NFTFi is an extremely potential industry if you put it next to areas like Lending & Borrowing or even more potential if you put it next to the DeFi market. So in this article, let’s clarify the potential of the NFT Lending market in particular and the entire NFTFi industry.

Some articles you can refer to before reading this article to have a more general perspective on this market!

- What is NFT Finance? The Future of NFTs in the Crypto Market

- What is CryptoPunk, BAYC? Why Are These NFT Collections So Successful?

And we will take a look at potential projects in the NFTFi industry!

Potential Of NFT Lending & NFTFi Industry

Natural human needs

NFTs have now become part of the crypto market and there are many people who own very valuable NFTs, up to several hundred thousand or even several million dollars for one NFT. Among the basic needs of a person when they own any type of asset, whether intangible or tangible, whether it has real or virtual value, the first need is to buy and sell. This is the reason why the earliest NFT Marketplaces were born such as Opensea, Magic Eden, LookRare,…

However, the need to buy – sell and exchange is only the first need, followed by the need for higher financial activities such as borrowing – lending, becoming collateral in many different places, … are generally deeply embedded in finance.

Therefore, after a boom period, there began to be projects about NFT Lending in particular and NFT Finance began to be built such as SudoAMM – the first AMM for NFTs, BendDAO – the first NFT Lending platform, NFTPerp – the first Long Short NFT enabling platform, JPEG’d – the first NFT stablecoin issuance platform,…

And I firmly believe that this is just the beginning for the NFTFi puzzle, which still has a lot of growth momentum in the near future.

