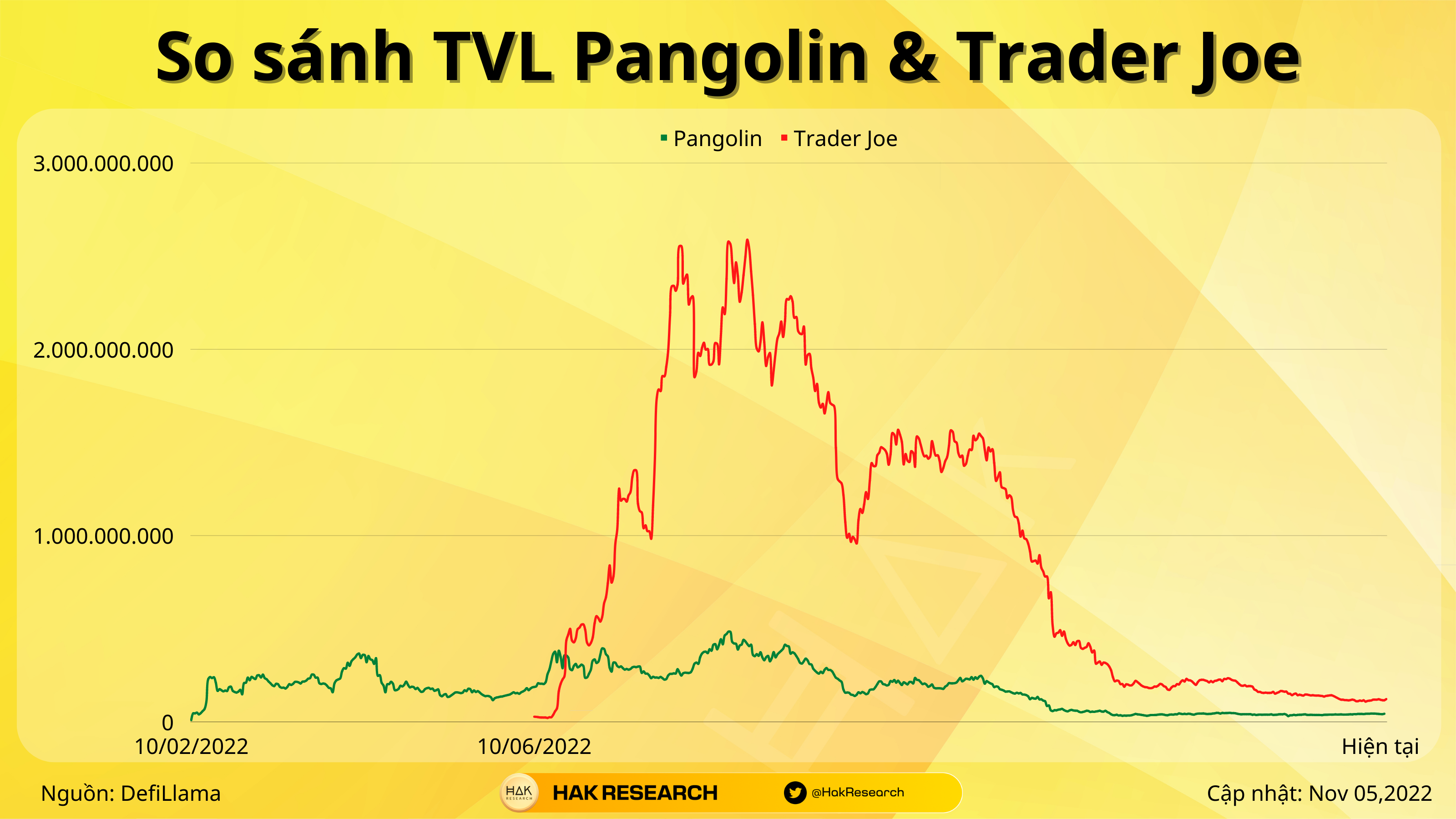

Trader Joe came from the position of a latecomer AMM but has successfully taken over the AMM throne on Avalanche’s ecosystem. It can be said that this is one of the most impressive overthrows in the crypto market in the past cycle.

So how did Trader Joe overcome a powerful Pangolin? Which factor? What details? If you are also curious, let’s learn about Trader Joe’s construction and development journey!

What is Trader Joe’s?

Trader Joe is a prominent AMM in Avalanche’s ecosystem, where users can trade tokens. Besides, Trader Joe also provides many types of services to users such as Lending & Borrowing, Staking, Farming,…

Understand details about Trader Joe: What is Trader Joe? Trader Joe’s cryptocurrency overview

Superhero Civil War: Pangolin & Trader Joe

Pangolin’s dominance

Pangolin is the first AMM on Avalanche’s ecosystem. Besides, Pangolin is also favored by Ava Labs, so the story of Pangolin becoming the largest AMM on Avalanche’s ecosystem is relatively easy to understand. But holding the AMM throne does not mean that Pangolin is perfect without fatal weaknesses. In fact, it does have many, but because its opponents are still weak, Pangolin has somehow rested on its laurels. me.

