Maverick Wars is gradually taking shape with the participation of many protocols such as Spiral DAO, Stake DAO, Rouge, Tomat Protocol and Unlock Finance. Obviously, many projects have prepared to participate in the war and surely the end of this war will be extremely fierce. So what are our opportunities? Let’s find out together in the article below about Maverick Wars.

To better understand Maverick Wars, people can refer to some of the articles below:

- What is Maverick Protocol (MAV)? Overview of Cryptocurrency Maverick Protocol

- Maverick Wars Is Just a Thing Sooner or Late

Maverick Overview

Maverick is an AMM platform with many innovations that allow liquidity providers to use a variety of different strategies to provide liquidity. It can be said that Maverick is the first project to introduce the concept of Dynamic Providing Liquidity.

If in Uniswap V3’s model, Liquidity Providers (Liquidity Providers – LPs) must choose the price range to provide liquidity, or with Trader Joe’s Liquidity Book, LPs must choose Bins with fixed prices. With Maverick, LPs can let their liquidity run automatically according to strategies such as:

- Mode Right: Follow the rising price trend

- Mode Left: Follow the downward price trend

- Mode Both: Follow the rising and falling price trends

- Mode Static: Liquidity stands still similar to Uniswap V3

In the article Maverick Wars Is Just a Sooner or Later Thing, I have presented very carefully the reasons why Maverick Wars will definitely happen and why Maverick Wars is so attractive. Everyone can read it again for further reference. After a very short period of time, Maverick Wars officially appeared.

Projects Involved in Maverick Wars

Stake DAO: The name is not strange but also not potential

Stake DAO is a Yield Farming project and is very familiar in the DeFi market. Maverick Wars is not the first war that Stake DAO has participated in, before that Stake DAO has participated in Curve Finance, Pendle, Frax Finance, Balancer,… Although there is a lot of experience, Stake DAO is almost unprecedented. win in any war.

Some reasons can include:

- Incentive is not attractive. Up to now, Stake DAO no longer has a Native Token as an incentive, so Stake DAO’s APY is often much lower than many other newly launched platforms.

- Lack of concentration. Because of being scattered into so many wars, there is no one war that Stake DAO focuses on all the time.

- Poor, unstructured marketing leads to failure to attract users to your platform.

- The fees on Stake DAO are also not too attractive.

Because of the above reasons, in this Maverick Wars, Stake DAO only plays a participating role to make the war more exciting and there is a high possibility that Stake DAO will not have a high ranking in this war.

Spiral KNIFE

Among the projects participating in Maverick Wars this time, it seems that Spiral DAO is a project with careful preparation and a relatively different operating model. Spiral DAO is a DAO combined with Yield Farming to bring the highest profits to its DAO members through a number of strategies such as:

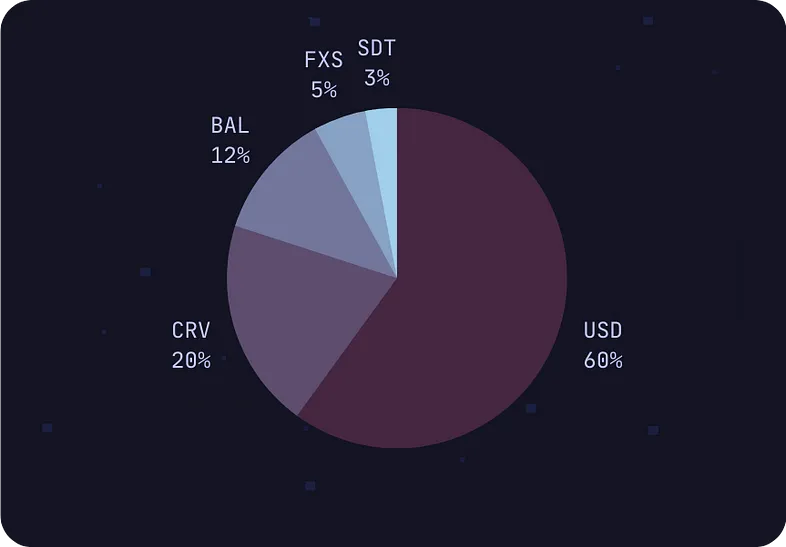

- Oriented to develop in the direction of POL to hold DeFi Blue chips such as CRV, BAL, FXS, AURA, SDT, CVX,…

- Building a Dual Token model of COIL and SPR to reduce selling pressure for Native Tokens, avoiding going down the path where many protocols have failed.

