.

In just 4 months of development Lido Finance has reached $4B TVL, the monthly growth on Lido Finance is at least 100%.

September 8, 2021: Lido Finance continues to support Solana with stSOL token.

November 1, 2021: stETH officially becomes collateral on Maker DAO to be able to mint stablecoin DAI. In addition to the roadmap for building liquidity, this is the biggest step for stETH since its birth, marking stETH’s maturity.

February 18, 2022: After Ethereum, Terra and Solana, the next name supported by Lido Finance is Kusama.

March 1, 2022: After Maker DAO, stETH is now available on the market’s largest Lending Protocol platform, AAVE. To make it easier for everyone to imagine how difficult it is to become collateral on AAVE and Maker DAO, since its development from 2017 – 2018 until now:

- AAVE’s Ethereum collateral only has 35 assets (10 stablecoins – 25 altcoins) in tens of thousands of projects on the market.

- The collateral on Maker DAO is even less with only a few prominent names in the industry.

March 2, 2022: Lido Finance continues to include MATIC in the list of assets it supports.

May 31, 2022: Kusama’s big brother Polkadot continues to be supported by Lido Finance.

July 18, 2022: Lido Finance continues to bring stETH to Layer 2 so that users are no longer limited to using the slow and expensive Ethereum network but can go to new lands to gain huge sources of profit.

Looking back at the failure with Terra

Clearly the failure with Terra has evaporated $8B in TVL, users & revenue that Lido worked hard to build on this ecosystem. However, because Lido Finance’s main product is stETH, although it is relatively seriously affected, the project can still continue to develop normally.

Advice: Never go out without an umbrella!

Achievements acquired

About TVL

Up to now, it can be affirmed that Lido Finance is standing tall at the pinnacle of Liquid Staking when their competitors are still an extremely far distance away from them. Certainly Lido Finance’s success does not come naturally but largely comes from the outstanding team that built Lido Finance including:

- Anton Bukov is Co Founder of 1inch (DEX Aggregator platform).

- CryptoCobain is a KOL with more than 500k followers on twitter and is also the Co Founder of Ethereum.

- Banteg is a member of the core team of the yEARN Finance project.

Besides, resources also help Lido Finance go faster, the project has successfully called for $167M from leading VCs such as A16Z, Dragonfly Capital, Paradigm, Coinbase Ventures,…

Paradigm invested $51M, A16Z invested $70M and Dragonfly Capital invested $24M.