Pangolin’s biggest weakness lies in the project’s tokenomic story

1. Token Allocation

The advantage and also the most prominent point of Pangolin is that 100% of the total PNG supply will be brought to the market through the Liquidity Mining and Retroactive programs, with no private sale and no allocation of any tokens to the development team. .

This supports the psychology of Token Holders and Liquidity Providers in that there will be no selling pressure from VCs or Teams who should have good positions for projects like this.

2. Token Release

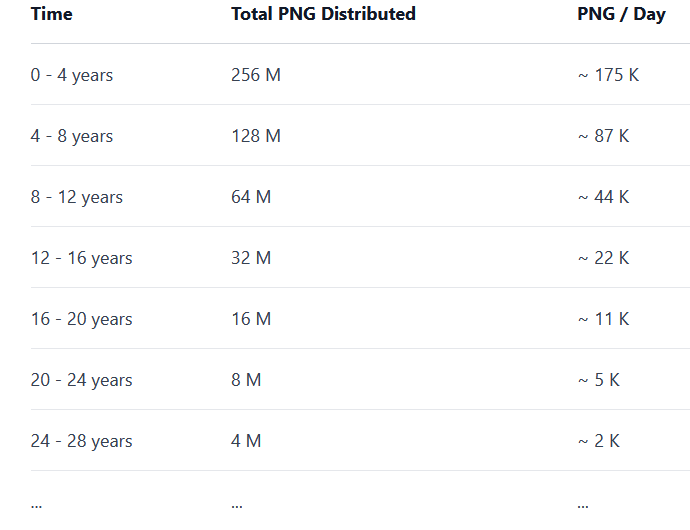

Pangolin has a total supply of 538,000,000 PNG and is amortized over 36 years. Similar to Bitcoin, every 4 years the amount of PNG released to the market is reduced by half, aiming to reduce the inflation of the PNG token by half every 4 years.

In the first 4 years, 175,000 PNG will be brought to the market every day through the Liquidity Mining program, which is an extremely large number, even larger than the protocol’s revenue when first deployed.

Most importantly, at that time the development team only focused on improving their AMM model and did not care about PNG’s Token Use Case. PNG’s only use case at that time was Governance and nothing else besides.

The amount of PNG paid every day is too large + There is no reason for the Holder to replace the LP holding PNG, of course no one will hold PNG and the LPs after being rewarded with PNG will also sell immediately the price of PNG from ATH is nearly $19 has dropped to under $2 in just a few months.

The birth of Trader Joe’s

And in the early days of June, a new project appeared but did not receive too much attention from the community, Trader Joe, and the coup officially began.

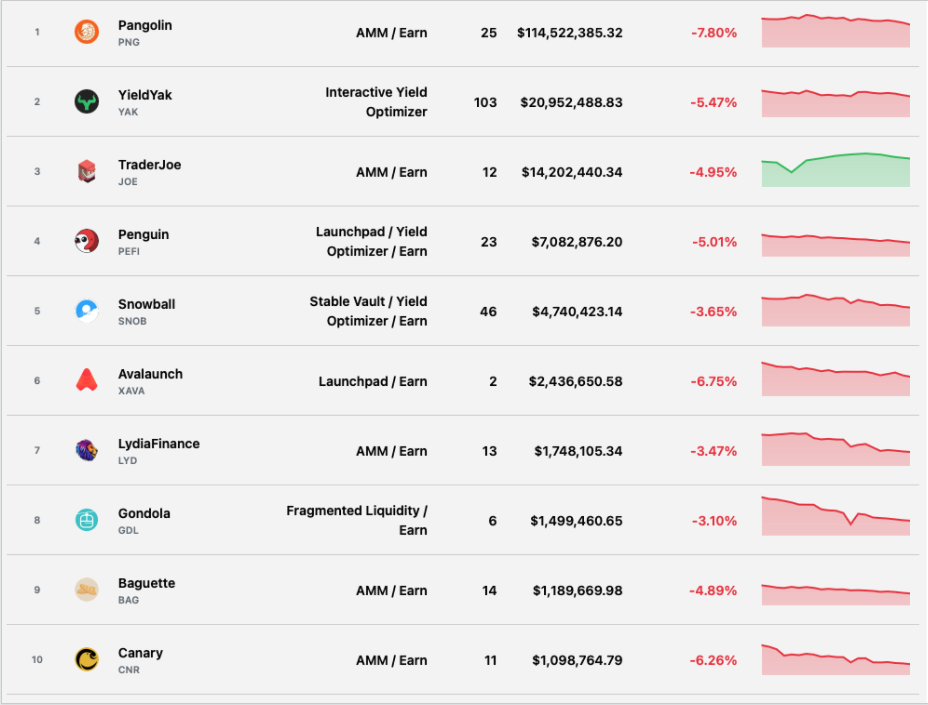

The initial step was extremely successful when in the second half of June, Trader Joe surpassed a series of names on Avalanche’s ecosystem and was only behind Yield Yak – the Yield Farming platform and Pangolin at this time Trader Joe’s TVL. is only about $14M while Pangolin is $114M, about 10 times more.

