Uniswap – The True Unicorn Cryptocurrency Ever Produced. It was actually built in the cold winter days of the end of 2018 in the crypto market, but with its own strength, Uniswap has surpassed a series of other competitors to become the most popular AMM in the crypto market. and Uniswap’s model also inspires many developers and other ecosystems.

What is Uniswap?

Uniswap is an AMM (Automated Market Maker) first built on the Ethereum ecosystem. With Uniswap, users can trade many different types of tokens (even those on CEX exchanges such as Binance, FTX, OKX,… that do not exist) without verification, without having to deposit assets, all everything is clear and transparent.

Uniswap is considered the flag not only of the DEX segment but also of the entire DeFi movement that has passed, but Uniswap continues to improve, upgrade and launch many potential products in the future.

History begin

On November 2, 2018, more than 4 years ago, Uniswap was officially introduced to the community.

1/🦄 Excited to announce the launch of @UniswapExchange ! It's a protocol for automated exchange of ERC20 tokens on Ethereum. https://t.co/czTqyRit7u

— hayden.eth 🦄 (@haydenzadams) November 2, 2018

A year earlier, Hayden was forced to quit his job. While depressed, Hayden contacted his friend Karl Floersch – who was working at the Ethereum Foundation at that time. Karl convinced Hayden to learn programming languages such as Sodility and Javascript.

