Centralized liquidity in AMM, also known as CLMM, was first introduced by Uniswap V3 and is currently the protocol with the leading trading volume in the Defi market. But besides Uniswap, a number of other projects also develop according to this model, especially Trader Joe.

So what’s the difference between Uniswap and Trader Joe’s centralized liquidity model? Let’s learn about these two models in detail in this article!

To understand more about centralized liquidity, you can read the following articles:

- What is Uniswap (UNI)? Uniswap Cryptocurrency Overview

- What is Uniswap V4? Will Uniswap Continue to Lead the AMM Field?

- What is Uniswap V3? Is Centralized Liquidity Changing the Crypto Market

- Uniswap V4: Creativity Is Unlimited

- What is Trader Joe’s (JOE)? Trader Joe’s Cryptocurrency Overview

- What is Maverick Protocol (MAV)? Overview of Cryptocurrency Maverick Protocol

- What is Orca (ORCA)? Orca Cryptocurrency Overview

- What is Centralized Liquidity (CLMM)? Outstanding Projects In The CLMM Array

- What is Cetus Protocol (CETUS)? Overview of Cetus Protocol Cryptocurrency

Overview of Centralized Liquidity

Concentrated Liquidity Market Making (CLMM) is a model that allows liquidity providers (LPs) to specify the price range in which their liquidity operates. This is a huge difference compared to the liquidity stretching from 0 to infinity of the original AMM model.

Liquidity only operating in one price range will help limit the risk of Impermanent Loss to the maximum level. With low Impermanent Loss risk, the protocol will attract more liquidity. Liquidity operating within a price range also makes fees more effective at that price range.

But this model also works well with less volatile asset pairs like BTC-USDT, ETH-USDC or Stablecoin pairs or parity asset pairs like ETH-stETH. Because when used for highly volatile assets, the price will continuously move out of the liquid price range, causing the price to continue to slide rapidly. At that time the liquidity provider cannot earn fees and the trader also suffers large price slippage.

Uniswap

Overview of Uniswap

We already know that Uniswap is the largest AMM Dex in the Defi market and has a daily transaction volume of up to billions of dollars. Uniswap is still working on V2 and V3 versions but this article only focuses on V3 because it deals with centralized liquidity.

Uniswap V3 was released in May 2021 and introduced a centralized liquidity model for the first time. This model focuses on solving the Impermanent Loss problem by providing liquidity, capital efficiency, helping to execute good transactions and increasing fees for LPs.

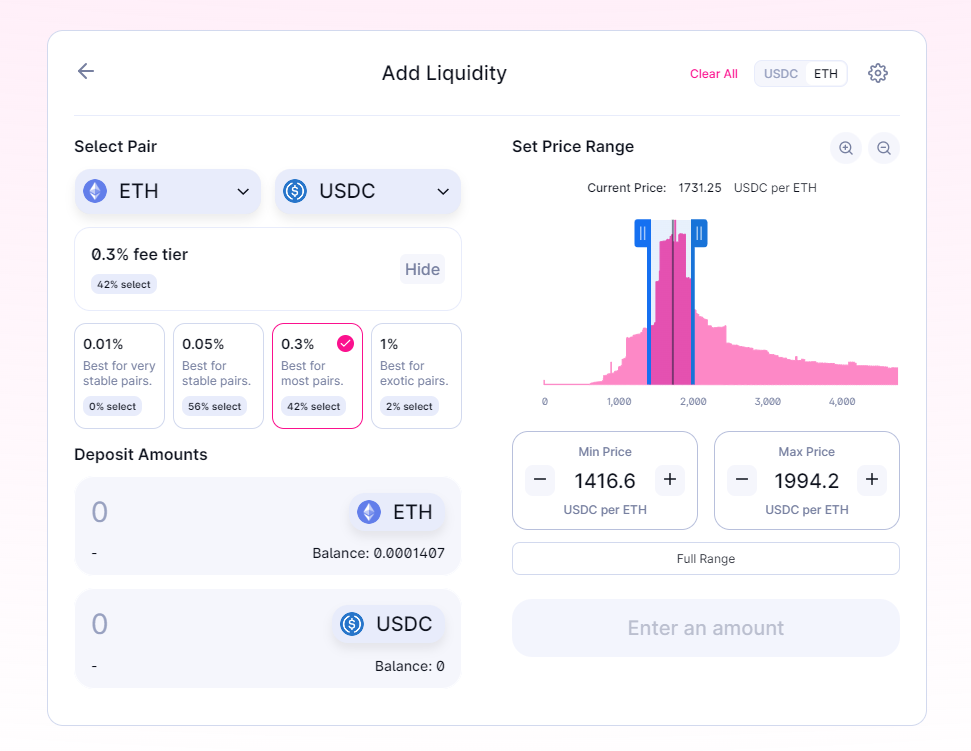

Uniswap V3’s centralized liquidity model is called Concentrated Liquidity. It is a mechanism that enhances liquidity by allowing users to place orders at many different prices within a preset range instead of placing a single order at a fixed price point like in the previous version. Previously by Uniswap. This helps reduce risks and transaction fees, while increasing the flexibility and efficiency of the trading process on Uniswap V3.