And in less than 2 months, Trader Joe officially defeated Pangolin to become the largest AMM on Avalanche’s ecosystem and she lost to BenQi – the Lending & Borrowing platform at that time, but BenQi was later beaten by AAVE. Defeated right at home.

As a follower, what are the things? element helping Trader Joe reach even beyond Pangolin. Similar to Pangolin or all DeFi protocols, Trader Joe also implements the Liquidity Mining program to attract users and LPs. Besides, Trader Joe also has a series of improvements including:

- First, the interaction and community support of the Trader Joe’s team is much better than Pangolin’s. They are more active, enthusiastically helping all users in their channels.

- Next, Trader Joe designed and improved to make providing liquidity extremely easy and convenient with just a single operation with the Zap feature.

- Next, Trader Joe has a much better tokenomic design than Pangolin as JOE holders get to capture much more value from the project than PNG holders.

- Trader Joe introduces a roadmap with many new products and new features such as Lending, Leverage Farming and Yield Optimizer to differentiate themselves from Pangolin.

- Right after launch, Trader Joe announced cooperation with a series of partners Verso Finance and ELK Finance to create pools to help LPs farm both tokens of 2 different projects.

- Creating “Farm & Trade Competition” contests with huge rewards such as $3,000, $1,500 or $500 has stimulated a number of users to come and use Trader Joe.

- Launching new products to retain users, on October 10, 2021, Trader Joe introduced the Lending product to help users make the most of their assets without having to waste time. go through other protocols.

Realizing that he had been surpassed, Pangolin made clear moves to change his tokeomic such as:

- The decision to burn 57% of the total token supply helps reduce PNG’s inflation rate significantly, somewhat supporting the PNG token price, making the reward more valuable to LPs. This partly helps Pangolin pull LP from Trader Joe back to him.

- Rewards for LPs have also been changed to attract LPs and increase TVL.

- Receive $2M from Avalanche Rush program.

But it was all too late when the changes were indeed there but the use cases for PNG were still not many, so they could not create motivation for LPs to hold PNG, so it was very difficult for LPs to continue dumping PNG. Normal.

It can be said that tokenomic is the critical point that helps Trader Joe “save the world”. So what’s interesting about Trader Joe’s tokenomics?

- First, Trader Joe simply introduced xJOE where users could lock their JOE to share in revenue from the protocol side. xJOE holders will receive 0.05% of the revenue of all protocol products.

However, Trader Joe also has weaknesses when their construction team is completely anonymous, including some members such as:

- Cryptofish: Currently Co Founder of Trader Joe’s. Cryptofish has a Master’s degree in Computer Science from a university in the US. Before coming to DeFi, Cryptofish worked at Google and a number of exchanges focusing on derivatives. Besides, Cryptofish is also one of the first to make important contributions to the Snowball and Sherpa Cash projects.

- Accompanying Cryptofish is Murloc. Unlike Cryptofish, Murloc has a Bachelor of Electrical Engineering from a university in the US. Before creating Trader Joe’s together, Murloc had a period of time with Grab. And Murloc’s expertise is product management.

The Winner Is The Strong One

The superhero civil war resulted in Trader Joe being the winner and becoming the largest AMM on Avalanche’s ecosystem. Unlike Pangolin, Trader Joe’s does not rest on its laurels but continues to develop and upgrade.

Continue product development

Banker Joe

Introduced on October 10, 2021, this is essentially a Lending platform built on Trader Joe and the project will develop with an All in One vision.

