Royalties are always a topic that causes a lot of controversy and heated discussion from the community. NFT creators are the ones most affected by this issue, and in this article, let’s join Weakhand to explore ways that creators can apply to deal with the situation of dwindling royalties. like now.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is NFT (Royalties fee)? The secret to helping Blur surpass OpenSea

- NFT Marketplace Wars and the ultimate winner

- Opensea regulates license fees & Controversy from the community

What Are Royalties?

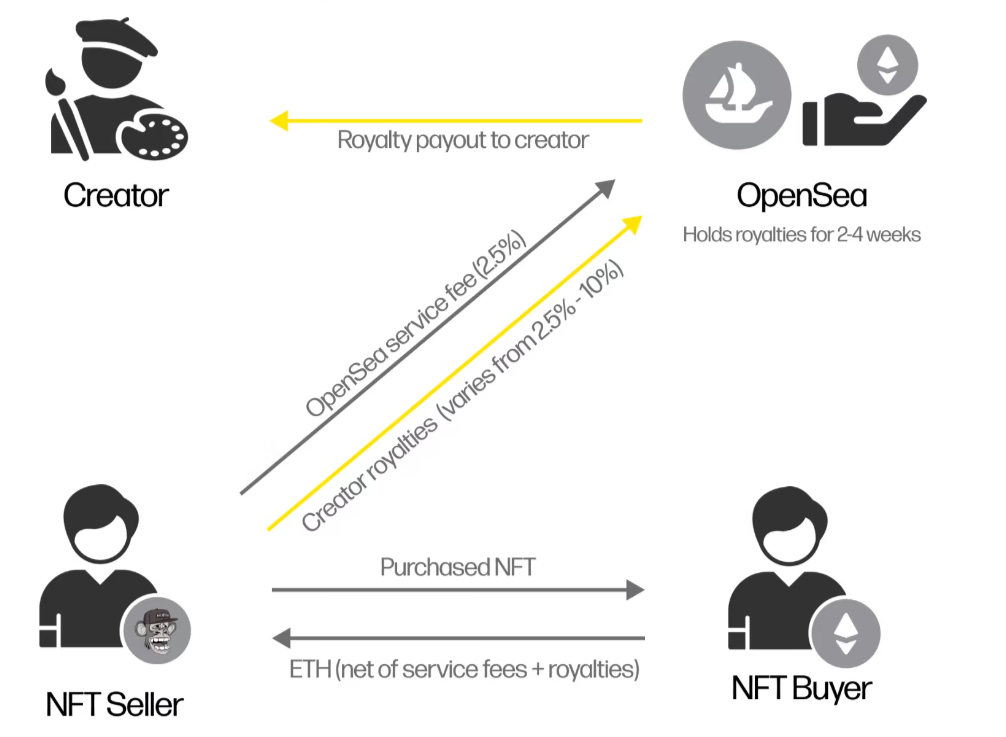

Royalties overview

Royalties are payments paid to creators each time their work is sold on the secondary market. Normally every time a user sells an NFT, a royalty fee is included with the transaction fee on NFT Marketplaces. Depending on the NFT collection, royalty fees can vary, but a rate of 5-10% of the selling price is usually considered standard. For larger NFT collections, lower royalty fees of around 2.5% are common.

What is a copyright fee?

Royalties remain an important aspect for NFT creators, artists and brands, helping them receive an ongoing revenue stream from their NFT collections. Creators can then use these funds to continue growing their NFT collections and provide more use cases for NFT holders.

However, not all NFT collections apply royalties, Degods and Moonbirds are two typical collections in eliminating copyright fees. Some other NFT collections that still apply a royalty fee mechanism include:

- Azuki: 5% fee on secondary sales distributed to Chiru Labs.

- Doodles: 5% royalty fee, half of which goes to the community treasury (Doodlebank).

- Bored Ape Yacht Club (BAYC): 2.5% secondary sales fee distributed to Yuga Labs.

- Meebits: 5% of royalties distributed to Yuga Labs.

Historical development of royalties

If people don’t know, CryptoPunks was the first NFT collection launched on Ethereum but has never established royalties on its NFT collections. CryptoPunks Exchange – the popular marketplace where CryptoPunks NFTs are traded – also does not take any royalties on secondary sales. CryptoPunks creator Larva Labs has chosen an alternative business model in which they choose to keep 1,000 Punks on their balance sheet and sell these Punks sporadically to generate revenue.

It wasn’t until the arrival of Yuga Labs with its popular Bored Ape Yacht Club (BAYC) collection in mid-2021 that royalties received much attention. To date, Yuga Labs has earned a staggering over 140M USD in royalties from all of their NFT collections.

Other projects have also noted Yuga Labs’ success and adopted a 2.5% royalty fee as standard practice. As the NFT market continues to heat up in the second half of 2021, the benchmark has further increased to 5% thanks to NFT collectibles like Azuki, Doodles, CloneX, and Moonbirds. Yuga Labs has also taken advantage of this royalty trend to apply to the Otherdeeds collection with a royalty fee of 5%. To date, Otherdeeds has generated a revenue stream of up to 44M USD from secondary sales since its launch in April 2022.

Royalties – A Controversial Issue in the Community

In the ongoing battle over royalties, two leading schools of thought have emerged. Royalty advocates point out that royalties are vital to helping creators have a sustained revenue stream, which in turn keeps them motivated to keep building and growing. my product. Royalty advocates worry that reduced royalties or no royalties will make creators less interested in their projects and cause the project to decline.

On the other hand, royalty opponents argue that calculating royalties is unnecessary and that NFT collections need to redirect to other income to create a more sustainable business model. Additionally, charging royalties will be a barrier for NFT traders and they will tend to look for collectibles with lower or no royalties.