The potential of the NFTFi industry

Potential of NFT Lending & NFT Finance industry

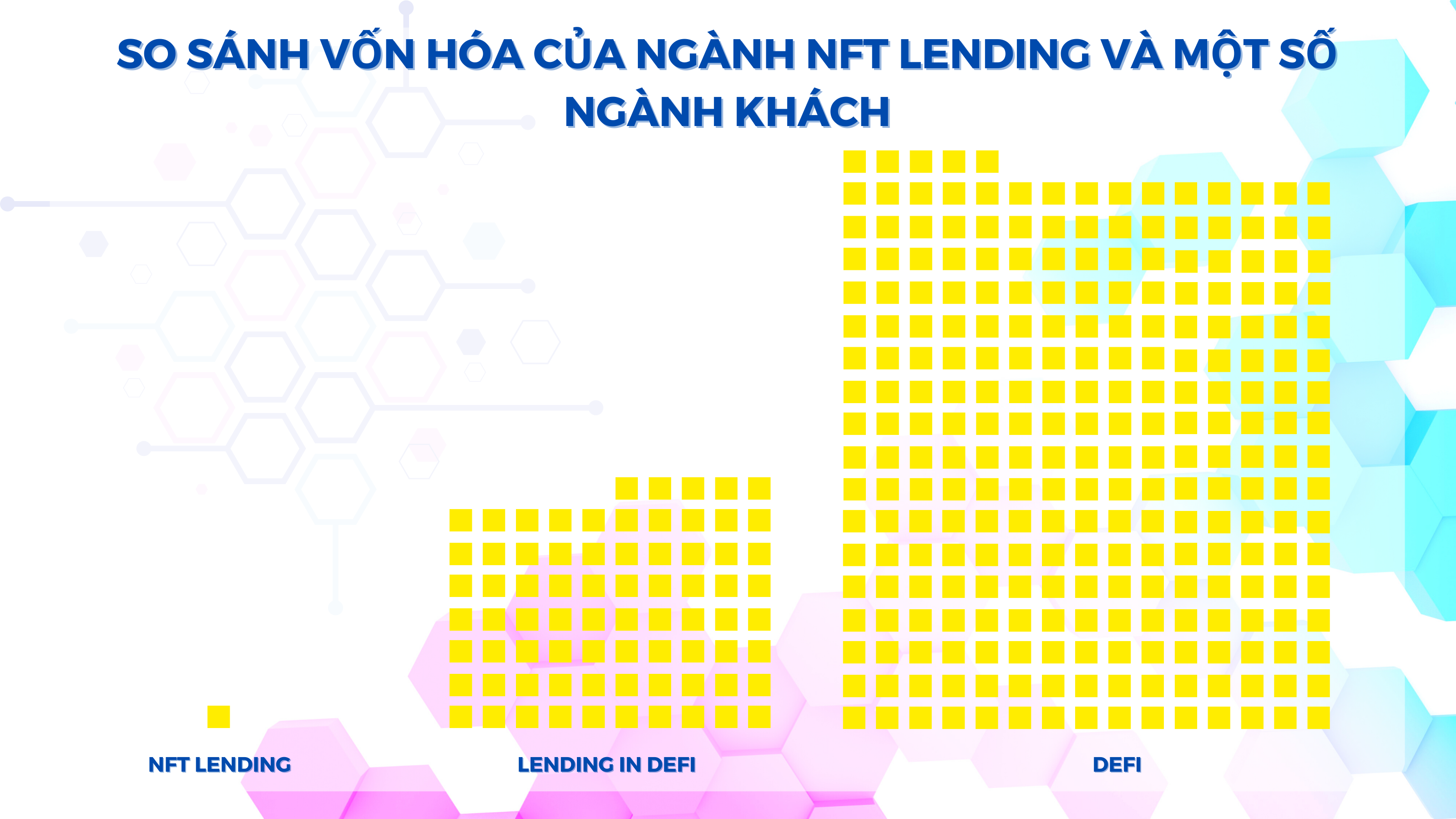

If we do a simple calculation with 3 unknowns: the NFT Lending market with a TVL of only about $200M, the Lending & Borrowing segment of the DeFi market with a TVL of about $15B, and the entire DeFi industry with a TVL of about $15B. $50B then we have a few simple comparisons as follows:

- Lending & Borrowing in DeFi 75 times NFT Lending segment

- The whole DeFi industry 250 times NFT Lending segment

If we put the capitalization of NFT Lending platforms next to the major Lending & Borrowing platforms in the market, we have the following capitalization parameters:

- BendDAO: $11M

- JPEG’d: $26M

- AAVE: $1.2B

- Compound: $400M

Including parameters on TVL and market capitalization of projects with the highest TVL, it is clear that NFT Lending and Lending & Borrowing on DeFi have a huge difference. For example, BendDAO is the largest NFT Lending platform in the market with a capitalization only 1/100th that of AAVE.

Some Potential NFTFi Projects

BendDAO – The largest P2P Lending platform in the NFT ecosystem

BendDAO is the first and also the largest lending platform in the NFT industry. BendDAO has a relatively simple and effective operating model when providing P2P Lending services. Users will create their own pools with information such as the collateral they want to receive, the maximum amount of loan support, how long to lend NFTs,… then users will deposit NFTs into the pool and wait for takers. Borrow to choose the right Pool. It can be said that BendDAO’s operating model is very similar to ETHLend – the predecessor of the current AAVE.

Up to now BendDAO is supporting blue-chip NFT collections in the market such as: Bored Ape Yacht Club, CRYPTO PUNKS, Mutant Ape Yacht Club, Azuki, Moonbirds, Doodles, Space Doodles, CloneX,… In the future BendDAO plans to support even more NFT collections.

JPEG’d – Maker DAO of the NFT village

If BendDAO is considered the AAVE of the NFT village, then JPEG’d will be considered the successor of Maker DAO. This also speaks to the operating mechanism of JPEG’d, which is that users can deposit NFTs accepted by the platform into the pool and can then mint a stablecoin called $PUSd and use this stablecoin on other platforms. DeFi and NFT platforms that JPEG’d has successfully integrated.

Currently JPEG’d is accepting blue-chip NFT collectibles such as Bored Ape Yacht Club, CRYPTO PUNKS, Mutant Ape Yacht Club, Azuki, Doodles, CloneX, Fidenzas, Ringers, EtherRocks,… and in the future will there are more NFT collections to be collateralized on JPEG’d.

Currently JPEG’d has a few notable points as follows:

- The project continues to have proposals to integrate more collateral in the near future, including Squiggles, CryptoDickButts?,…

- The project integrates with DeFi protocols such as Chainlink, Olympus DAO, Tokemak, Dopex,…

- The project is developed and supported by DeFi OGs such as Tetranode, Defigod, Dopex,…

I firmly believe that if the team can build more and more use cases for PUSd, the possibility of JPEG’d’s success will be even greater than BendDAO in the same way that Maker DAO has surpassed both AAVE and Compound in DeFi.

