Of course, fundamental analysis is not a difficult phrase to understand in financial markets in general, but in the crypto market, people are still very confused about what are the factors to fundamentally evaluate a project. crypto and how will those steps be implemented? And in this article, I will share my personal views on basic analysis of a crypto project.

7 Steps to Complete Fundamental Analysis of a Crypto Project

In this article, I will share with everyone the 7 steps to complete Basic Analysis of a Crypto project. Not only that, I will also share with everyone how to read information, how to compare information and how to find information. Accurate, reputable.

We will basically have 7 factors to analyze with a Crypto project including:

- Project overview

- Mechanism of action

- Difference compared to competitors in the same industry.

- Development roadmap

- Investors & Partners

- Development team

- Tokenomics

Project overview

Docs of the Lido Finance project

In the Project Overview and Operational Mechanism section of the project, we will read the Document section of the project. Normally, Document abbreviated as Docs will be available somewhere on the project’s official website. If you can’t find it, you can google it with the keyword Project Name + Crypto + Document. At Docs, with the project overview, we must grasp some of the following main ideas:

- Which industry in the market does the project belong to? Like DeFi, Infastructure, NFT, Gaming, Social,…

- Which category does the project belong to in the above industries? If the project belongs to the DeFi segment, it belongs to AMM, DEX, Lending, Liquid Staking,… If the project belongs to the Infastructure segment, it belongs to Layer 1, Layer 2, Wallet, Bridge,…

- If the project is a Protocol or Dapp, which blockchain is it built on?

- Project features such as transaction fees, security, customer base, key products,…

- Identify projects in the same industry and with similar products.

This is a very simple thing for someone new to the crypto market, so everyone needs to understand it carefully when starting a new project.

Mechanism of action

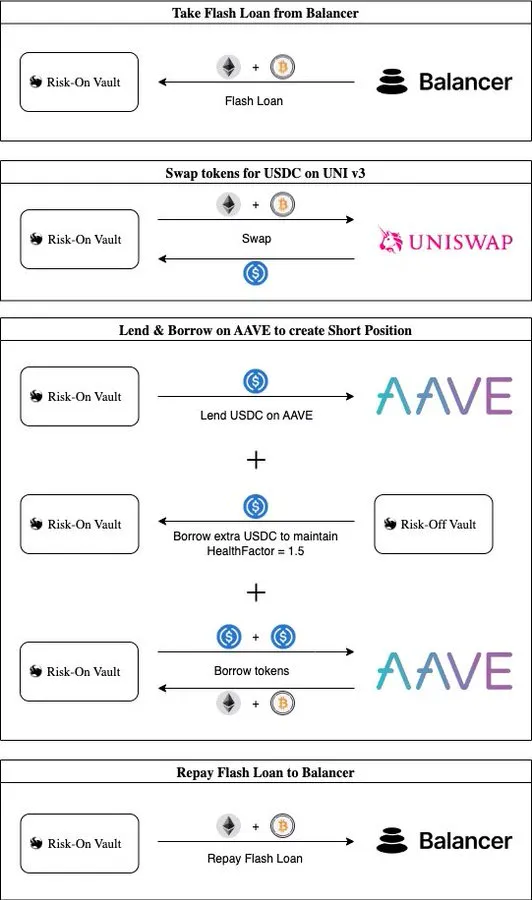

With the operating mechanism we need to understand 2 parts:

- User-side operations. In what aspects will users interact with the project? For example, users depositing assets into the Lending & Borrowing protocol, mint stablecoin users, users providing liquidity,…

- Working from the protocol side is hidden underneath the project. Like the project providing liquidity on another protocol, how the project implements lending,…

- Interaction activities between users on the project. Like users providing liquidity on Uniswap and the protocol sending back users LP Tokens representing liquidity in the pool,…

In the operational mechanism part of the project, we need to read and research carefully before making specific assessments as follows:

- What are the advantages and disadvantages of this operating model?

- At what steps and stages does this operating model pose potential risks?

At every step, we always need to have reverse thinking – Reverse Thinking to find unreasonable points, even unreasonable risks, impossible to do in order to find the bad points of the project.

For example: I have read and researched very carefully about the operating model of Rage Trade’s Delta Neutral strategy and found that it is very complicated, risky and especially very expensive and will not create much profit for users. use. I myself also contributed directly to the project and the project even betrayed and disparaged me. After 2 months, the project eliminated Delta Neutral products.

Difference compared to competitors in the same industry

After reading the Overview combined with the Project’s Operational Mechanism, we need to find projects similar to the project we are reading, such as:

- AMM: Uniswap, Sushiswap, PancakeSwap, Curve Finance, Balancer,…

- Lending & Borrowing: AAVE, Compound, Solend, Silo Finance, Radiant Capital,…

- CDP: Maker DAO, Parrot, Venus Protocol,…

- Liquid Staking: Lido Finance, Ankr, Stader Labs, Rocket Pool,…

Essentially, when a project belongs to the AMM segment, we also need to differentiate in detail whether it is a regular AMM or an AMM for Stable Assets.

In this section we need to answer some of the following questions:

- This project is similar to other projects in the same industry.

- What similarities does this project have with the largest projects in the industry?

- How is this project different from the biggest projects in the industry?

