PancakeSwap recently, when the entire crypto market showed signs of recovery and growth again, the price of CAKE decreased rapidly. So what is the reason why the leading AMM on BNB Chain and Aptos has such a decline? Let’s find out together in this article.

To better understand this article, people can refer to some articles such as:

- What is Pancakeswap (CAKE)? Pancakeswap Cryptocurrency Overview

- Series 5: Real Builder in Winter | PancakeSwap – Changpeng Zhao’s Good Son

Everything Comes From Tokenomics V2.5

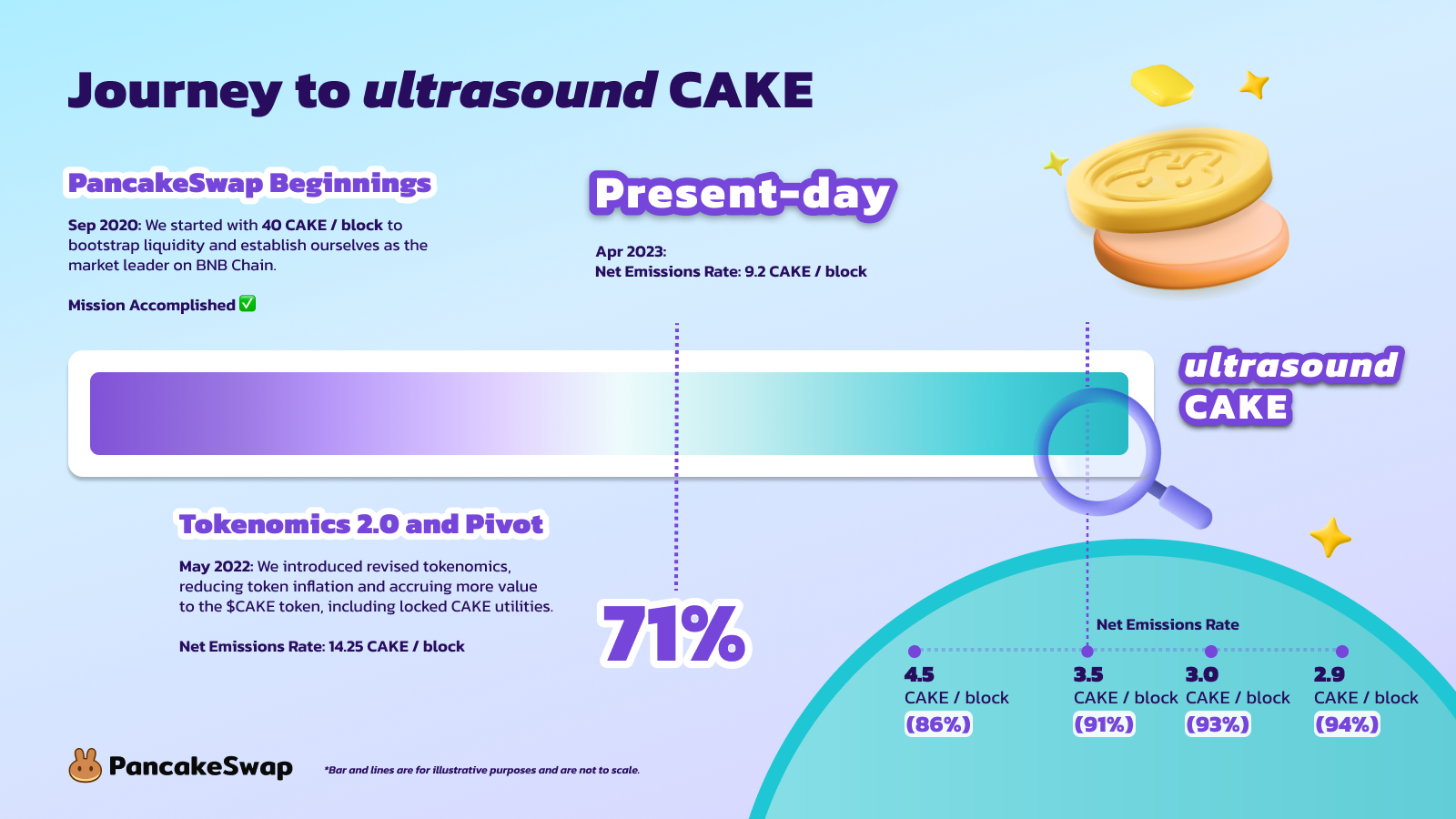

Desire to reduce inflation rate from Core Team

The project development team’s ultimate wish is for CAKE – PancakeSwap’s native token, to move from an inflation rate of more than 20% to only 3 – 5%, and even in the long term, CAKE will also switch to deflation mode. . Besides, the development team also wants to switch to Real Yield (profit sharing) mode instead of staking CAKE to receive inflationary CAKE tokens and prioritize long-term stakers.

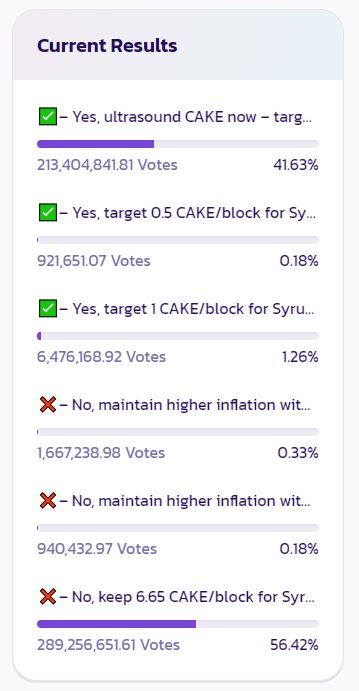

The accompanying condition for this proposal is that there must be more than 50% agreement before the proposal can be implemented by the development team.

Proposal overview Discussion Proposal for CAKE Tokenomics v2.5

Background section

In the area before entering the main idea of the proposal, Pancake also shared some of the achievements that the development team has completed with DAO in 2022 including:

- Approved the maximum total supply proposal for CAKE of 750M.

- Voting to approve the proposal to upgrade Pancake V3 with centralized liquidity to compete with Uniswap.

- Pancake also launched many new products to increase the amount of CAKE burned and gradually reduce incentives from Syrup Pools.

- Continue to provide CAKE Stakers with the highest reward.

Besides, the development team believes that it is time to turn a new page for CAKE’s tokenomics towards a low inflation rate or even deflationary model. The team also emphasized that this is a discussion proposal and is ready to receive comments from the community.