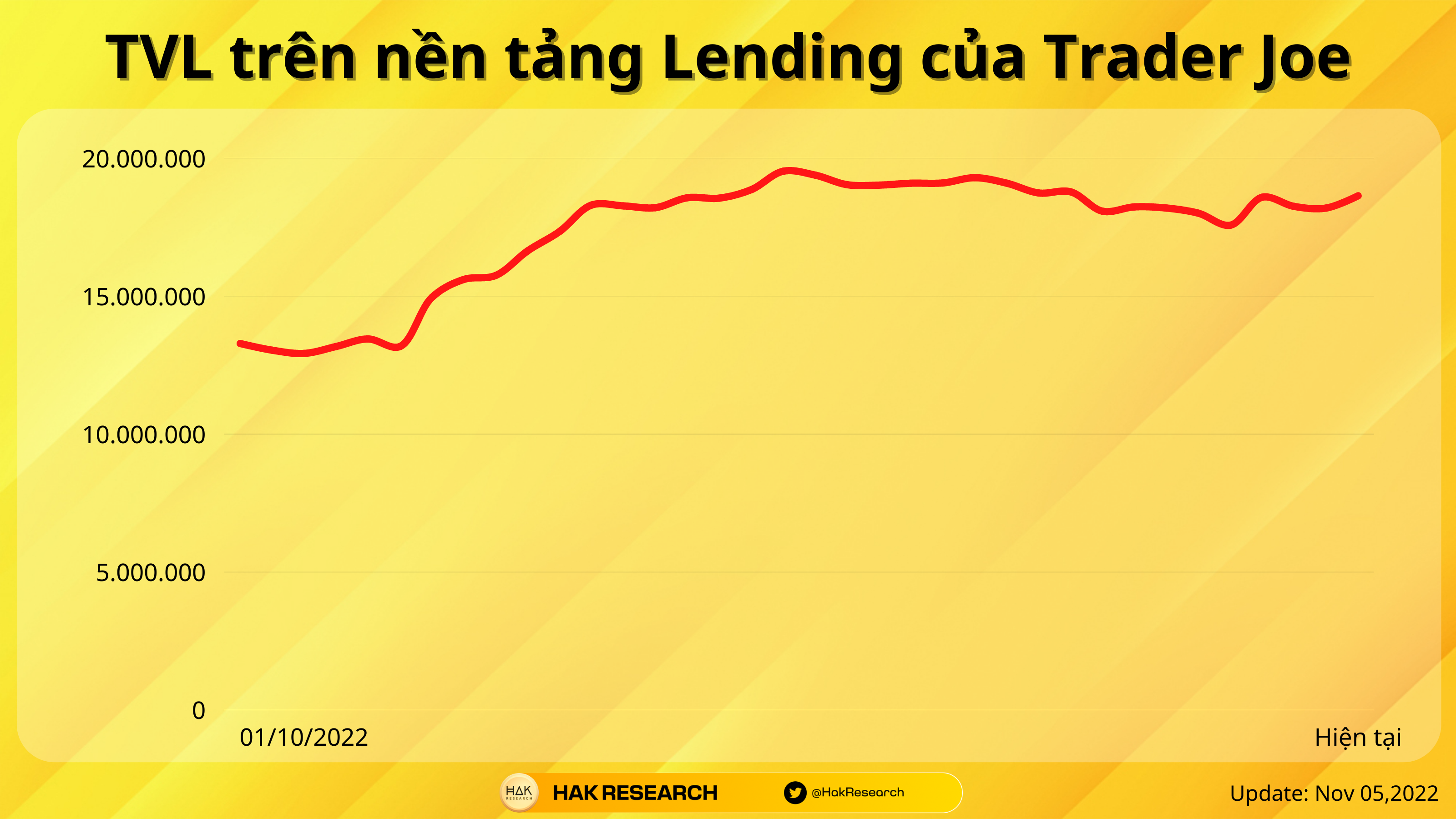

Although launched in October 2021, the TVL of the Lending segment on Trader Joe’s does not have many breakthroughs, partly because projects like AAVE or BenQi are too large.

