Today, we know that Camelot is one of the largest and most successful native AMMs on the Arbitrum ecosystem with different strategies compared to its competitors at the same time. However, not everyone knows about the dark side of this platform and let’s explore it together in this article.

To understand more about Camelot, people can refer to the article:

- What is Camelot (GRAIL)? Camelot Cryptocurrency Overview

Overview of Camelot & Achievements

Overview of Camelot

Camelot is not the first native AMM but is the most successful and largest native AMM ever on the Arbitrum ecosystem. A relatively interesting Camelot animation that is a combination of Uniswap V2 and Andre Cronje’s Solidly includes:

- The liquidity pool runs on the formula x * y = k (similar to Uniswap V2) for volatile assets such as BTC, ETH, ARB and many other altcoins.

- The liquidity pool runs according to the formula x^3*y + x*y^3 = k for peer-to-peer assets such as Stablecoin, Synthetic Token, Liquid Staking Token (LST),…

In addition to the Dual – Liquidity Type model, Camelot also introduces to the community the Dynamic Directional Fees model, which allows adjusting the transaction fees of trading pairs at different times of the market to suit.

Differences create results

It can be said that the biggest difference in our development strategy is not to indulge too much in Liquidity Mining to cause negative consequences for the price of native token GRAIL and become a Launchpad platform.

At that time, Arbitrum’s ecosystem was growing very strongly with countless new projects in many different fields, but the ecosystem did not have a Launchpad platform that was reputable and influential enough to be able to do it. The ecosystem explodes further. Realizing that opportunity, Camelot evolved and became a Launchpad platform.

Not only stopping at supply and demand on the Arbitrum ecosystem, but since its inception, Camelot has had support not only from the Arbitrum Foundation but also many other projects in the ecosystem such as GMX, Dopex, Plutus DAO, Jones DAO,… clearly Camelot’s development team has a relatively wide relationship with projects in the same ecosystem.

The IDO model on Camelot is relatively simple. To be able to participate in IDO on Camelot, there will be 3 rounds as follows:

- Round 1: For xGRAIL holders. It is a form of GRAIL lock, the longer the lock time, the more xGRAIL you will receive. This caused the price of GRAIL to increase from $200 to an ATH of $4,600.

- Round 2: For the project’s whitelist including early project supporters, Giveaway participants,…

- Round 3: Public Sales for everyone to participate.

The first projects to be IDO on Camelot all had good growth such as Camelot’s GRAIL or Neutra Finance’s NEU. That’s what made FOMO users participate in Camelot’s IDOs.

Besides being a reputable Launchpad platform on the Arbitrum ecosystem, during the development process to date, Camelot has had a number of outstanding achievements such as:

- Become the AMM with the largest TVL in the Arbitrum ecosystem.

- Lead the Arbitrum ecosystem to develop and attract cash flow from the market, CEXs and other ecosystems.

- Proof that you don’t need to abuse Liquidity Mining to become successful.

- Camelot is also preparing to launch V2 version targeting Centralized Liquidity similar to how Uniswap V3 was successful.

However, behind those highlights and differences, Camelot still has its own dark notes at the present time and if the project does not improve promptly, Camelot will certainly be at risk of going into gold. cede the playing field to new, more potential projects.

The Dark Side of Camelot

IDO was successful but it should have been more

Indeed, the level of success of IDO on Camelot brings extremely positive benefits to both the project, users and the ecosystem. However, if Camelot changes their ways, the IDO coverage on Arbitrum will be 5, 10 or even 20 times higher.

Camelot deploys IDO in the form of contributing money to a pool and then buying a certain amount of tokens from the project. The larger the amount of money entering the pool, the higher the token price and Market Cap of the token. This will optimize the amount of money successfully raised from the project, but after listing, the price of the token will not increase sharply or be large. This causes investors’ interest to gradually decrease. Later, Camelot fixed it but it was a bit late.

If on normal Launchpad platforms, users will have to stake & hold Native Token and then participate in buying the lottery. The capitalization of the project will be fixed and will not be pushed up like Camelot. After listing the project floor, it can be x20, x30 times as a minimum, while FOMO projects can be x100 or even x200 times (usually happens in uptrend).

Obviously, if Camelot chooses to follow the Lottery direction, it will be many, many times more successful than it is now.

