What is zkLink? zkLink is an infrastructure solution that helps developers easily build a DApp based on zkRollup technology with high customization. zkLink attracts the attention of many investment funds such as Coinbase Ventures, Cypher Capital, Big Brain Holdings, Houbi Ventures, GSR Ventures, Arrington XRP capital, Skynet Tradung, ZBS Capital,…

Why does zkLink have such appeal? Let’s find out together in the article below.

Overview of zkLink

Crypto market landscape

The Crypto market is growing with new products, new upgrades or new breakthroughs in all industries. However, development always comes with challenges that make projects headache such as:

- Liquidity fragmentation: The number of Blockchains is increasing over time at an exponential rate, causing users’ assets to be fragmented into different chains, thereby causing liquidity to also be fragmented, making it difficult for users to transact with them. the risk of slippage, and for liquidity providers, it is Impermanent Loss.

- Multichain deployment challenge: In the context of each Blockchain using a different language and virtual server, projects are forced to rewrite code, thereby posing challenges for developers. Even EVMs will still have differences.

- High cost: User when desired Exchanging token A on chain A for token B on chain B via DEX will go through a cumbersome, time-consuming and costly process.

- Security: From the above factors, multichain protocols, especially cross-chain, will encounter problems related to Smart Contract vulnerabilities.

What is zkLink?

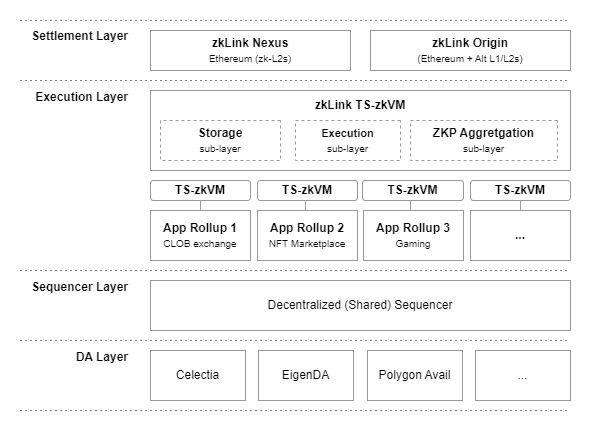

zkLink is an Multichain zkRollup Infrastructure (multi-chain zkRollup infrastructure platform) is composed of 4 Layers including:

- Settlement Layer

- Execution Layer

- Sequencing Layer

- SKIN Layer

These layers will be separated to be customizable depending on the developer’s needs, because each developer may wish to build a zkRollup specifically designed to suit the industry they are working in, for example. DeFi prioritizes security, Trading, GameFi & NFTs require scalability.

First, we will come to the concept Multichain zkRollup. This concept allows rollup contracts not only on a Layer 1 but also across multiple networks Layer 2 same time. In the zkLink model, Only one chain is chosen as the Primary Chain to perform ZKP (Zero Knowledge Proof) verification, while the other chains only need to play a supporting role called Secondary Chain without ZKP verification. This factor makes verification on the Primary Chain synonymous with verification of all Secondary Chains.

Principle of operation of Multichain zkRollup includes some basic steps as follows:

- Commit: Sequencer synthesizes all data from Secondary Chain to Primary Chain. On-chain Contract on Primary Chain will verify data from Sequencer using ZK Proof.

- Prove: ZK Proof of Secondary Chains will be proven on Primary Chain by On-chain Contract.

- Synchronize: After proving the authenticity of ZK Proof, data synchronization will take place on both Primary Chain and Secondary Chain.

- Execute: The execution process will be similar to regular zkRollup platforms.

Next we come to zkLink’s Settlement Layer including:

- zkLink Nexus: zkLink Nexus are Layer 3 where transactions will be settled and status updated (state commitment) directly on zkRollup platforms such as Starknet, zkSync, Linea, Scroll,… and finally to Ethereum.

- zkLink Origin: zkLink Origin will allow transactions to be settled and status updated on Ethereum, Layer 2 (can be Optimism or Arbitrum) or Layer 1 provided that these platforms must support Zero-knowledge technology .

To maintain connectivity between Layer 1 and Ethereum, zkLink is introduced Light Oracle Network is a cross-chain messaging solution.

Next we come to the Execution Layer. Here, zkLink introduces TS-zkVM as a highly efficient ZKP execution environment specially designed for projects in the fields of Oderbook, Spot, Derivatives, NFT,… Besides, in terms of Data Availability, there is also zkLink Nexus and zkLink Origin both support Validium, in addition to DA solutions from third parties such as Celestia, EigenDAAvail,… to meet diverse needs from developers.

Some differences of zkLink

Some differences of zkLink include:

- Users on zkLink have a single wallet address for all networks like Polygon, Starknet, zkSync, Linea, Arbitrum, Optimism, Scroll, Solana,…

- All assets will be unified into one wallet such as ETH on Arbitrum network, ETH on Optimism network, ETH on zkSync,… instead of being ETH (Arbitrum), ETH (Optimism), ETH (zkSync),… will be unified into a single ETH. Same with other assets.

- Helps developers easily build an App Rollup with Sequencer customization, Data AvailabilityNetwork Collections, Stetlement,…

zkLink’s ecosystem

zkLink started to have the first pieces of the puzzle such as:

- ZKEX: ZKEX is a DEX that allows users to trade tokens between Blockchains. Unlike current DEX exchanges that use the AMM mechanism, ZKEX uses an order-book mechanism to bring an identical experience to current CEX exchanges such as: Binance, OKX,…

- zkJump: Cross-chain solution with high speed and low transaction fees.

- Open World: Is a decentralized exchange on the zkLink ecosystem.

