What is Curvance? Curvance is a Lending & Borrowing platform with collateral as yield-bearing assets (Yield-bearing Assets). After launching for a while, Curvance received a lot of attention from many investors in the Crypto market,

So Curvance has something that attracts people so much, let’s find out in the article below.

Curvance Overview

What is Curvance?

Curvance is a Crosschain platform Lending Market (Cross-Chain Lending Market) for Yield-bearing Tokens and Crypto Assets (ERC 20 Tokens) on various platforms such as Ethereum, Polygon zkEVM, Base, Arbitrum and Optimism.

Curvance will have some of the following characteristics:

- Build Isolated Pools. Each different asset with different risk level will be located in independent pools. This leads to the fact that a problematic asset does not affect the entire protocol like today’s popular P2Pool Lending model.

- Curvance focuses on profitable assets instead of regular Crypto Assets. However, Curvance will still support Crypto Assets such as BTC, ETH,…

- Curvance builds a Modular Framework that makes it easy for other platforms to build and take liquidity from the platform. This will create a Curvance ecosystem in the future.

- With the implementation of ERC 4626, Curvance allows loans to be automatically pooled and collateralized thereby optimizing profits for users.

- Curvance uses the Dual Oracle model to enhance protocol security. With this factor when both Oracles offer different prices, asset borrowing can be paused when both offer the same price.

Curvance’s loan marketplace

The lending market will consist of borrowers, lenders, and Oracle operating in the middle. For lenders they can deposit Stablecoins or ERC 20 tokens to earn more profits. After depositing funds into the protocol, lenders will receive dTokens representing their protocol assets. Earned interest will be automatically included in the user’s position.

The interest rate on Curvance will depend on loan demand and the yield of the underlying asset. In case the deposited asset is LP Token or LSD Token, Curvance’s interest rate model will also be similar to popular models such as Fraxlend, Rari or Kashi.

Next, for borrowers, they will deposit collateral assets into the platform, and the platform will proactively generate maximum profit from the type of assets users put in. For example, when a user puts GLP into the platform, the platform will automatically transfer GLP to GMX and stake it to earn more profits. Users can then flip the switch to put GLP as collateral and borrow Stablecoins from it. In addition, the borrower will also receive cToken representing the loan and interest paid.

Note that with Curvance, borrowers can only borrow Stablecoins, not other types of assets.

Applying Wormhole’s Crosschain technology

Wormhole’s Crosschain technology has given Curvance a complete DAO model. At present, most DAOs only allow Token holders to vote and express their governance rights on a single respective chain. With Wormhole, users who hold veCVE can vote on any group on any Blockchain that Wormhole supports. This means:

- Users can block CVEs on any thread and vote for any thread.

- Protocol fees collected from all chains will be shared with veCVE across all chains.

- Liquidity can be encouraged on different chains.

It can be said that CVE is an Omnichain Token.

Development Roadmap

Update…

Core Team

Curvance’s development team is anonymous.

Investor

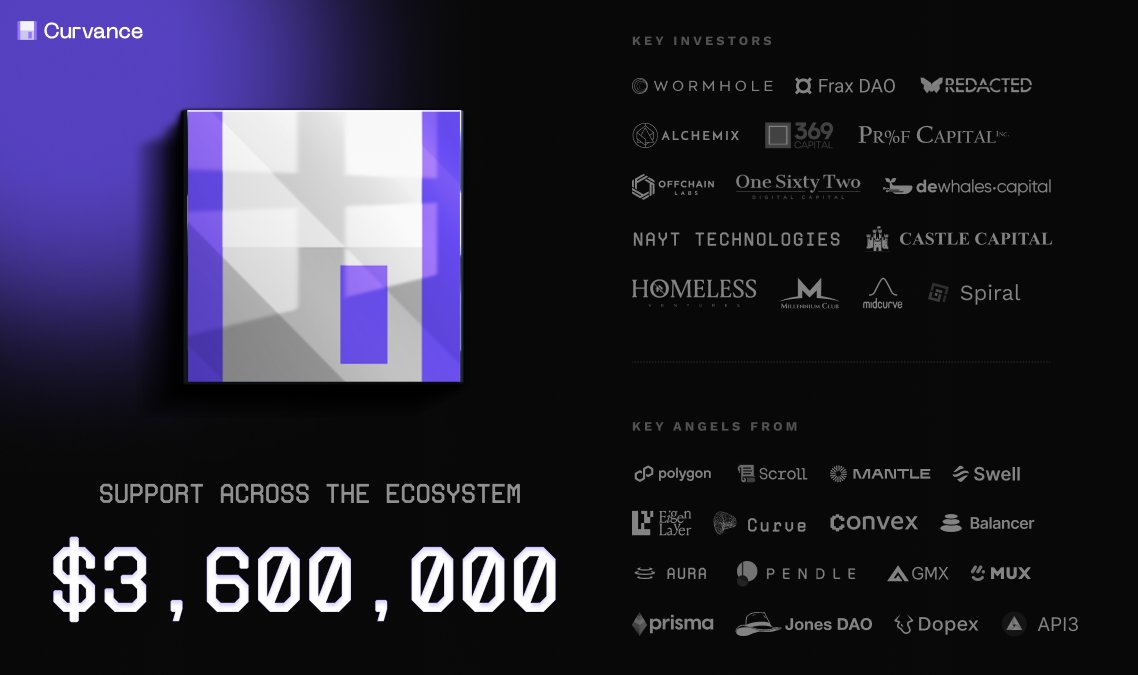

- December 5, 2023: Curvance successfully raised $3.6M for the first time in the Seed round with the participation of Offchain Labs, Frax DAO, Redacted Cartel, Castle Capital,… and many Angel Investors from projects such as Pendle Finance, Jones DAO, Curve Finance,…