IDO projects are not as successful as thought

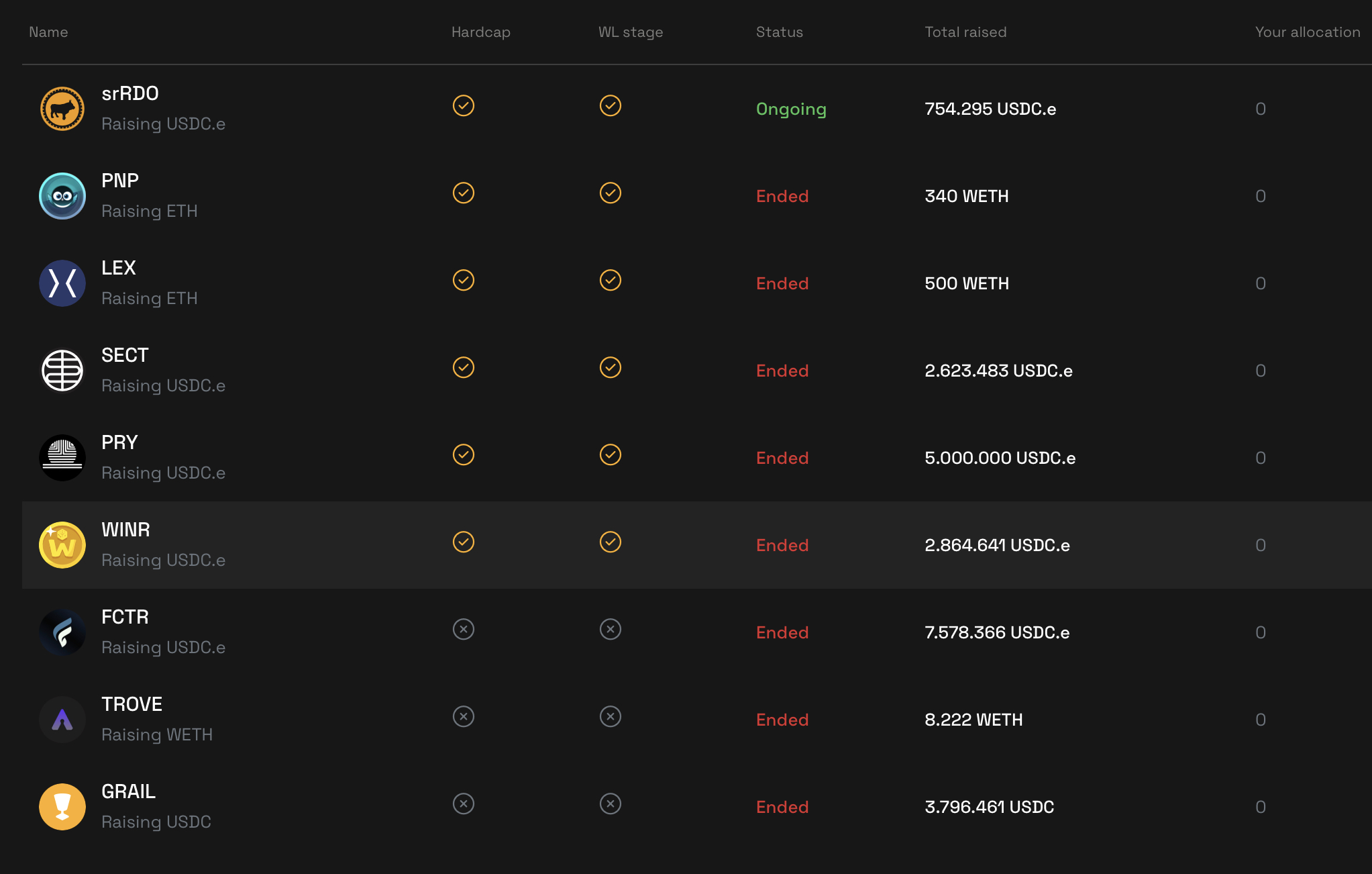

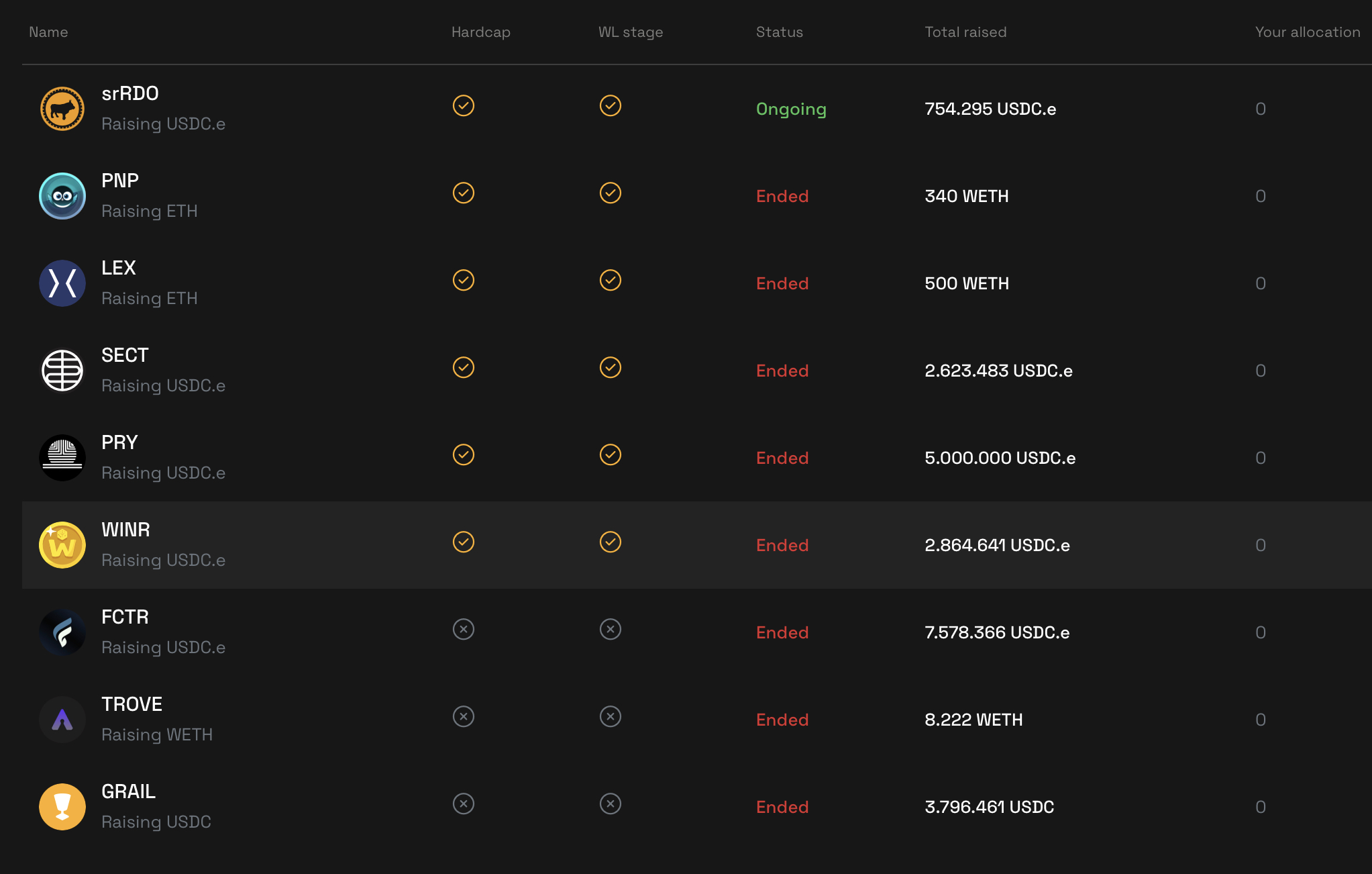

Now we will look back at the prices of each IDO project on Camelot after a period of development:

|

Nr.Crt |

Project |

IDO price |

ATH price |

PNL |

HT price |

|---|---|---|---|---|---|

|

first |

Camelot |

$250 |

$4,600 |

1.900% |

$1,390 |

|

2 |

Arbitrove |

$0.08 |

$0.08 |

0% |

$0.02 |

|

3 |

Neutra Finance |

$0.6 |

$2.5 |

500% |

$0.58 |

|

4 |

Factor |

$0.75 |

$0.75% |

0% |

$0.21 |

|

5 |

Winr Protocol |

$0.029 |

$0.12 |

400% |

$0.018 |

|

6 |

Perpy Finance |

$0.02 |

$0.03 |

50% |

$0.0026 |

|

7 |

Sector Finance |

$0.26 |

$0.34 |

30% |

$0.05 |

|

8 |

Lexer Finance |

$0.02 |

$0.05 |

150% |

0.015 |

|

9 |

Penpie |

$0.35 |

$2.26 |

550% |

$1.95 |

Among the 10 IDO projects on Camelot, up to now there are up to 7/10 projects where the current token price is lower than the IDO price, the profitability rate of IDOs on Camelot is also unstable, this shows that even The process of approving the project to deploy Launchpad on Camelot is also not really clear.

We can assume that currently many IEO projects on Binance have also had their prices drop dramatically after the collapse of the crypto market. However, we need to seriously review that IDO projects on Camelot only really took place a few months ago and that is not a long period of time.

According to this statistical table, holding IDO tokens on Camelot in the medium and long term is often very risky. Surely this will cause negative emotions for future IDO participants on Camelot.

