We have talked a lot about the potential of NFTFi projects but we have never talked about the actual operation of NFTFi projects such as TVL, Trading Volume, Active User,… and through the With that index we can somewhat evaluate the effectiveness of the platforms.

However, to have an overview of this article, people should refer to some of the articles below:

- What is NFTFi? The Future of NFTs in the Crypto Market

- Summary of Potential Projects in the NFTFi Industry

And together they will get right into the actual operations of NFTFi projects.

NFTFi Overview

NFTFi stands for NFT Finance with the goal of bringing NFT collections to financial activities such as Lending & Borrowing, AMM, Derivatives,… Meaning instead of simply holding NFTs In their wallet, they can lend, provide liquidity, stake, use as collateral to open leverage orders,…

The birth of NFT has many similarities with the coins/tokens at the time of 2017 – 2018 that were simply held, so the birth of DeFi is a quite obvious story, so the birth of NFTFi is also a natural story. course.

At the present time, when looking at projects belonging to the NFTFi puzzle, we have seen similar DeFi puzzle pieces appear quite fully such as:

|

Branch |

Project |

|---|---|

|

NFT Marketplace |

Opensea, Blur, LookRare, Magic Eden, Mintbase, Paras, X2Y2, Rarible, Trove,… |

|

AMM |

SudoSwap, HadeSwap, NFTX, Uniswap (combined with SudoSwap to build AMM for NFTs),… |

|

Lending & Borrowing |

Pine Protocol, JPEG’d, BendDAO, Drops, ParaSpace, Frakt, NFTfi, Flowty, Taker Protocol, Arcade, Zhata, Sharky, Sodium, Zumer,… |

|

Derivatives |

Hook, NFTPerp, LiquiFi Labs, Nifty Option, Floor DAO, Jpe, OpenLand,… |

|

NFT Management |

Zerion, Metamask Portfolio, Zapper, WGMI, Rabby Wallet, Debank, Rainbow,… |

|

Some other segments |

Haliday, Voyage, Upshot, Meritic, Banksea, Deep NFT Value, Abacus,… |

Pieces such as NFT Marketplace, Lending & Borrowing are growing the most strongly but have many different models. However, more complex pieces such as Derivatives and AMM are facing many problems in liquidity fragmentation because unlike tokens, where all tokens are the same, NFTs have different characteristics and rarities, leading to Prices vary.

Actual Operation Situation of NFTFi Projects

SudoSwap – Health indicators show negative signs

SudoSwap is a first AMM platform for NFT collectibles where users can swap ETH into NFTs. It can be said that SudoSwap is completely different from the current popular NFT Marketplaces. It can be said that NFT Marketplaces are Order Book platforms.