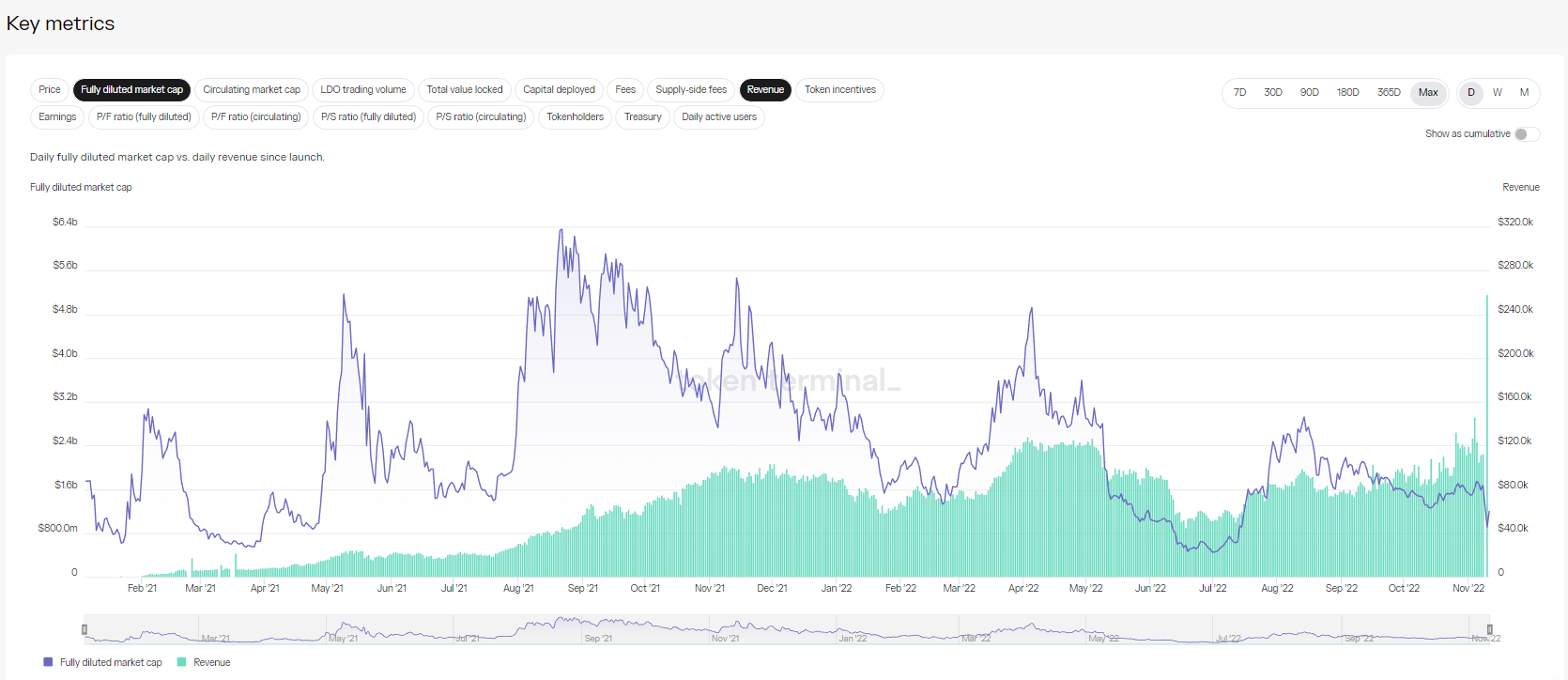

About Revenue

Lido Finance’s revenue not only does not decrease during the downtrend like other projects but tends to grow right in the middle of crypto winter. The project’s revenue has returned to equal the uptrend period of 2021 and 2022. This is an extremely positive signal for the project and token holders.

About the number of users

In addition to revenue growth, the number of regular users also has good growth over time. That helps us see users moving deeper and deeper into the layers of DeFi.

The Road Ahead

The road ahead is still extremely chaotic for Lido Finance as they still need to continue expanding to the next Layer 1 in their current plan including Near Protocol, Avalanche and many other platform blockchains. The question is whether Lido Finance will support Layer 2 such as Optimism, Arbitrum, StarkNet or ZkSync. If so, this will be an extremely large piece of cake for Liquid Staking in the future.

Challenge

There are still many challenges ahead for Lido Finance.

- stETH has done very well but with the remaining assets such as stSOL, stKSM, stDOT, stMATIC there are still very few use cases and Lido Finance needs to do better. At Solana Stadium, Lido Finance has not been able to win against Marinade, so Lido needs new strategies to overcome this project.

- There are still many platform coins that need the support of Lido Finance. In addition, due to early voting development, it sometimes affects the development speed of the project.

Lessons From Lido Finance

I also wrote an article to compare Lido Finance and Rocket Pool: Rocket Pool and Lido Financel: The battle for the throne of Liquid Staking

The biggest lesson I learned from Lido is:

- Price is not the best place to compete, the product is the deciding factor. Rocket Pool offers users more than 8% APR and Lido Finance only more than 5%, but Lido still wins because stETH has too many use cases compared to Rocket Pool’s rETH.

- Take 1 market and conquer it from there as a stepping stone to conquer the next markets. Ethereum has ascended the throne, using stETH as a springboard Lido Finance attacks Solana, Terra, Polkadot, Kusama,…

- Always develop with the initial goals set.