Rocket Joe

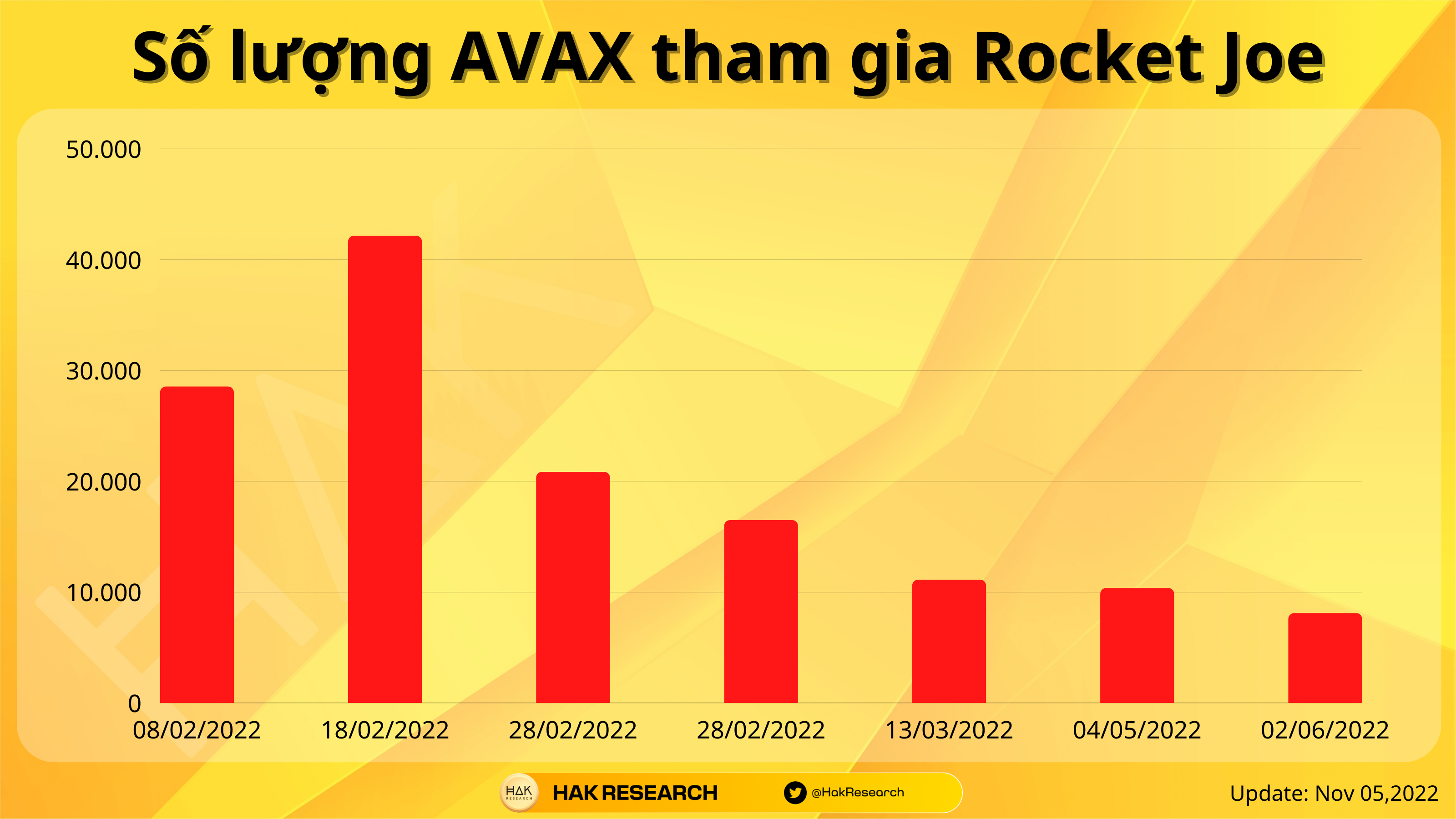

First introduced on January 16, 2022, this is essentially a “Launchpad” platform developed by Trader Joe, but the way to participate is many different from traditional Launchpad platforms. Launchpad that Trader Joe deployed is similar to the auction format.

With Rocket Joe, users stake their JOE to receive rJOE to participate or get AVAX directly to participate in auction pools.

Up to now, there have been 7 projects launched on Rocket Joe, but with the market trend going down, launchpad projects on Rocket Joe are gradually losing their appeal.

NFT Joepegs

Continuing to be a product introduced by Trader Joe in April 2022, NFT Joepegs includes the usual features of an NFT Marketplace:

- Supports minting of NFTs

- Trade, buy and sell all types of NFTs

- LaunchPEG: Launhpad platform for NFT projects

There have been many NFT sets launched on the Joepegs NFT platform such as Happy Ducks, Crabeanies, Chippers, Assetha, Smol Estates, Innermost by Brian Morris, Yumekana..? by CKGC, Wondercats, Wolffi Land, Culinary Delights,…

Currently, projects are busy launching their NFTs on Launchpad Drops, but currently NFTs on Avalanche are not as successful as on Solana. This probably takes time to wait when famous publishers are not present on Avalanche. .

