AMM is always an indispensable piece for every blockchain, however most AMMs today can only be used in a single blockchain. When you want to buy a certain token on another chain, the only way is usually Use Bridge. However, there are currently a few projects working on the AMM Cross chain segment, allowing users to swap across the chain in a single dApp. So today we will learn about a project with the above product, Chainflip.

To understand more about Chainflip, people can refer to a few articles below:

- What is Decentralized Exchange (DEX)? The Role of Decentralized Exchanges in DeFi

- What is cross-chain? When Blockchains Are “Traded”

- What is Uniswap V3? Is Centralized Liquidity Changing the Crypto Market

Chainflip Overview

What is chainflip?

Chainflip is a Cross-chain AMM, allowing users to trade tokens on any chain with each other, from non-EVM to EVM, from Layer 1 to Layer 2. Chainflip’s AMM is inspired by Uniswap V3 but There are many creative changes. According to Chainflip, it is a Just in time AMM, making transactions faster and less susceptible to price slippage.

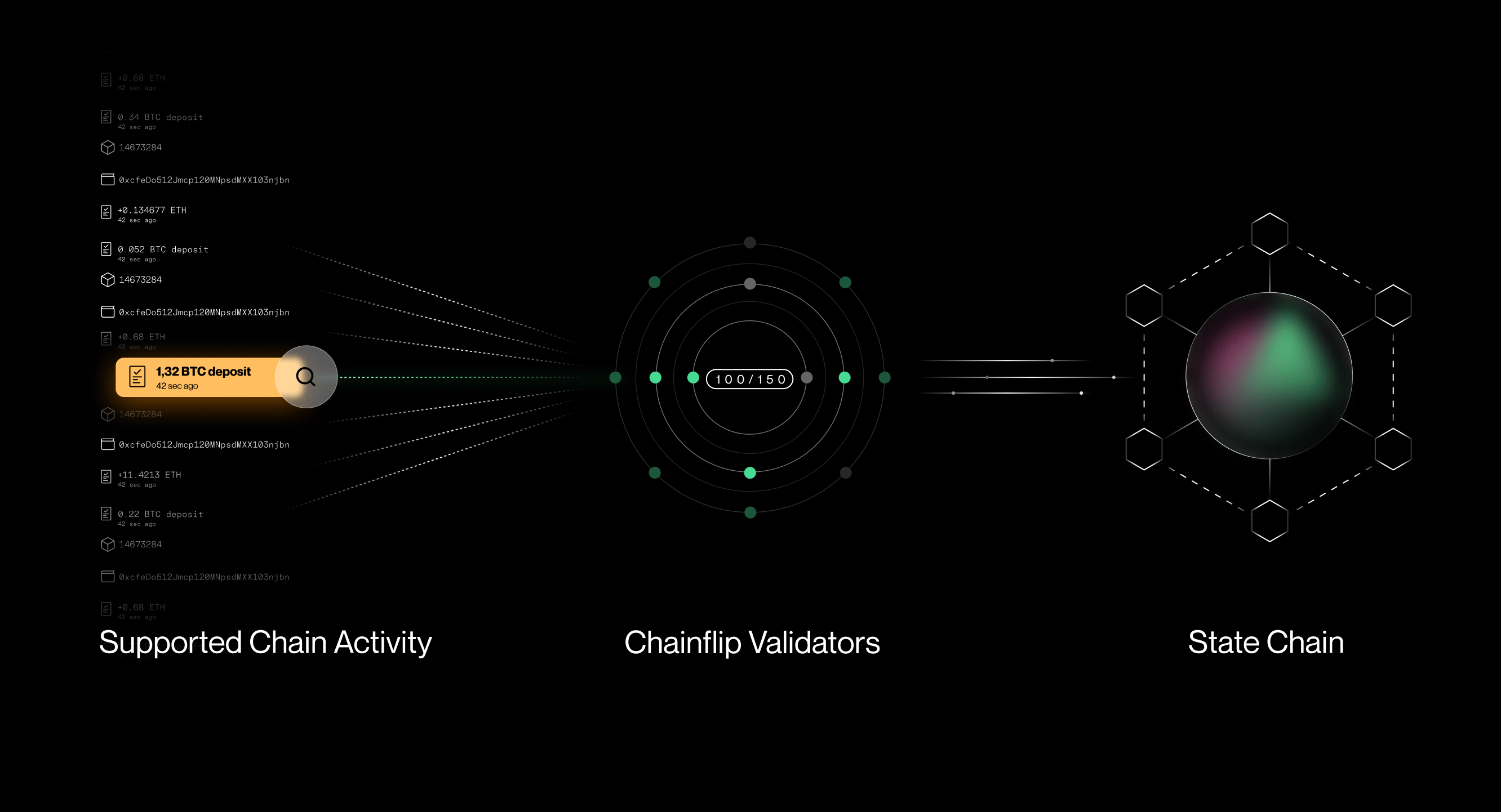

Project components

- Vault: Is where the project’s liquidity is stored and controlled by Validators.

- Statechain: Is an appchain of Chainflip. It is different from other platform blockchains in that it was built only to serve activities on Chainflip, not for other applications to build on it. Chainflip’s Statechain is built on the Substrate framework on Polkadot. Statechain contains the core database for all network operations. All statuses will be tracked, recorded and acted upon, for example: Validator Auctions, Voting, opening and closing status channels, transaction fees,…

- Validator: Is the authenticator for transactions taking place on the project. Statechain will have a maximum total of 150 Validators. For a transaction to be performed, it must have the consensus of at least 100/150 Validators. To become a Validator of the project, you must go through the auction process. Whoever wins will become the Validator.

- User: People who need to perform cross-chain transactions on different Blockchain platforms.

Mechanism of action

Actually, the project has a quite simple operating mechanism, but to implement it, the process is quite complicated, here I will introduce it in the most general way for everyone:

