NFTFi is out of step in the gloomy NFT market context with a series of alarming parameters about TVL, Volume, Active Users,… So are NFTFi projects still building and developing their products? Everyone, please join me in finding out in the article below.

To better understand the article NFTFi is out of tune in the context of the gloomy NFT market, people can refer to some of the articles below:

- What is NFTFi? Will NFTFi Become A Strong Trend

- NFTFi Trend: Is NFTFi’s Growth Dynamic Full?

- Actual Operation Situation of NFTFi Projects

- Summary of Potential Projects in the NFTFi Industry

NFTFi is out of step amid gloomy NFT market

The NFT market is gloomy

It could be said that the NFT market is truly experiencing its first winter. Determining that the NFT market is in winter is based entirely on the indicators of trading volume, user participation, price reductions of collections, news of the entire market, and more. comes with many other on-chain elements.

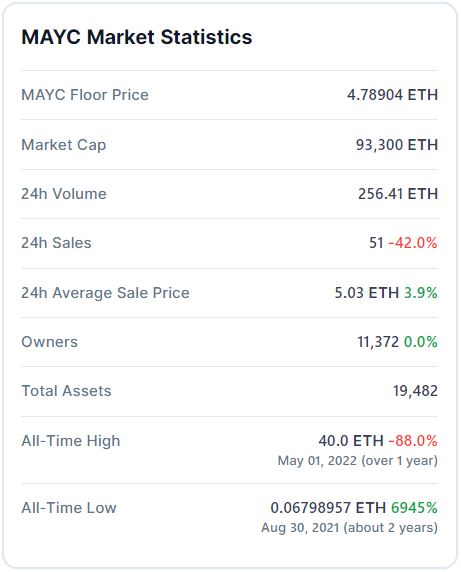

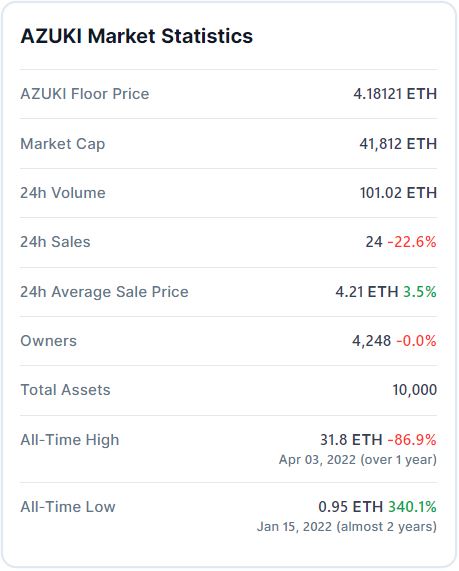

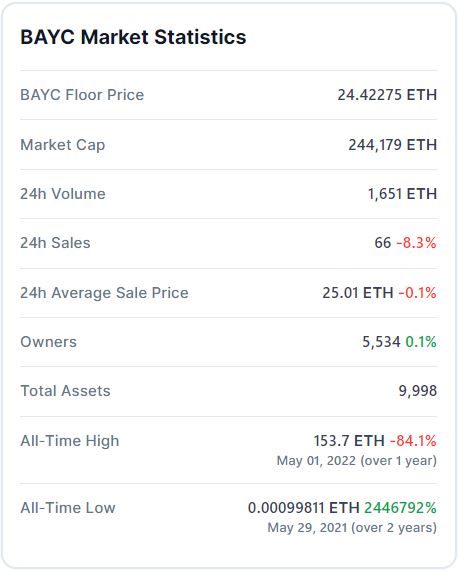

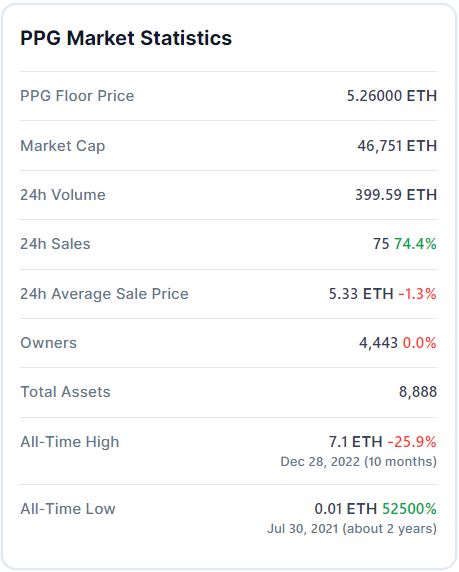

Looking at the prices of Bluechip collections such as BAYC, MAYC, Azuki, Moonbird,… there has been a sharp decrease of 80% or more, with the exception of the Pudgy Penguins collection which is still holding its price very well. thanks to their achievements in the real world. Does this remind people of anything in the Crypto market? This certainly reminds people of the prices of Altcoins such as Ethereum, Solana, Avalanche, Polkadot, Cosmos,… This is a typical sign of winter for asset types, which is the price. chief.

