It has been a long time since the last project with a billion-dollar valuation by investment funds launched tokens and listed them on exchanges. The next name on this billion-dollar list is Pyth Network, a project working on the Oracle segment. In this article, let’s join Weakhand to predict the floor list price of Pyth Network.

To better understand Pyth Network, people can refer to some other articles from Weakhand:

- What is Oracle? The Effect Of Oracle In Crypto

Overview of Pyth Network

Pyth Network is an oracle project that provides data from the real world to DeFi or more specifically smart contracts. Pyth Network was initially built and developed on the Solana ecosystem and quickly became the largest oracle here. After a long time, the development team brought its product to more ecosystems including both EVM and non-EVM.

To be able to transmit large amounts of data quickly and accurately, Pyth Network has been building a network including many data providers. The names participating in this data providers network all have influence and reputation in the market such as Binance, Wintermute, CMS, DWF Labs,…

Factors Affecting the Price of Pyth Network

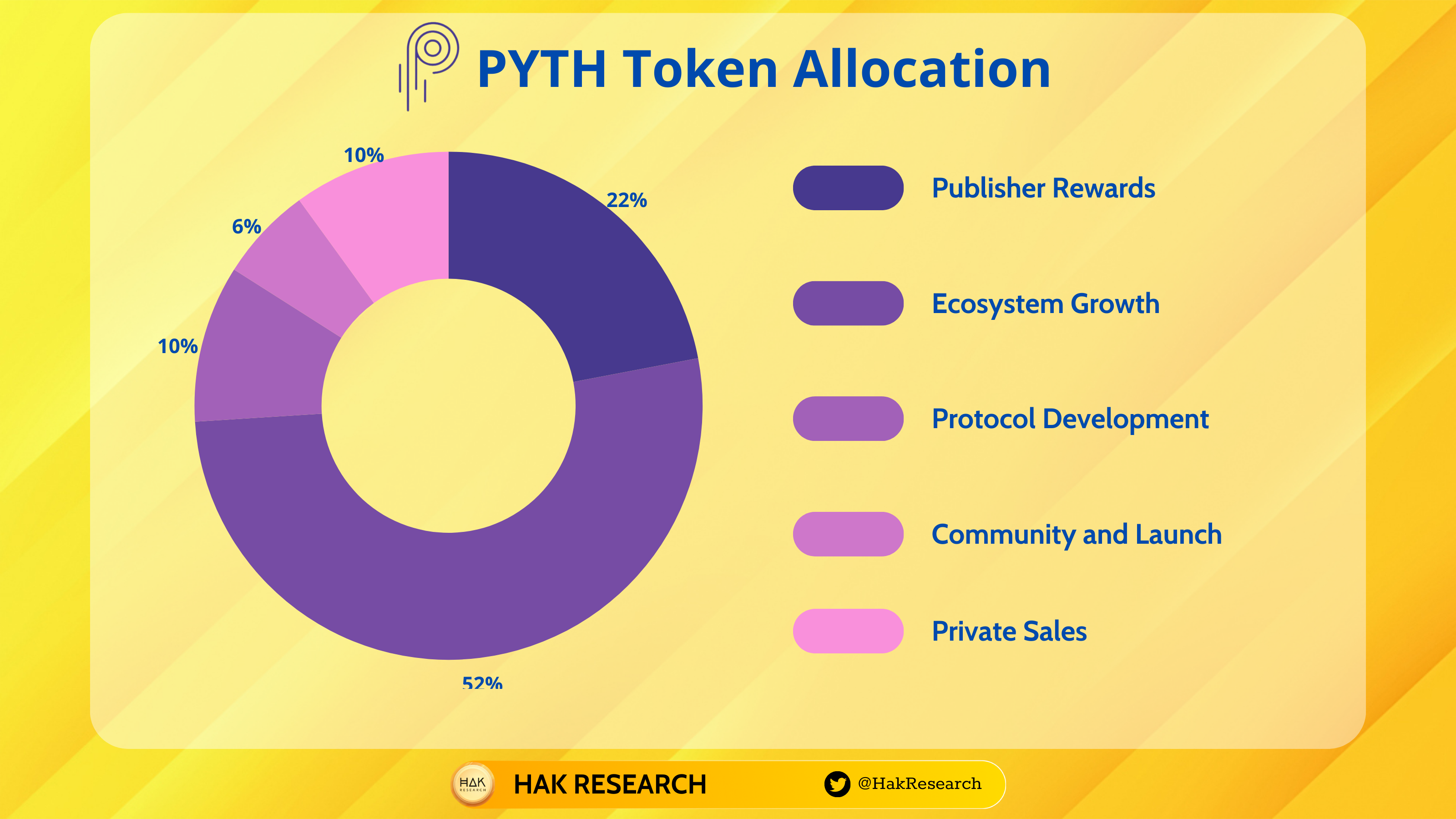

Tokenomics

PYTH token vesting:

- Publisher Rewards: Unlock 2% (50M) at TGE time, the rest is locked for 6 months and vesting gradually over 4 years.

- Ecosystem Growth: Unlocked 13% (700M) at the time of TGE, the rest is locked for 6 months and vesting gradually over 4 years.

- Protocol Development: Unlock 15% (150M) at TGE time, the rest is locked for 6 months and vesting gradually over 4 years.

- Community and Launch: 100% unlocked (600M) at TGE time.

- Private Sales: Locked for 6 months and vested gradually for 4 years.

