JPEG’d is a CDP project in the NFT Lending segment, a project with TVL in the Top 4 in the segment. Recently the project announced a new proposal called PIP-65 and introduced a new Tokenomics design for the JPEG Governance Token. With this news, the price of JPEG increased by more than 50%. So what’s special about the new proposal and the new Tokenomics design? What is the future development potential of JPEG’d? Let’s find out in this article!

To understand more about JPEG’d, you can read the following articles:

- Series 10: Real Builder in Winter | JPEG’d – Will Too Big Ambition Succeed?

- JPEG’d Protocol – Unlocking the Concept of NFT CDP in the NFTFi “Surge”

- What is JPEG’d (JPEG)? Overview of Cryptocurrencies JPEG’d

- NFT Lending: Model, Efficiency & Investment Opportunity

JPEG’d Overview

What is JPEG’d?

JPEG’d is a CDP project in the NFT Lending segment, allowing users to mortgage NFTs to borrow assets such as pETH and PUSd. pETH and PUSd are two assets minted from Smart Contract, they will be burned when the borrower repays the loan, withdraws collateral or liquidates the position.

JPEG’d is supporting many major collections such as CryptoPunks, BAYC, MAYC, BAKC, Milady, Doodles, Pudgy Penguins, Azuki, Clonex, Autoglyphs, Fidenzas, Ringers, Chromie, Otherdeeds, Meebits. And will support many other collections in the future.

The protocol integrates Oracle ChainLink as a source of liquidation quotes for borrowed positions. In addition, JPEG’d also integrates features such as Swap, Farming, and Staking right on the protocol, which is very convenient for users. Offers insurance products and NFT auctions.

Mechanism of action

Borrowers can pledge approved collectible NFT assets to borrow pETH (at 5%-10% interest) or PUSd (at 2% interest). When the borrower repays the loan, they can withdraw the collateral and burn the loan assets, pETH or PUSd.

When the position is liquidated, JPEG’d auction the NFT, then DAO will burn the pETH or PUSd of that position.

Tetranode support

Tetranode is a Whale, Angel Investor of many projects and a DeFi market builder with 174k Followers on Twitter. Tetranode is one of JPEG’d’s Chad board members and is also a consultant for the project. The Chad Council had to spend $2 million to bring in 5% of the total supply of JPEG.

In projects that receive investment, support, and advice from Tetranode, JPEG’d is considered a darling. Tetranode is quite interested in this project and continuously Tweets about it on his personal Twitter. And JPEG’s new Tokenomics design was also created from his ideas.

