Rocket Pool and Lido Finance are two famous projects in the Liquid Staking segment, but the positions of the two projects are relatively opposite. While Lido Finance is firmly in the TOP 1 position in the Liquid Staking segment and TOP 2 in the entire DeFi market, Rocket Pool is considered a challenger to Lido’s position when the operating model introduced by Rocket Pool has many advantages. points more than Lido Finance.

Evaluating Lido Finance’s Operating Model

Operating Model

Lido Finance provides a comprehensive staking solution to users, and they do not need to worry about their assets being locked in smart contracts.

First, users will deposit assets that Lido supports (Ethereum, Solana, Polygon, Polkadot, Kusama) into Lido Finance’s total pools. In addition, Lido Finance cooperates closely with major staking service providers in the crypto market such as Everstake, Stakefish, Nethermind, Blockdaemon, Certus.One, P2P,… User assets will be sent to these validators and taken for staking.

On the contrary, Lido Finance will send back to the user the derivative assets representing the user’s assets in the pool. For example, a user sends to Lido Finance 1,000 SOL and Lido Finance will send back to the user 1,000 stSOL. Lido Finance continues to work to connect with DeFi projects on Solana to integrate stSOL into DEXs, Lending & Borrowing, Derivatives, Margin Trading,…

This is similar to assets like Ethereum, Polygon, Kusama, and Polkadot.

Read the detailed analysis article about Lido Finance: What is Lido Finance? Overview of Electronic Conveniences Lido Finance

Advantages and disadvantages of Lido Finance

|

Advantage |

Defect |

|---|---|

|

Supports a variety of assets such as Ethereum, Polygon, Solana, Kusama, Polkadot. |

The number of validators is limited, affecting the decentralization of Proof Of Stake networks. |

|

Reputable and large staking partners with well-known names in the crypto market. |

StToken derivative assets are only limited to DeFi and have not yet reached CeFi. |

|

Lido Finance has many use cases for stToken derivative assets. |

The number of supported Blockchains is still quite small. |

Evaluating Rocket Pool’s Operating Model

Rocket Pool’s operating model

Rocket Pool provides 2 products to its users including:

- Stake ETH: Users stake a minimum of 0.01 ETH into Rocket Pool and receive rETH representing the assets the user deposited.

- Stake + Run Node: Instead of the minimum 32 ETH to run a node on Ethereum, users only need to stake a minimum of 16 ETH and the remaining 16 ETH will take the pool. Stake ETH to add up to 32 ETH.

Read the detailed analysis article about Rocket Pool: What is Rocket Pool? Overview of Rocket Pool Electronic Turning

Pros and cons of Rocket Pool

|

Advantage |

Defect |

|---|---|

|

The interest rate from Ethereum staking is higher than the general market at 8.41% |

The number of supporting blockchains is very small, only supporting Ethereum. |

|

From the way it works, the network is more decentralized than Lido Finance |

The number of use cases of rETH is very small compared to stETH. |

|

The team has had a long time developing with Ethereum and the Crypto market. |

Operations may be ineffective because of lack of interaction with professional partners. |

The Difference Between Lido Finance and Rocket Pool

Both Lido Finance and Rocket Pool receive ETH from users but the difference is:

- Lido Finance: Send ETH to specialized units running Validator.

- Rocket Pool: Wait for 32 ETH to deploy a node yourself or combine with 16 ETH from the pool Stake + Run Node to combine enough 32 ETH to run the node.

Actually, if the two projects had equal TVL, there would be no problem, but at present the TVL between Lido Finance and Rocket Pool is very different. As of the time of writing

