Real World Asset is one of the extremely potential industries in the DeFi ecosystem that is showing signs of decline. RWA plays an important role in driving engagement with DeFi & TradFi. Let’s summarize potential projects in the Real World Assets industry in the article below.

To better understand RWA, people can refer to some of the articles below:

- What Are Real World Assets (RWA)? Potential Projects In RWA Array

- Will Real World Assets (RWA) Become Narrative After LSDFi

Real World Asset Overview

Definition of Real World Asset

Real World Asset, abbreviated as RWA, is an ecosystem of projects with the goal of bringing DeFi and TradFi together with real interactions. Some typical examples include:

- Users in DeFi can lend money to organizations and individuals outside of TradFi.

- Users globally can buy and own US Government Bonds – the safest Bonds in the world today.

- Users outside of TradFi can mortgage real-world assets to participate in Lending & Borrowing on DeFi.

- Platforms in DeFi can use real-world assets to issue Stablecoins.

We have countless different applications being explored by developers in the RWA market. Currently, the TVL of the entire industry is only about $1.5B with 25 projects compared to the entire DeFi industry of $40B or the current largest industry, LSD, of $20B. Even compared to the real estate market, RWA still has too much growth momentum. develop in the future.

Barriers to the Real World Asset industry

Not only does great potential come with advantages, there are still undeniable barriers to the Real World Asset industry including:

- Lending in the form of subprime mortgages or unsecured loans in exchange for high interest rates can lead to the project being “exploded” by the debtor into bankruptcy. We have seen this problem happen with Maple Finance or Goldficnh.

- Legal issues. Currently this problem has not happened but I believe that sooner or later there will be legal problems with projects in the RWA segment. Maybe because the projects are still small, the SEC hasn’t noticed yet. The SEC is still focusing on the lawsuit with Grayscale and Bitcoin ETF Spot.

- The profits of the RWA industry will be attractive in the downtrend but in the uptrend, if there is no change to become relevant, the industry will not receive too much attention.

- There is no uniformity because each project has different standards.

Recognizing the barriers and difficulties of the industry helps us have a more objective, overview view of the entire industry to limit FOMO leading to investment losses.

Summary of Potential Projects in Real World Assets Industry

Ondo Finance – Bringing users access to US bonds

Ondo Finance in the past was a project in the Liquidity As a Service (LaaS) segment that allowed projects to rent abundant liquidity from users. However, the downtrend came and this business was no longer as attractive as when DeFi exploded and Ondo Finance shifted to the RWA industry. Ondo V2 offers many products including:

- USDY: stands for USDollar Yield Token is a tokenized token backed by short-term US Treasury bonds and bank deposits. USDY aims to be an interest-bearing Stablecoin and is pegged to $1.

- OUSG: Users will deposit USDC into the platform. USDC will be converted into USD and buy assets such as US government bonds or corporate bonds, which are all types of assets with low risk, high liquidity and safety. The protocol and users will share profits with each other and users can reclaim their USDC at any time.

- OMMF: This product helps users access US Money Markets, looking for investment opportunities in the foreign exchange market. One of the world’s largest liquid markets.

- OHYG: This product will target high-yield corporate bond ETFs. In addition, there is also a small portion of USDC and USD to ensure product liquidity.

- Flux Finance: is a version similar to Compound V2 that allows users to profit from depositing Stablecoins into the protocol and vice versa.

100% of Ondo Finance’s current products demonstrate the goal of promoting interaction between DeFi and TradFi. In the context of a downtrend, DeFi becomes risky, US interest rates continue to increase, products such as US government bonds are a gold mine for Crypto projects. Not only Ondo Finance, Maker DAO or Tether all hold a large amount of US government bonds.

Ondo Finance has successfully raised $34M by many large investment funds such as Pantera Capital, Coinbase Ventures, Tiger Global Management, Wintermute, GoldenTree,… There are also many rumors that Ondo has relationships with organizations Large financial institutions like BlackRock.

Goldfinch – Maple Finance – TrueFi: Take a slice of the Credit Protocol cake

It’s hard to say that Goldfinch, Maple Finance or TrueFi are the projects leading the Credit Protocol segment. Simply imagine Credit Protocol, which is a protocol that mobilizes cash flow (usually Stablecoin USDC) from DeFi to lend to organizations and individuals in the real world. In order for real-world organizations and individuals to borrow from the protocol, they must KYC and have collateral. However, borrowing in these protocols is easier, with less collateral than bank loans.

In return, DeFi users receive high profits of 12 – 18% and this is a fixed profit. The difference between the 3 protocols is:

- Goldfinch: Focus on lending to emerging markets such as Asia. The companies that Goldfinch targets are mainly startups that have passed the early stages and are starting to have their first revenue.

- Maple Finance: Previously, Maple also focused on organizations around Crypto, but with the lesson from “clearing debt”, Maple Finance has also approached other markets so as not to be affected by risks from organizations in the market. Crypto school.

- TrueFi: The user base that TrueFi targets is the difference. TrueFi aims to provide credit loans to reputable individuals in life through KYC.