With Uniswap V3, the basic model is clearly stated in the “centralized liquidity overview” section. V3 version also accounts for the majority of TVL and volume on Uniswap. From the centralized liquidity model introduced by Uniswap V3, there have been many other projects that fork this model and many projects that build on Uniswap’s liquidity layer to take advantage of liquidity sources or solve some problems of centralized liquidity model.

In addition, Uniswap V3 also provides users with many other features and products such as freely choosing fee levels and being able to provide liquidity.

Advantages and disadvantages

Advantage

- The ability to customize price range and liquidity depth allows liquidity providers to increase profits and maximize trading efficiency.

- The new design helps optimize liquidity depth, reduce gas costs and increase user trading experience through reducing Token loss during trading.

- Improve transaction security by using a pool system that avoids the use of two-sided markets (AMM) and better monitors segment decentralization.

- Support for Concentrated Liquidity feature helps users maximize profits and enhance pricing capabilities for liquidity pools.

- Improved Swapping feature helps users pre-determine the range to be evaluated for opimising transactions from liquidity interest.

- Supports deposit funding for dApps developers and supports DAOs features.

Defect

- Requires LPs to have high technical knowledge: Uniswap V3 features Concentrated Liquidity, allowing LPs to concentrate a limited number of tokens into a certain price range, thereby increasing productivity and reducing gas costs. However, this feature also requires LPs to have high technical knowledge to understand how it works and provide effective liquidity.

- Leverage and trading fees could increase significantly: For highly leveraged trades, LPs will have to provide greater liquidity, which will lead to significantly increased trading fees. Additionally, LPs also incur gas costs for transactions with the Concentrated Liquidity feature.

- Limitations on transaction fee structure: Uniswap V3 has a rather complex transaction fee structure and can make it difficult for users to calculate and manage fees.

- Concentrated liquidity in one price area is also dangerous when prices fluctuate strongly, especially for assets with low capitalization.

Trader Joe’s

Overview of Trader Joe’s

Trader Joe is known as a leading AMM Dex in the Avalanche ecosystem. First, Joe is also a regular AMM, but with good strategies and products, Joe has surpassed Pangolin. After that, Trader Joe continued to launch products like veToken and Liquidity Book. But it was not noticed by the market until Joe expanded the market to the Arbitrum generation system and grew rapidly. Currently, Trader Joe’s is always in the Top 10 Dexes with the largest daily trading volume according to DefiLlama statistics.

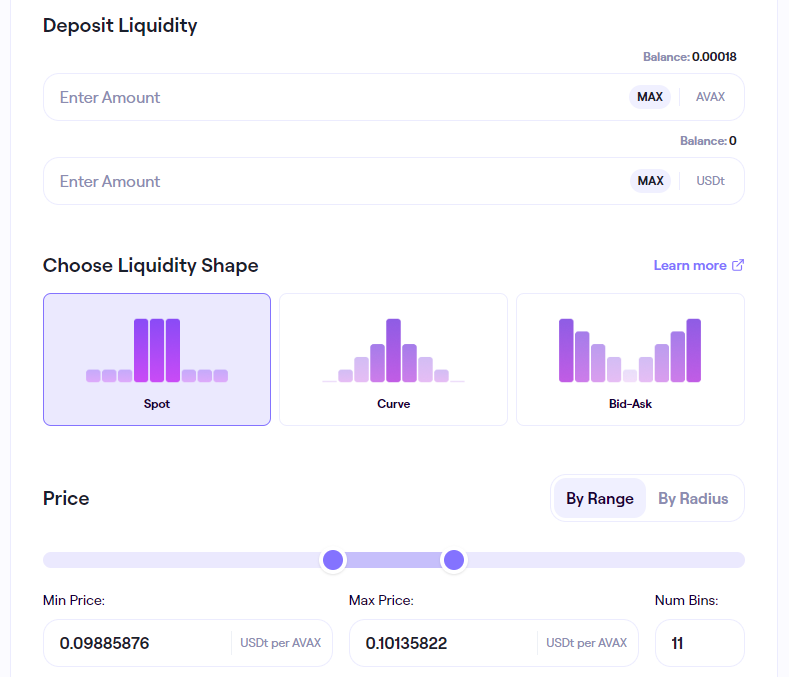

Liquidity Book was introduced by Trader Joe in version V2 and is the version mainly used on Trader Joe currently. Liquidity Book is also a form of centralized liquidity, but unlike Uniswap V3 where liquidity providers can customize the price range at will, Trader Joe will uniformly regulate a smallest liquidity area called “Bin”. . Liquidity providers can also choose an arbitrary number of Bins, meaning they can provide an average of 1 or 3 or any number of Bins.