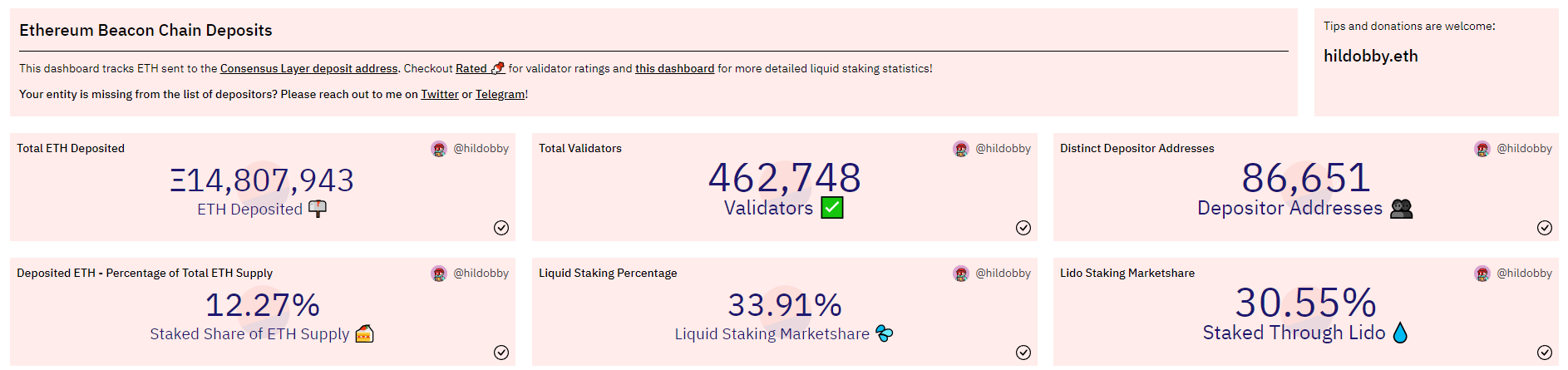

- There are a total of 14,807,943 ETH being staked on BeaconChain.

- With Lido Finance, there are about 4,511,989 ETH being staked with 149,899 deposit addresses.

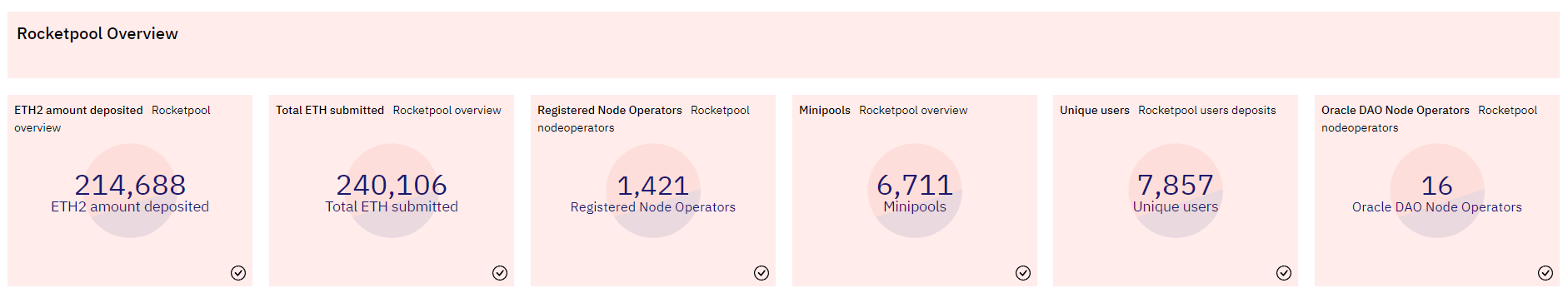

- With Rocket Pool, there are about 296,864 ETH being staked and 1,692 nodes have been created.