Development Roadmap

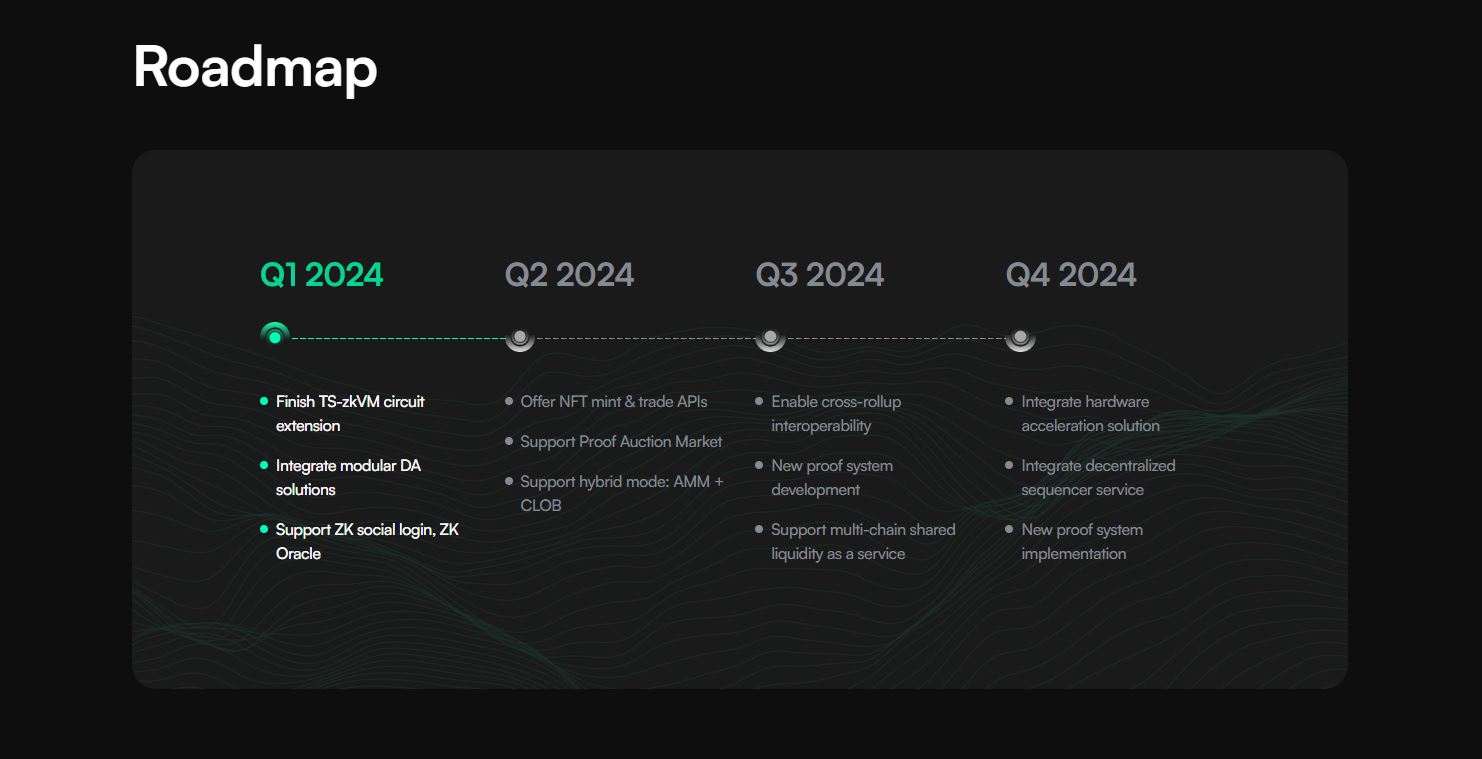

zkLink’s development roadmap in 2024 is divided into 4 stages:

- Q1/2024: Integrate more DA solutions and support ZK Social Login and ZK Oracle solutions.

- Q2/2024: Supports AMM + CLOB and Proof Auction Market models.

- Q3/2024: Develop a new proof system, allowing cross-chain interaction.

- Q4/2024: Integrate Decentralized Sequencer services, deploy new proof systems, and integrate solutions for hardware acceleration.

Investor

- September 22, 2021: At the Seed round, zkLink successfully raised $8.5M led by Republic Crypto with the participation of Houbi Ventures, GSR Ventures, Arrington XRP capital, Skynet Tradung, ZBS Capital,…

- May 4, 2023: At the Seed round, zkLink successfully raised $10M with the participation of Coinbase Ventures, Cypher Capital, Big Brain Holdings,…

Core Team

Update…

Tokenomics

Public Sales information on Coinlist

- Deployment date: January 25, 2024

- Price and Lockup Terms: $0.15 per ZKL of which 30% will be unlocked on March 31, 2024 and paid in installments over the next 9 months.

- FDV: $150M

- % Total Supply: 3.125%

- Selling amount:31,2500,000 ZKL (ERC 20)

Token Allocation & Release

Update…

Token Use Case

ZKL will be used in a number of cases as follows:

- ZKL is a payment token for DApps access the zkLink service and pay for the use of the network’s block space.

ZKL will act as a Governance Token with some characteristics such as:

- DApps must stake ZKL to gain access to Manager Contract.

- Validators must stake ZKL as collateral to participate in the process of creating ZK Proofs and receive rewards from there.

- zkLink Eco dApps users will be motivated to buy and hold ZKL to unlock special user perks and rights such as transaction fee discounts.

- ZKL holders can stake ZKL to obtain veZKL to launch proposals and vote on proposals to coordinate the development of the protocol.

Exchanges

Update…

Project Information Channel

Summary

zkLink is a comprehensive solution for developers who want to build a Layer 2 or even a Layer 3 according to their own needs. Hopefully through this article everyone can understand more about what zkLink is?