First Failure

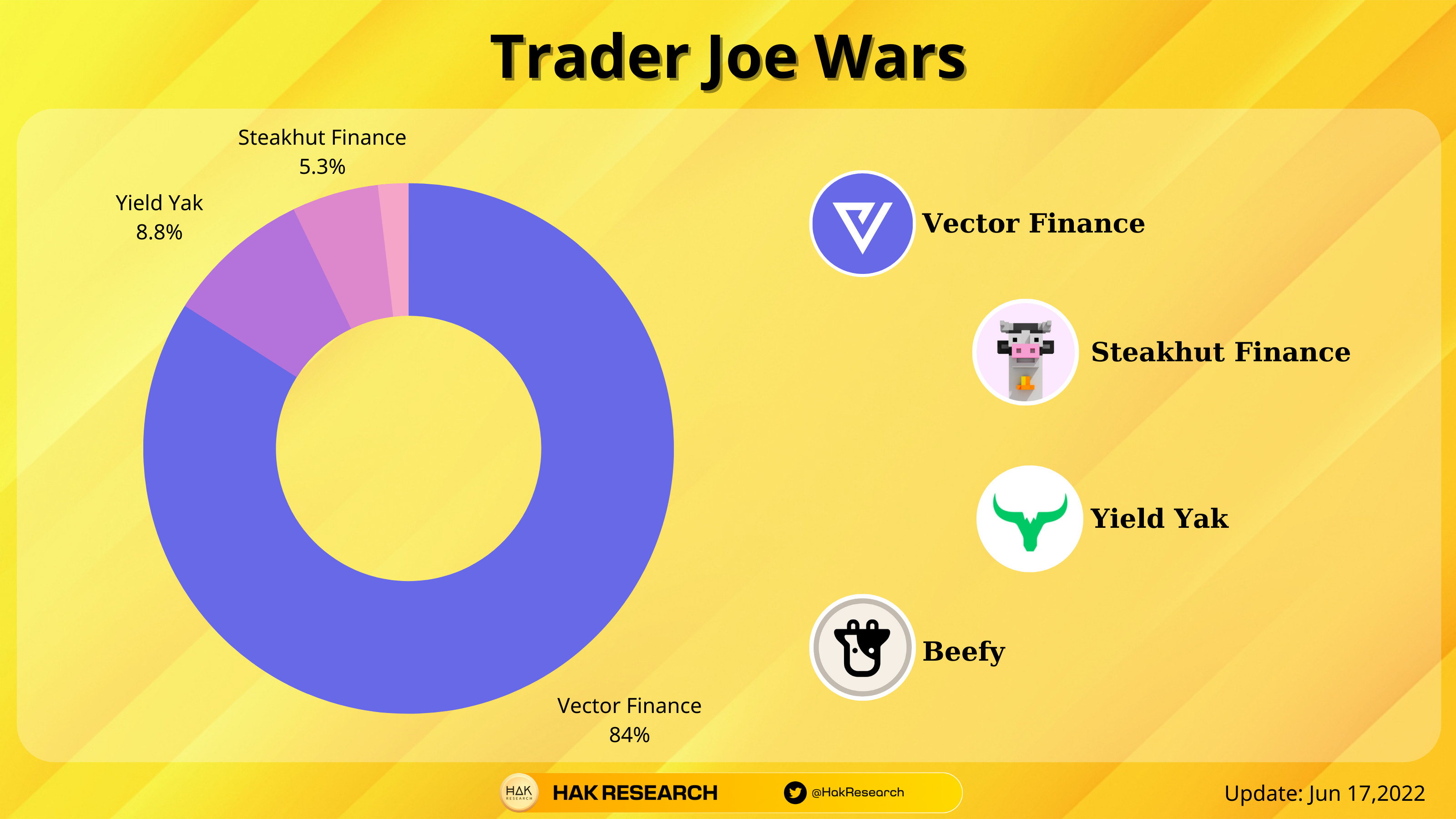

The first failure soon came to Trader Joe’s when the project began implementing the veToken model. At the same time as launching products related to NFT & NFT Marketplace, Trader Joe’s simultaneously introduced and deployed veToken inspired by Curve Finance. Some features of veToken include:

- Lock JOE to receive veJOE for a period of time from 1 month to 4 years. The longer you lock, the more veJOE will receive. When you lock 1 JOE within 4 years, you will receive 1 veJOE.

- Receiving JOE is similar to staking.

- Decide which pool will receive the most incentives.

Joe Wars has been extremely successful, seeing many parties competing for both JOE and veJOE such as Vector Finance, Yield Yak, Steakhut Finance and Beefy.

Everything was going extremely smoothly for Trader Joe’s and the market was also paying attention to Joe Wars when the market collapsed from Terra – UST and of course the collapse of UST made the whole market bleed. Falling into alarm is the same way Joe Wars falls into oblivion. It can be said that this failure did not come from the team but from the collapse of the market and it was really impossible to time this.

Keep Moving Next

Recently, Trader Joe has focused on the NFT market through the launch of NFT collections. Recently, Trader Joe is also teasing a completely new AMM with almost zero slippage called Trader Joe V2: Liquidity Book. Joe V2 was born to overcome the shortcomings that still exist in Uniswap V3.

Similar to Uniswap V3, Liquidity Book also focuses on centralized liquidity with small differences:

- Liquidity is concentrated vertically, not horizontally.

- Price range is customized by LP.

- Liquidity is not limited at LP’s discretion.

Learn more about the next product, Liquidity Book, here

Achievements & Challenges

About TVL (Total Value Locked)