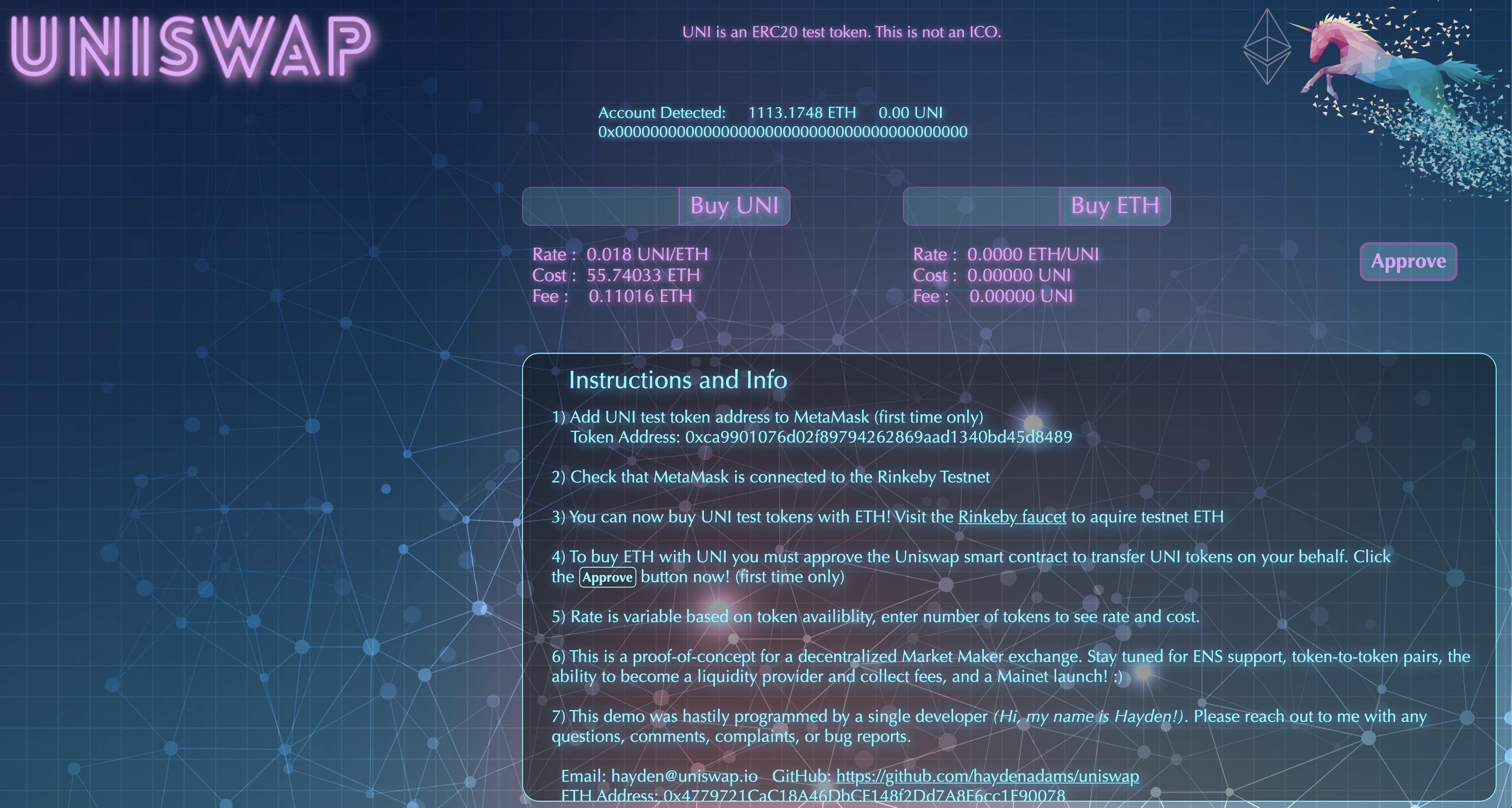

After 3 months from the time of being fired, Hayden built Proof Of Something including a Smart Contract and their first Website. And this is Uniswap’s early days.

During the following Devcon 3 event, through Karl Uniswap was introduced to the community and right when Hayden was having financial difficulties, they were provided by a man interested in the project, Pascal Van Hecke. for a grant to Hayden to continue building and developing the project.

At that time, Uniswap encountered two extremely big problems:

- Uniswap only supports ETH/ERC 20 trading pairs.

- Uniswap only supports 1 liquidity provider.

And just like that, Hayden step by step ventured into the crypto market through his close friend Karl. Hayden attends more events where he can meet talented people in the industry like Vitalik Buterin and many other like-minded people.

Product Development

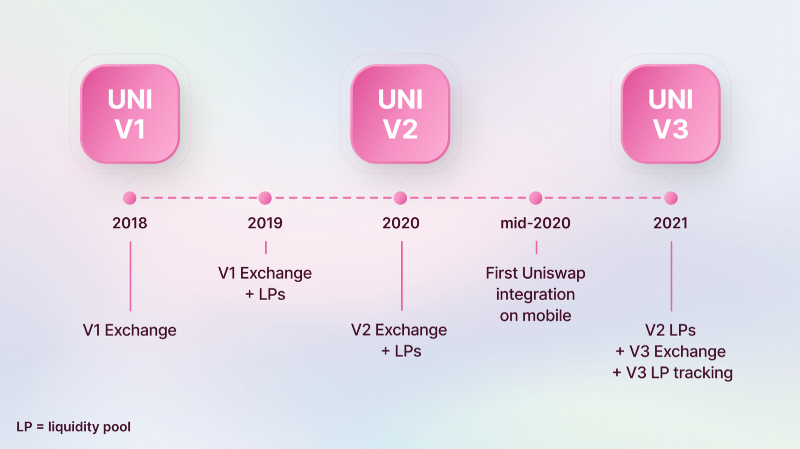

Uniswap has gone through a total of 3 evolutions and each time has helped Uniswap mark different steps of success in terms of both the protocol and the market, which are the three upgrades Uniswap V1, Uniswap V2 and Uniswap V3.

The common point of all 3 versions is that they use the same algorithm or mathematical formula to help users trade on Uniswap: x*y=k

In there,

- x is the amount of token A

- y is the amount of B tokens

- k is a constant, the total value of the pool (A, B)

Uniswap V1

The highlight of Uniswap V1 is that every transaction needs to go through ETH. In the deepest sense, Uniswap V1 only supports trading the ETH – ERC 20 pair and if you want to trade ERC 20 with ERC 20, there will be 2 transactions taking place at the same time.

For example: You want to trade Token A (ERC-20) to Token B (ERC-20)

Step 1: Uniswap will perform the transaction from Token A to ETH

Step 2: Uniswap continues to perform one more transaction from ETH to Token B

Defect:

- Fees are higher than usual because 2 transactions are performed at the same time. Instead of users only having to pay 1 fee, with Uniswap V1, users have to pay 2 fees.

- Charging the fee twice means sliding the price twice, first for the pair Token A and ETH then for ETH and Token B.

- The slower pace is understandable.

- Direct trading between ERC 20 tokens is not possible.

- Transactions are tied to ETH.

- For liquidity providers, because all trading pairs are tied to ETH, LPs also have to own ETH whether they want to or not.