Chainflip is also quite similar to CEXs, when people deposit money into CEX, their assets will also be stored in a fixed Pool. Everyone’s account number is only nominal, as long as it is not withdrawn, the floor is still the custodian. Chainflip is the same, when you make transactions, they are only nominal and take place on the statechain, and your money is still kept in the Vaults.

The implementation process will be:

- You perform a token swap command.

- Your order will be sent to the statechain, where Validators will confirm whether you really have this amount and whether the transaction is valid.

- Once your transaction is confirmed, the funds will be deposited into the Vault.

- At this time, Validators continue to confirm what type of token you want to receive and how much. After there is consensus confirmation from 2/3 of Validators, you will receive your token. And Validator will receive a reward of Flip token.

Development Roadmap

- November 2022: Launch Testnet

- July 2023: Audit

- July 2023: Launch of the swap program

- August 2023: Token sale on Coinlist.

- Quarter 3/2023: Mainnet, main product launch

- Quarter 4/2023: Expand integration chains for the project

- Quarter 1/2024: Expand wallet integration into the project

Investor

- February 2021: The project raised $3.81M in capital at a valuation of $15M. This round was led by Blockchain Capital, Mechanism Capital, Apollo Capital, CMS Holdings, DACM, etc

- August 2021: The project continued to raise $5.8M at a valuation of $45M. Notable names leading this round include Framework, Coinbase Ventures, Hypesphere, Delphi, Morningstar Ventures, EdenBlock, MetaCartel, Lemniscap, Defi Alliance, etc.

- May 2022: The project raised an additional $10M at a valuation of $120M. Investment funds include: Pantera Capital, Framework Ventures and Blockchain Capital.

- August 2023: The project continues IDO on Coinlist calling for 8,235,000 USD with a valuation of $164.7M

Core Team

Core team

On the coreteam project website are rows of NFT characters, you can refer to the image above. In there:

- Simon Harman is the Founder and CEO of the project

- Martin Rieke is the project’s chief technology officer.