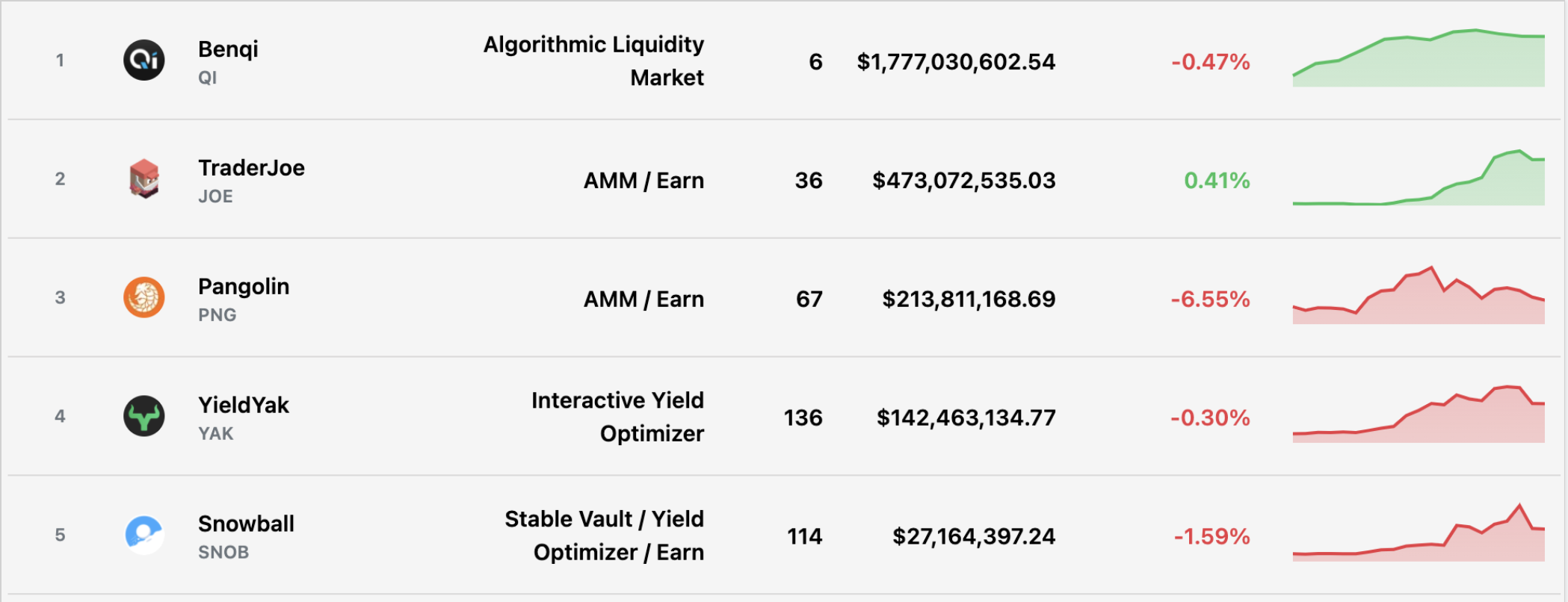

Up to now, when we are living in the crypto winter, users are leaving the market and DeFi, so the TVL of projects and blockchains has decreased by 70 – 80%, which is relatively understandable. That is similar to Trader Joe’s, but the project still ranks third after BenQi and AAVE, proving that despite the market decline, the project still maintains its position.

And arch-rival Pangolin is in the TOP 8 position.