Overview of Staking on Beacon Chain

Updated numbers about Lido Finance

Updated numbers about Rocket Pool

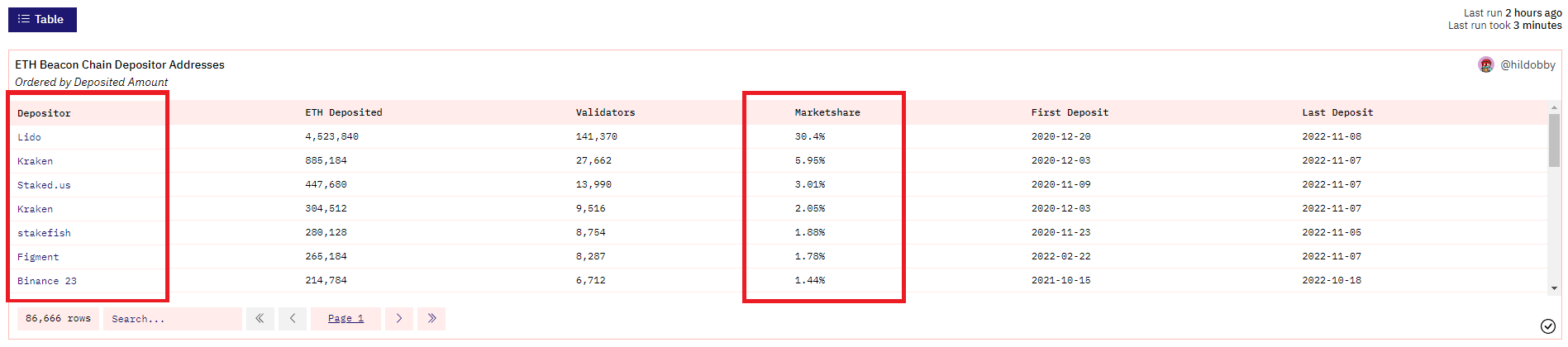

Through the numbers above, Lido Finance accounts for more than 30% of the total amount of ETH being staked in Ethereum 2.0, while Lido Finance’s partners in the staking service only have about 30 large Validator implementation units, and if the entire number is If this amount of ETH is put into 30 Validator units, this is possible Seriously affecting the decentralization of the Ethereum network in the near future.

Ranking of units implementing Staking services for Ethereum 2.0

Even large exchanges like Kraken or Binance cannot compete, which is understandable when with stETH or rETH users can participate in activities on DeFi. For example, if a user feels that the price of ETH may drop sharply, the user can sell stETH and then when the price of ETH actually drops, the user can buy it back or the user can mortgage stETH to borrow from other banks. Other assets.

So the results have shown that Liquid Staking projects on DeFi perform much better than CeFi.

Back to the main issue, Lido Finance’s popularity may cause the Ethereum 2.0 network to lose its decentralization. This issue has been dissected by many experts such as Vitalik Buterin and many major KOLs in the Crypto community.

Vitalik Buterin shared: “I am quite skeptical and worried about the decentralization of the Ethereum network after converting to Proof Of Stake when Lido Finance holds more than 30% of the staked Ethereum.”

You can read details about this article here.

There have been proposals to increase transaction fees when the amount of ETH on Lido Finance increases beyond 30 – 40% or limit the amount of ETH that can be deposited into Lido Finance when it hits the ceiling, but that spirit is not suitable for DeFi and all. Those proposals were rejected by the Lido Finance community even though Vitalik Buterin supported those proposals.

Can Rocket Pool surpass Lido Finance?

Looking at Lido’s current TVL, it accounts for 70% of the entire Liquid Staking industry, about 12 times higher than Roket Pool.

The advantage of Rocket Pool compared to Lido Finance is that Rocket Pool’s APR is 8.41%, higher than Lido Finance’s 5.3%, but the use cases of Lido’s stETH are much more than rETH. Some examples are:

- Regarding places to trade: stETH can be traded at many places such as FTX, Gate.io, Houbi, Bybit, MEXC besides 1inch, Curve Finance, Uniswap and if you look at rETH it is only available on Uniswap of Ethereum network and some Layer 2.

- In terms of liquidity, the stETH/ETH pair on Curve Finance has a total liquidity of about $1.1B while the rETH/WETH pair on Uniswap has quite low liquidity.

- Regarding Lending & Borrowing: stETH has become collateral on AAVE but rETH has not.

- In addition, stETH will be gradually developed by Lido Finance as multichain. In the immediate future, there will be Layer 2s such as Optimism or Arbitrum.

- If users simply stake a small amount, they will use Rocket Pool to get an APR 3% higher than Lido Finance.

- As for people who regularly work on DeFi or VCs who want to take advantage of leverage from derivative assets, they will use Lido Finance.

Most users in DeFi are more inclined towards the latter and of course users or VCs care more about profits than decentralization so they will still use stETH.

We can temporarily conclude that if Rocket Pool does not have a drastic change, this overthrow can be said to be extremely difficult and take a lot of time for Rocket Pool.

Of course we cannot blame Lido Finance, we can only blame Lido Finance themselves that they make products so good that no one can compete with them.

Solution

- From Rocket Pool’s side, it must create more use cases for rETH if it wants to compete directly with ETH.

- The market constantly has to launch new Liquid Staking projects to absorb Lido Finance’s lucrative pie.

- Relaunching Proposals on Lido Finance to have a ceiling on the ETH that Lido can hold although going against the DeFi movement but these are the best right now.

Summary

Toppling Lido Finance in a day or two is almost impossible. But the crypto market always contains many surprises, so please keep an eye on this event!