SudoAMM – The Uniswap of the NFT village

If we have BendDAO similar to Compound or AAVE or JPEG’d similar to Maker DAO then there definitely needs to be a platform similar to Uniswap, PancakeSwap, SushiSwap then we have SudoAMM – the first AMM platform for NFT market.

Normally, to buy and sell NFTs, users will often go to NFT Marketplaces such as Opensea, LookRare, Magic Eden,… it can be simply understood that NFT Marketplaces are similar to centralized exchanges with Orderbooks. like Binance, OKX, Houbi,… However, the market still needs a truly decentralized NFT exchange and we have the birth of SudoAMM.

It seems that Uniswap has smelled an opportunity, so they have official information that Uniswap and Sudo will work together to build a specialized AMM for NFTs. So we still need a more effective AMM model than SudoAMM currently has because SudoAMM is still facing some of the following problems:

- Sudo’s pools cannot distinguish between NFTs that share the same collection but have different rarities, leading to jumps that are not necessarily compatible, and if separating NFTs with common characteristics in a collection, it leads to discrimination. The liquidity scrap causes users to buy at a higher price than what they should pay based on Opensea.

- SudoAMM does not have an effective strategy to attract liquidity providers, so whether buying NFTs on Sudo is more effective than on Opensea?

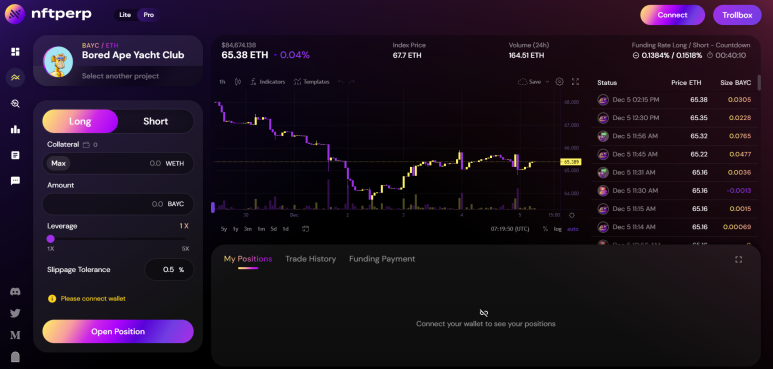

NFT Perp – The first Long Short NFT enabling platform on the market

Let’s review a bit if we have BendDAO as the AAVE of the NFT market, JPEG’d as MakerDAO, SudoAMM as Uniswap, then who will be dYdX, Perpetual, GMX then the answer is NFTPerp.

NFTPerp is the first platform that allows users to go Long – Short on NFT collections. However, if users see an investment opportunity, why don’t they buy and hold but decide to go Long – Short? following reasons:

- If tokens can be divided into small pieces to invest as much as $ to buy, then with NFTs, it is not special with expensive NFT sets where users have to spend a few hundred, a few thousand, a few hundred thousand, even a few million dollars to owning those NFTs, buy & hold investing will not be suitable for retail investors.

- Playing Long – Short, you can play for as much money as you can, besides curved projects provide leverage, which is something that spot does not have.

For the above two reasons, NFTPerp was born as a necessity according to common needs and suitable for the majority of the crypto market, which are retail investors.

Everyone can read and understand more deeply about NFTPerp in the article: What is NFTPerp? Overview of Cryptocurrency NFTPerp