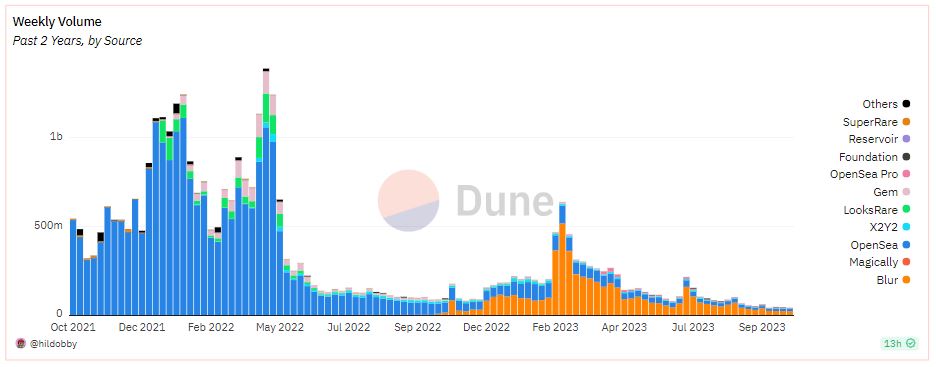

Along with the steady decline in prices of NFT Bluechip collections, the trading volume of the NFT market continues to bottom out in the late 2023 period. Currently, the trading volume of the NFT market is even lower than in the previous period. 2022 when a series of black swan events such as Terra collapses and FTX goes bankrupt. Many people are asking whether the NFT market can survive this period?

There were times when the total volume of the entire NFT market on Ethereum was lower than the trading volume of Friend.tech – the emerging SocialFi platform on Base’s ecosystem. According to the latest analysis articles of Weakhand NFT Monthly September: Is It Time to Catch the NFT Bottom for the Next Cycle? it is very possible that we are starting to enter the bottom of the NFT market in this cycle.

The outage of the NFT market lies not only in the on-chain indexes, but also in the fact that NFT projects have almost no outstanding activity. Most of the development teams of BAYC, MAYC, Azuki, Moonbird, DeGods,… are still only in the development stage without any significant achievements. Collaboration between major brands in Web2 with NFT projects has also not created a strong boost for the entire market.