Bin is the main difference in Trader Joe’s centralized liquidity model compared to Uniswap. Because Bin is unified, Trader Joe can easily aggregate liquidity in Bins that share the same price range. Traders can enjoy slippage-free trades thanks to the Liquidity Book model and the use of ‘Bin’.

The active bin contains both tokens in the trading pair and determines the current market value of the asset. And is the only bucket that earns transaction fees and transactions made in this bucket are free from slippage. The introduction of Bins upgraded the centralized liquidity of Uniswap V3, due to the accuracy of bins and higher liquidity centralization at more narrowly defined price points.

Transactions do not slip in price in Bin because the liquidity pool uses the formula x+y=k instead of the formula x*y=k like Uniswap V3. Slippage-free trading is useful for Stablecoin pairs and peer-to-peer assets. However, this model also causes a big problem: loss for liquidity providers and does not cause prices to move when trading.

To solve the above problem, Trader Joe’s has a trading fee regime that fluctuates based on Pool activity and price fluctuations. If the market fluctuates strongly, fees will increase to compensate for the risk of Impermanent Loss for LPs. If the market is stable and there are few traders, the fees will be low. And when all the liquidity from one Bin has been used, the price will move to the next Bin. This dynamic structure is a key feature of the Liquidity Book model.

Instead of liquidity being spread evenly across the price curve, it is deployed precisely to each Bin, allowing for larger transaction fees. It has the added benefit of being able to handle larger volumes with less liquidity when compared to conventional pools. The liquidity book can serve a large number of traders with the least amount of liquidity. More efficient than DEXs that rely on attracting a large, fixed amount of liquidity to provide an efficient price.

In addition, Trader Joe also offers Spot, Curve, Bid-Ask liquidity supply modes. Regimes have different levels of risk and availability.

Advantages and disadvantages

Advantage

- Transactions without price slippage.

- Liquidity efficiency, only a small amount of liquidity can still meet a large trading volume.

- Earn more fees.

- Bin is pre-determined so it is easier to aggregate liquidity.

- Effective for large-cap asset pairs, Stablecoin pairs, parity asset pairs.

Defect

- Impermanent Loss is very easy for liquidity providers.

- Prices sometimes do not reflect the true market price.

- Not effective for assets with high volatility.

Compare Uniswap V3 With Trader Joe V2

|

|

Uniswap V3 |

Trader Joe V2 |

|---|---|---|

|

AMM formula |

x*y=k |

x+y=k |

|

Model name |

Concentrated Liquidity |

Liquidity Book |

|

Provide liquidity |

Within an option price range between 2 limits is called a Tick |

With as many Bins as you like and modes to choose from |

|

Inflation |

High |

Short |

|

Impermanent Loss |

Short |

High |

|

Fee revenue |

Medium |

High |

|

Use liquidity effectively |

Medium |

High |

|

The most optimal asset |

Top coin pair |

Stablecoin pair |

|

Reflects price |

Good |

Least |

Personal Projection

Centralized liquidity is the most widely used model in the Crypto market. In particular, Uniswap is still the most trusted place by traders, and Trader Joe is also quite successful with its Liquidity Book model, always in the Top 10 Dex with the largest daily trading volume on the market.

The centralized liquidity model is quite good, brings many benefits, but it cannot exist alone. That’s why Uniswap V2 and V3 always develop together and complement each other. Although centralized liquidity solves the problem of Impermanent Loss and effectively uses liquidity, it is not suitable for the low-capitalization Altcoin market. And when the price fluctuates strongly beyond the concentrated liquidity zone, the price will slide very quickly, so it still needs the support of version V2.

As for Trader Joe, it cannot compete with Uniswap, especially the V4 Uniswap version will leave behind most AMM Dex on the market. But praise must also be given to Trader Joe’s for inventing the Liquidity Book model, it is a good idea and has a certain efficiency as well as a voice in the market. And this model may also need time to continue to improve and develop in the future.

Trader Joe’s has shown it to be very effective on Stablecoin or peer-to-peer asset pairs. This niche could also be the key to opening the door to the future for Trader Joe. In addition, Uniswap is expanding its share on many EVM Blockchains, so Joe’s wings are also narrowing. But instead of going head-to-head, Trader Joe needs to play to its strengths and maybe eat into the niche market or support Uniswap.

Summary

This can be seen as a battle in the centralized liquidity model, but from the beginning, Uniswap’s challenger, Trader Joe, predicted the outcome would be failure. But on the positive side, Joe shows that they are still a project with a different product, gaining users and ready to compete with Uniswap. Let Uniswap not feel secure while sitting on the throne.

However, Uniswap is still the big brother, still superior, still too big to defeat. Especially the recently introduced V4 version, there are too many problems solved. These problems may not be solved by other AMM Dex.