- Is the project’s differentiation effective, realistic and feasible? Does the project’s difference have a chance to break through to a leading position? Does the project’s differences pose any potential risks? What is different about the project and how long does it take to build?

Development roadmap

The development roadmap of each project is extremely important. For projects without a development roadmap, 90% of those projects are short-term projects, focused on profits and need to be clearly alert. . Normally, the development roadmap will be available in Docs or on the project’s Website. If not, you should ask the project’s development team in Discord.

Reading the project’s development roadmap, you need to grasp some of the following main ideas:

- Is the past development roadmap on the right track? If there is a delay, why?

- Is the future roadmap consistent with the protocol? Details or vague generalities like multichain development, UI UX updates,…

- Is the future roadmap feasible? Or the project is dreaming, drawing a roadmap within 1 year of mass adoption of crypto.

Investors and partners

For a new project, having potential VCs and Partners helps us evaluate part of the project. This is also a point that many people choose to filter hidden gems in the crypto market. However, with this section we need to answer some questions as follows:

- Over what time period, how much money, and at what valuation level do VCs invest?

- Pay special attention to what price VCs buy at to determine how much VCs have profited or lost at the current price? If a project’s VCs are x100, then when we buy x2, the VCs are x200 determine position is extremely important.

- What kind of VCs invest in the project? Are they long term or short team VCs, are they exchange VCs, are they famous MM VCs,…

- Are partners related to the project’s products? Is there project support in any aspect? Are partners really useful for the project or just for filler?

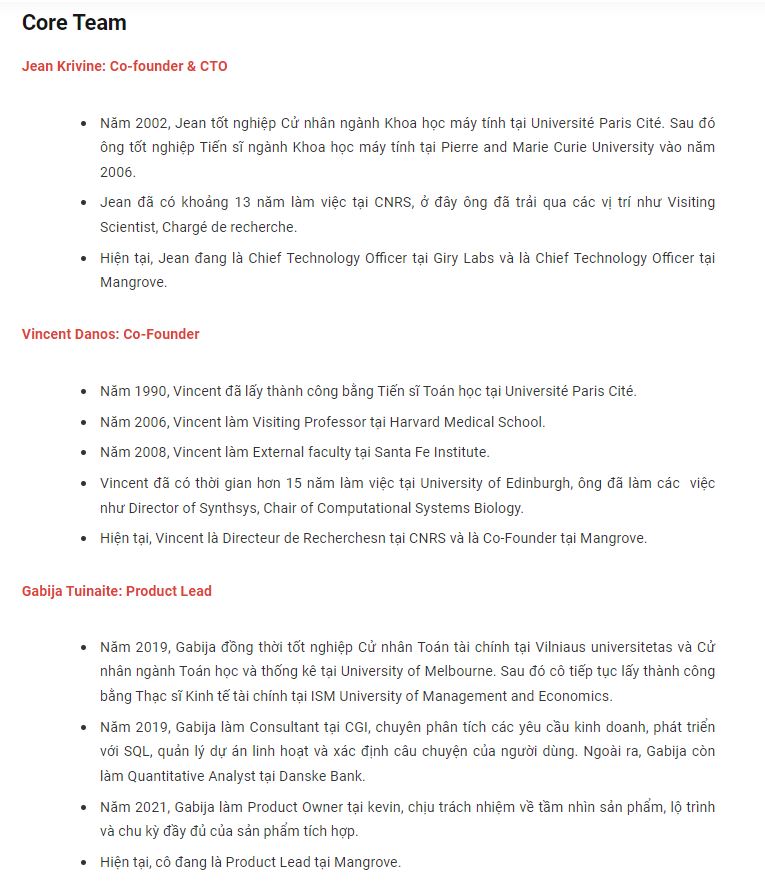

Development team

For Weakhand, investing in projects is investing in people. The people here are the development team. When learning about the development team on LinkedIn, we need to note the following main ideas:

- Must know the information of Core Team members such as qualifications, work history, experience and position.

- When did you join the crypto market and what was the first crypto project you worked on? About which field? Are there any achievements? What is the current operating situation like?

- Is the current project related to past projects?

- Has the development team ever worked together on any place or project? Is there a bond between each other? Do you have in-depth experience in your piece? For example: A CTO must have many years of experience working as a Software Engineer for many large companies, organizations,…

Above is how Weakhand’s team learns about the development team of a project in great detail.

Tokenomics

In the tokenomics section, there will be two main parts for us to observe and evaluate: Token Use Case, Token Allocation and Token Release. We need to answer some of the questions below:

- How to allocate tokens? Who is holding it and what is the ratio? Is the ratio reasonable? Like Core Team should be around 15 – 20%, VCs should be around less than 30%,…

- Allocation is one thing, then how to pay tokens? Are Core Team and VCs locked? If you don’t lock the project, it will be quite short-term. If you lock it for 6 months, on average, if you lock it for 12 months, it will be the best, but not all. Need to check big items like the team can sell tokens in other areas so it needs to be fully checked.

- Determine TGE time and token unlock times.

- What purpose is the project token used for? Does the project have any special token model? Is there any way to reduce inflation? Is there a revenue sharing program? In short, is there any way to limit the supply of tokens in the market?

Remember that we invest in both the project token and the project, so we need to have a comprehensive perspective, not just looking at tokenomics to invest.

Summary

Above are 7 factors so people can analyze and evaluate a crypto project in a basic and preliminary way.