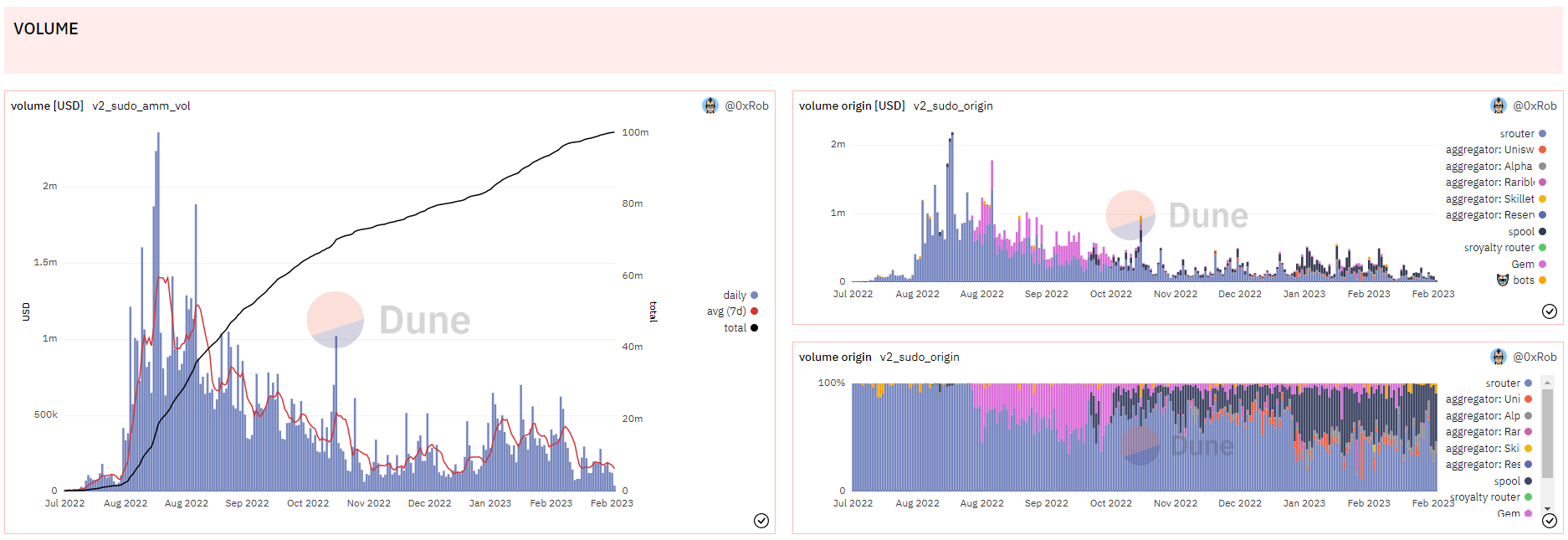

Trading volume of the SudoSwap platform

From the table above we can see that SudoSwap’s trading volume increased very strongly in August 2022, but after that the platform’s volume decreased rapidly and there was only a slight recovery along with the market at the beginning. years, but after that the platform’s volume returned to a downward trend.

Up to now, the daily trading volume on SudoSwap is only about a few hundred thousand dollars, which is a relatively small number compared to Uniswap at its inception.