We can easily calculate that at the time of TGE there will be about 15% of the total supply of PYTH in circulation, equivalent to 1.5B tokens. In the circulation supply at TGE, there is a high possibility that the Publisher Rewards and Ecosystem Growth parts will not be used with a total of about 750M tokens because they need to go through the DAO to be able to use them.

We will only need to pay attention to the two main parts in circulation:

- Community and Launch: All tokens will be distributed to the community through the Retrospective program and early contributors in the community.

- Protocol Development: The purpose of this token is not mentioned, but there is a high possibility that it will be distributed to members of the development team.

So we can summarize that at the time of TGE there will be no selling force from investment funds because they are locked for 6 months. The selling force will come from the community (which certainly exists in other TGEs) and the project development team as they can fully decide to use 150M tokens from Protocol Development for any purpose.

PYTH token will be used to focus on the governance mechanism of data providers such as:

- Determine the price update fee scale for the protocols used.

- Define part distribution mechanism for data providers.

- Approve on-chain software updates for blockchains.

- Identify new tokens and their reference data listed on Pyth.

- Identify data providers eligible to join the network.

Backer

According to information provided by the project, Pyth Network has gone through a total of 2 rounds of capital calls from investment funds, but there is not too much detailed information about these 2 rounds of capital calls. From some unconfirmed information sources, Pyth Network’s last round of funding was valued at up to $2.5B, this number is much higher than other Layer 1s such as Celestia which is only $945M or Sei Network which is $800M.