The NFTFi market is out of tune

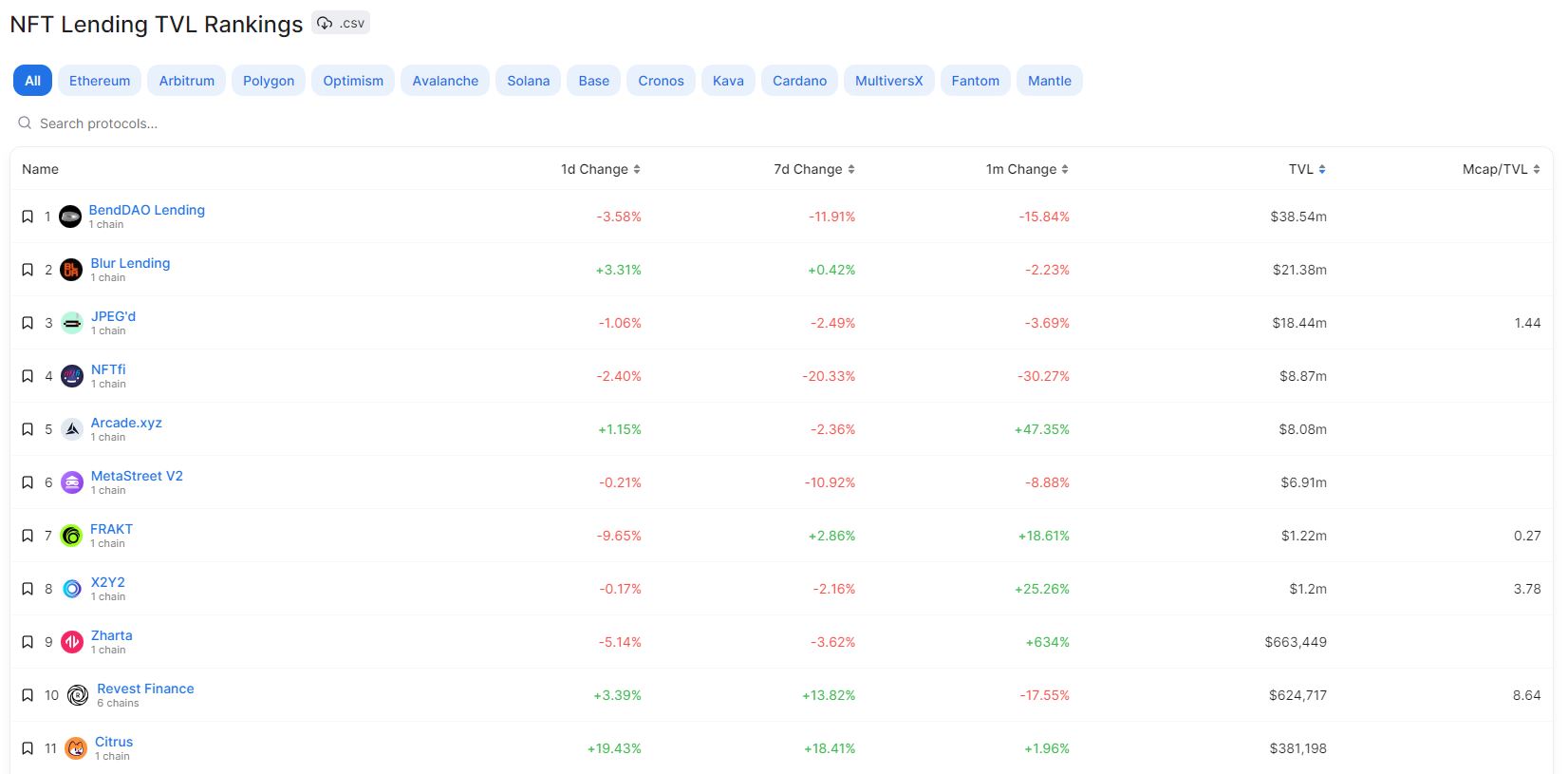

The sharp decline in the NFT market caused the entire NFTFi industry, especially NFT Lending projects, to also have a sharp decrease in TVL. In mid-2023, when the TVL of the entire NFT Lending industry reaches $400M, up to now there is only about more than $100M, equivalent to a 75% decrease, and this decrease is unlikely to stop.