Tokenomics

Information about Chainflip tokens

- Token name: Chainflip Token

- Ticker: FLIP

- Total supply: 90,000,000

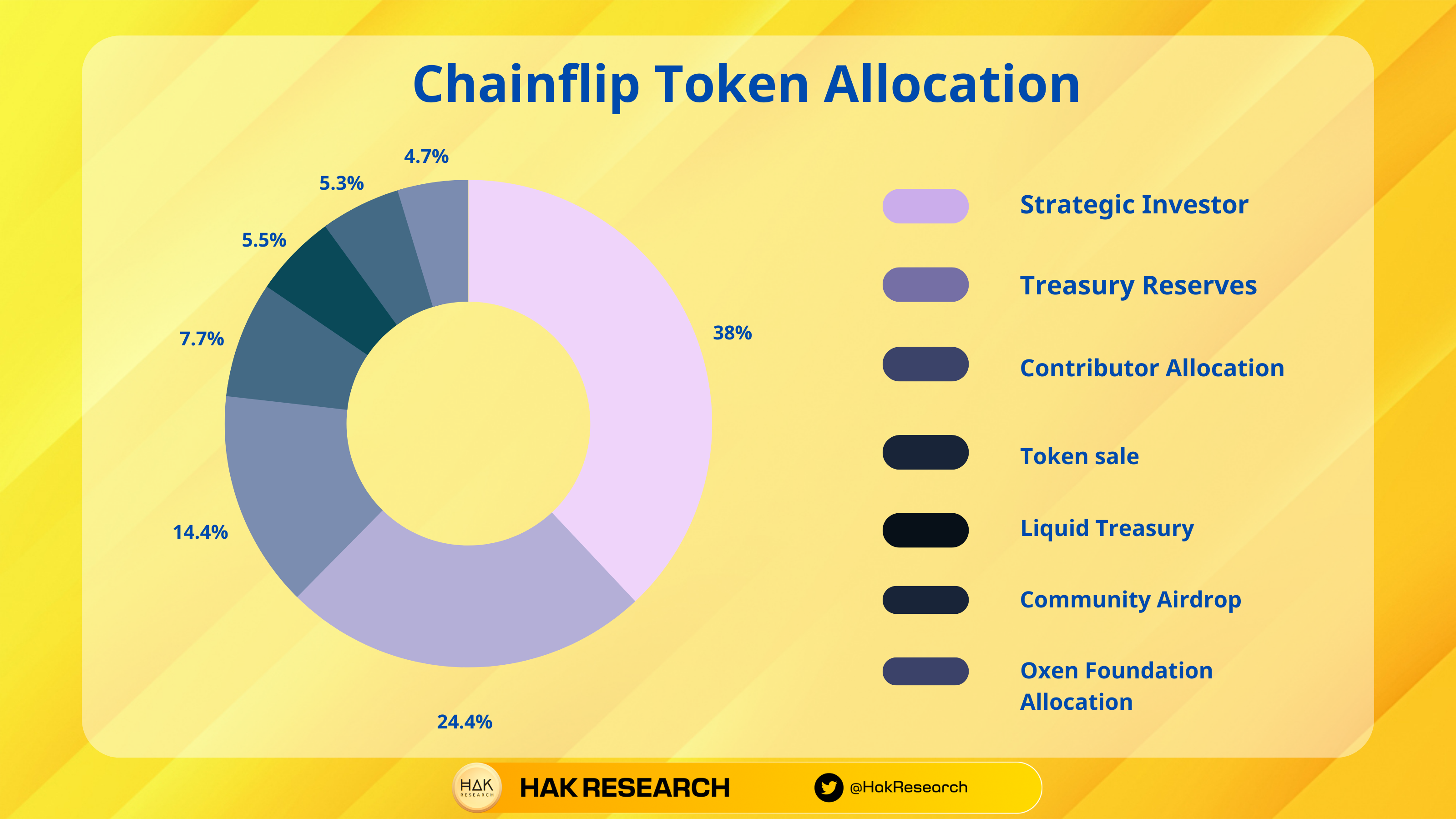

Token Allocation

- Strategic Investor: 34,200,000

- Treasury Reserves: 21,960,000

- Contributor Allocation: 12,960,000

- Token sale: 6,930,000

- Liquid Treasury: 4,950,000

- Community Airdrop: 4,770,000

- Oxen Foundation Allocation: 4,230,000

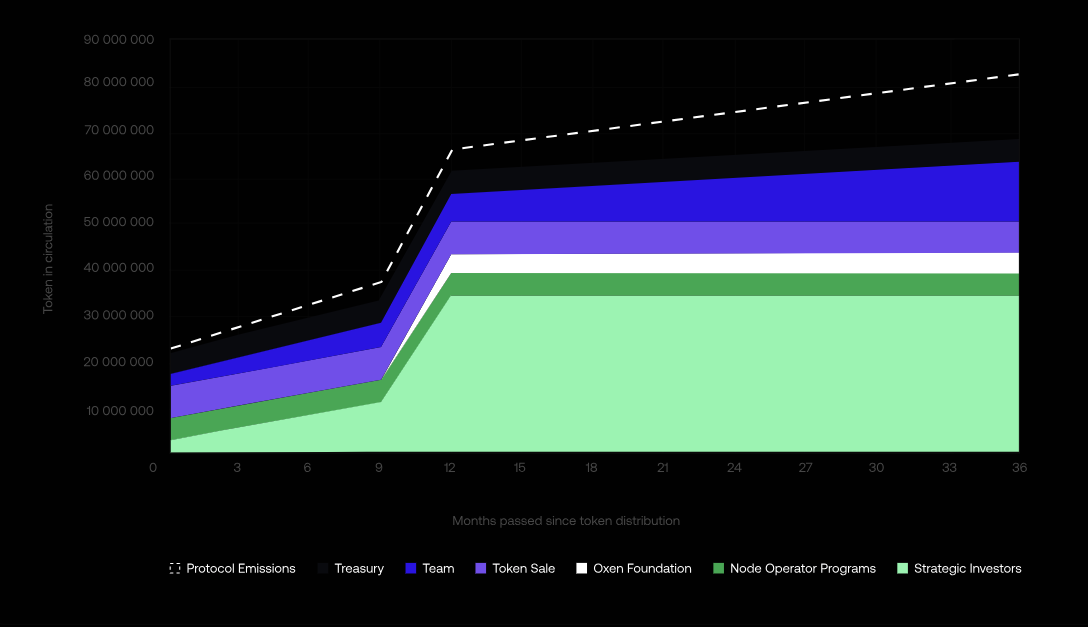

Token Release

- Strategic Investor: 34,200,000: 20% unlocked at TGE, 80% released linearly within 1 year.

- Treasury Reserves: 21,960,000: No information.

- Contributor Allocation: 12,960,000: 20% unlocked at TGE, 80% released linearly within 1 year.

- Token sale: 6,930,000: 100% unlocked at TGE.

- Liquid Treasury: 4,950,000: 100% unlocked at TGE.

- Community Airdrop: 4,770,000: 100% unlocked at TGE.

- Oxen Foundation Allocation: 4,230,000 : Linear release within 1 year.

Exchanges

Update…

Chainflip Project Information Channel

- Website: https://chainflip.io/

- Twitter: https://twitter.com/chainflip

- Discord: https://discord.gg/chainflip-community

- Telegram:

Summary

Chainflip is a good, innovative project and is invested in by many famous investment funds. However, concentrating liquidity in a fixed Vault will accidentally become the target of many hackers. If you are interested in the project, please follow me to update the latest information