In a rising market context like the current one, many of you are probably anxiously looking for coins and tokens to buy, thinking you don’t want to miss the boat. And if you are currently in such a situation, don’t rush into the market, calm down and go through this article with me to understand the reasons why you still have many opportunities ahead. .

What are you waiting for? Everyone, join me in this article. If you hold Stablecoin, stay calm and don’t rush into FOMO.

Statuses of Investors When Holding Stablecoins

Background of the article & market circumstances

First, the context of this article is in a bull market and possibly an uptrend. I believe that during a bull market period, whether it is recovering or growing strongly beyond ATH, there will be many users with sentiments such as:

- Wait for the bottom before buying.

- Wait for a discount before buying.

However, there are many Stablecoin holders who do not have enough patience and are criticized by the market, the community or especially some KOLs such as:

- Opportunity to get on board with projects A, B, C before the market grows.

- Project A under $1 is a gift.

- If you don’t invest in Crypto right now, you will miss the market’s growth opportunity in the near future.

That’s why investors easily rush into the market and follow ongoing trends, eventually leading to losses.

Opportunity For Investors Holding Stablecoin During Uptrend

Market trends happen on top of each other

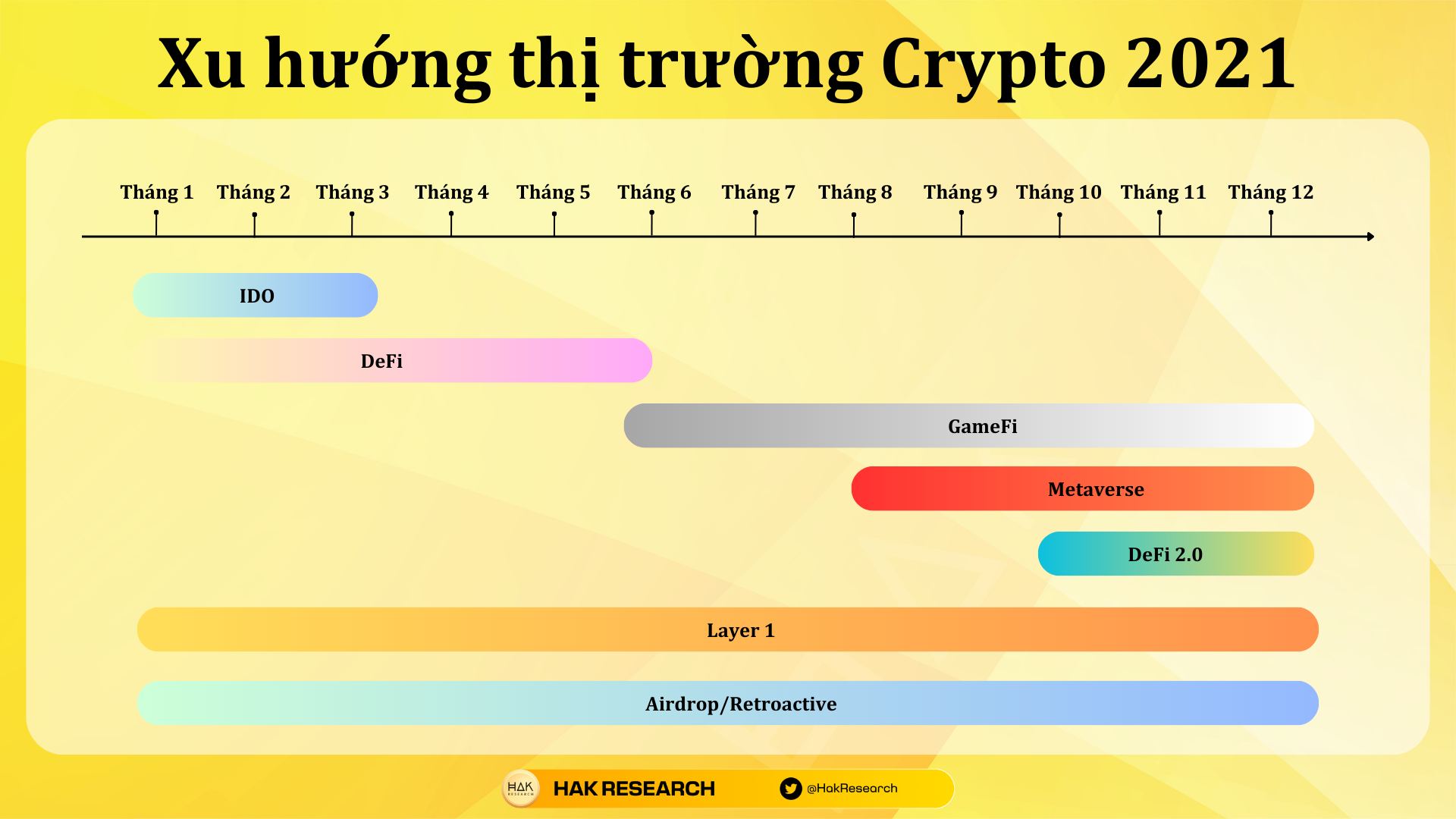

Let’s look back at the Crypto market in 2021, this is considered a boom year for the market in a 4-year cycle from 2020 – 2024. In 2021, we see the market divided into stages. Trends like:

- Most startups and events throughout each strong growth cycle are a form of capital raising. With the 2021 market boom comes IDO.