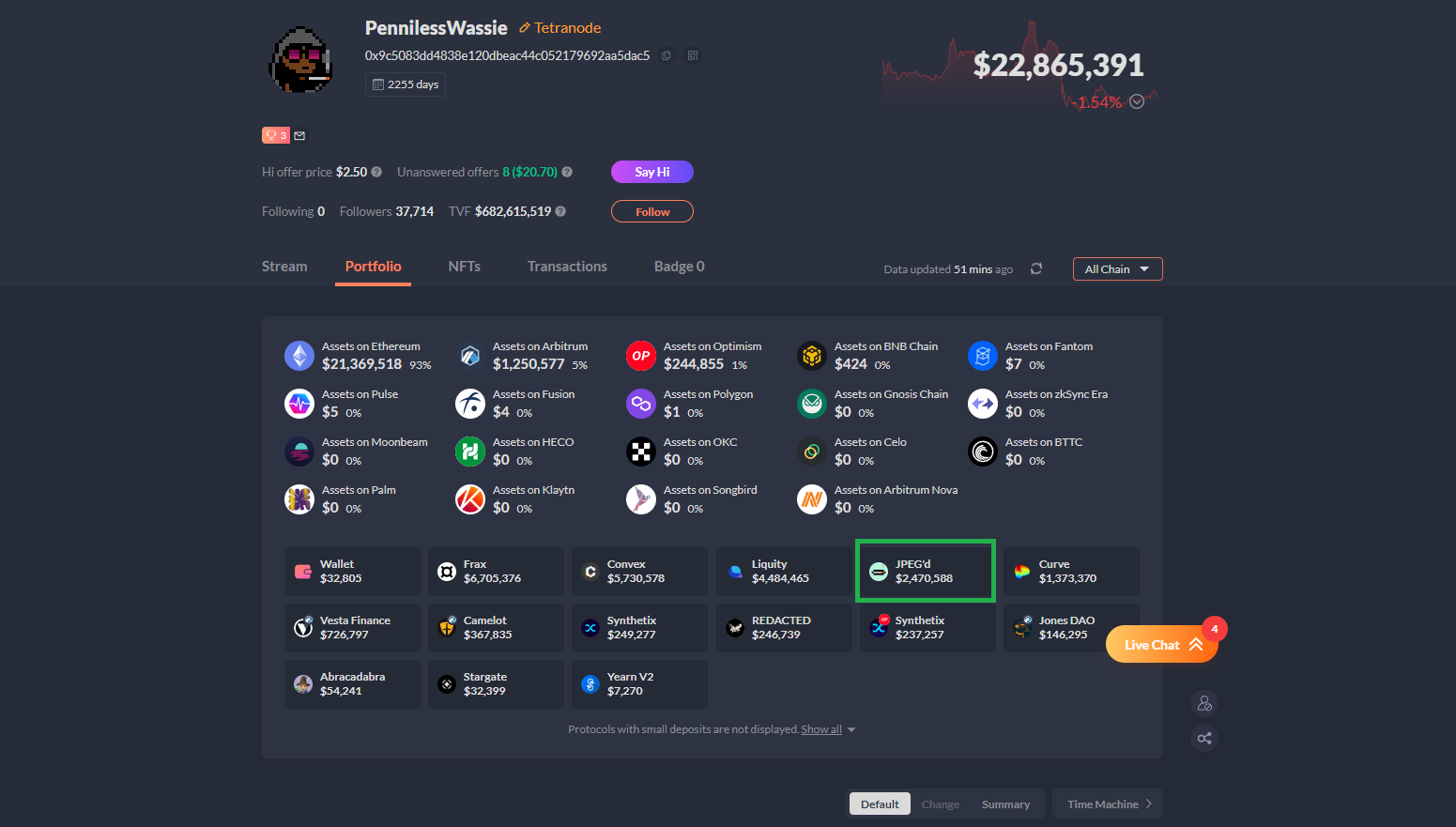

Currently, Tetranode not only provides communication support for the project, but Tetranode itself also has nearly $2.5M in JPEG’d protocol. Most of this money comes from Tetra mortgaging its NFT collections to borrow against pETH, and it doesn’t stop there:

- The pETH that Tetra borrowed, he used it to provide liquidity for pETH – ETH on Curve Finance so we see $1.3M being stored in Curve Finance. This action is not only to keep peg for pETH but also to create more liquidity for pETH.

- The NFT collections that Tetra mortgaged, he also locked up JPEGs for 66 years to increase LTV which contributed to reducing the supply of JPEGs on the market.

JPEG’s current Tokenomics model

JPEG’s current model also has many applications such as administrative voting, locking to increase LTV, and participating in auctions. With this model, the JPEG Token also has a lot of applications, but because the demand is not great and the project has not attracted the majority of users in the NFT market, the JPEG Token also has a low price.

The unique and new point of JPEG’d is that instead of only giving Mint Stablecoin, the project also gives Mint pETH.

In addition, JPEG has 30% remaining supply and more than $60 million raised from the Public sale round. With that large amount of assets, the project can open many programs to attract liquidity as well as users for the project. In addition, the project can also ensure liquidity for the assets they issue.

The problems of JPEG’d

- The NFT market, especially NFT Finance, is still young and not widely known and used, so the TVL of this segment is currently very low.

- Liquidity for PUSd is still very poor. Although the project only focuses on developing pETH and it is the preferred asset in the NFT market, the Lending market prefers Stablecoin, especially during the Uptrend season.

- Although all related products are integrated into the protocol, it is very convenient, but the interface is not very friendly.

- Fierce competition with other projects in the Lending segment such as BendDAO, ParaSpace and especially the very large project in the NFT Market Place market.

- The features and calculation formulas are not really minimalist to reach new customers.

Proposed PIP-65

PIP-65 is a proposal to use JPEG as a bribe reward for CVX or veCRV holders who vote for the JPEG/pETH Pool on Curve Finance. Voters will receive a reward of about 33%. This proposal is nothing special. Normally, we just want to thicken the liquidity pool to provide a good trading experience. But the root cause is preparation for the next big plans.

JPEG’s New Tokenomics Design

The new design in Tokenomics of JPEG that I want to mention in this article is that in the future JPEG’d will let users mortgage JPEG to borrow pETH or pUSD. This model is like mortgaging a volatile asset like an NFT to borrow an asset issued from the platform. But projects using JPEG as collateral will have higher risks because JPEG is a low-capitalization asset.

This model is not too special, but it brings a lot of applicability to the governance token. In particular, JPEG’d is the leading project in using governance tokens for the CDP model. This is also the beginning for many other projects to apply this model in the future.

Although in theory this model is very sustainable, if the liquidity pool of the pair of collateral and loan assets is not thick enough, when the market fluctuates strongly, many loan positions are liquidated, leading to Token prices. JPEG will plummet and bring the risk of losses to the liquidator. This is also the reason and root cause of the birth of the PIP-65 proposal.

This model brings applicability and demand to governance tokens like JPEG, but when the market is bad, many positions are liquidated, the selling pressure is also greater than usual.

Roadmap to Bringing JPEG to Light

This route was introduced by Tetranode in a recent Tweet on Twitter. Tetranode talked about the roadmap to increase the applicability of the JPEG Governance Token. The first is to update PIP-65 to increase liquidity for the JPEG/pETH Pool. JPEG will then be used as collateral to borrow other assets on Silo. Finally and most importantly, accept JPEG as collateral to borrow pETH on the JPEG’d protocol.

Summary

Although this new model increases the application and demand for JPEG Token, it also brings great selling pressure when the market is bad. Need to provide enough liquidity for the Liquidity Pool and maintain it. This model also increases risk for borrowers when the collateral is JPEG Token which is very volatile.

So I have introduced the Tokenomics model of JPEG and an overview of this model. Hope this article brings you a lot of useful information.