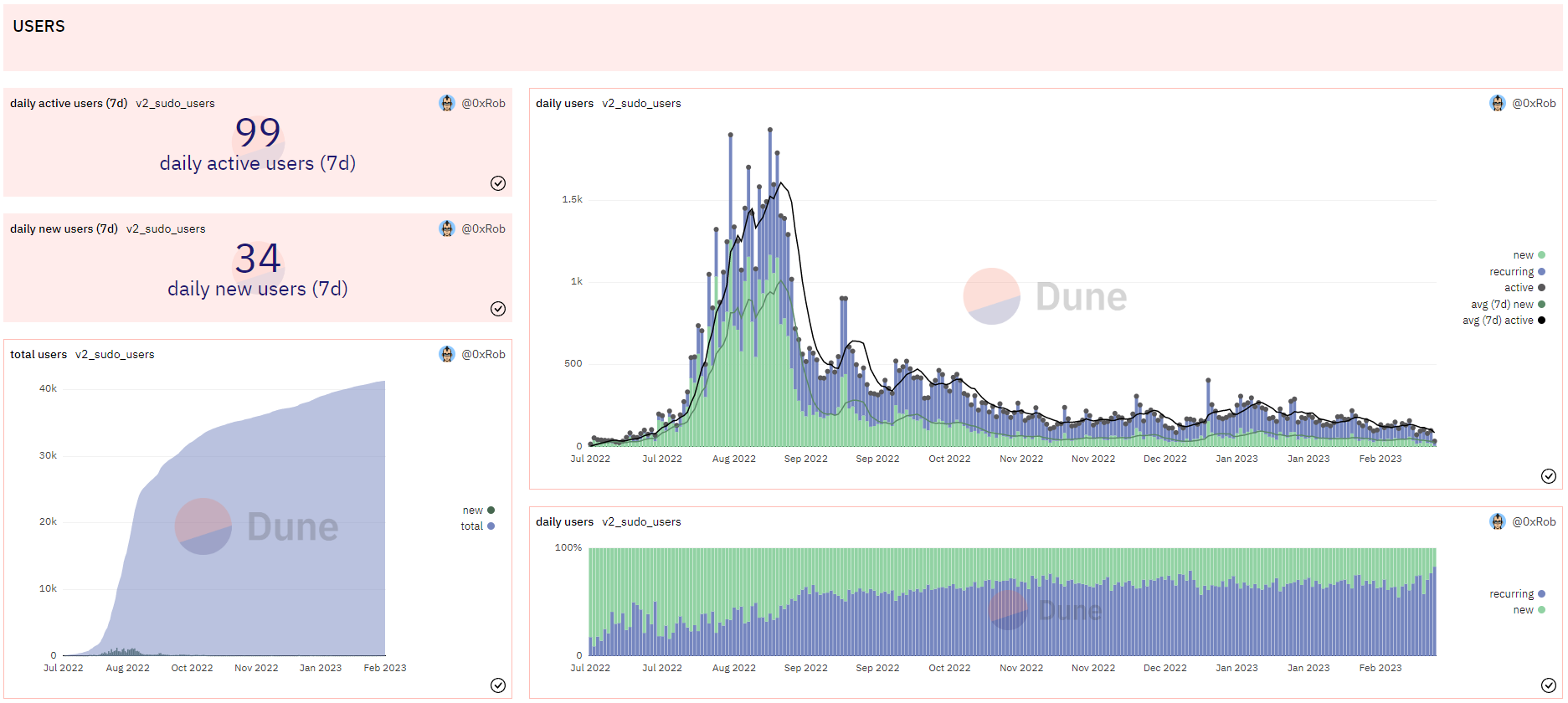

Number of users on the SudoSwap platform

Similar to the volume number, the number of new users and regular users on the SudoSwap platform is decreasing greatly and quickly with no recovery in the early part of the year when the entire crypto market warmed up. As of now, 80% of SudoSwap’s regular users come from former users of the platform.

After a period of strong growth in August, SudoSwap has entered a temporary saturation period when Sudo’s AMM model is not really more effective than the currently popular NFT Marketplace.

And we ask ourselves whether the AMM model with NFTs is really better than the Order Book model that NFT Marketplaces are using? Remember that Order Books are very popular in CeFi, but due to factors of underlying liquidity fragmentation in DeFi, AMMs are more dominant than traditional Order Books.

