Bitcoin Ordinals was once considered the shining star of the NFT world but is currently experiencing a significant downturn in both trading volume and sales. Let’s join Weakhand to learn about the problems that Bitcoin Ordinals is facing in this article.

Before jumping into the article, everyone can refer to some of the following articles to better understand.

- What is Bitcoin Ordinals? Everything about Bitcoin Ordinals

- What is BRC 721? NFT standard on the Bitcoin network

- What is BRC 721E? Bringing NFTs on Ethereum to the Bitcoin blockchain

- What is BRC 69? Game changer in the Bitcoin space

What is Bitcoin Ordinals?

Bitcoin Ordinals is one of the hotly discussed topics in the community recently and is considered one of the new methods to create NFTs on the Bitcoin blockchain. Released on January 20, 2023 by Casey RodarmorBitcoin Ordinals are created by appending more information such as images, videos, sounds, etc. to a single satoshi on the original Bitcoin blockchain.

Bitcoin Ordinals uses an arbitrary ordering system called Ordinal Theory (a numbering scheme for Satoshis that allows individual satoshis to be tracked and transferred) to identify each individual Bitcoin satoshi with a unique ID. Because it is completely native to Bitcoin, Bitcoin Ordinals operates without changes to the Bitcoin protocol and without any additional layers.

Bitcoin Ordinals: Rapidly Declining After Only 3 Months

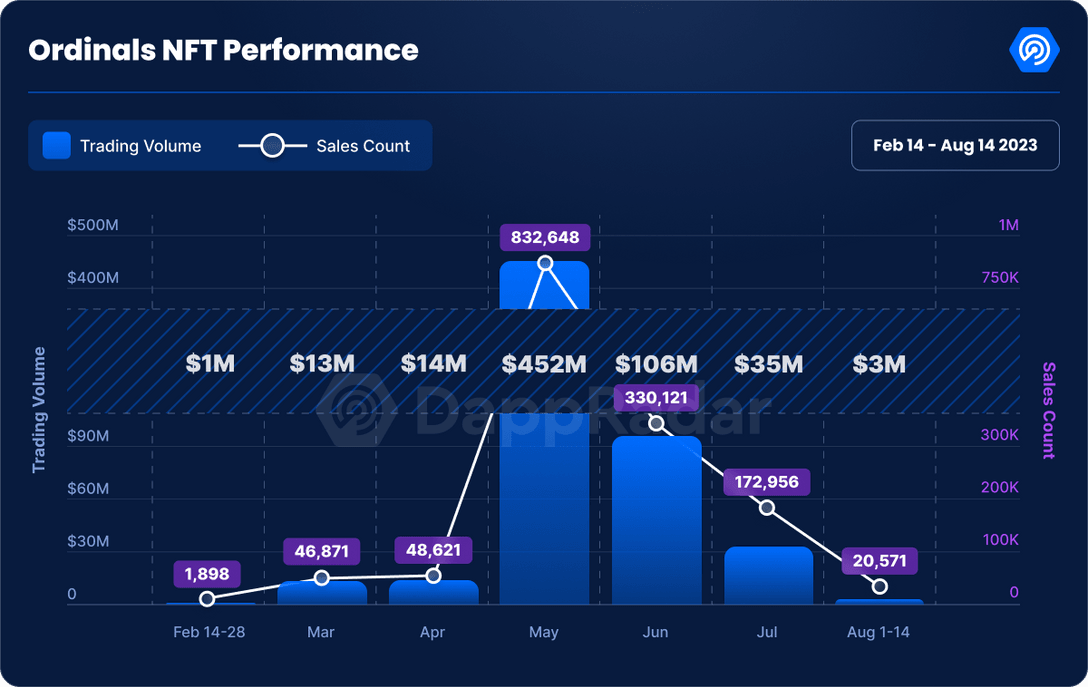

Bitcoin Ordinals was once considered the top choice of NFT traders and continuously created Hype by attracting many new users to join the Bitcoin ecosystem. However, according to recent data provided by DappRadar, trading volume and sales on Bitcoin Ordinals have seen a sharp decline of more than 97% since May 2023. This alarming downturn raises concerns about the sustainability and future relevance of Bitcoin NFTs as the broader NFT market faces new challenges as the landscape changes.

Statistics on trading volume and sales on Bitcoin Ordinals

Bitcoin Ordinals rose to prominence in the second quarter of 2023 by continuously introducing new standards that increased the scalability of Bitcoin Ordinals. Bitcoin Ordinals’ network activity increased significantly in May 2023 and recorded an impressive trading volume of 832M USD and revenue of up to 452M USD.

However, the following months painted a bleak picture for Bitcoin Ordinals. The report highlights a sharp decline in transaction volume and sales since the peak in May 2023. June saw transaction volume reaching only 330M USD, down 60.3% and sales reaching only 106M USD, down 76.5% compared to the previous month.