Treasury of Spiral DAO expected after ITO

Spiral DAO itself went through a relatively successful ITO (Initial Treasury Offering) and they currently have close to $7M in their Tresury. Tresury is also operating quite effectively at many different DeFi protocols such as Curve Finance, Convex Finance or Frax Finance.

On July 8, 2023 the project decided to expand its products to Maverick. This is the first war that Spiral DAO participated in. Those who deposit MAV into Spiral DAO will receive sprMAV at a 1:1 ratio. When participating in Maverick Wars, there will be 2 factors that Spiral DAO focuses on including:

- Deep Liquidity: Building deep liquidity for sprMAV allows users to exit locked MAV positions at any time without affecting the amount of MAV they hold. sprMAV will build liquidity on Maverick itself.

- Encourage users to participate in Voting and will receive benefits from Voting.

Some of the differences between Spiral DAO and one of the leading projects in this field, Convex, we see the difference at Voting Power and Vote Incentive. For example, those who lock CRV on Convex to receive cvxCRV will not be able to participate in voting on Curve Finance, but only those who hold vlCVX (the locked version of CVX) will have the right to use veCRV on Convex Finance.

For Spiral DAO it is different:

- sprMAV, when staked on Spiral DAO, will be able to participate in voting on Maverick.

- Voting fees will be 0% for the next 3 months after this period will increase to 17%. This fee will be used to increase the yield for MAV locking and increase Tresury.

- Users can participate in voting themselves or delegate to the Spiral DAO.

It can be said that Spiral DAO is preparing quite thoroughly for Maverick Wars this time. However, with its fairly new model, Spiral DAO may encounter some challenges when users approach it for the first time.

Tomcat Protocol

When users lock MAV on the Tomcat Protocol platform, they will receive tcMAV at a 1:1 ratio. The amount of user’s MAV will be locked by Tomcat Protocol for maximum time on Maverick to make the most of resources from the model’s structure. veToken. tcMAV is an ERC 20 that can be transferred or integrated into DeFi protocols on the market.

Currently, Tomcat Protocol has deployed Launch Vault for users who participate in staking MAV early on the platform, and users will receive future Airdrops from Tomcat itself. Some outstanding features of Tomat Protocol include:

- Users who own tcMAV will receive everything that users who hold veMAV receive.

- Tomat Protocol will also integrate LayerZero to help tcMAV participate in gorvernance on any blockchain.

Currently, Tomcat is deploying to attract MAV from users. However, this is a quite sensitive stage for a project, so if people intend to participate, they need to research carefully before participating.

Unlock Finance

Similar to Tomat Protocol, when a user locks MAV on Unlock Finance, the user will receive unkMAV at a ratio of 1:1. Besides, Unlock Finance also locks a maximum of MAV on Maverick, users can only escape from the position. unkMAV’s position is through the MAV liquidity pair – unkMAV is built by Unlock Finance itself on Maverick itself.

Currently there is only some information about Unlock Finance as follows:

- Users who support the Unlock Finance platform early can receive Airdrops from Unlock Finance in the future.

- UNK is the Native Token of Unlock Finance that will be used to decide how veMAV will vote on Maverick.

- Unlock Finance will also organize events to help users increase the amount of UNK they hold such as Games, Minting, Contributing,…

Rouge

Rouge is the only project among the 5 projects that does not have any information yet.

Review of Maverick Wars

It can be seen that Maverick Wars is still in its early stages, some projects have begun to run while some projects are still in the preparation stage, so it will be relatively difficult to launch. current comments. However, when looking through and learning about the projects, I can make some comments as follows:

- The ability to win with Stake DAO is relatively difficult due to the reasons I presented above.

- Spiral DAO is a well-prepared project and has a strong Treasury. If Spiral does what they say about being the first project to have a liquidity pool and also the deepest, Spiral DAO will hold the most advantages.

- Tomcat has begun deployment to attract MAV. However, the EVR project has not been audited by any party, so users are quite worried.

- Unlock Finance doesn’t have too many special things and Rouge doesn’t have any information yet.

However, we should not conclude too early about the war and make hasty investment decisions. Remember that Convex Finance is new and came later but won against the powerful Yearn Finance. Most recently, Penpie, despite having a lot of experience, was overwhelmed by an Equilibrie in the Pendle Wars.

Summary

We still need to closely monitor Maverick Wars to have more information to help our investment decisions become more accurate. Hopefully through this article everyone will understand more about the Maverick Wars