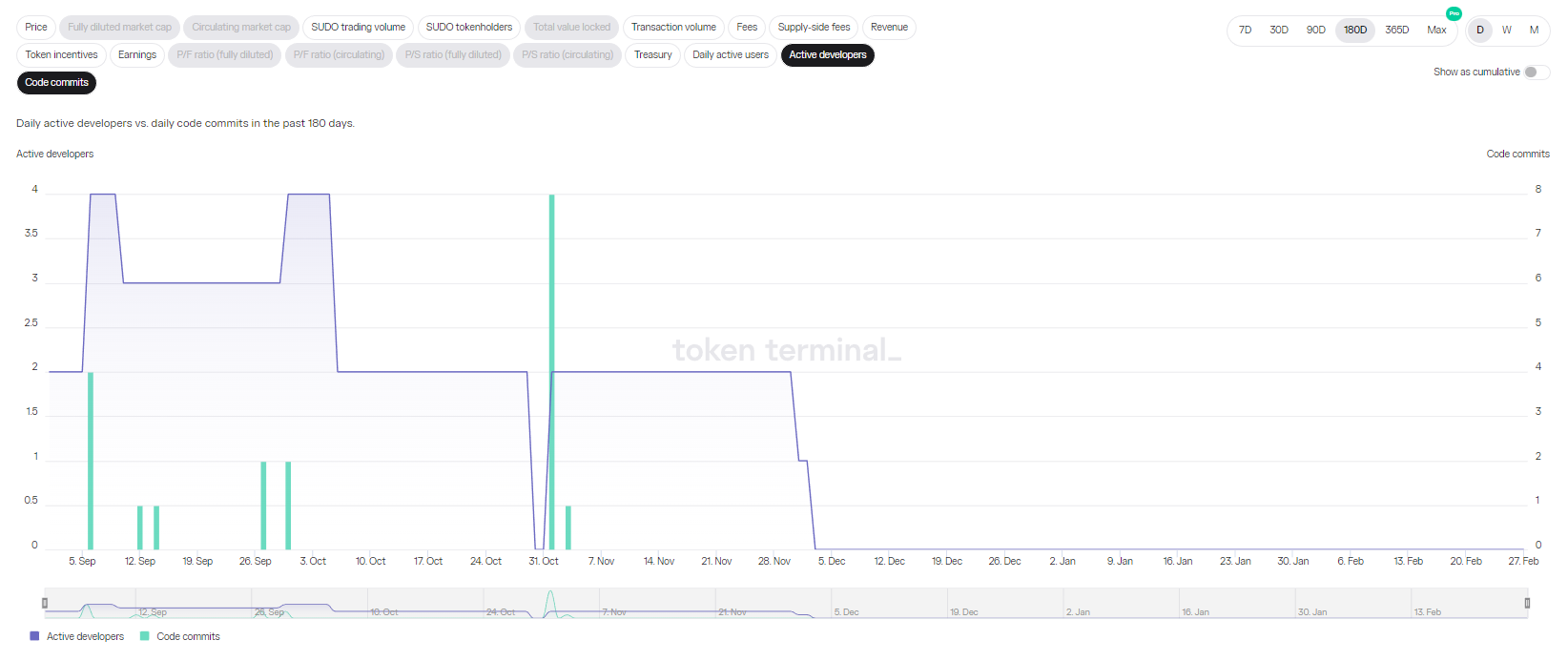

Code Commits and Active Developers metrics

Even more alarming are the indicators of Code Commits and Active Developers (source: Token Terminal). Regarding the activities of developers on the SudoSwap platform, there have been no further updates since September 2022 until now. So what are SudoSwap developers doing now? Are they focusing on researching a new AMM for NFTs with Uniswap.

BendDAO – Lending & Borrowing Platform has many positive signs

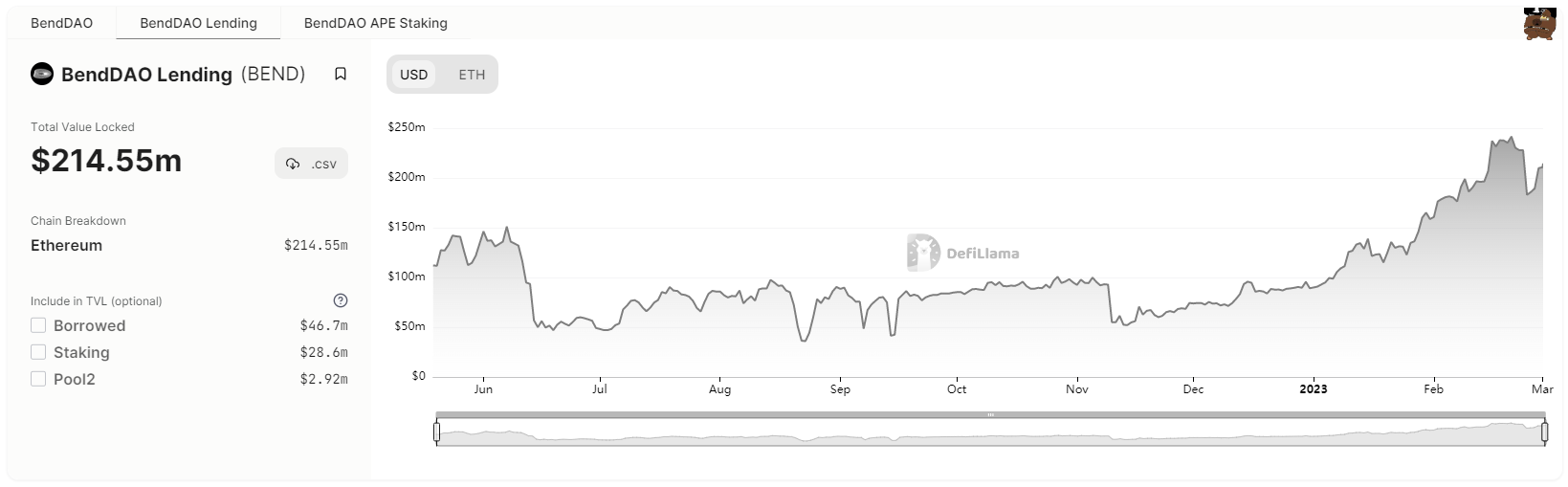

TVL of the BendDAO platform

BendDAO’s TVL reached an ATH of nearly $250M at the end of February 2023, proving the attraction of BendDAO in particular and NFTFi in particular. However, to reach this ATH level, BendDAO must also implement the Liquidity Mining program.