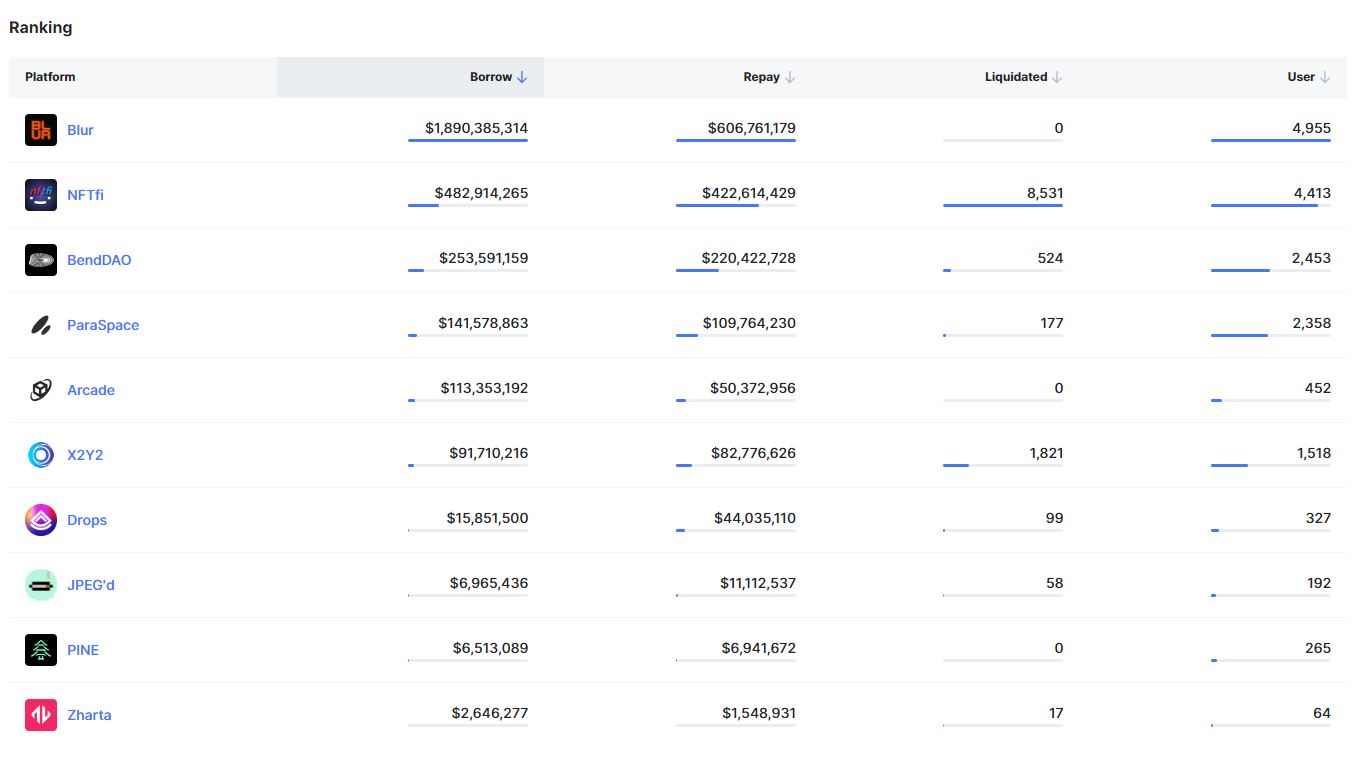

According to NFTScan, the number of users on NFTFi platforms is at a very low level and these numbers will continue to decrease in the future if the market does not recover. Besides, the current number of users participating in Lending & Borrowing mainly comes from the Blur platform, however most transactions on Blur are mainly aimed at incentives also from this platform. Therefore, it is difficult for us to determine how much the real demand is, but it will be much lower than the current number.

Besides NFTFi becoming boring, even the DeFi market is running out of attractive profit sources so ETH borrowed from NFT collateral is not becoming too attractive.

Will NFTFi be wiped out?

NFT and NFTFi have similarities with Crypto and DeFi. If Crypto disappears completely, there is a high possibility that DeFi will also be wiped out. In a similar situation, if NFT no longer exists, NFTFi certainly will not have enough motivation to exist. So to answer whether NFTFi will be wiped out or not depends on the question of whether the NFT market can survive this winter?

Some optimistic perspectives on the NFT market include:

- Diversification in fields of use: The NFT (Non-Fungible Tokens) market is not only limited to digital art trading, but also expands to many other fields such as video games, music, sports, real estate, and more again. This diversification brings great potential to the market and attracts diverse user groups.

- Preserve value and ownership: One of the important characteristics of NFTs is the ability to verify and certify ownership. The sole ownership concept of NFTs allows users to prove that they are the rightful owners of a particular digital asset. This could bring great value to NFTs and stimulate the growth of the market.

