Magpie – Yield Farming project emerged from Wombat Wars. However, Magpie does not stop there and is gradually expanding with the launch of Penpie – a product built specifically by Magpie to participate in Pendle Wars. So what is interesting about Magpie & Penpie? Let’s find out in this article.

To better understand this article, people can read some of the articles below:

- What is Wombat Exchange (WOM)? Wombat Exchange Cryptocurrency Overview

- What is Quoll Finance (QUO)? Overview of Cryptocurrencies Quoll Finance

- What is Magpie XYZ (MGP)? Magpie XYZ Cryptocurrency Overview

- Wombat Exchange Ecosystem and WOM Wars

Magpie & Penpie Overview

Overview of Magpie

Magpie is a Yield Farming platform created to optimize profits for liquidity providers through veToken wars in combination with AMM according to the veToken model. Magpie has joined forces with Quoll Finance and Wombex to create an outstanding Wombat Wars on the BNB Chain ecosystem in 2022. Magpie helps Wombat Exchange WOM token holders maximize profits without having to lock WOM long term on Wombat Exchange.

In addition, owning a large amount of veWOM gives Magpie increased voting power to allocate emissions from Wombat Exchange into Magpie’s own asset pools, thereby directly bringing greater profits to liquidity providers. on this platform.

Achievements in Wombat Wars

Up to now, in Wombat Wars, there are 3 participating protocols including Quoll Finance, Wombex and Magpie. Up to now, Wombex is temporarily leading with 35.9% of veWOM, followed closely by the Magpie platform holding 26.41% and finally Quoll Finance holding 11.75%.

The race has changed a lot when Wombat Exchange launched on Arbitrum. Specifically, Magpie and Quoll Finance have increased the amount of TVL significantly by sacrificing project tokens to bootstrap liquidity.

With the positive changes of Wombat Exchange recently, Wombat Wars is expected to continue to heat up until Wombat becomes a Stable Swap platform of a certain ecosystem. Unlike Curve War when the throne was called Convex, with Wombat Wars the ranking of projects is still only “temporary” because:

- WOM – Wombat Exchange’s Native Token still has 95% of its total supply unlocked.

- 30% of the current circulating WOM is not yet included in Yield Farming protocols like Magpie.

The future of Wombat Exchange in particular and the Wombat ecosystem is still extremely open ahead. However, projects in the Wombat Exchange ecosystem will be considered silly if they go all in on Wombat Wars, so projects need to participate in many other Wars to get more users, revenue, etc. .. And that’s why Magpie came to Pendle Finance.

Overview of Penpie

Pendle Finance is a DeFi Yield – Trading Protocol that enables users to build trading strategies to generate profits from the future yield of the underlying assets they are holding. Pendle is one of the prominent projects earlier this year with asset pools attached to LSTs and LSTs-ETH LP with extremely strong TVL growth.

If we have Magpie participating in the veWOM war at Wombat Exchange, Pendle Finance with the veToken model is also promising to open a new war. Realizing this, Penpie pioneered and became one of the first projects to participate in Pendle Wars.

In fact, at the present time, the big Wars have almost had results or are relatively too much for a new platform like Penpie, but choosing Pendle Finance as a new and potential project will be a big deal. Smart choice for Penpie at the present time.

To understand the potential of Pendle Finance, people can refer to some of the articles below:

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- What Are Yield Derivatives? Will Yield Derivatives Become the Next Trend of Yield Farming

Penpie’s mechanism of action

Before going into Penpie’s operating mechanism, we need to first learn about Pendle Finance’s veToken model. Pendle’s veToken model has some of the following characteristics:

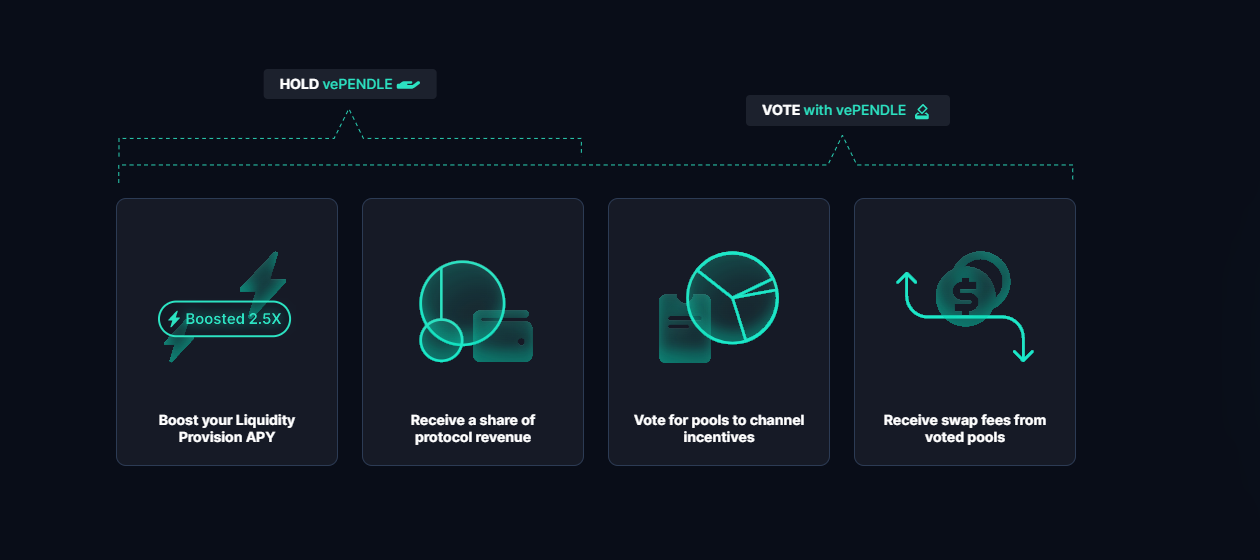

- vePENDLE will be locked for a maximum of 2 years, the value of vePENDLE will gradually decrease over 2 years.

- Hold vePENDLE to boost yield from LP and share revenue with the protocol.

- By participating in voting, you receive additional incentives & transaction fees from the pools you vote for.

Pendle Finance’s veToken model has many similarities with Wombat Exchange in that vePENDLE holders will have the most profits and benefits. Penpie’s operating mechanism is quite simple as follows:

- Step 1: Users deposit PENDLE into Penpie, then Penpie will permanently lock this amount of PENDLE on the Pendle Finance platform to optimize voting rights. In other words, Penpie helps LPs increase yield without having to lock PENDLE.

- Step 2: Penpie will share Pendle Finance protocol revenue from holding vePENDLE to those who deposited PENDLE into the protocol.

- Step 3: In parallel with step 2, Penpie will also return to the user mPENDLE representing the amount of PENDLE the user sent to Penpie. mPENDLE will be used on protocols that Penpie has previously worked on.

To be able to win Pendle Wars early and maintain that advantage, Penpie needs to harmonize the following factors:

- Build many use cases for mPENDLE.

- Build a large liquidity pool for mPENDLE (leveraging the power of veWOM to bootstrap liquidity on Wombat Exchange).

- Abundant Incentive to attract TVL.

While building use cases for mPENDLE and building a thick liquidity pool for mPENDLE takes a lot of time and resources. The most important thing for a protocol in the early stages of development is to have an abundant amount of incentives. That is the reason Penpie will launch its token in the near future.