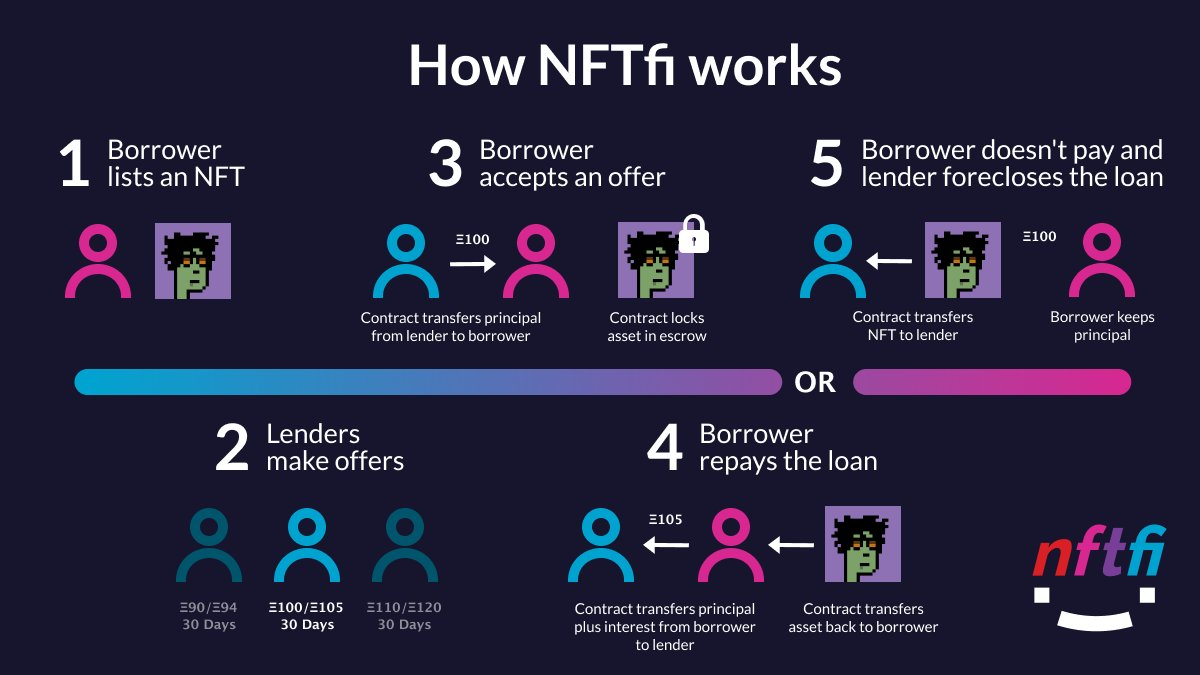

NFTfi – NFT Lending platform with retroactive opportunities

NFTfi’s operating mechanism has many differences compared to BendDAO. Instead of the lender filling in all the loan information, they just need to list the NFT in the pool, then many borrowers will come to make many different offers and the NFT owner only needs to choose the offer of the lender. Loan that best suits your needs.

Currently NFTfi is accepting many NFT collections as collateral such as Ethereum Name Service, ArtBlocks, Goblintown, Unstoppable Domains, SuperRare, Doodles, Rarible, Rumble Kong Leage, Drakons,… At the moment NFTfi has not Token launch so everyone can experience the project to have a chance to receive retroactive from the project.

Frakt – Reclamation of a new land called Solana

When the Lending land on Ethereum is starting to get crowded, the next potential location for NFT Finance projects is Solana – Blockchain with the 2nd largest number of transactions and NFT transaction volume in the entire blockchain, it even also ranked above names like Flow, Immutable,…

Frakt’s operating mechanism is similar to P2P Lending platforms on the NFT market, the main difference is the main market that the project is targeting. As of the time of writing, Frakt has provided a total of 4,669 NFT loans in addition to a TVL of nearly 500K SOL.

Frakt currently accepts a number of collections such as DeGods, Yoots, Pawnshop Gnomies, Okay Bears, Turtles, Claynosaurz,…

Disadvantages Still Exist With NFT Finance Projects

That’s the potential, but NFTFi projects still have many problems that need to be improved in the future if they want to have a bigger, more attractive piece of the pie, more users, and more revenue. Some problems still exist such as:

- AMM for NFTs cannot be for all NFTs in a collection because each NFT has a rarity that leads to different prices and a lot of difference, if the price is based on a % jump, it is not really reasonable.

- Liquidity remains a burning issue for the NFT industry, an issue that threatens the survival of NFT Lending. A few more percentage points in NFT collections could have led to the demise of BendDAO.

- How can NFTs be broken down to help investors easily participate in this market (synthetic assets?).

- Projects have not been in operation long enough to prove the safety of smart contracts in addition to the real appeal of the product to users.

Summary

NFTFi is an extremely potential industry in the near future as the liquidity of NFT collections becomes increasingly thicker. However, the industry still has many risks of hacking and rugpul, so users need to research very carefully before becoming a user or an early investor in this market.

And above are some potential projects in the NFTFi industry that people can research more carefully before making financial decisions.