- The ability to connect art and technology: The NFT market has opened up a new approach for artists, allowing them to express and reach the public directly, without the intermediary of traditional media. Blockchain technology provides transparency and provenance verification for works of art, attracting the interest of both creators and consumers.

- Markets and scarcity: The NFT business model is based on the principle of scarcity, meaning that only a limited number of special editions or assets will be created. This creates appeal and value to NFTs. Thanks to scarcity, the NFT market can continue to exist and grow.

- Potential for creativity and expansion: The NFT market is blooming and constantly absorbing new ideas. The combination of blockchain technology and creative work opens up a lot of opportunities for creativity and expansion in different directions. Potential NFT projects like Metaverse and augmented reality (AR/VR) could help NFTs survive and thrive in the future.

While there may be some challenges and volatility in the market, the above factors demonstrate the potential and versatility of NFTs in redefining the way we approach owning and trading assets. digital product.

What NFTFi Projects Are Doing In The Current Landscape

BendDAO – Leading project in Lending & Borrowing segment

The last time BendDAO had product changes took place in July 2023 when BendDAO officially supported a new product, USDT, which meant that users could mortgage NFT to borrow USDT. Additionally, users can deposit USDT into the protocol to receive interest. In the context of a downtrend market, borrowing Stablecoins becomes more attractive than borrowing ETH directly.

In addition, BendDAO only has a few community activities with the NFT market in general and other NFTFi projects in particular.

Blur Lending – Live with Incentive

From the moment NFT Marketplace launched Blend, Blend quickly rose to become the largest P2P Lending platform in the NFTFi market. The explanation for Blend’s rapid success comes from Incentive BLUR, which means that users who pledge NFTs and borrow from the protocol can receive additional rewards in BLUR, plus Blur is supported by many Large VCs like Paradigm make BLUR more valuable in the eyes of the community.

Up to now, Blend’s products have not changed much. The biggest change comes from Blend continuously adding NFT collectibles as collateral on its platform.

JPEG’d – Add value to JPEG

JPEG’d’s products have not changed much in recent times. JPEG’d still follows its original development path of allowing users to mortgage NFTs to mint pETH. NFT marketplace CDP platform.

The biggest difference of JPEG’d comes from improving the JPEG model through several steps as follows:

- Step 1: Use NFT as collateral to borrow pETH.

- Step 2: Add liquidity to the pETH – WETH pair on the Curve Finance platform and receive LP Tokens.

- Step 3: Deposit LP Tokens into Auto-compounder to receive even more rewards as JPEG’d holds a large amount of CVX and receives representative tokens.

- Step 4: Send Representative Tokens to The Citadel to receive an additional reward of JPEG.

The main goal of JPEG’d is to promote liquidity for the pETH – WETH pair. As of the time of writing, The Citadel’s TVL is $5.28M

NFTPerp – Launched version V2

NFTPerp V2 was born to solve the uPnL problem for traders.

Everyone can refer to the article NFTPerp V2 Review: Ending V1 And Moving Towards NFTPerp V2 to better understand the V2 version of NFTPerp.

Personal Comment On NFTFi Market

It can be seen that NFT Lending projects have almost no breakthroughs in their products. Most of the major changes are product upgrades that are expected to have a positive impact on the protocol in the long term. This is quite understandable, if we look back at the Lending & Borrowing segment in the DeFi market such as AAVE, Compound, Maker DAO also did not launch new products in the recent period.

Given that liquidity is the biggest problem with the NFT market, this also hinders the growth of the NFTFi industry. Obviously, if the market liquidity is thin, it will certainly be difficult for NFTFi to develop higher pieces.

For me, it is very difficult to have hope for the NFTFi market right now because if the NFT market does not recover, it will be almost impossible for NFTFi to reverse the wind. However, this time is an extremely good time for us to monitor projects that are actually being built and developed.

Summary

NFTFi is expected to become one of the big trends in the Crypto market, however it is facing major challenges as the NFT market is getting worse and worse. Hopefully through this article, everyone will have more perspectives on the situation of the out-of-step NFTFi industry in the context of the gloomy NFT market.