Pendle Wars is becoming a keyword on the social network Twitter. So how is Pendle Finance performing, is Pendle Wars really attractive and where are the investment opportunities? Everyone, please follow me in the article below.

To better understand Pendle Wars, people can refer to some of the articles below:

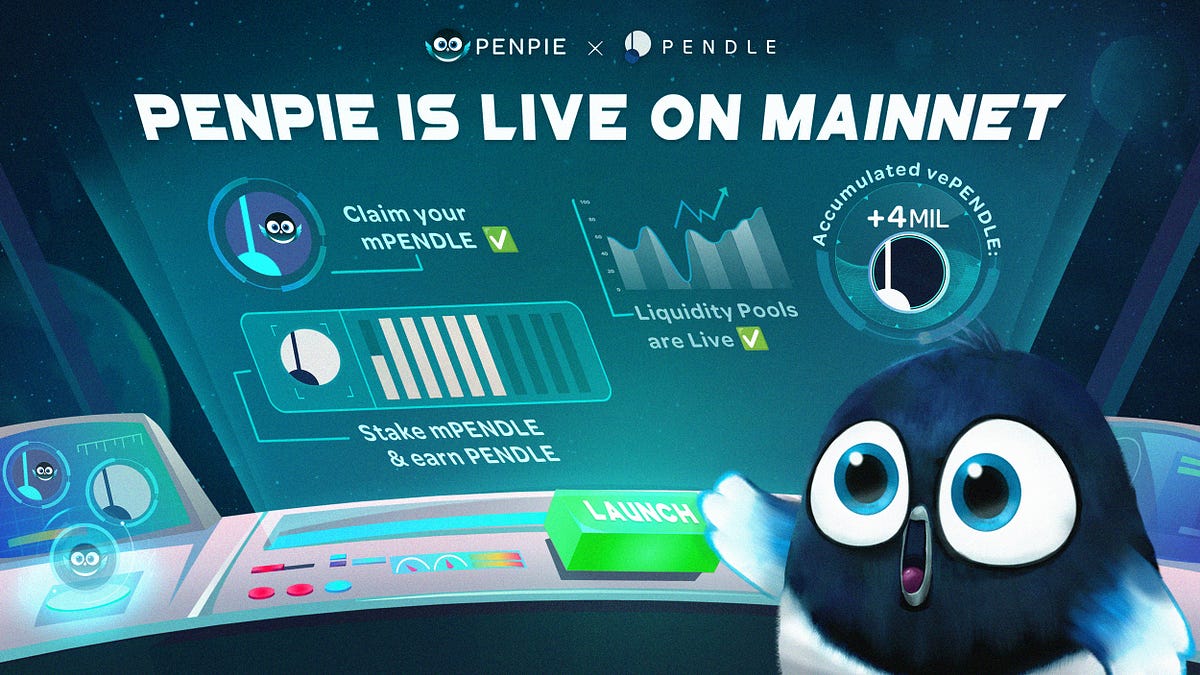

- Penpie & Strategic Position in Pendle Wars

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- What is Equilibria Finance (EQB)? Overview of Cryptocurrencies Equilibria Finance

Pendle Wars Overview

Overview of Pendle Finance

Pendle Finance enters a relatively new market niche that the project names itself as Yield Trading or Yield Derivatives. To put it simply, you can make a profit from the future profits that you will definitely receive.

For example: You deposit 1 stETH into Pendle Finance and 1 stETH will generate 0.1 stETH in 1 year. Instead of having to wait 1 year to receive 0.1 stETH, you can get 0.1 stETH at the time you deposit 1 stETH into the protocol to make a profit.

Why has Pendle Finance become so famous recently?

Pendle Finance is a project built a long time ago by a team in Singapore. However, the project officially transformed recently thanks to LSDfi. So why was the project not outstanding before in that same area but now when moving to LSDfi it is outstanding, it can be briefly explained as follows:

- After the successful Shanghai Upgrade, the TVL of the LSD industry skyrocketed to become the largest industry in the DeFi market, the number of LSTs also increased significantly, making users want to look for specialized projects for LSTs to optimize. profitization.

- Profit in LSDfi, especially with ETH, is a safe and sustainable source of profit over time, so building financial tools on this source of profit is relatively safe.

- In the context that ETH staking only brings an APR of 6 – 8%, this forces ETH holders to look for more channels to generate more profits.

- The number of LSDfi projects mainly focuses on CDP direction, only Pendle Finance has its own direction, so when choosing, users do not have a similar choice.

It can be seen that Pendle Finance’s new direction is creating certain successes for the project.

It can be seen that this new direction of Pendle Finance has revived a project that will go into oblivion when the crypto season comes. Pendle Finance’s TVL has increased sharply from around $4M to its current level of $112M or 28x. The growth in TVL is similar to the popularity on Twitter. As TVL increases, Pendles mentioned in Threads also show signs of increasing.

A look at the current situation Pendle Finance is supporting many different markets such as stETH, sfxrETH, USDT, APE and LST liquidity pairs.

What started the Pendle Wars?

Similar to Curve Finance, Wombat Exchange or Trader Joe, the war started when Pendle Finance officially launched vePENDLE. However, there is a certain difference compared to Curve Finance’s veCRV model.