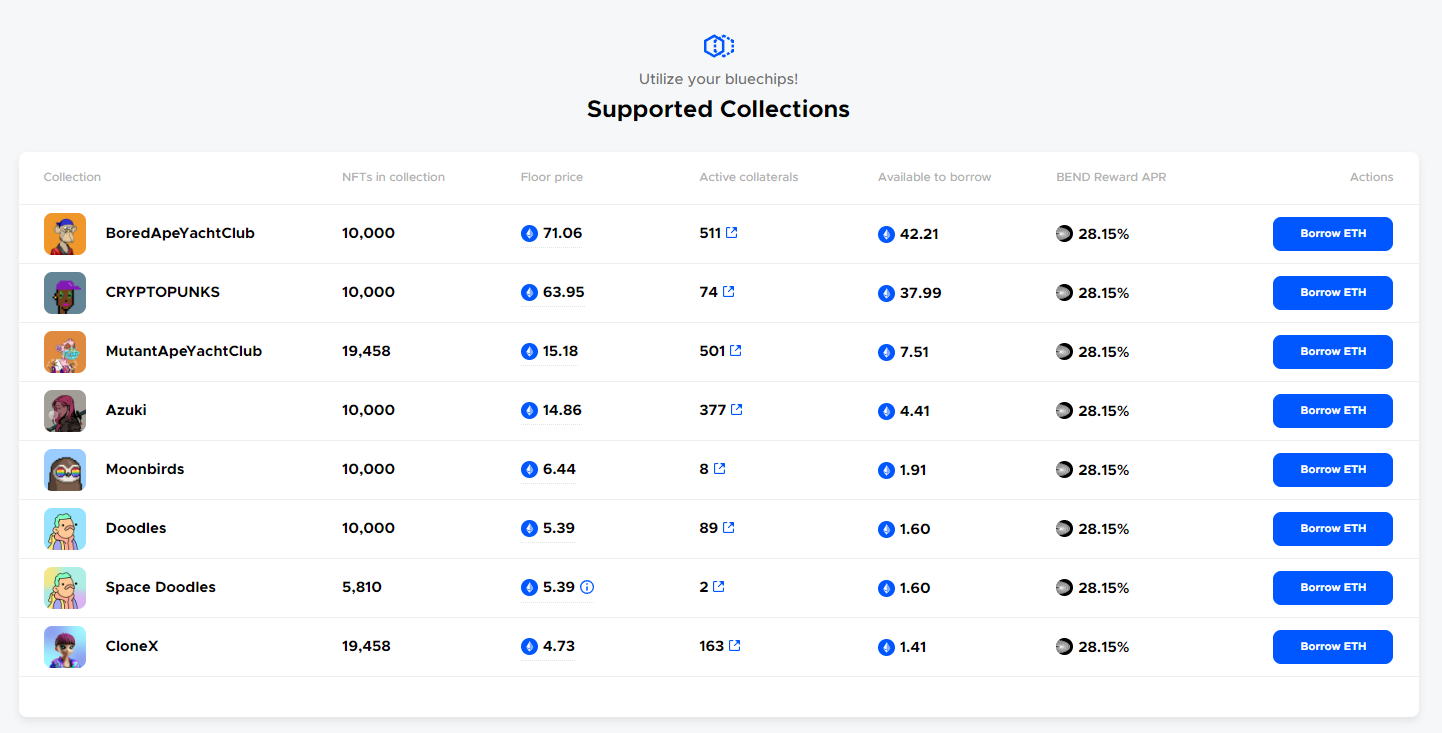

Currently, similar to other DeFi platforms, BendDAO is also organizing a Liquidity Mining program to bootstrap liquidity for the platform with an APR of up to nearly 30%. According to Coingecko, BendDAO’s current market supply is about more than 500 million BEND tokens, but BEND’s total supply is up to 10B tokens, so there will be many tokens left for BendDAO to stick to this strategy.

