Pendle Finance has achieved many great achievements even during the Crypto winter, when most projects stopped operating and only maintained a basic level of operation, Pendle Finance still moved forward. Whoever holds the flag will fly it is a saying that is very true for the current situation of Pendle Finance.

In this article we will go deeper into the achievements that Pendle Finance has achieved and some of the future potential of this project. To understand more about Pendle Finance, people can refer to some of the articles below:

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- Pendle Wars Becomes Center of LSDfi

- Magpie – When “War” Is a Profit-Making Tool with subDAO & Radpie

Some Outstanding Achievements of Pendle Finance

Overview of Pendle Finance & Turning point of change

Pendle Finance is one of the novel projects in the crypto market, the niche project I am implementing is Yield Derivatives or Yield Trading. Simply put, Pendle Finance allows people to use future profits to make profits today.

For example: If you deposit 1 stETH into Pendle Finance with an APR of about 10%/year, each year you will receive 0.1 stETH instead of having to wait for the end of the year to receive stETH. Then you will receive assets representing 0.1 stETH issued by Pendle Finance. You think that before the end of the year, the price of ETH will drop sharply and you will sell 0.1 stETH to stablecoin then wait for the low price to buy it back.

That is the basic and easy-to-understand operating mechanism of Pendle Finance.

The turning point of Pendle Finance was that after the successful Shanghai Upgrade on the Ethereum network, the Liquid Staking Derivatives (LSD) segment exploded with an increased number of LSDs, the LSD segment grew to become the largest segment in the market, Lido Finance officially separated from the top to become the most powerful DeFi platform,… Pendle Finance has shifted to focus on the LSD market and has had certain achievements.

Some outstanding achievements

We have to agree that while DeFi is struggling to regain its position with a current TVL of only around $45B compared to $180B from ATH, DeFi protocols TVL has dropped 80 – 90 % compared to the ATH level in 2021, Pendle Finance has a TVL at the ATH level.

During the past crypto winter, like many other DeFi protocols, Pendle Finance’s TVl also decreased from $37M to only $3.7M, at the present time with successfully grasping the LSD trend and becoming the leading LSDfi in the entire industry. Pendle Finance’s TVL is around $122M with an increase of 33 times.

Along with the growth in TVL, we cannot ignore the fact that the project’s native token, PENDLE, has increased from $0.033 to the current level of $0.9, equivalent to a growth rate of nearly 30 times, quite similar to TVL.

Recently, when Pendle Finance decided to develop into Arbitrum, there were a number of achievements including:

- A project that holds a lot of rETH (released version of Rocket Pool). Pendle Finance holds 83% of the total rETH supply on Arbitrum.

- Is a project in the TOP 3 projects holding the most wstETH (released version of Lido Finance). Pendle Finance holds 32% of the total wstETH supply on Arbitrum.

- The liquidity of wstETH and rETHh on Arbitrum both improved significantly when Pendle Finance appeared on the ecosystem.

As of the time of writing, Pendle Finance’s TVL on the Arbitrum network is nearly equal to that of the Etherreum network. Pendle is not only quick to know that the cash flow is in LSD but is also quick to know that the cash flow is in the ecosystem. Arbitrum – one of the most diverse and vibrant ecosystems today.

It is undeniable that the birth of Pendle Finance has made strong contributions to the entire LSDfi industry such as:

- Increasing user experience, users will not only stop at using LSTs as collateral on CDP platforms, but they will also have Pendle Finance to choose from.

- In the context that stablecoins issued by CDP platforms have not yet been mass adopted in DeFi, making profits from Pendle Finance is much easier.

- Increase liquidity and use cases for LSTs. This makes the entire LSD industry stronger and more sustainable.

Pendle Finance will officially be present at GM Vietnam

GM Vietnam is the largest Blockchain event in Vietnam in 2023, bringing together quality projects and voices in the crypto community. It can be said that GM Vietnam has gathered all the real builders in the market.

Pendle Finance is also present to share views and visions about the crypto market, the entire DeFi industry in particular and the LSD and LSDfi markets in particular in the short to long term.

