The crypto market is a fertile land and many people participate in this market because of the desire to change their position, but not everyone always wins because they apply the wrong strategy, DCA is considered one of the The most effective long-term strategy. So what is DCA? How to use the DCA strategy effectively?

What is DCA?

DCA stands for “Dollar Cost Averaging”, which can be understood as the method of averaging the value of each batch or even purchase. This is a popular investment strategy in which, instead of making a single investment at the moment, you divide the amount you want to invest into parts and then buy the same investment over time. certain time.

For example: If you want to invest 100 million VND in a certain investment and apply the DCA method, you will divide this amount into 10 parts and invest 10 million VND each month. Thereby, the average price of your investment will decrease, while minimizing the risk of investing all the money at the same time at a bad time.

The DCA method is often used for long-term investments such as Bitcoin, Ethereum, large coins instead of small projects or lowcap coins to minimize the risk of asset loss.

DCA Price Calculation Formula

We will take as an example the formula for calculating the average price of periodic Bitcoin purchases, which is similar to the formula for calculating the average price of other token purchases, specifically as follows:

- DCA price of BTC = Total value purchased / Total amount of Bitcoin purchased

Example: If you bought 0.1 BTC at $10,000/BTC in January, then bought an additional 0.05 BTC at $12,000/BTC in February, your average recurring BTC purchase price would be To be:

DCA price of BTC = (0.1 BTC x 10,000 USD/BTC + 0.05 BTC x 12,000 USD/BTC) / (0.1 BTC + 0.05 BTC) = 10,666.67 USD/BTC per Bitcoin.

Popular DCA Strategies

Periodic DCA

Periodic DCA is simply buying a certain coin or token at a certain period and in a certain amount over a long period of time because you believe that the asset will increase in price. To make it easier to understand, we will plan to buy DCA for a capital of $10,000 as follows:

- Dividing $10,000 into 50 different purchases equals $500 per purchase.

- The cycle will be every 2 weeks.

So every 2 weeks we will buy the previously selected asset and continuously repeat this process for 10 months.

The advantage of the periodic DCA strategy is that you do not need to spend too much time observing the price of the selected coin or token. However, the biggest disadvantage of this method is that capital is locked up for a long time and is not suitable for people who are full-time in the market.

DCA price reduced

This can be understood as a method of buying more coins and tokens every time the price drops to greatly increase the amount you hold. We will continue with an example with $10000 as follows:

- The initial price of token A is $10, we use $5000 to buy 500 tokens.

- However, after it drops to $5, we use the remaining $5,000 to buy another 1,000 tokens.

So, with $10,000, we can buy 1,500 tokens if we use the DCA reduction strategy instead of only buying 1,000 tokens without using the DCA strategy, and when the token price increases back to $10, we also have a profit of $5,000. .

However, the disadvantage of this method is that it is difficult to apply on all lowcap coins and tokens because the risk is very large.

DCA price increased

The rising price DCA method is a method of buying after the price has increased higher than the previous purchase price and creates a signal that it can increase further. In general, this method requires higher analytical capabilities than the DCA methods mentioned above as this is a double-edged sword because the price may decrease from subsequent purchases.