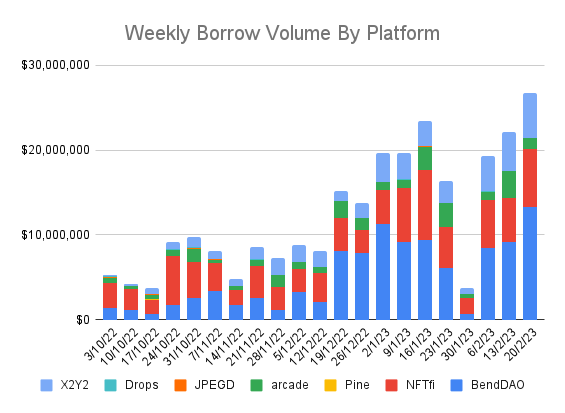

Lending volume of NFT Lending protocols

We can see that the loan demand of NFT Lending platforms is growing quite well from October 2022. Above we see protocols like BendDAO, NFTfi, Pine, Arcade.xyz, JPEG’d, Drops and The above is approximately $300M as of February 20, 2023.

We see that the amount of lending out has not reached 10%, which shows that NFT Lending protocols are not working effectively. At this time, users mainly deposit NFT or ETH into the protocol, but the need to borrow from NFT Lending platforms is still relatively low.

JPEG’d in preparation for Convex & Curve Wars

It can be said that JPEG’d is the only platform that follows the CDP model, which means users can lock their NFTs to mint pUSD (the project’s Stablecoin similar to DAI) or pETH. At the moment, JPEG’d only sets the mint rate at about 30%, meaning that locking an NFT worth $100 will receive a maximum of $30 pUSD or pETH. This is a rather cautious approach from JPEG’d when their liquidity pools are still relatively thin.

Basic specifications on JPEG’d on February 28, 2023

Basic specs on JPEG’d on January 7, 2023

We will take a look at some of the achievements of JPEG’d in recent times. It can be seen that from the beginning of the year until now JPEG’d’s TVL has had a remarkable growth, increasing from $19M to $34M, besides NFTs Deposited and JPEG Boosts have grown. I personally see that JPEG’d’s team is also quite active in upgrading and developing the product.

One thing to note is that JPEG’d has defined the product in a long-term direction, why does Weakhand see that? Because currently JPEG’d has sold Bond to collect CVX, meaning users who put CVX into the platform will receive JPEG at a discounted price, besides JPEG’d also deducted Tresury to sell daily to buy CVX. This confirms that JPEG’d will participate in Curve and Convex Wars to win the most incentives for its liquidity pools. Currently JPEG’d holds 2% of the total CVX supply.

ParaSpace – The platform has many positive signals

ParaSpace is a project in the NFTFi segment with the goal of developing multichain and cross-chain. ParaSpace’s operating mechanism focuses on blue-chip NFT collections to issue nTokens and nTokens will be disseminated into DeFi arrays and protocols, thereby helping users easily earn profits. Proactively profit from your NFTs instead of having to wait for someone to borrow/borrow.

