UniswapLabs announced launched the UniswapX Protocol product on July 17, 2023. UniswapX is in the Mainnet Beta phase so the product is not yet smooth and fully featured, but the product has been integrated into the Uniswap dApp.

With the combination of available products combined with UniswapX, Uniswap will certainly take the majority of the market share and smash the ambitions of rival DEXs because Uniswap is simply too optimized and too fast to catch up. So what is UniswapX? What are the highlights of UniswapX Protocol? Let’s find out in this article!

To understand more about UniswapX, people can refer to the following articles:

- What is Uniswap V3? Is Centralized Liquidity Changing the Crypto Market

- What is Uniswap V4? Will Uniswap Continue to Lead the AMM Field?

- What is TWAMM? Why Was TWAMM Developed In Uniswap V4

- Uniswap & Trader Joe: Centralized Liquidity War. Is Joe the Winner?

What is UniswapX?

Uniswap is a protocol developed by Uniswap to integrate into the Uniswap dApp to bring optimal user experience with benefits such as good prices, refund of failed transactions, MEV protection and support for financial transactions. cross-chain production.

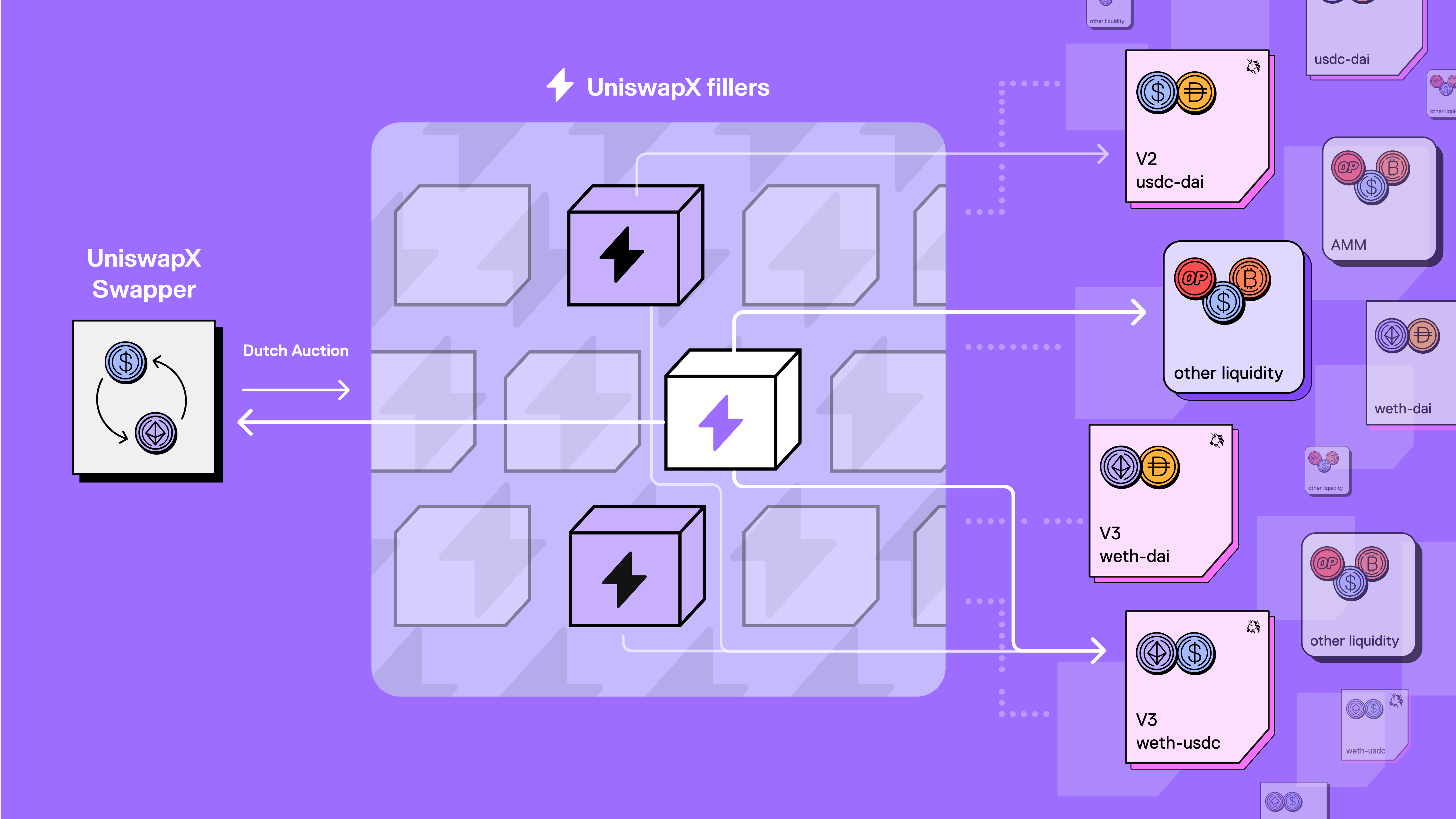

UniswapX is based on the Dutch auction mechanism, which means auctioning from high to low. UniswapX will operate on EVM chains. UniswapX aggregates both onchain and offchain liquidity, internalizes MEV in the form of price improvement, provides gas-free swaps, and can be expanded to support cross-chain trading.

To make it easier to understand, you can imagine that UniswapX is a DEX Aggregator and other utilities on Uniswap. UniswapX will be a combined product with previous products such as Uniswap V2, V3 or upcoming V4. When you do a Swap on a Uniswap dApp you are using UniswapX, and when you provide liquidity you can provide AMM Uniswap V2 or V3.

UniswapX Highlights

- Better prices by aggregating liquidity sources.

- No need to use original Tokens like ETH, MATIC,… to pay network fees.

- Protects against MEV.

- There are no fees for failed transactions.

- And in the coming months, UniswapX will expand to cross-chain swaps.

UniswapX’s Working Mechanism

Aggregator

UniswapX routes transactions or orders to the Liquidity Pool offering the best price which can be one of the Uniswap versions V2, V3, V4 or possibly another DEX. Aggregator is committed to providing users with the best prices when trading on Uniswap.

UniswapX also supports orders that, unlike regular limit orders, always execute at their limit price. These orders are executed in a Dutch auction style, executing at a price that depends on when it was entered into a block. The order starts at a price estimated to be better for the swapper than the current estimated market price and ends when placed on the block at the original price if the previous order cannot be filled.