There are also many rumors about Goldfinch having cooperative relationships with Blackrock – Wall Street’s largest financial institution managing about 10 trillion dollars. However, this segment also has many risks such as Maple Finance having bad debt due to the collapse of FTX & Alameda Research and Goldfinch also facing difficulties when one of the companies (debtor) is facing financial difficulties. .

Centrifuge – Intermediate step connecting CeFi & DeFi

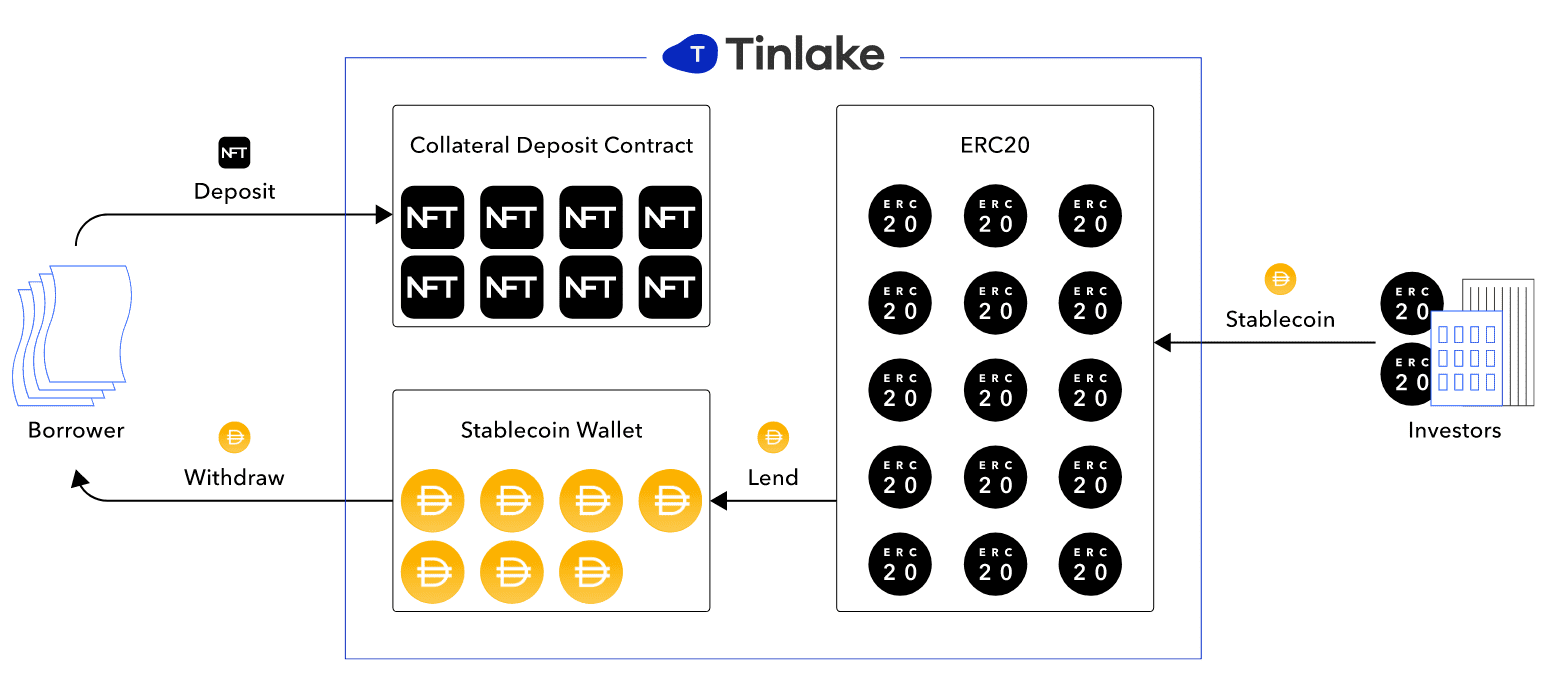

Centrifuge’s first product is Tinlake, which allows real-world investors to Tokenize Real World Assets into NFTs on Centrifuge’s own network. From there, through Tokenization, real-world assets can participate in the DeFi network with many different industries AMM, Lending & Borrowing, Derivatives,…

Centrifuge’s product is so good that Maker DAO used Tinlake technology to put real-world assets as collateral on Maker DAO to mint DAI. In addition, Centrifuge also built Centrifuge Chain as a Layer 1 on Polkadot, using Polkadot’s Substrate framework technology to help improve security and speed.

Some other outstanding projects in the RWA industry

Some outstanding projects in the RWA industry include:

- Matrixdock: Is a digital assets platform (Digital Assets) that provides institutional investors with access to tokenized real world assets (RWA).

- RealT: Is a real-world Real Estate coding platform that allows real estate to be uploaded to Web3.

Summary

Above is a summary of potential projects in the Real World Assets industry with many notable names such as Centrifuge, Maple Finance, Goldficnh, Ondo Finance,…