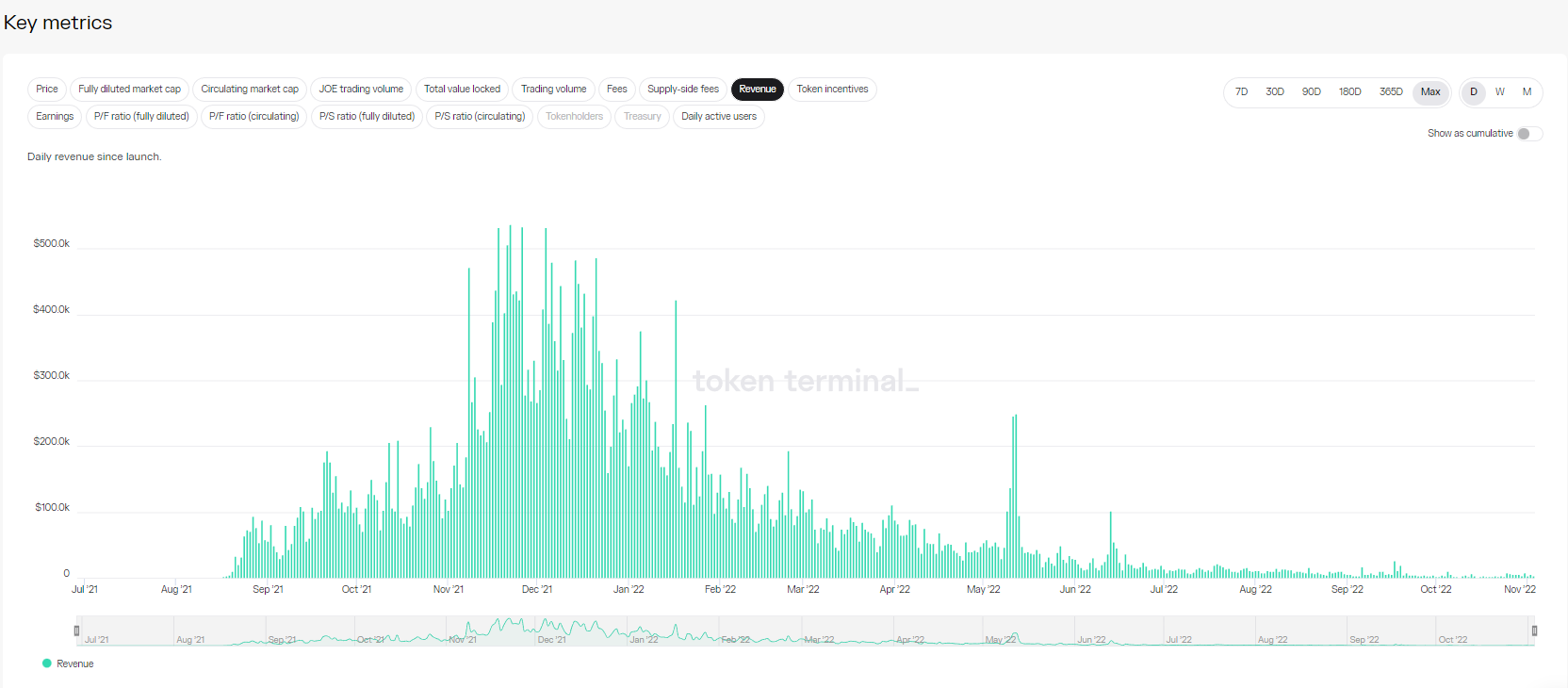

About Revenue

There was a time when Trader’s Revenue earned more than $500K per day, but now on average a day the project only earns about $3K divided more than 100 times. This is also the challenge of the project in the upcoming downtrend period when the only time the project successfully called for a modest amount of only $5M, will the project need to continue calling for capital to survive the season? crowded or not?

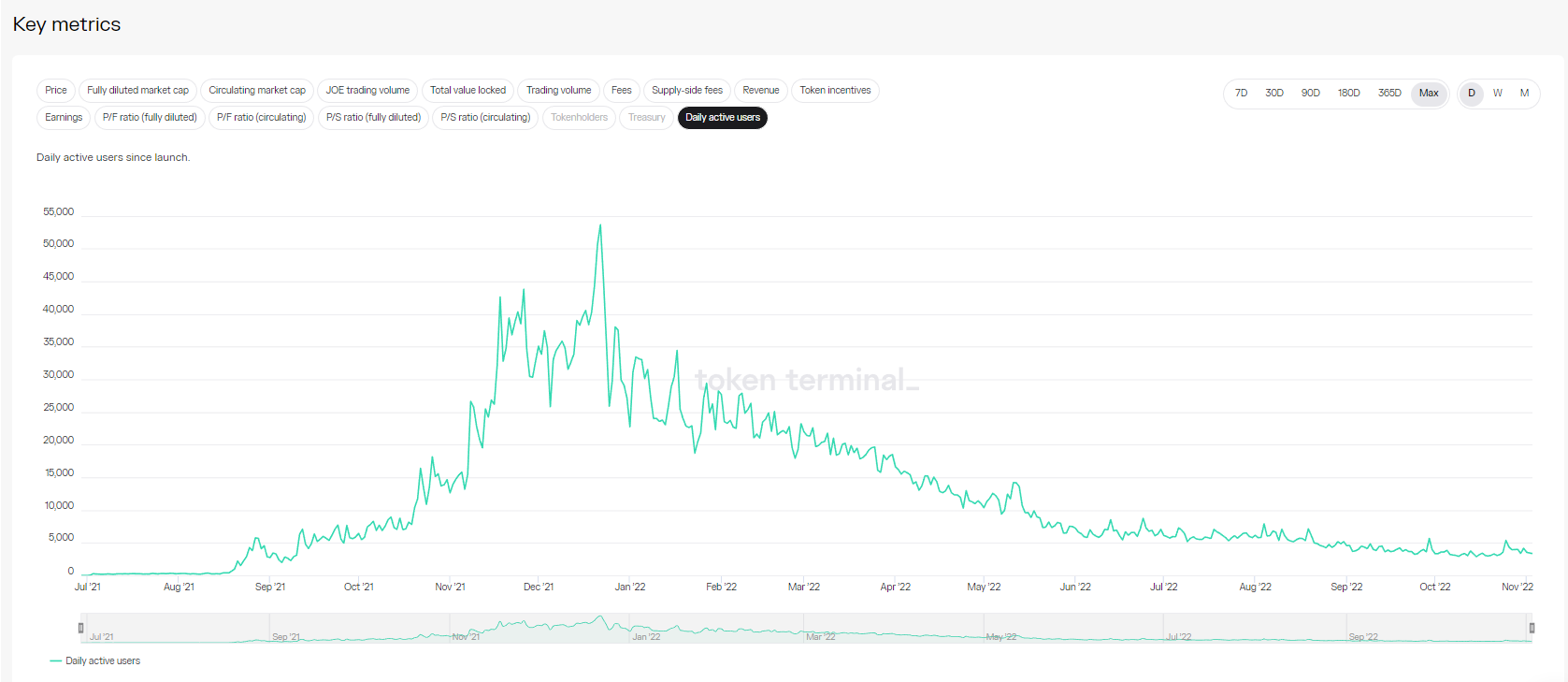

About the number of active users every day

The number of people regularly active on Trader Joe’s has also decreased back to the beginning when it first started developing.

Summary

It can be said that Trader Joe’s is a pretty good case study in the crypto market in handling competitors’ problems perfectly to attract users to the project.

Currently Trader Joe is focusing on the NFT and Liquidity Book markets. Recently, Opensea has also approved product development on Avalanche and if NFT is as successful on Avalanche as on Solana, Trader Joe will have a resounding victory even in the middle of a downtrend.