Benefits of Using a DCA Strategy

The problem of price increase in a cycle

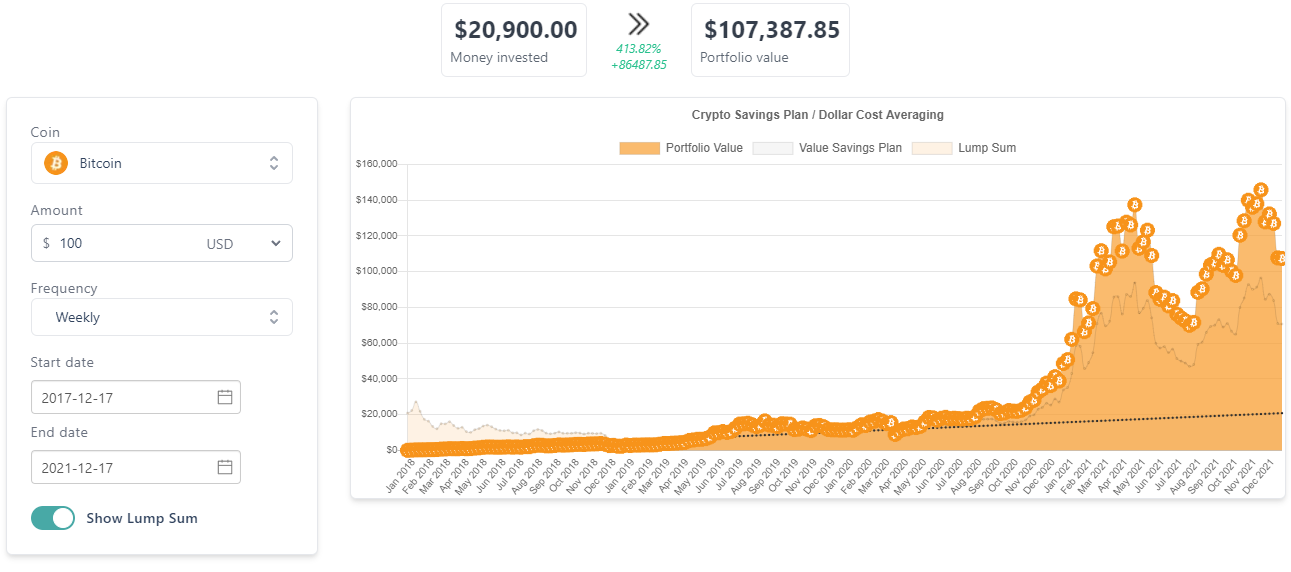

Let’s take a simple example of how we started DCA from the peak of Bitcoin in 2017 on December 17, then 4 years later, a full cycle of the crypto market with regular weekly purchases of $100 BTC.

- The total amount of money spent to buy BTC in 4 years is $20,900.

- The recorded ROI would be approximately 400% or $105K.

If you use that $20,900 to buy only once on December 17, 2017, the recorded profit will only reach a much lower level of 270%.

Discount problem

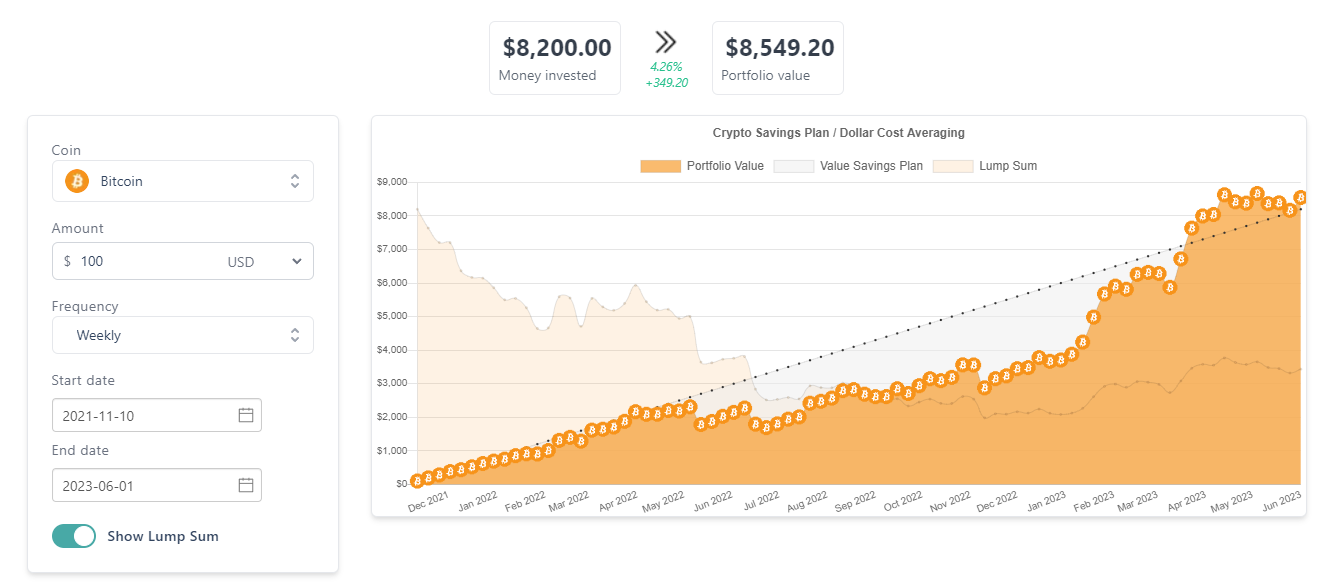

In this problem we will take the example of buying Bitcoin during the downtrend part of the crypto market cycle. Assuming you started buying BTC from the peak at $69000 with $100 per week until now (June 2023), we would calculate a few numbers as follows:

- The total amount spent to buy BTC is $8200.

- The average return was positive 4% despite negative market volatility.

If you use that $8,200 to buy BTC right at the peak, up to now this investment is losing about 63%, equivalent to $5,166.

Summary

Above is what you need to know to understand what DCA is. Hopefully, through this article, Weakhand has brought reasonable strategies from which people can apply in the investment process easily and quickly. the most effective.