Radiant Wars was sparked when Radiant Capital officially introduced a completely new version of tokenomics. So what projects are participating in Radiant Wars and what its real potential is? Let’s find out together in the article below.

To better understand Radiant Wars, people can refer to some of the articles below:

- What is Radpie (RDP)? Radpie Cryptocurrency Overview

- What is Radiate Protocol (RADT)? Radiate Protocol Cryptocurrency Overview

- What is Radiant Capital (RDNT)? Radiant Capital Cryptocurrency Overview

Radiant Wars Overview

Background of Radiant Wars

One of the factors affecting Radiant Capital’s development is Tokenomics. Radiant uses an incentive amount of RDNT (inflation) to attract TVL, users and Volume. However, this leads to some disadvantages as follows:

- Users who deposit money into Radiant only target RDNT, they are all short-term LPs and when incentives gradually decrease, they will withdraw money to participate in other projects with more attractive incentives. Therefore, the incentive was not given to the right place.

- Incentive abuse can have a negative impact on the price of RDNT, which affects all users including those with short, medium or long term with the protocol.

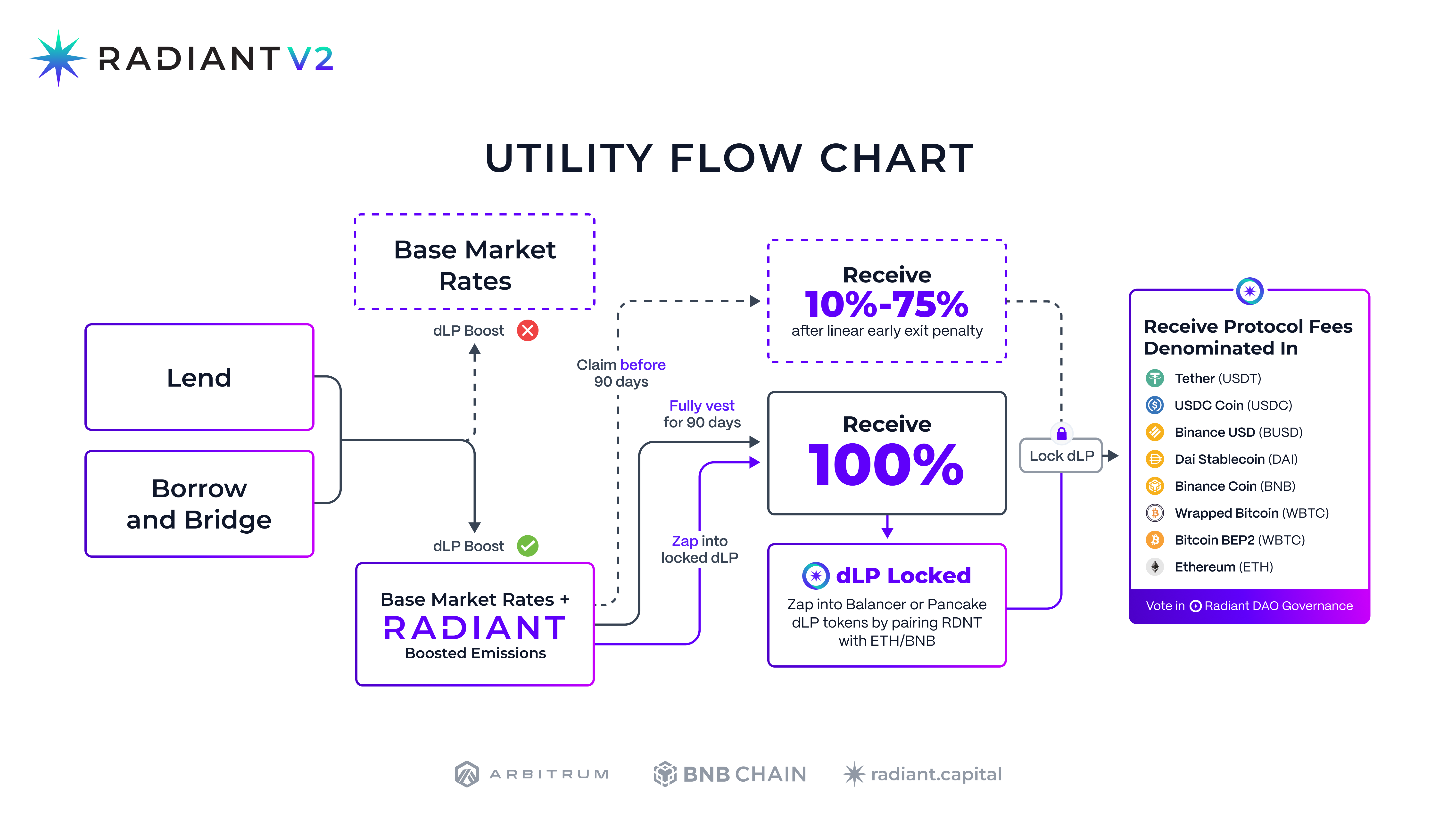

Therefore, the Radiant Capital development team has introduced a completely new tokenomics model. Radiant introduces to the community the concept of Dynamic Liquidity, which means that depositors or borrowers on Radiant Capital who want to receive an incentive of RDNT are required to provide liquidity of at least 5% of the total Volume for the pair. RDNT – BNB or RDNT – ETH.