Launching liquid PNP & Bootstrap tokens

Launch of PNP token

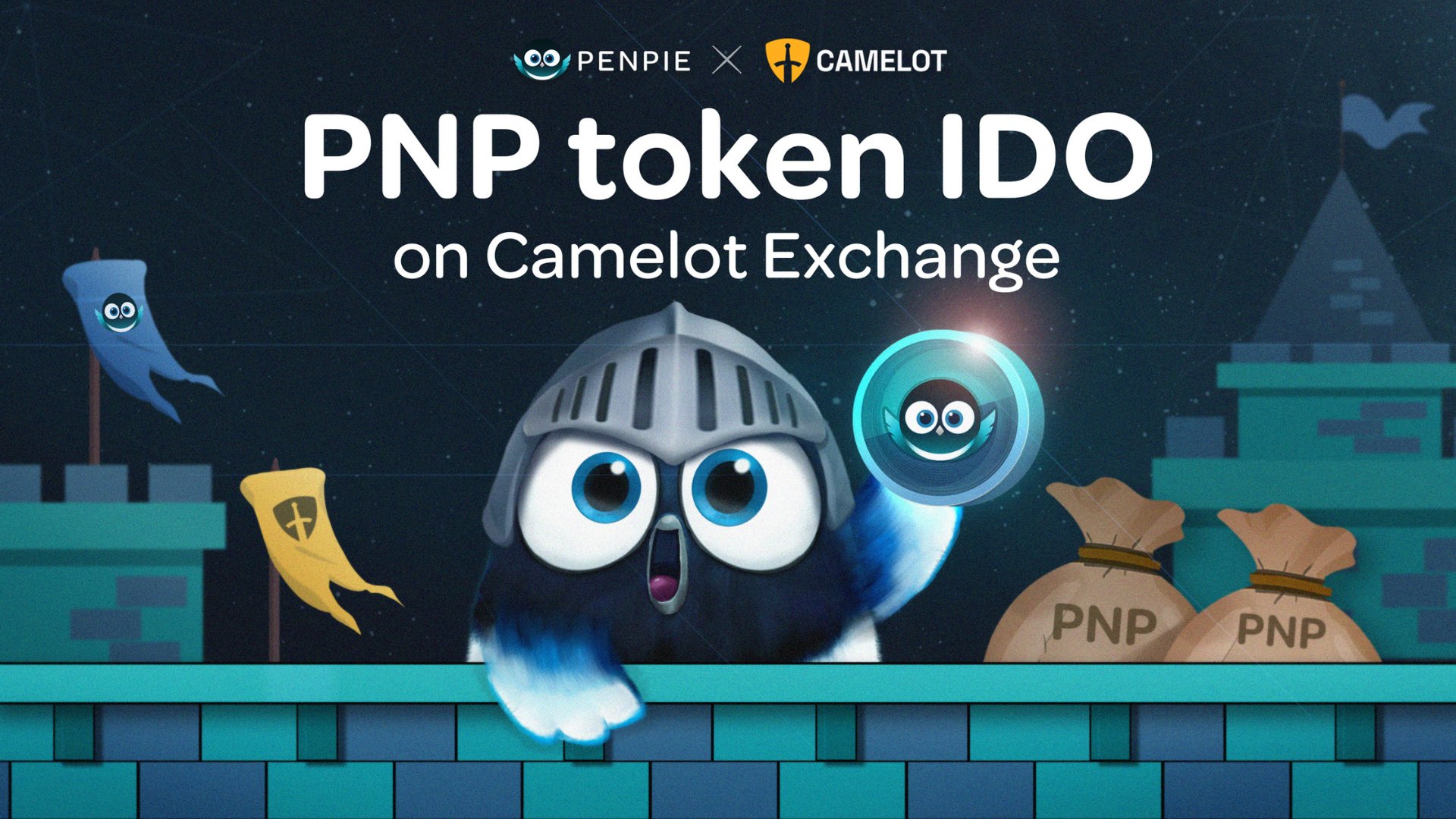

Incentive tokens play an important role in deciding the winner of any veWar. Magpie understands this well and has experience in the Wombat war, so Penpie is currently rushing to launch Token. Taking a look at Penpie’s upcoming IDO held on CamelotDEX, we have a few notable points as follows:

- Penpie community projects and say no to VCs

- Team will not receive any PNP tokens

- The amount of IDO tokens will be sold to the community at the specific rate as below.

Token Allocation:

- Penpie Liquidity Providers: 10%

- xGrail Holder: 35%

- vlMGP: 25%

- mPENDLE: 30%

Penpie has built an interesting IDO selling strategy when:

- Ensure clear benefits when spending up to 65% of $PNP for preferential sales to the community of people who have participated in supporting Penpie.