For example: If the current market price is 1,000 USDC per ETH, a sell order could start at 1,050 USDC per ETH. The price of the order then decreases over time until it reaches the lowest price the swapper is willing to accept (for example, 995 USDC per ETH).

Gas-free Swapping

With UniswapX traders sign an offline order, which is then filled by alternative gas payers (Fillers). Thanks to this, traders do not have to pay gas fees, so they do not need the chain’s native network tokens (e.g. ETH, MATIC) to trade or pay anything for a failed transaction.

Fillers factor gas fees into the swap price, but can reduce transaction costs by bundling multiple orders to compete for the best price. Additionally, users still need to pay gas fees in specific cases, such as for initial token approval.

MEV Protection

On UniswapX, there are arbitrageurs trading MEV for profit. Those profits will be returned to traders to provide better prices. Paying MEV profits to traders is completely automatic right in the trading order being executed.

Support Crosschain

According to the plan for the end of 2023, UniswapX will support Crosschain transactions. That is, users can swap assets in the source chain to any asset in the destination chain. This product will use 3rd party bridges to support cross-chain swaps.

The project has not announced that it will use an embedded bridge, perhaps a synthetic bridge looking for the best price. From a personal perspective, UniswapX can use Circle’s CCTP, CCIP’s Chainlink, LayerZero interoperability or through an Omnichain asset for the best price.

Personal Projections About UniswapX

With this product, Uniswap is a very comprehensive DEX. Uniswap is still the top DEX with the highest trading volume and liquidity but sometimes there are some assets that have good prices in other DEXs. With UniswapX integrated, there is no reason for users to use any other DEX.

UniswapX will help Uniswap affirm its number one position in the DEX segment and continue to maintain it in the future. Thereby, we can see that the project development team is still actively bringing the best products to the market.

Uniswap will also threaten other DEXs like Aggregator or AMM, but from a personal perspective, Aggregator projects will be the most at risk. Crosschain Dexes like Stargate are equally risky. AMMs that can support specialized niches such as Stablecoin, LST or some special mechanism that can bring better prices than AMMs on Uniswap can still exist and grow. Especially platforms like LayerZero, CCTP or CCIP continue to be technologies for the future and can support the Crypto or Uniswap market very well.

Summary

UniswaX Protocol is a strategic product to help Uniswap perfect its product and target the Mass Adoption market. It not only affirms and enhances Uniswap’s position in the DeFi market, but also poses a threat to other Dex. But the market is like that, if it doesn’t get better it will be eliminated, what’s left will continue to grow.

So I have clarified what UniswapX is? Hope this article brings you a lot of useful information!