For example, if Huong owns $20,000 and wants to get maximum profit from Radiant Capital, he will need to go through some specific steps as follows:

- Step 1: 5% of $20,0000 is $1,000 will be provided liquidity to the RDNT – BNB or RDNT – ETH pair, the remaining $19,000 will be deposited into the protocol.

- Step 2: After providing liquidity, Tuong will receive dLP representing assets in the Pool.

- Step 3: You will have to lock your dLP to receive the incentive of inflated RDNT and a portion of the protocol revenue (stETH, USDC, USDT,…). The longer the lock time, the incentive will be proportional to it.

With this move, Radiant Capital targets users who are willing to accompany the project for a long time and these people will also enjoy more benefits, incentives to go to the right place, but also unintentionally contribute to the impact. Negative impact on project success in the short term when conditions are more difficult and fewer people participate. Not only TVL but liquidity on the protocol is also affected.

This trade-off must take place and the project must choose. When reading this far, you probably vaguely realized that the main reason why Radiant Wars started to appear is that users must lock dLP to receive incentives, revenue and protocol governance rights.

The birth of platforms participating in Radiant Wars

The operating model of these projects is similar to Convex Finance, Clever, Pirex, Wombex,… The operating mechanism of these projects is simply visualized as follows:

- Step 1: After receiving dLP from Radiant, instead of locking it directly on Radiant Capital, users send dLP to Yield Farming protocols.

- Step 2: Yield Farming protocols will lock maximum time dLP on Radiant Capital and return to users xdLP representing dLP in the protocol.

- Step 3: Users hold xdLP to receive incentives from both Radiant and the Yield Farming project itself, Radiant protocol revenue, and governance rights on Radiant.

- Step 4: With incentives from the Yield Farming project itself, users can lock in protocol revenue and protocol governance rights.

- Step 5: Users can exit xdLP and dLP positions at any time through the xdLP – dLP liquidity pair, for which any project must build a liquidity pool.

With this model, Yield Farming projects have brought dLP holders some basic benefits as follows:

- Users will receive maximum profits from locking dLP on the Yield Farming platform.

- Users do not need to worry about dLP liquidity being locked and can exit the position at any time when the market has bad fluctuations.

Some of the Protocols Participating in Radiant Wars

Radpie – The project has a lot of experience in wars

Radpie can say that this is not a novice when they have quite a lot of experience in battles. In the past, the first product of this development team was Magpie with Wombat Wars on BNB Chain and later on Arbitrum. Currently, in Wombat Wars they are in second place below Wombex and above Quoll Finance.

Most recently, this team successfully deployed Penpie as an IDO on the Camelot platform when there was a 700% growth. Penpie is a project built to fight in Pendle Wars. Currently, Penpie and Equilibre are competing fiercely in this war and have not yet won or lost.

It can be seen that Radpie holds a number of advantages as follows:

- The project has experience participating in wars, but as of the time of writing, they have not officially won a war.

- In the story of building a liquidity pool, Radpie has an advantage because its brother Magpie holds a lot of veWOM. Currently, Wombat is available on both BNB Chain and Arbitrum, which is similar to Radiant.

It can be seen that in this battle, Radpie has many advantages at the start.

Radiate Protocol – Can the dreamer win?

Radiate Protocol is a new project so there is not much information to evaluate the project’s potential. However, a new project or a beginner cannot help us evaluate this project’s lack of potential and inability to win. Obviously, we saw a novice like Convex Finance defeat Yearn Finance in Curve Wars.

But there is one point that I observed that at the beginning when I started following Radiate Protocol, I saw that the project had many shortcomings in implementing the Document, the project copied a lot from Radiant Capital and many others. when there’s even a spelling mistake. This leads to the temporary opinion that Radiate’s team is not really thorough with the project.

The Future of Radiant Wars

Radiant Wars will likely not be as fierce as DEX Wars because the main source of profit for DEX Wars comes from Bribe, which is not the case for Radiant Cpaital. In my opinion, Radiant Wars will be quite as normal as the GMX Wars we have seen.

However, Radiant Wars should still be best promoted by Radiant Capital itself because the bigger Wars is, the thicker and more sustainable their liquidity is. So in order for Wars to grow big and be maintained in the long term, the key point is that Radiant Capital must maintain a sustainable amount of revenue or an attractive enough RDNT incentive, or even both.

Another thing that many people will wonder about is if Curve Wars, Convex Wars or Joe Wars have a direct impact on the price of Native Token, will that happen with Radiant Capital? I think it’s possible. high is no. However, with Radiant Wars we can hope that the whole protocol can develop sustainably and long-term.

Summary

Radiant Wars is not rated as highly as DEX Wars, but it is still very worthy for us to take the time to follow and find investment opportunities that are suitable for ourselves.