Uniswap V2

Uniswap V2 is truly a revolution for AMMs in general and DeFi in particular. With Uniswap, there have been extremely clear reform steps, solving all remaining problems with the Uniswap V1 version.

With Uniswap V2 version we have:

- Direct transactions between ERC 20 and ERC 20 without the need for ETH intermediaries.

- Speed up transactions, reduce transaction costs and reduce price slippage

- Uniswap V2 is built using the Sodility programming language.

A model that has approached perfection, plus when Uniswap launched its V2 version in May 2020, signs of the DeFi trend gradually appeared.

So almost all DEXs later forked Uniswap’s model, then the projects integrated this and that segment to make their projects more attractive to users, typically Sushiswap. But with the position of the leader, Uniswap has successfully dominated the market even though there was a time when Sushiswap thought it had succeeded in taking over Uniswap’s pie.

Uniswap V3

When the whole market thought that Uniswap V2 would be the most perfect version for an AMM, Uniswap said no when in March 2021 they first introduced the Uniswap V3 version and officially launched it in May/ 2021.

Unfortunately, when it launched, Uniswap was not in a hurry to Open Source to avoid the Fork of other projects. The only point that makes Uniswap stand out is “Centralized Liquidity”.

You can look at the chart on the right hand side of the photo and you can see that the blue area is liquidity and it is not spread evenly but only concentrated in a short segment.

- For Uniswap V1 and V2 versions, liquidity will range from negative infinity to positive infinity. For example, if a project has a token price that often fluctuates around $10 – $20, providing liquidity to it at a price of $1,000 or several thousand dollars is a waste because it will be difficult to trade. that token at that price for a short period of time.

- As for Uniswap V3, Uniswap allows users to choose different price points to provide liquidity. Whoever chooses the more accurate price will be rewarded more. Therefore, liquidity is concentrated among swap users with low price slippage, LPs are rewarded more based on their personal analysis.

Upgrading the Organization

In August 2022, Uniswap officially introduced and launched the Uniswap Foundation, which was provided with $74M to have plans to promote Uniswap’s development. Besides, this is also a Venture Capital that has invested in many different projects.

Achievement

About TVL (Total Value Locked)

Uniswap’s contributions to the entire crypto market are undeniable, but if expressed through numbers, TVL Uniswap is not TOP in all protocols and all chains. In addition, Uniswap also ranks TOP 5 on the system. Polygon, similarly is TOP on Arbitrum, TOP 6 on Optimism and finally TOP 7 on Celo ecosystem.