- Accompanying IDO is the DeFi wave. Although DeFi exploded in 2020, it will continue in 2021 on many other ecosystems.

- After DeFi gradually declined, GameFi began to sit with Axie Infinity with the Play to Earn model, especially the “support” of the Covid 19 epidemic, making this trend explode even more.

- After GameFi, with Facebook changing the name to Meta with a Metaverse vision, GameFi projects labeled Metaverse or NFTs labeled Metaverse exploded strongly.

- The end of the year is a small wave of DeFi 2.0 with solutions around liquidity.

- Throughout 2021, the big trend that will remain is Layer 1 and Airdrop/Retroactive.

Next, let’s look back at the Crypto market in 2023, which also has many new and unprecedented trends. Trends taking place in 2023 include:

- The AI trend exploded at the beginning of the year with GPT Chat being born and taking life by storm. Projects labeled AI on Crypto are also growing strongly.

- Following the launch of ARB and a huge Airdrop to the community, Arbitrum has become the focus of the market along with its ecosystem.

- BRC 20 started to explode with the first projects. Along with that, the successful Shanghai Upgrade also gave birth to a new niche called LSDfi.

- By the middle of the year, there was an explosion of Chinese coins such as Coinflux and Meme coin projects, especially PEPE.

- SocialFi first came to light with the Friend.tech project on Base. From there, the Friend.tech wave began to spread throughout the ecosystem.

- By the end of the year, we witnessed the strong return of BRC 20, GameFi with projects such as Big Time, Pixels or Shrapnel and the Solana ecosystem.

- Throughout the year, the Airdrop/Retroactive trend remains persistent with a series of projects such as Arbitrum, Pyth Network, Celestia, Jito Labs,…

Reviewing the above trends lets everyone see that during a period of market growth, we have many different trends and the special point here is that the trends do not happen at the same time but occur simultaneously. in a pillowy manner. Therefore, if you miss a trend, don’t rush into that trend with FOMO but try to observe the market to catch the next trend.