Real Yield Model

Some of the main proposed changes to reduce the expected inflation rate are as follows:

- Reduced staking reward rate from 6.65 CAKE/block to 0.35 – 1 CAKE/block.

- Revenue sharing: CAKE stakers will receive 5% from Pancake V3 revenue. The longer you participate in staking, the greater the revenue you receive.

- Higher emissions for long-term CAKE stakers.

- Increase use cases for long-term CAKE stakers.

Emissions Scenario Analysis

The changes are not only for long-term staking holders and participants, but also for liquidity providers, reducing the reward rate from 6.65 CAKE/block to just from 0.35 – 1 CAKE/block.

Besides, PancakeSwap is committed to launching many new products so that CAKE can be burned more in the near future.

The results of the vote & the Pancake community are divided

As a result, the proposal was strongly opposed mainly by liquidity providers whose rewards were reduced too much. The fate of the CAKE token before the proposal was proposed was expected to increase when the proposal was approved, but it was not approved as planned, causing the CAKE price to also plummet.

In my opinion, the approach of the PancakeSwap team is a bit extreme when it comes to shockingly reducing rewards for staking participants and providing liquidity while what they promise is to share the revenue of Pancake V3 but this product also not released yet. According to me:

- Launching the V3 product allows users to understand how well Pancake V3 does and how it generates revenue.

- Reducing rewards from the staking program and Syrup Pool has a roadmap such as reducing 10% after each month.

Making an overly ambitious proposal caused the Pancake team to watch the price of their favorite product plummet when the whole market was extremely excited.

However, as the team has shared, this is just a discussion proposal and I believe that CAKE’s inflation will eventually decrease, but the time to achieve that goal is not 1 week but there must be a roadmap to Let stakers and LPs get used to it.