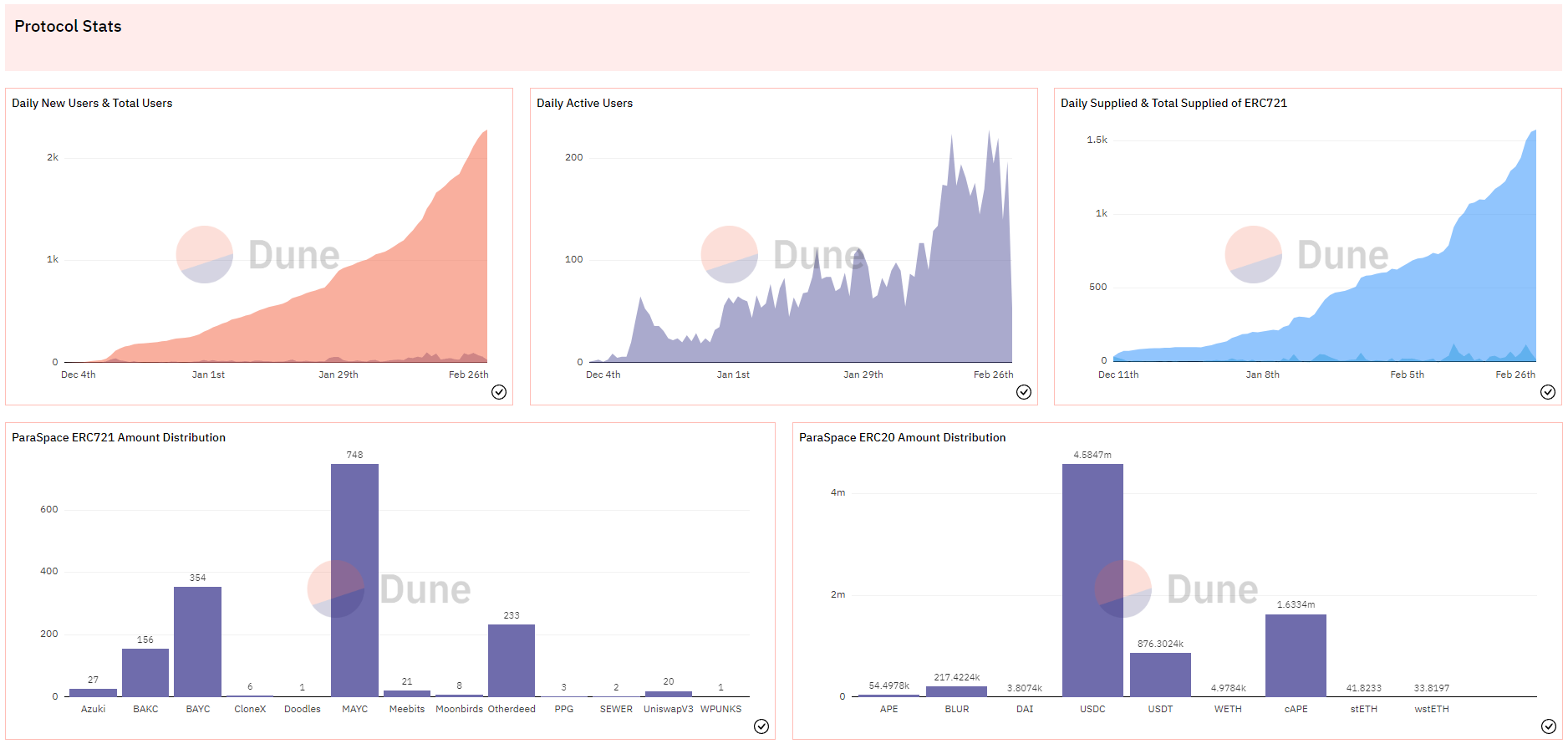

Some on-chain parameters of the ParaSpace project

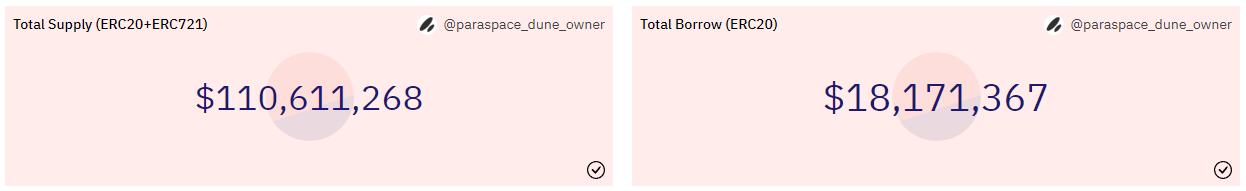

In the past 3 months, the ParaSpace project has had incredible growth when the number of Daily New Users or Daily Active Users has grown very strongly. Besides, surpassing many other major NFTFi platforms, ParaSpace is already the 2nd largest platform in the market with a total TVL of about $77M, second only to BendDAO. Besides, MAYC is also the most popular collection on ParaSpace currently.

ParaSpace started deploying its product in December 2022 with a modest starting TVL of only about $6M and now we have a growth rate of 1,200%, behind the growth there are a number of driving forces. Growth like:

- Diverse products such as Ape Staking, Lending & Marketplace help users optimize their experience on a single platform.

- No Fees February Program: ParaSpace platform has waived gas fees for auto-compounding services for both products, P2Pool & P2Peer.

ParaSpace Borrowing and Lending Index

However, ParaSpace’s borrowing and lending ratios are still relatively low. The project should have more strategies in stimulating the creation of loans such as the Liquidity Mining program, reducing interest rates,…

Summary

NFTFi protocols, especially NFT Lending protocols, are active and have seen strong growth in recent times. Each project has different development strategies, however projects are very active in asserting themselves through upgrades and community activities and this is a good thing for NFT Lending in particular and NFTFi in general.

As for other industries such as AMM or Derivatives, it still takes a lot of time to build and develop and will need more time to launch a complete product.