Some Noteworthy Points About Pendle Going Forward

vePENDLE and the Pendle Wars

With Pendle Finance introducing to the community the veToken model equivalent to vePENDLE, it will definitely create a war like the way Curve Wars, Convex Wars or recently Wombat Wars happened. Users can lock PENDLE to receive vePENDLE with some of the following benefits:

- Rewards and incentives from Pendle Finance will be greater for vePENDLE. Because not everyone is willing to lock the PENDLE.

- Protocol administrator rights. Voters can coordinate liquidity through voting.

Currently, more than 30% of PENDLE’s total supply is locked in this model. The Pendle Wars is also happening with three main names: Penpie, Equilibrie and Stake DAO. Regarding Pendle Wars, I have analyzed it very carefully in the article Pendle Wars Becoming the Center of LSDfi, everyone can refer to it for more information.

If the market situation remains good and positive as at present, the veToken model will have a positive impact on the price of PENDLE as well as the TVL of the project.

Integrate LayerZero to develop cross-chain Governance

With integration with LayerZero, PENDLE can move across different Blockchains that Pendle Finance has built and developed. The important thing here is that, in new Blockchains other than Etherreum, transaction fees become much cheaper, making it easier for users to participate in providing liquidity, participating in the governance model, etc. than.

It can be affirmed that multichain development and LayerZero integration will certainly have positive impacts on Pendle Finance such as:

- Users easily participate in providing liquidity, which causes users, TVL, and protocol revenue to improve and continue to grow.

- Users can easily participate in protocol governance, causing a decrease in PENDLE supply in the market, which will have a positive impact on the price of PENDLE.

- Users can choose from multiple LSTs, which will not only stop at the ETH version but will be expanded to many new asset types.

Pendle Finance is not the first protocol to apply LayerZero technology, but before that there were many different DeFi protocols such as Trader Joe and Radiant Capital. Most protocols have positive changes after integrating LayerZero.

Continue to develop multichain to expand the market

Most protocols, when successful at a starting Blockchain, will be forced to follow multichain if they want to expand the market thereby gaining more users and revenue, Pendle Finance is no exception. After successfully deploying on the Arbitrum ecosystem, Pendle Finance will continue to deploy on the BNB Chain network.

BNB Chain is a Blockchain directly supported by Binance. BNB currently has a total capitalization of up to $38B, this is an extremely potential market for LSD in general and LSDfi in particular. Certainly the opportunity for Pendle Finance to continue leading the LSDfi segment on BNB Chain is quite wide.

Some Projections & Personal Views

Clearly, Pendle Finance has experienced a period of hot growth along with the gradual optimism of the market in recent times. However, the road ahead for Pendle Finance still has many changes that can directly impact the protocol including:

- vePENDLE and Pendle Wars were only recently implemented. It is expected that there will still be a lot of PENDLE on the market which means we will likely continue to see the supply of PENDLE continue to decrease as Pendle Wars gets hotter.

- Orienting multichain development and adding new products helps Pendle Finance expand its market and customer base, thereby increasing its own revenue.