Pyth Network’s ecosystem

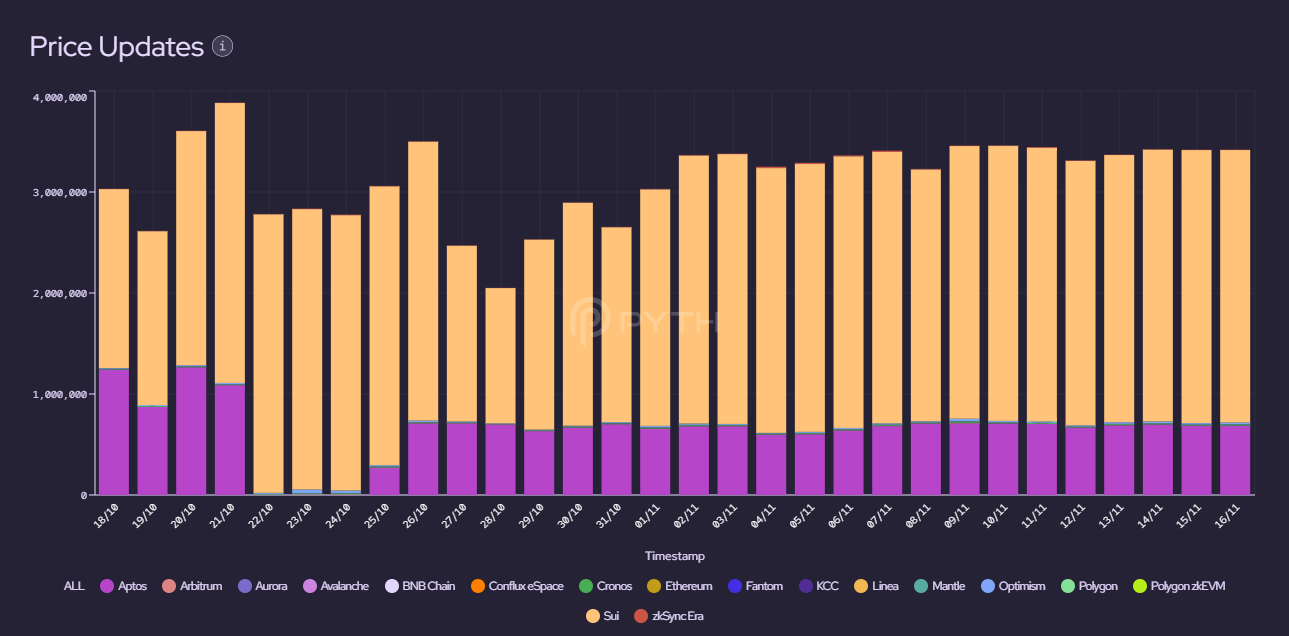

Pyth Network is currently the pioneer oracle in supporting new ecosystems regardless of whether they are EVM compatible or not. This direction is completely different from Chainlink or oracles that only focus on supporting blockchains as well as other protocols.

Protocols that use Pyth Network to get oracle prices from other sources must pay data providers each time they are updated. And with the current strategy of developing and capturing new blockchains as well as protocols built on them, Pyth Network’s market share will be huge.

In addition, Pyth DAO has the complete right to decide which tokens will be used by projects to pay data provision fees to data providers. If this really happens, it will be one of the very strong driving forces for Pyth Network in the future.

Pyth Network’s market share in the Solana ecosystem is very large and one thing that everyone can see recently is the extremely strong return of Solana. It is likely that PYTH will benefit in no small part from the effects that Solana has brought recently.

Pyth Network Floor List Price Prediction

Compare Pyth with Chainlink

Pyth Network is currently the oracle project with the second largest number of supporting projects in the entire DeFi industry with 120 projects, second only to Chainlink with 358 projects. If we calculate the FDV ratio between PYTH and LINK using the ratio between supporting protocols, then PYTH’s FDV would be $4.5B equivalent to a price of $0.45, and if we compare at par it would be $1.35 per PYTH.

Compare Pyth with recently listed major projects

To be fairest in this category, we will take the ROI ratio on ATH price compared to the last round price of investment funds from recently listed projects:

|

Project |

whip % |

Roi X |

PRICE PYTH |

|---|---|---|---|

|

Celestia |

700% |

x8 |

$2 |

|

Arkham |

1300% |

x14 |

$3.5 |

|

CyberConnect |

540% |

x6.4 |

$1.6 |

|

Sei Network |

350% |

x4.5 |

$1,125 |

Summary

If we consider the above valuation levels, the initial valuation of Pyth Network will be very high at the time of TGE. However, nothing is impossible with an optimistic market situation like the present time combined with the Solana ecosystem showing signs of booming again.

Above is the prediction of Pyth Network’s floor list price from Weakhand. Hopefully, through this article, everyone who receives PYTH airdrop from the project will be able to sell it at the best price.