The Layer 2 war is becoming more and more exciting than ever. If in the past we had the four pillars of Arbitrum, Optimism, zkSync and Starnet, today there are many new names participating in the war such as Linea, Base, Taiko, Scroll,… But in the context of Layer 2 being overvalued, what are the opportunities for retail investors? In this article we will learn about Layer 2 investment opportunities.

To better understand this article, people can refer to some of the articles below:

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What is Sequencer, Prover? The Role Of Sequencer & Prover In Layer 2

- What is Data Availability (DA)? The Importance of DA in Blockchain

- What is ZK Rollup? ZK Rollup Solution Overview

Overview of the Layer 2 Battle & Retails’ Position

With the explosion of Arbitrum & Optimism after the launch of Token with a number of regular users, the number of transactions per day has grown strongly. Along with that, ZK Rollup has had a certain level of hype in recent times with a series of new projects such as Scroll, Taiko, Kakarot,… Not only that, the stories of Arbitrum Orbit, Superchain – Optimism, Hyperchain – zkSync and Layer 3 – Starknet attract even more users and finally the big guys are focusing on Layer such as Binance, Coinbase, A16Z, Polygon,.. The heat of Layer Wars is getting bigger and bigger .

However, let’s reconsider our position with Layer 2 platforms such as:

- In Arbitrum’s most recent capital call on August 31, 2021, the project was valued at $1.1B and currently Full Marketcap is around $8B, which means Series B VCs are x8 . However, with Series A and Seed rounds, the possibility will be much greater than x8. I think that the investment projects at Seed Round in 2019 are likely to be x30 – x50 times.

- In Arbitrum’s most recent capital call on March 17, 2022, the project was valued at $1.5B and currently the Full Marketcap is around $6B, which means that Series B VCs are x4 . Similar to Arbitrum, VCs have invested in Optimism in Series A and Seed rounds many times.

Similar to many other Layer 2 platforms, in the most recent round, Scroll is valued at $1.8B in 2023 or StarkWare is also valued at up to $8B. Another thing is that even in the current downtrend context, our position is not really good, not when the market enters an uptrend.

Obviously, the position of my retail investors with you (those who are reading my article) will be very difficult to be as good as the VCs at the beginning. So where is the opportunity to invest in Layer 2? Let’s find out together in this article.

Some opportunities that can be mentioned if Layer 2 explodes are:

- Ecosystem of Layer 2 platforms.

- The Battle for Data Availability.

- Share Sequencer battle.

- Rollup As a Service Battle.

The Battle for Data Availability

Overview of issues surrounding Data Availability

Data Availability (DA) roughly translated as data availability in Blockchain, is the factor that ensures any individual or organization can access information and data on the Blockchain openly and transparently. . It can be said that DA is one of the factors that helps Blockchain develop in the medium and long term along with the market.

Let’s look back at the problems of the current Crypto market such as:

- Long-standing Blockchains such as Bitcoin or Ethereum have the ability to grow very quickly after each year, for example Bitcoin is 20%/year and Ethereum is 30%/year.

- Later Blockchains such as Solana, Aptos, Sui, Monad,… aim for a transaction speed of tens of thousands of TPS and block completion time of less than 1 second, the size of these Blockchains will increase. one ways to dizzying.

Looking deeper into the story of Ethereum, Rollup solutions such as ZK Rollup and Optimistic Rollup are increasing. In the future, when all Rollups (Superchain, Layer 3 have Starknet, Orbit or Hyperchain), the number of transactions will increase. Deposits to Ethereum will grow larger and may grow exponentially. Therefore, there is a high possibility that in the future, storing the above data will be extremely expensive. However, this is just a prediction, we need to wait until after Cancun Upgrade to have more accurate analysis.

Obviously, in such a context we need DA solutions that can replace Ethereum, leading to much cheaper transaction fees. However, everything is a trade-off when a project chooses another platform to host transactions, which means that platform will certainly not be as decentralized and secure as Ethereum.

Some potential projects in the Data Availability field

There have been many projects born with the aim of providing DA As a Service that is much cheaper and more affordable than Ethereum, but the projects still commit to a high level of security and decentralization although not as good as Ethereum. . However, all solutions have trade-offs and cannot balance Scability – Decentralized – Security.

Some projects can include:

- Celestia: Celestia is a platform that has separated Blockchain into many layers, including 2 main layers: Execution Layer and DA & Consensus Layer. For the Execution Layer, it will be the Rollup Chains located in Celestia’s ecosystem and will send transactions to the DA & Consensus layer. The DA & Consensus Layer is strictly considered a service that projects outside of the Celestia HST can take advantage of.

- EigenLayer: EigenLayer is a platform to reuse LSTs and LP LSTs to participate, users can retake LSTs such as stETH, rETH,… into Validator platforms on EigenLayer. EigenDA is one of the strategic products launched by EigenLayer, projects can fully use EigenLayer as a DA or Consensus layer.

- Espresso Systems: Espresso provides Data Availability services quickly, efficiently and simply for developers. With its own technology, Espresso DA hopes to become a reputable, secure and decentralized DA Layer in the market.