July further reinforced the bearish trend with trading volume plummeting 66.9% to $35M USD and sales falling 47.6% to $172M USD. Early August data paints an even grimmer scenario showing a 91.4% drop in trading volume to just 3M USD accompanied by a staggering 88.1% decline in sales, total only reached 20M USD.

What is especially worrying for Bitcoin Ordinals is the persistent decrease in transaction numbers, which suggests waning enthusiasm or lack of trust in Bitcoin-based NFTs. While fluctuations in trading volume can be attributed to market dynamics, a persistent decline in the number of transactions can indicate deeper problems at play. This trend raises questions about the longevity and relevance of Bitcoin Ordinals in today’s competitive NFT landscape.

Statistics on the number of NFT transaction addresses on the three blockchains Bitcoin, Ethereum and Polygon

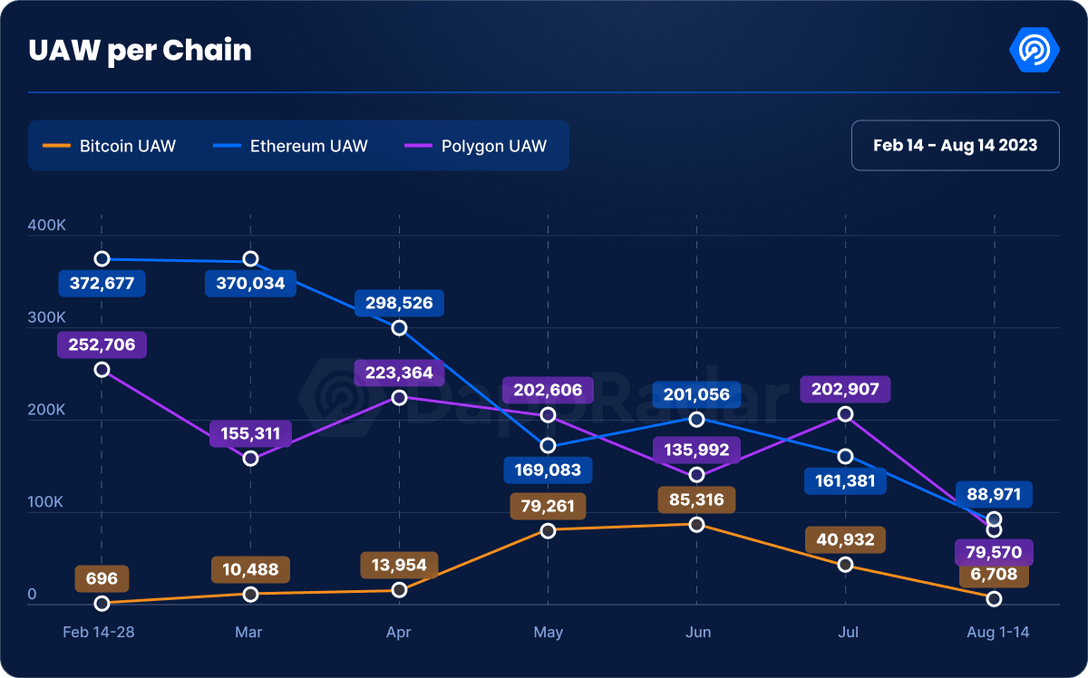

Comparatively, Ethereum and Polygon, despite facing their own challenges, have shown more resilience in their NFT trading activity. From February to mid-August 2023, the number of wallet addresses trading NFTs on Ethereum decreased by 22%, while Polygon saw a steeper drop of more than 60%. However, this drop is less pronounced than Bitcoin Ordinals’ staggering 90% drop over the same period.

After skyrocketing from 696 active wallet addresses in February 2023 to a peak of 79,261 in May, Bitcoin Ordinals faced a rapid decline and saw a sharp decline to 40,932 wallet addresses. in July and hit that level of 6,708 in the first half of August.

One of the reasons for this is that Ethereum and Polygon have better reputations and broader applications in the NFT sector, making them less susceptible to drastic market changes. Additionally, it is worth noting that Bitcoin NFTs are primarily focused on Profile Picture NFTs (PFPs) which often have more limited use cases compared to the diverse range of NFTs on Ethereum and Polygon.

Looking Ahead: Temporary Failure or Systemic Problem

Bitcoin Ordinals is known to be for the community and built by the community. While some see the initial hype surrounding Bitcoin Ordinals as unsustainable, others argue that Bitcoin’s primary function will remain as a store of value rather than delving into the NFT realm. This difference of opinion reflects the ongoing debate over Bitcoin’s role in the rapidly growing digital economy.

The coming months are expected to be pivotal in determining whether this downward spiral is just a temporary setback or a sign of deeper challenges for Bitcoin Ordinals. As NFTs continue to grow, Bitcoin Ordinals needs to make changes to suit the market landscape and fierce competition from many different Blockchains.

summary

All in all, the apparent decline in trading volume and sales on Bitcoin Ordinals raises key questions about the future of NFTs on the Bitcoin blockchain. Above is all the information I want to introduce in this article, hope everyone has received useful knowledge.