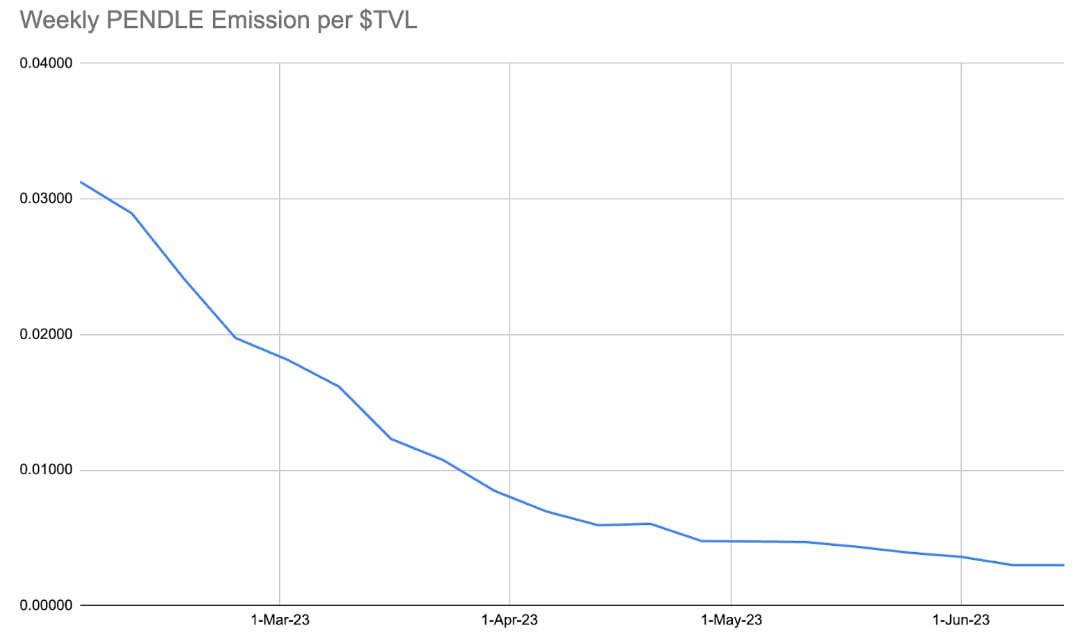

Besides, we have some numbers to be optimistic about PENDLE in the near future, such as the inflation rate of PENDLE on TVL which is also showing signs of a sharp decrease in recent times.

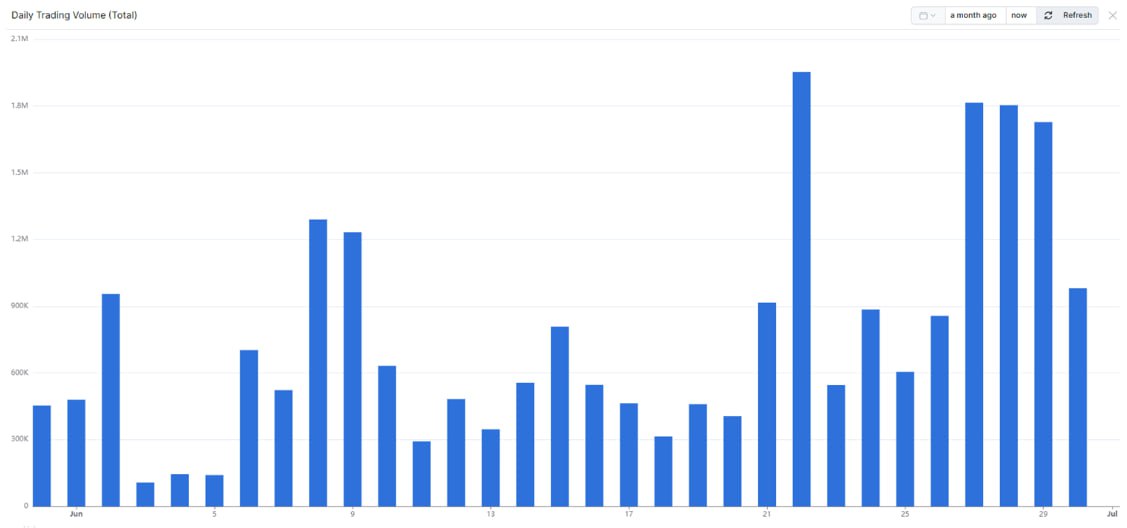

Total Trading Volume on Pendle Finance is also at $109M, an extremely high number if we compare it to other Yield Farming protocols on the market and even new AMM platforms. In particular, the largest trading volume on the daily frame is $4.5M and in June the highest day is nearly $2M.

However, one thing to note is that the price of PENDLE has increased many times since the beginning of this year, so you need to think carefully before making the right and accurate investment decisions.

Summary

Pendle Finance is a real bright spot in the crypto market amid bad news from the SEC and the US government. Pendle Finance is still there and growing but has Pendle Finance reached its peak of growth or will the above dynamics still help the protocol grow? What do you guys think about this question?