2023 is a boom year for Perp Dex with impressive statistics from users to transaction volume, however, the gap in user experience between Perp Dex and Cex at the present time is still relatively large. . One of the main reasons for this difference lies in the “independent” nature of each blockchain, thereby creating liquidity fragmentation on each chain.

Realizing this problem, Orderly Network built Orderly Omnichain with that goal tConsolidate all liquidity at individual chains on one orderbook. In this article, let’s learn how Orderly Omnichain handles the problem of liquidity fragmentation at Perp Dex!

Perp Dex & Liquidity Fragmentation Problem

Over the past year, Perp Dex has become increasingly popular with users not only in DeFi but it also attracts a large number of traders moving from Cex exchanges. Outstanding Perp Dex in terms of trading volume in recent times include dYdX (dYdX chain), GMX (Arbitrum), Vertex (Arbitrum) and Kwenta (Optimism). Although each Perp Dex pursues a different model with its own advantages and disadvantages, in general they are all facing the same problem: “fragmented liquidity” This makes it difficult to expand to other chains. To solve this problem at the present time, there is a popular method called “Bridge”.

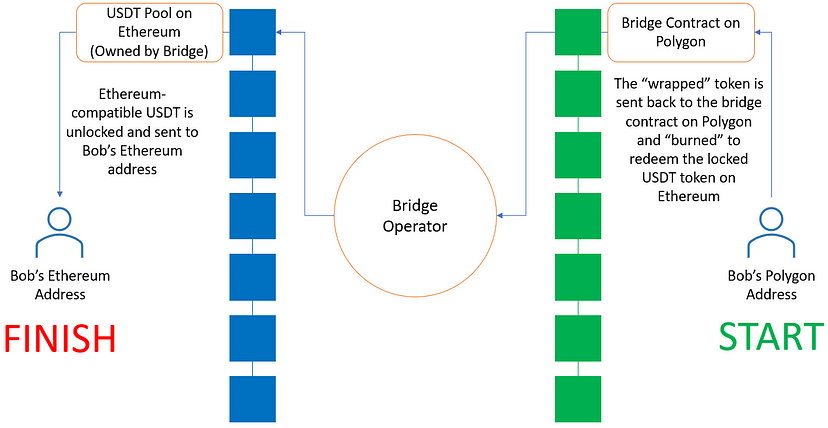

Cross-chain bridges are protocols that allow users to deposit their tokens on one chain and receive a corresponding token on another chain, like wrapped Bitcoin (WBTC) on Ethereum. These bridges can be centralized (trusted) or decentralized (trustless), depending on whether they use a third party or smart contract to authenticate transactions.

Although widely used, Bridge poses great risks in terms of asset safety as it is a favorite bait for hackers. Specifically, in 2022, a number of bridges between chains were exploited by hackers to steal millions of dollars, such as Wormhole bridge ($200M), Ronin bridge ($600M) and Nomad bridge. These attacks lead to asset loss and token price drops on the chain. In addition, another security risk when using bridges between chains is the lack of standardization in building a secure model for application interactions between chains. Different bridges may have different architectures & features that users need to learn carefully before using them.

Furthermore, the use of wrapped assets as collateral or liquidity in DeFi protocols introduces many other annoyances and risks to users, such as price manipulation, lack of liquidity, and High price fluctuations. Packaged assets are not fully guaranteed by the underlying assets, and they depend on the creditworthiness and solvency of the issuer or conduit. If the issuer or bridge crashes or is threatened, the packaged assets may lose their value or functionality. Furthermore, packaged assets can be driven by price fluctuations, liquidity issues, and systemic shocks affecting the underlying asset or the DeFi ecosystem as a whole.

The above difficulties are the reason why the current top tier Perp Dex only stands out on a certain chain and this wastes liquidity resources as well as available users on other chains.

Orderly Omnichain – Solution to Perp DEX’s Liquidity Problem

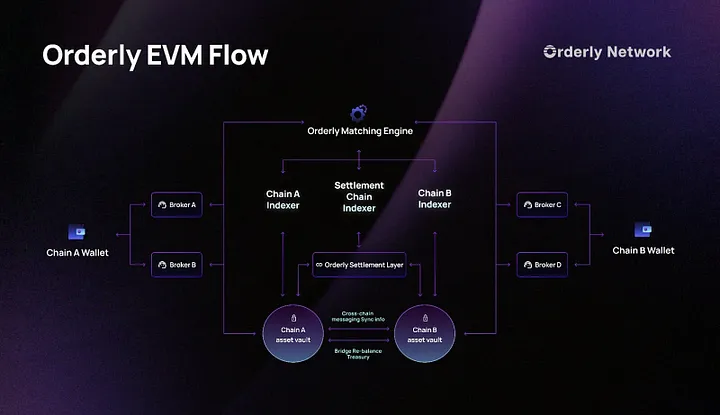

Orderly Omnichain is structured with 3 main layers:

- Asset Layer: This layer is present at every chain that Orderly supports in the EVM ecosystem. Users interact with this layer when registering an account, depositing money into or withdrawing money from their wallet.

- Settlement Layer: This layer exists on an independent chain and takes care of the function of exchanging data (message) between different chains. The Settlement Layer acts as a transaction ledger to store data, users do not interact directly with this layer.

- Engine Layer: This class ensures the operation of the Order Book and operations related to orders on the Orderly System. Users interact with this class when managing orders, placing orders and closing orders.

For all orders made on-chain, Orderly’s Settlement Layer sends/receives specified information about sending/receiving deposits/withdrawals from the Engine Layer and updates the user’s balance on-chain. The Settlement Layer then forwards this information to the Asset Layer — all of this “information exchange” is powered by LayerZero technology.

Simply put, your assets really don’t need to move. Only messages are sent across chains with all related data recorded on-chain (at the Settlement Layer) to ensure optimal transparency, verifiable by anyone.

The most obvious benefit of this architecture is that it links liquidity from different chains, creating a deep liquidity layer that helps users reduce transaction costs while attracting whales to come. with DeFi. Besides, users will be able to easily make transactions right at the chain where they have available assets, instead of having to bridge to the chain with the exchange they want to trade.

Not only that, thanks to the Settlement Layer being built on Optimism’s OP Stack technology, it helps bring outstanding interaction and combination capabilities with Layer 2. This is because all OP chains share a common security and communication layer, built together from a standard set of technologies. This means users can move their assets and data across different OP chains without having to switch networks or use bridges. Meanwhile, applications can interact across different OP chains without loss of functionality or performance degradation. Additionally, OP Stack provides the composability and modularity needed to achieve optimal security, superior speed, and fair implementation costs.

Combined with Orderly Network’s SDK, in the near future it is hoped that many developers will build more dApps with optimal quality user interface to compete with CEX.

Conclude

Orderly Omnichain is now officially mainnet and Arbitrum is the first destination with WooFi pro products. With LayerZero’s technology and the potential of the Orderly Network team, it is likely that in the first quarter of 2024, we can see the landing of this protocol on most Layer 1 and Layer 2 EVMs.

Weakhand will continue to monitor and update you with information about the project in the near future.