Regardless of the school of thought, the current situation in the market is that the source of revenue generated from royalties is in serious decline.

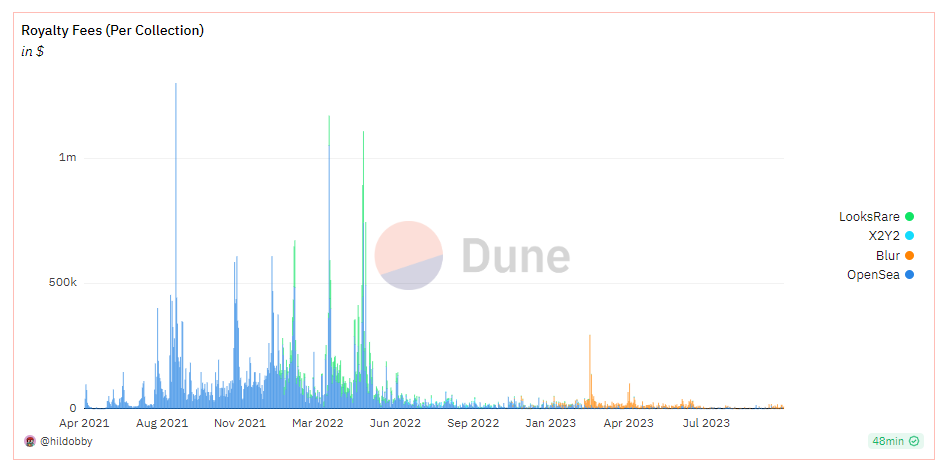

Statistics on royalty revenue on the NFT market

According to data provided by Dune Analytics, royalties have continuously decreased from June 2022 to the present time. The two reasons are that NFT trading volume has decreased sharply over the past year and NFT Marketplaces have reduced their copyright fees to increase their competition.

Most recently, OpenSea also adjusted its license fee to a custom similar to Blur and this has caused a lot of controversy from the community. OpenSea is known to be the main platform that generates royalty revenue for creators, and this decision appears to have made that revenue stream smaller and smaller.

On @opensea‘s decision to sunset their Operator Filter. pic.twitter.com/ahc155WWkX

— Yuga Labs (@yugalabs) August 18, 2023

Yuga Labs is a prominent name that is not happy about OpenSea’s decision and they will not list any of their NFT collections on OpenSea until the decision is changed. And with this decision, the OtherDeeds collection cannot be traded on OpenSea and Blur, users can only trade them on X2Y2. Recently, Yuga Labs also cooperated with Magic Eden in a plan to create its own NFT Marketplace, expected to launch in early 2024.

In general, royalties are always a hot topic that needs to be addressed and with the current situation of royalties decreasing, there are creators and the NFT Marketplace platform standing up to take action and My opinion to protect the creator.

Ways to Help Creators Cope with Declining Royalties

After learning about royalties and the current situation of royalties on the market. Let’s learn about ways that creators can deal with this problem.

Find strategies to earn revenue from NFT supply

The first and most basic approach a creator or collection group might consider is to reserve a certain supply of NFTs of their own collection.

As the project develops, the Team can sell this supply in a drip format over time to obtain additional funding. There are two variations of this method: increase the supply further (like what Chromie Squiggles does which is increasing the maximum supply by 250 NFTs for special occasions) or keep the supply the same (like how Larva Labs mint 1,000 NFTs in the CrypoPunks launch and they used them to drip sell over time). Overall, this is a suitable strategy for a team that is motivated to grow and wants to see their collection succeed.

Become an LP on NFT AMMs

As the NFT market grows, NFTFi is increasingly blooming with many projects across different segments. At the present time, we have seen a number of NFT AMM projects such as: SudoSwap, Midaswap, Pikoswap,… Creators can leverage their NFT holdings to become Liquidity Providers (LP ) on NFT AMM platforms, thereby earning transaction fees.

For example: The Sappy Seals team uses its own 50 NFTs to provide liquidity on SudoSwap starting August 2022. Since then, the team has earned thousands of dollars in revenue from transaction fees.

Around 6 months ago our team took a risk and bought 50 seals so that we could provide liquidity for our own @sudoswap pool. pool.

We have since generated around $50K in fees (royalties) and have also just received a free $20K airdrop for doing so.

Alternate streams revenue exist.

— wab.eth (@wabdoteth) February 19, 2023

Use Tool Reservoir

In the current time when NFT Marketplaces such as: OpenSea, Blur,… are increasingly reducing royalties to bring better competition, many NFT collections that want to enforce copyright fees have launched NFT Marketplace own and most recently is the move of Yuga Labs when collaborating with Magic Eden to launch a separate NFT Marketplace expected to be deployed in early 2024.

Luckily at this point there are infrastructure projects like Reservior that make it easy for creators to deploy their own custom NFT Marketplace with royalty support.

For example: Finiliar Collection uses Reservoir to develop its NFT Marketplace on finiliar.com. They set up the user interface the way they like it and then Reservoir takes care of all the actual market operations.

Incentive royalties

On major NFT Marketplaces today, custom royalty rates are applied, meaning sellers can arbitrarily set the royalty payment percentage (minimum 0.5%). Creators can take advantage of this by setting up an onchain tracker that identifies sellers who pay high royalties for their NFT collections.

From there, creators can offer incentives such as NFT Airdrop, Whitelist, Ranking-based rewards, etc. This measure can encourage users to pay more royalties each time. sell their NFTs and so creators can receive a larger revenue stream.

summary

The recent sharp decline in royalties has forced creators to speak up and take measures on this issue. Above are ways that creators can deal with the current royalty situation. Hopefully everyone has received useful knowledge.