What is the NFT floor price? NFT Floor Price, also known as NFT Floor Price, is the lowest price in a collection. This is considered a widely used piece of data that helps users determine the value of an NFT collection. So what’s special about the NFT floor price? Let’s find out with Weakhand in this article.

What Is NFT Floor Price?

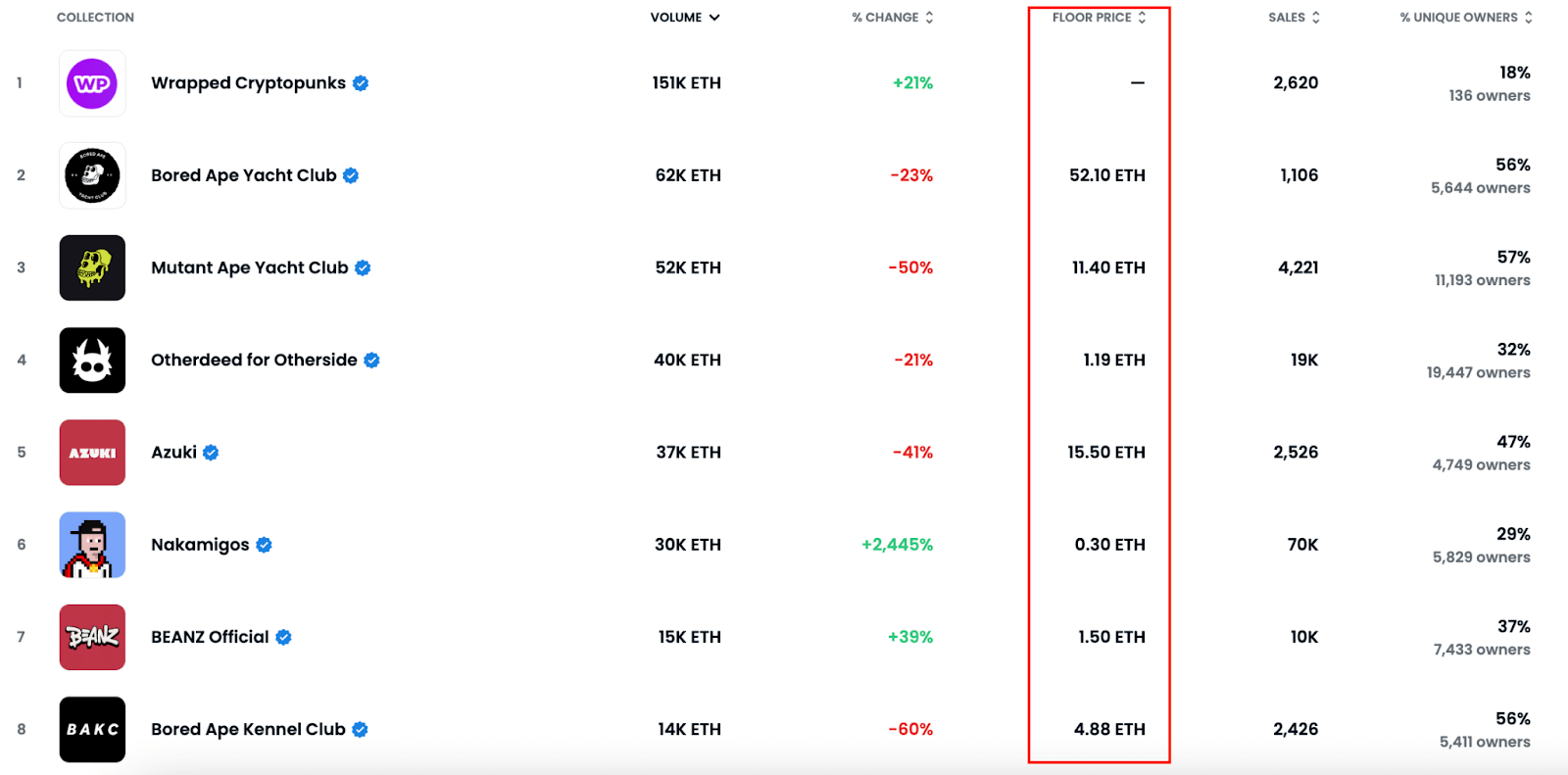

NFT Floor Price, also known as NFT Floor Price, is the lowest price for any NFT in a given collection. Overall, NFT price floor is a data that helps users participating in the market to gather detailed information about a collection. Additionally, NFT floor prices are also often a direct indicator of how the current market values an NFT collectible. This helps users make more accurate buying, selling and investment decisions.