Trading volume is too low

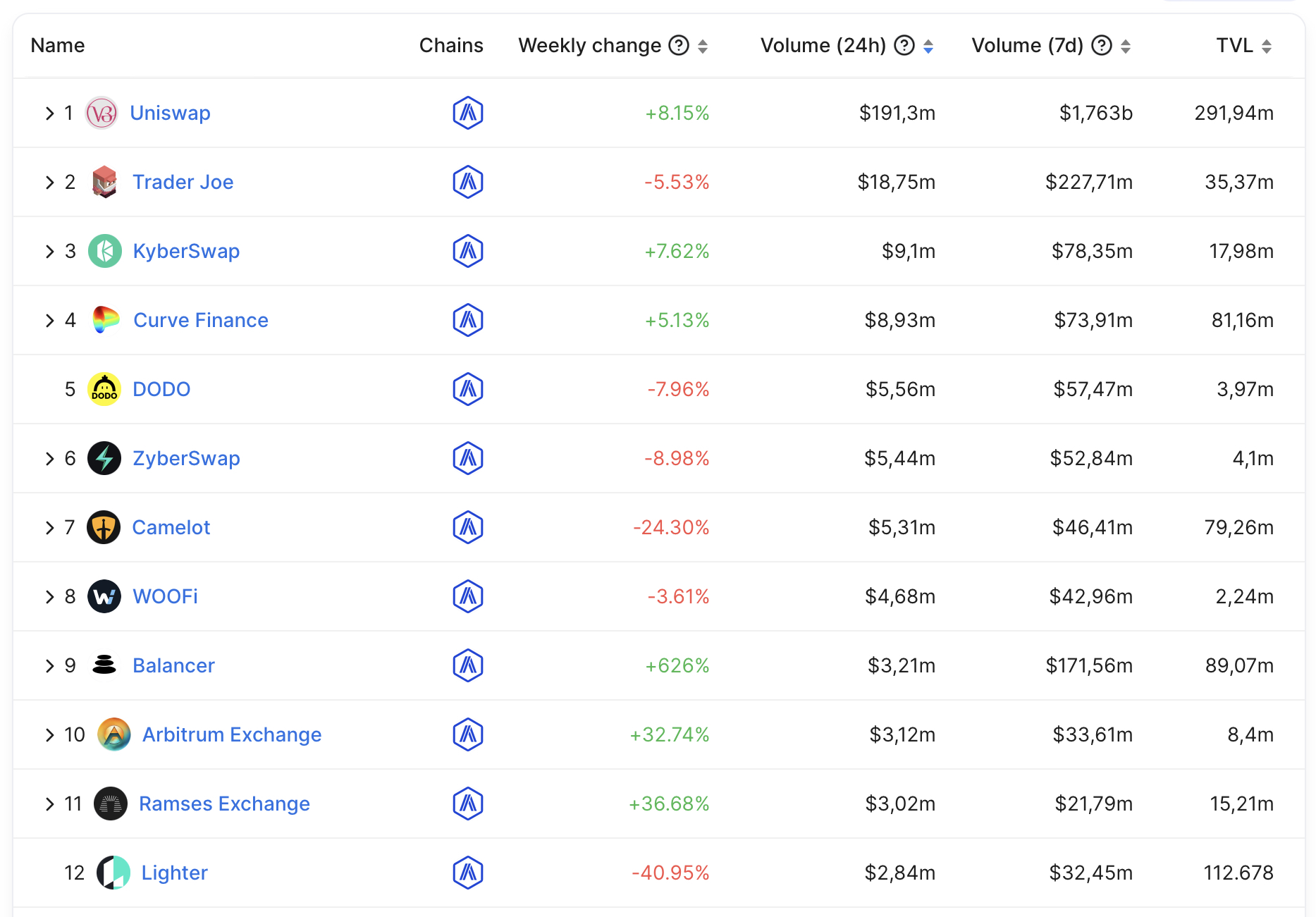

Up to now, Camelot is one of the AMMs with the largest TVL in the Arbitrum ecosystem, second only to Uniswap, Curve Finance and Balancer, but in terms of transaction volume, Camelot is behind Trader Joe, DODO, and KyberSwap. AMM that has gone into the past on Arbitrum is ZyberSwap.

From this data, it shows that most users are not choosing Camelot for their transactions. Most trading volume on Camelot only focuses on pairs that once sold IDO on Camelot. So Camelot is not being used for the purpose of its birth and name.

Currently, Camelot is also deploying version V3 with Centralized Liquidity, but this Camelot product is not yet attractive to users.

Summary

Camelot has been successful and has become one of the major protocols on Arbitrum. However, at the same time, Camelot still has many dark sides as I shared above and if it is not promptly resolved, it is likely that Camelot will gradually lose its position on the Arbitrum ecosystem.

What do you think about the darkness of Camelot?