- Penpie was very smart when Deduct 30% of Penpie’s total supply to bootstrap liquidity to the protocol from the beginning without waiting for the token to be officially deployed.

Besides, the Public Sales of the project, the development team also presented quite well Be clear about the use of capital raised as providing liquidity for PNP-ETH with 40%, 30% is used for future protocol development, 20% is paid for marketing costs and 10% is used for product audits.

$PNP – Penpie’s Native Token will be sold in Public Sales at a valuation of $3M and 600K capitalization at the time of TGE. Compare the FDV ratio between Convex:Curve = 1:6 => If this ratio is applied, FDV Penpie ~ $15M. However, this is only a relative calculation because the models, roles and positions of Curve and Pendle are not exactly the same.

Pendle Rush Program

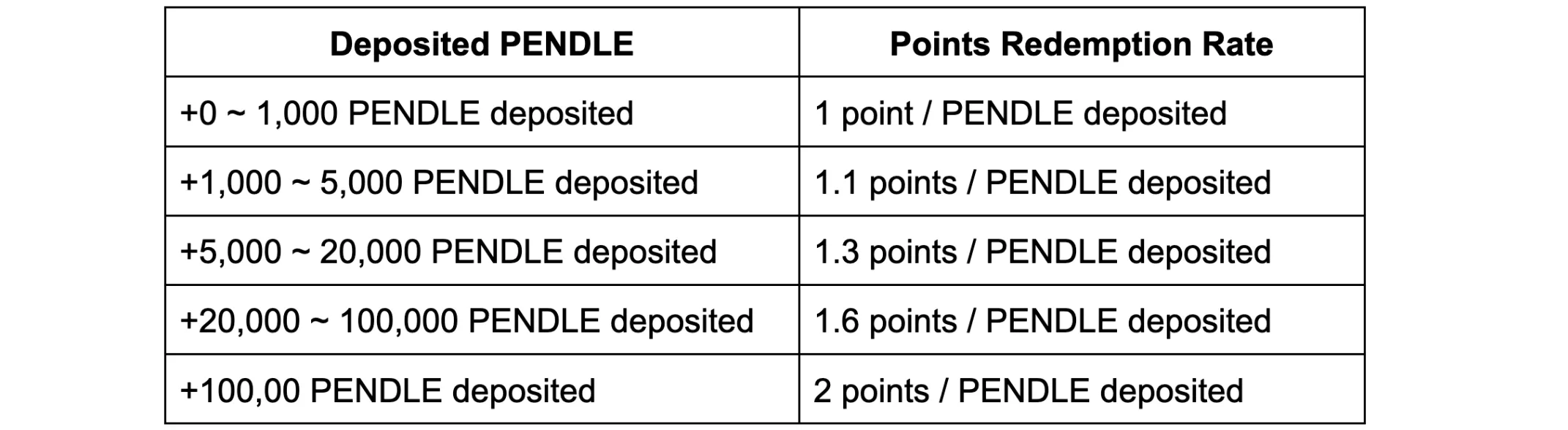

Penpie also launched the PENDLE Rush program – using rewards to encourage $PENDLE holders to deposit tokens into the Penpie platform. In other words, this program creates an opportunity for $PENDLE holders to own $PNP early.

PENDLE Rush lasts for 15 days, participants receive Points that are calculated progressively depending on the amount of $PENDLE loaded into Penpie. When the program ends, users will be divided an amount of $PNP tokens in the reward pool of 200,000 PNP with the corresponding ratio = Points owned / Total event Points. In addition, when the program ends, participants will receive back the amount of mPENDLE at a 1:1 ratio with the amount of PENDLE they participated in.

Note: 30% of the $PNP amount is paid at TGE, 70% will be paid in installments over 1 year.

With the use of PNP to bootstrap liquidity for the protocol, there have been many positive signs when currently 2.93M PENDLE is deposited into the Penpie protocol and this program has 1 week left before ending.

Summary

Today’s DeFi protocols have many ways to increase their customer base, in addition to building a model with a variety of different revenue sources. Magpie is also a similar project, but the projects that Magpie bets on have potential but also have many great risks.