What is NFT floor price

In addition to the NFT floor price, there are some parameters in the collection that users need to pay attention to:

- Total Volume: Total trading volume of NFT collection

- Ceiling Price NFT: Ceiling Price NFT, also known as NFT ceiling price, is the highest price of any NFT in a given collection.

- Owners: Number of NFT holders in a collection.

- Supply: The total number of NFTs contained in a collection.

For example: On OpenSea, the Bored Ape Yacht Club (BAYC) NFT collection has a floor price of 43 ETH as it is the lowest listed price for BAYC NFTs on the market.

How is the NFT Floor Price Calculated?

Usually the floor price is calculated based on the NFT holders in the collection. Whoever lists their NFT at the lowest price will be set as the floor price. Several factors can influence the floor price in an NFT collection:

Demand for NFTs

Demand for NFTs is an obvious factor when determining the floor price of an NFT collection. As more people compete for a limited number of assets in a collection, the floor price increases. Conversely, if interest in NFTs or collectibles dwindles, the floor price may drop accordingly.

Market trend

Market trends are also one of the factors that influence the floor price of an NFT collection. For example, in March – May 2022, Bored Ape Yacht Club (BAYC) received a lot of attention from the community, and the PFP NFT segment also benefited with a series of price increases of other collections. like: Azuki, Doodles,…

Utility/value of NFTs

Many NFTs in the market provide little or no real value to the holder, and as a result, the floor price declines over time. Creators use NFTs to provide real value and utility to their owners, and so the increased floor price also represents an increase in the value that NFTs bring to their owners.

Brand/creator reputation

When a brand or creator releases an NFT, the floor price tends to be higher. This is due to the trust that the community has in the publisher, but it also does not mean that the project will be successful in the future. That also depends on the leadership ability as well as the right direction that the development team takes to run the project.

Pros and Cons of Buying NFTs at Floor Price

Buying an NFT at floor price has both pros and cons, let’s take a look at some of the pros and cons below:

Pros and cons of buying NFTs at floor price

Advantages of buying NFTs at floor prices

- Buy NFT at the cheapest price: Since the floor price is the lowest price a user needs to pay just to own an NFT in a given collection, users can rest assured that they are getting the best price possible.

- Profit potential: If this is a potential project and you buy NFTs at a good price, the possibility of generating profits in the future is very high.

- High liquidity: Usually NFTs at floor prices often have a higher amount of liquidity than rare NFTs because rare NFTs are often highly valuable and beyond the affordability of many investors. With NFTs at a floor price, there will be greater demand for users leading to higher liquidity.

Disadvantages of buying NFTs at floor price

- Typically NFTs at floor prices have lower growth potential than NFTs with rare attributes. So for an experienced user, they will look for rare NFTs, even though the price may be a little higher than NFTs at the floor price, the profits earned in the future will be much higher.

- Buying NFTs at floor prices does not mean buying at a good price and potentially making a profit in the future. For example, it makes no sense for a user to buy an NFT at the floor price of a project that is no longer active. Therefore, people need to research the project carefully before making their investment decision.

What is NFT Floor Scan?

Floor sweeping refers to an investor purchasing a large amount of NFTs at a floor price. This can cause the floor price of a collection to increase rapidly and create fomo for investors. Usually the floor sweep is done by a “whale” and is also a good sign that they believe in a particular NFT collection and are taking advantage of the low prices to get their hands on NFTs before they go up. price.

summary

The NFT floor price is an important metric in the NFT market, assisting in assessing the potential and value of a digital asset. By understanding the factors that influence the floor price and determining the floor price of an NFT collection helps users make informed decisions when buying, selling and trading NFTs.