Tokenomics

Information about Curvance tokens

Update…

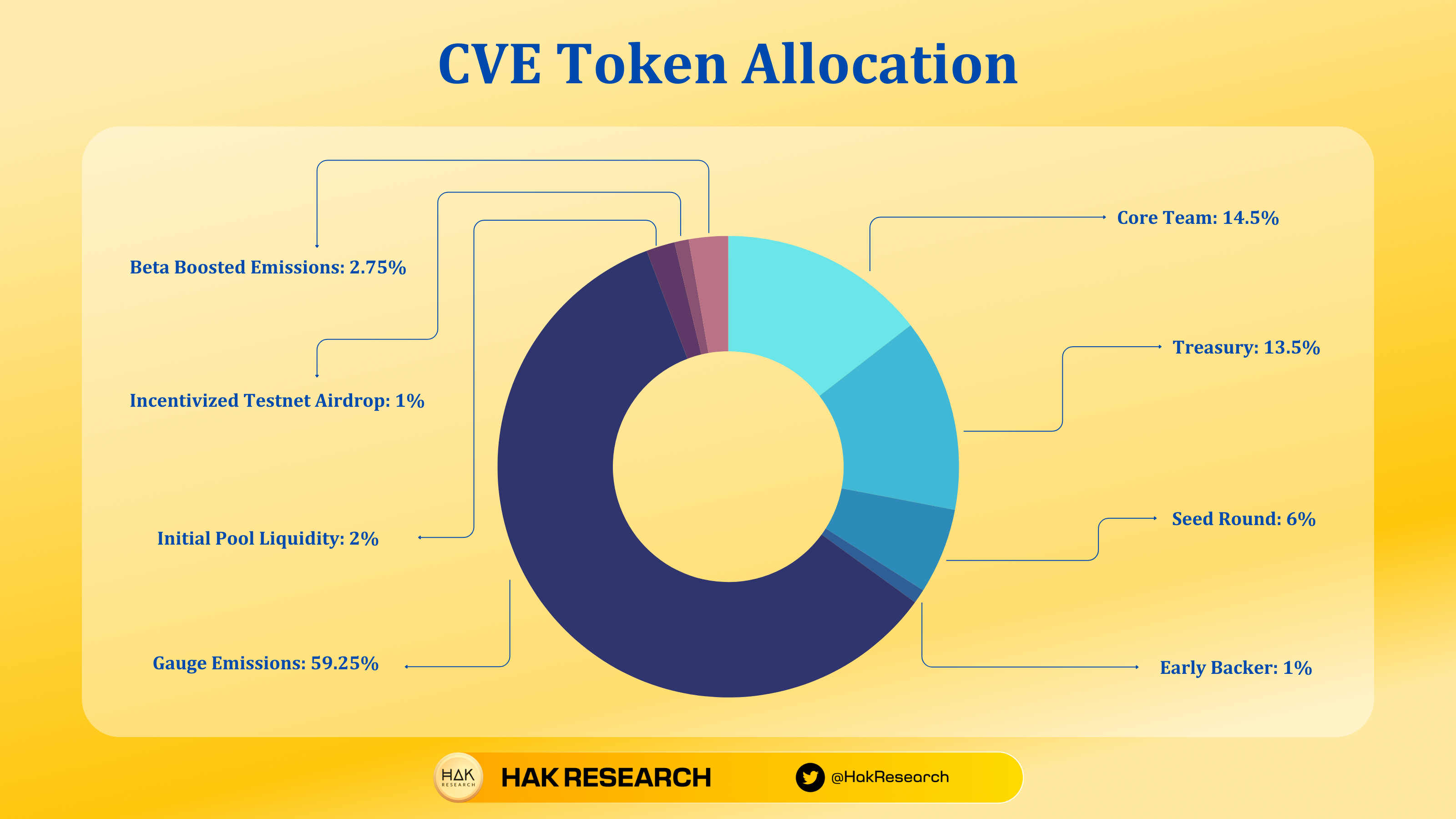

Token Allocation

- Treasury: 14.5%

- Core Team: 13.5%

- Seed Round: 6%

- Early Backer Raise: 1%

- Gauge Emissions: 59.25%

- Initial Pool Liquidity: 2%

- Early Backer/Incentivized Testnet Airdrop: 1%

- Beta Boosted Emissions: 2.75%

Token Release

- The team will be opened gradually every month and within 4 years. 25% will be locked so you can participate in voting right from the beginning.

- Seed Round will be paid in installments within 1 year and can participate in voting right at the time of TGE.

- Early Backers will be paid in installments within 1 year and can vote right at the time of TGE.

Note that 1% for Early Backers sold at a price of $0.0793 and for Seed Round investors sold at a price of $0.135.

Token Use Case

Users can block CVE on any Blockchain that Wormhole supports to receive veCVE. veCVE will participate in protocol governance such as:

- Use protocol treasury.

- Platform fees,

- Liquidity Mining Program.

- Protocol security.

Exchanges

Update…

Project Information Channel

- Website: https://curvance.com/

- Twitter: https://twitter.com/Curvance

- Telegram: https://t.me/curvance

- Discord:

Summary

Curvance is a breath of fresh air for the DeFi market built on many different Blockchains. Hopefully through this article everyone can understand more about what Curvance is?