Shared Sequencer War

Overview of issues surrounding Layer 2 Sequencers

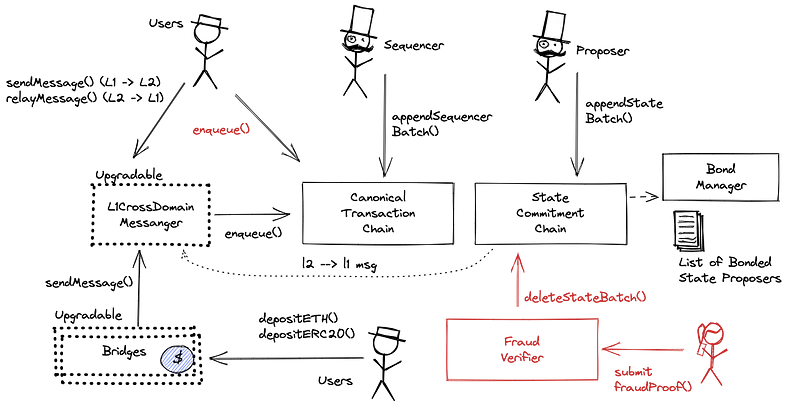

Sequencer is roughly translated as a process that arranges the responsibilities of executing transactions, gathering transactions into batches and then posting them to Ethereum. Sequencers play an important role in operating and ensuring security for the Layer 2 network. It can be said that the work of Sequencers on Layer 2 is similar to Validators on Layer 1 but Sequencers have less power than with Validator.

Shared Sequencer is when Rollup platforms use the same Sequencer together. Because many Rollup platforms use the same Sequencer, transaction compression becomes more optimal, thereby leading to cheaper transaction fees because it can be compressed to the maximum, in addition to using additional Sequencers. outside helps the Layer 2 network become more decentralized.

Some of the benefits when Rollups use the same Sequencer include:

- Minimize transaction fees because the amount of compressed transactions is always at a maximum level.

- Rollup platforms share a common Sequencer that can interact cross-chain with each other easily.

- Simplify interaction compared to Layer 1 instead of each Rollup platform having its own set of Sequencers.

Some potential projects in the Shared Sequencer field

Shared Sequencer is one of the pieces that continues to advance the Layer 2 industry as a whole in a relatively comprehensive way. Some potential projects in the Shared Sequencer segment include:

- Espresso Systems: Espresso Sequencer is a decentralized Sequencer Network for Rollups designed to provide secure, high-throughput, low-latency transaction ordering and availability. short. Espresso Sequencer will engage Ethereum validators through resets. This staking capability of Espresso Sequencer is similar to EigenLayer, which allows validators from Ethereum to participate and can use ETH LST to stake these validators.

- Astria: Astria is a Sequencer service platform that allows Layer 2 platforms to share a single, simple, permissionless network of decentralized sequencers to join.

- Radius: Similar to Astria, it provides Shared Sequencer service for Layer 2 platforms on the market. The project successfully raised $1.7N at the Pre Seed round with the participation of Hashed besides Crypto.com, Superscrypt,…

Rollup As a Service Battle

Overview of Rollup As a Service

Rollup As a Service is a service that provides an infrastructure of available frameworks and SDKs to help developers easily build a Rollup platform that suits their own needs and goals. The level of customization here will be around Layers such as Execution, Consensus, Data Availabilty or Settlement. For example, a developer might build his Rollup according to the following model:

- Execution on its own platform.

- Consensus and Settlement will be implemented on Ethereum.

- Data Availability on Celestia.

With developers able to customize Layers to their liking, they will build Layer 2 platforms with different characteristics and target different needs, segments and ecosystems. That Layer 2 can become faster and cheaper than other Layer 2s, from there it can move towards the NFT, Gaming, Social market,… That Layer 2 can move towards decentralization and security and from there build Build a financial ecosystem such as DeFi, NFTFi, LSDfi,…

It can be seen that Rollup As a Service makes it easier for developers to access Layer 2. Obviously, in the context of many Protocols & DApps on Ethereum that need a lot of network optimization for their own products, Rollup As a Service is an effective solution. Rollup As a Service also helps projects develop Layer 3 platforms, not just Layer 2.

Potential projects in the Rollup As a Service industry

Some potential projects in the Rollup As a Service segment include:

- Caldera: Caldera is one of the popular RaaS platforms today. Caldera has integrated many different toolkits on the market such as Optimism’s OP Stack, Arbitrum’s Orbit Chain. Not only that, Caldera is moving towards an All in One Rollup platform when providing both Data Availabilty and Shared Sequencer services.

- Sovereign: It can be said that Sovereign will build Sovereign SDKs similar to how Cosmos builds its Cosmos SDKs, these blockchains will use zkRollup technology. Some of the advantages of Sovereign SDK include the fact that developers do not need to have cryptographic knowledge to use ZKP technology or that developers have many programming languages to choose from such as Rust, C++ ,… and can be executed on zkVMs

- Argus: Argus aims to build an SDK framework called World Engine so that developers can build their own blockchain for their Web3 games. The project successfully raised $10M in funding led by Haun Ventures

Ecosystem of Layer 2 Platforms

In fact, if Layer 2 projects are in an overrated state, the ecosystem of Layer 2 platforms from our perspective is in an underrated state. Because to find Hidden Gems with factors such as not yet launching Tokens, launching Tokens but capitalization is still low and products with many special or different features, there are still relatively many.

Let’s look at each ecosystem to see clearly:

- Optimism: Velodrome, Pika Protocol.

- Arbitrum: Jones DAO, Plutus DAO, Vertex Protocol, Vela Exchange,…

- Base: Aerodrome, Friend.tech, BSX, Avantis,…

In itself, if the money flows to Layer 2, the projects in the ecosystem will have very strong fluctuations as we saw when Arbitrum launched and the money flowed to Arbitrum, projects in the system such as Jones DAO, Plutus DAO, Vesta Finance, GMX, Treasure DAO,… all have incredible growth.

Summary of Layer 2 Investment Opportunities

Layer 2 is just the catalyst for many smaller trends to emerge, typically Layer 3, Shared Sequencer or DA Wars. Obviously, if we look closely we see many Layer 2 investment opportunities at the present time.

Hopefully through this article, people can find more Layer 2 investment opportunities.