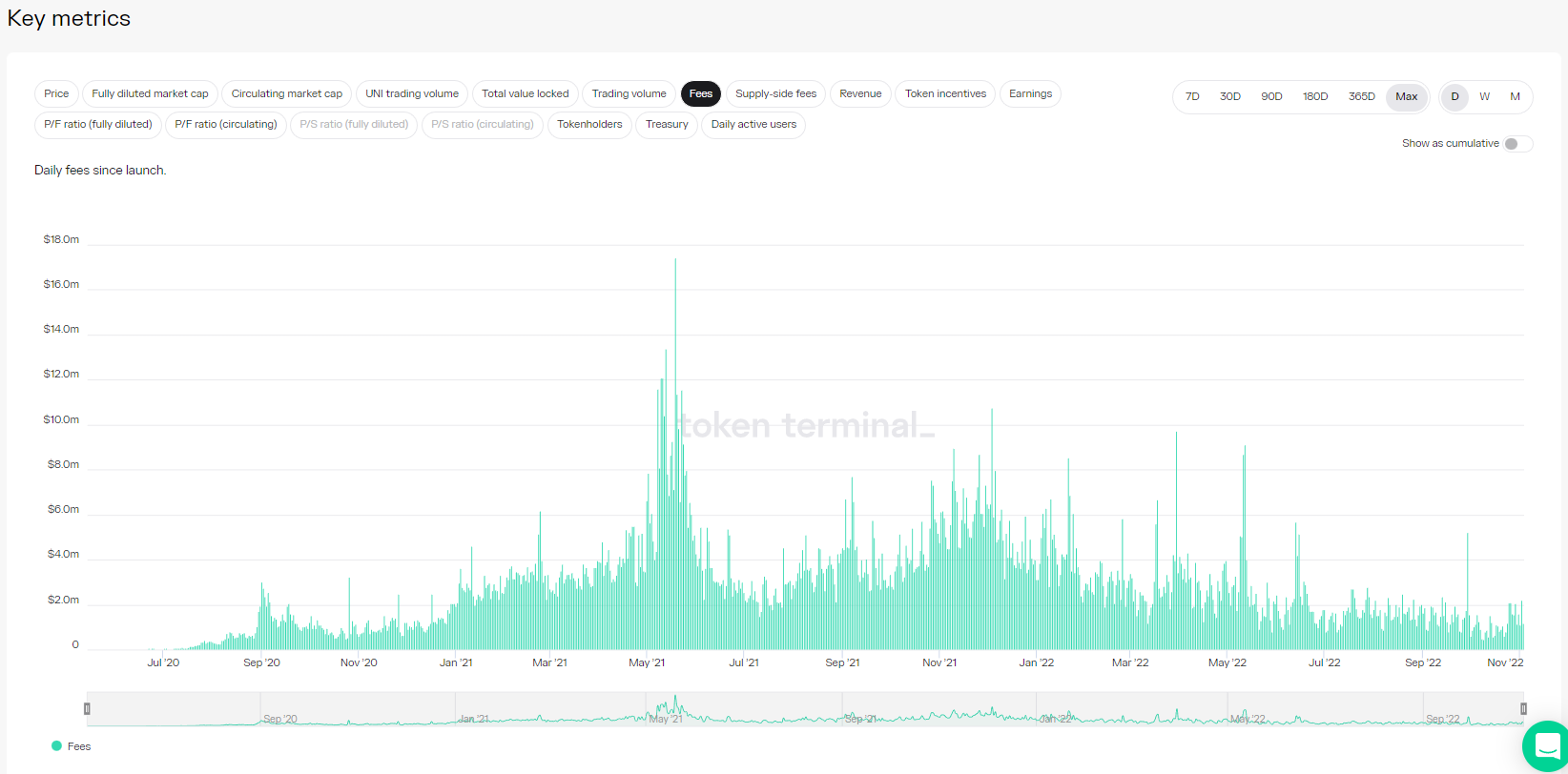

About revenue

The downtrend market is correct, it is not wrong for users to leave DeFi, but in general there are still people who stay and that is shown through the Fees that Uniswap collects from users and the number has decreased recently. but still bigger than the time when many people did not know about DeFi.

Besides, the “daily active users” index shows that although we are in winter, the number of regular users of Uniswap has not decreased but shows signs of growth returning to nearly the same level as when Bitcoin was at zero. $69K.

Toward the future

NFT is the market that Uniswap is targeting, but instead of directly competing with Opensea to build a similar NFT Marketplace, in the third quarter of 2022, Uniswap also officially cooperated with SudoAMM – AMM for for the first NFT in the crypto market to build an AMM dedicated to NFTs.

But that was not the first move, about 2 months ago Uniswap acquired an NFT Marketplace Genie ready to go deeper into NFTs.

It can be said that compared to other projects, Uniswap chose a new and more risky direction. Competitor in the same industry, Curve Finance, decided to build its own stablecoin platform, competitor in another industry, AAVE, also built its own stablecoin GHO.

It can be said that Uniswap is creating the most important thing for any asset type which is “liquidity” and if Uniswap succeeds in building liquidity for NFTs, this will be a big step forward to help NFTs and DeFi is closer together.

Because when there is liquidity, NFTs can easily be mortgaged on Lending & Borrowing, Yield Farming,…

Again, although he is not the creator of the industry, he has enough basis to lead the industry.

Challenges Ahead

The biggest challenge that Uniswap faces is not in the industry it is strongest in because it is currently difficult for Uniswap’s competitors in the same industry to overcome it, the challenge lies in the AMM dedicated to NFTs that is being built. Because normally transactions on Opensea will be similar to Orderbook but with AMM, users do not see NFTs or jumps can be suitable for most NFTs but with rare NFTs, how to deal with them?

Recently, some challenges regarding capital for construction have also been resolved when on October 13, 2020, Uniswap successfully called for an amount of $165M at a valuation of $1.5B with this amount Uniswap can comfortably built in winter

Summary

It can be said that many big events are waiting for Uniswap ahead. Can Uniswap survive this crypto winter? Will Uniswap be successful with the NFT segment? Will Uniswap build its own stablecoin?

Let’s wait and follow Uniswap!