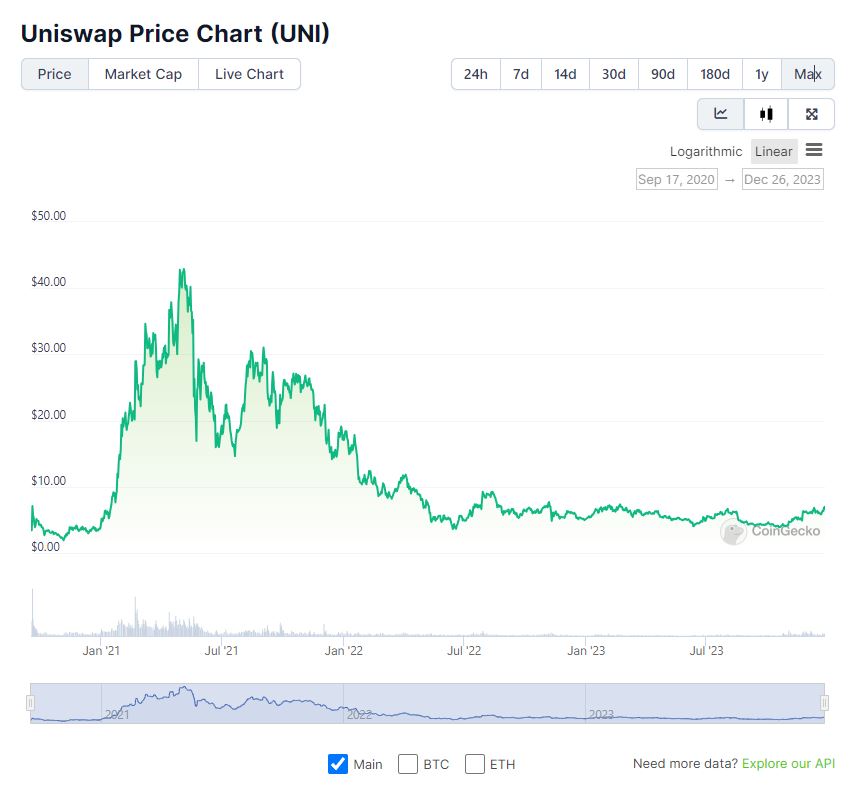

Sanbox price chart according to CoinGecko

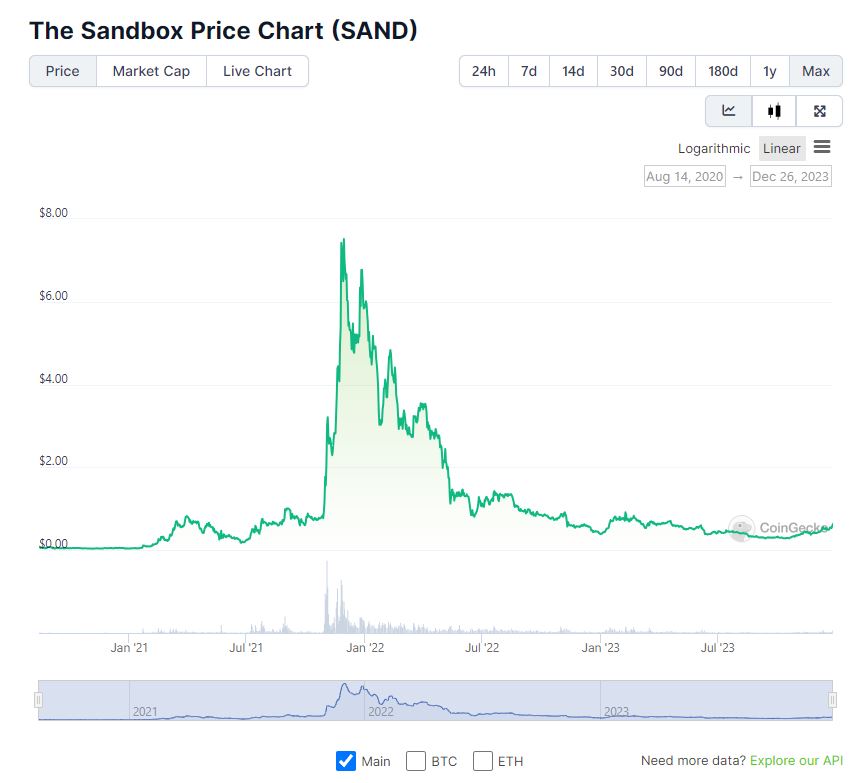

Uniswap price chart according to CoinGecko

Axie Infinity price chart according to CoinGecko

I take examples of 3 projects that represent the trend:

- Uniswap represents a DeFi trend that started increasing in December 2020 and peaked in May 2021.

- Axie Infinity represents a GameFi trend that started increasing in June 2021 and peaked in November 2021.

- The Sandbox represents a rapidly increasing Metaverse trend and peaked in November 2021.

- Olympus DAO represents the DeFi 2.0 trend that started increasing in August 2021 and peaked in November 2021.

Just rely on a few basic parameters like this so you can see what I just asserted that in a growth period there are many different trends, don’t feel like you missed the first trend. but quickly all in on it so as not to miss the boat. Instead, let’s do some analysis like this:

- What stage is the current trend in? Usually a trend will have many different stages, so there are some ideas like: Is the leading project saturated? Are there many fork versions across ecosystems? What is the market sentiment like? Usually when the trend phase has too many forks on the market, the trend is likely to start near the top and prepare to go down.

- Try to predict the next trends of the market and take shortcuts. But taking shortcuts should not be all in. Always reserve Stablecoins for unexpected trends.

Launchpad is the platform to pay attention to

In every booming market period, there is always a tendency to call for capital. In the previous period, we witnessed IDO and up to now there has not been any new capital calling model, so we will still review IDO models. However, IDO today also has some interesting updates.

So even in the context that the Crypto market has entered a growth cycle and combined with your understanding of how the market operates, you will still find opportunities to change your position.

Finding potential IDO projects is extremely important. So where do we start? First, each Launchpad platform is attached to an ecosystem, so we must condition that ecosystem with some characteristics such as:

- The underlying blockchain must call for a huge amount of capital ranging from Tier 2 to Tier 1 in the Crypto market.

- Blockchain must have many Native DApps and must be extremely diverse in many different areas.

By identifying the correct Blockchain platforms, we then look for Launchpad platforms that are reputable. Some Launchpad forms in the past and present that are worth noting include:

- Stake Native Token of Launchpad project then receive lottery tickets. If you win the lottery, the user will have the right to buy Public Sales of the project.

- The project opens an unlimited pool for a fixed number of Tokens that want to sell Public Sales. This model is often quite risky and does not bring too much profit to investors.

- The project opens a limited pool, investors only need to deposit the required project assets and receive the equivalent amount of Tokens.

- The project opens NFT sales, if users buy and hold NFTs, they have the opportunity to participate in the project’s Public Sales. This is a relatively new model

Understanding how Launchpad projects operate helps us determine how to invest effectively. With the above 4 methods, currently the first method brings the highest profit rate but is also much riskier than the methods below.

Summary

Through a short article, I want to share with everyone that there are always opportunities no matter what stage the market is in, so FOMO on trends that have reached the end of the stage is unnecessary. Hopefully through this article, everyone will have more perspective when holding Stablecoins in the context of market growth.