Pendle Finance believes that veCRV has not completely resolved liquidity coordination as those who voted in the wrong liquidity pool still receive fees in other groups. With Pendle, voters only receive transaction fees from the groups they vote for and support. This helps incentivize liquidity pools that really need liquidity.

Of course, to own vePENDLE, users need to lock PENDLE for 1 week to 2 years. The longer you lock, the more vePENDLE you will receive. If the user locks PENDLE for up to 2 years, they will receive 1 vePENDLE. If they lock for less time, they will receive less. Some of the basic benefits of holding vePENDLE are:

- The amount of incentives and rewards will be more because not everyone also holds vePENDLE.

- Protocol administrator rights. Voters can vote to decide which liquidity pool will receive the most incentives. Thereby coordinating liquidity to the pools that need it most.

There are 2 quite good and interesting points in vePENDLE’s model:

- vePENDLE will gradually decrease to 0 during the main lock period so after each epoch the power and rewards of voters will gradually decrease. Therefore, if you want to optimize profits, voters must continue to lock for the maximum time after receiving the PENDLE incentive.

- Pendle takes a 3% fee from all profits accrued by YT. 100% of this fee will be distributed to vePENDLEs. However this may change in the future.

- All fees collected from the Swap will also be distributed to vePENDLE holders.

It can be seen that Pendle Finance and the development team will have no revenue during the initial period of development. However, there is currently no statistical data on what Pendle Finance’s revenue is like?

The general mechanism of projects participating in Pendle Wars includes some basic steps as follows:

- Step 1: Instead of locking PENDLE on Pendle Finance, you can lock it on Penpie, Stake DAO and Equilibria to receive xPENDLE representing PENDLE in the protocol.

- Step 2: Yield Farming protocols will be locked for up to 2 years on Pendle Finance to optimize the profits you receive.

- Step 3: Users can exit the vePENDLE position at any time through the xPENDLE – PENDLE liquidity pair.

Projects Involved in Pendle Wars

Penpie – From Wombat Wars to Pendle Wars

Penpie is the next project participating in Pendle Finance. This is the second project of the development team after the first project, Magpie, participating in Wombat Wars and is currently ranked second in the group after Wombex. Recently, Penpie has successfully IDO on the Camelot platform, bringing a profit of more than 600%.

Some of the advantages of Penpie include:

- The development team has experience in battles.

- There will be advantages to building liquidity on Wombat Exchange.

About Penpie, I have presented it in great detail in the article Penpie & Strategic Position in Pendle Wars, everyone can refer to it for more information. However, remember that an advantage is an advantage, a great advantage does not necessarily mean a winner. The clearest proof is that Convex Finance “overturned the table” against Yearn Finance in Curve Wars.

Equilibria – An emerging project that has a chance

Unlike Penpie who has experience, Equilibria is a new project (Note: we only know it is a new project and the development team has no information so it cannot be evaluated). According to my observations, although it is a new project, Equilibria’s tokenomics model is more optimal than Penpie in the long term.

Some differences and more optimal tokenomics of Equilibria compared to Penpie include:

- LP and ePENDLE receive incentives mostly in xEQB (it takes 24 weeks to fully redeem 1:1 if redeemed early, the excess EQB will be burned).

- Equillibra burns 5% for every 100m of EQB mint as incentives.

- Incentives are paid according to the ePENDLE/total PENDLE stake ratio, so it is more suitable.

- xEQB is designed to be integrated into many DeFi protocols.

Stake DAO – Too difficult to “turn the table”

Stake DAO is a familiar name in the Wars village. Stake DAO is currently present in many different DAOs such as Curve Finance, Balancer, Frax Finance, Yearn Finance, Pendle Finance,… however in every battle Stake DAO is usually not too prominent and does not have too many advantages compared to opponents.

The main reason Stake DAO loses in so many battles is because the amount of SDT left as an incentive for Stake DAO is not much, which makes Stake DAO’s APR much lower than its competitors even though sometimes In terms of liquidity Stake DAO does better than its competitors.

Current situation of Pendle Wars

After initially leading the race, Penpie now had to cede the lead to Equilibria. It can be said that Pendle Wars is a two-horse race between Penpie and Equilibria, while Stake DAO only plays a role in making this war more exciting. Penpie, thanks to the effect of Magpie, took the lead in the early stages, but with outstanding designs in tokenomics, Equilibria has had a breakthrough.

So let me confirm even more that just having a lot of experience is not enough to guarantee the race. I’m looking forward to Penpie having strategies to overcome Equilibria and we will see a fierce struggle between the two sides. Currently, Penpie can still make changes to catch up, but if they delay they will finish second in Pendle Wars the same way they finished second with Wombat Wars.

The Future of Pendle Wars

Pendle Wars can grow even stronger if LSDfi continues to maintain its appeal and Pendle continues to generate more revenue. However, we still need accurate numbers about Pendle Finance’s actual revenue? Only when we have specific numbers on hand can we predict the long term of a trend.

At the present time, Pendle Wars is a short-term trend that you can observe and invest in in the short term. If you bought Penpie’s PNP on Camelot, you would have made a relative profit during the downtrend season. Therefore, in the downtrend season with short-term trends we can still find ways and make profits from it.

Summary

Can Pendle Wars become a long-term trend like Curve Wars did or will it fade away like Wombat Wars and even have to abandon the veToken model like Trader Joe. What are everyone’s opinions?