After Azuki’s collapse, unrecorded profits on NFTPerp spiked. This caused the development team to discontinue the NFTPerp V1 version and make some modifications and improvements in the V2 version. So what’s special about NFTPerp V2? Let’s find out with Weakhand in this NFTPerp V2 review article.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is NFTPerp? Overview of the cryptocurrency NFTPerp

- What are NFTs? All about NFTs

What is NFTPerp?

NFTPerp is a decentralized Perpetual futures for NFTs on Arbitrum. The platform allows users to take Long or Short positions, speculating on floor price movements on popular NFT collections on the market at the moment.

Users can make trades with up to 5x leverage without requiring NFTs as collateral. Instead, they can use ETH and monitor the floor price fluctuations to make transactions.

For example: At the present time, the floor price of BAYC is 26 ETH on OpenSea. Buu Pro predicts that the price of BAYC will increase in the near future so he decided to execute a Long order with a volume of 1 ETH and leverage x5. If BAYC’s floor price exceeds 26 ETH in the near future, Buu Pro will make a profit and if below 26 ETH, Buu Pro will make a loss.

NFTPerp is solving key problems plaguing the NFT industry including:

- Many popular NFTs, such as BAYC and CryptoPunks are too expensive for the vast majority of web3 participants. Most people do not have more than 20 ETH available to purchase NFTs making these Blue-chip NFTs accessible only to wealthy individuals or whales while retail investors cannot access them. they.

- There is currently no way to hedge against price declines for certain NFTs or for those wanting to hedge their positions to short them.

- Traders find making a profit from trading on OpenSea challenging due to high platform fees and royalties that make it extremely difficult to make a profit in the short term.

Summary of NFTPerp V1

NFTPerp V1 version is designed according to the model Protocol-as-LP vAMM was launched on November 25, 2022 and quickly became the best place to trade NFT derivatives on-chain. During the 7 months of running the Beta version, NFTPerp generated a trading volume of 281,855.42 ETH (equivalent to 530M USD) with the participation of 2,576 wallet addresses and grew a Discord community of 9,000 members.

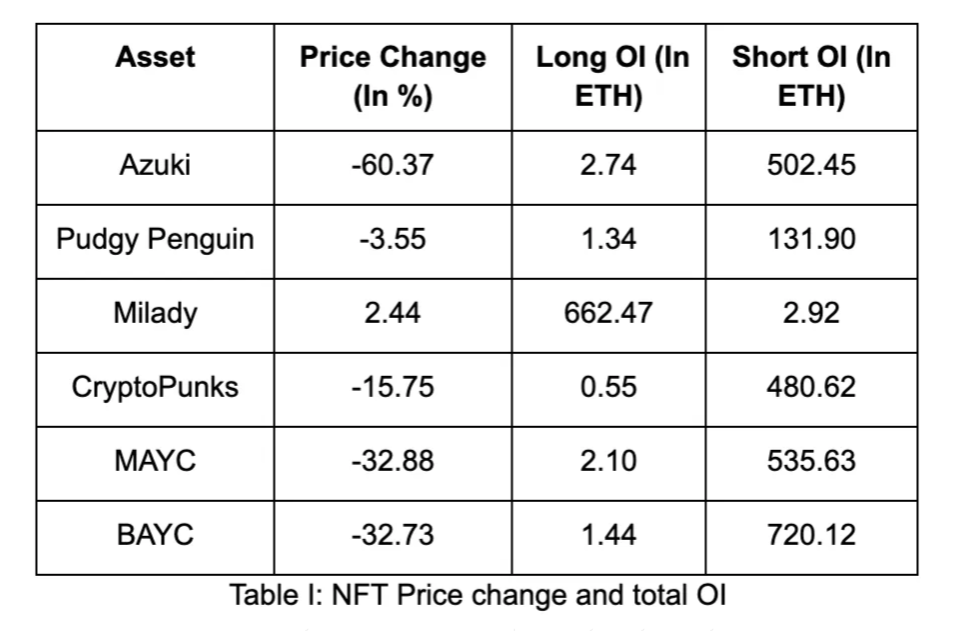

Between June 15, 2023 and July 6, 2023, the market saw many Blue Chip NFT collections plummet. Azuki saw a 60% drop while Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) dropped 32%. NFTPerp is one of the NFTFi platforms that allows traders to short-sell these NFT collections. This has been shown in the table below:

Long or Short volume statistics of NFT collections

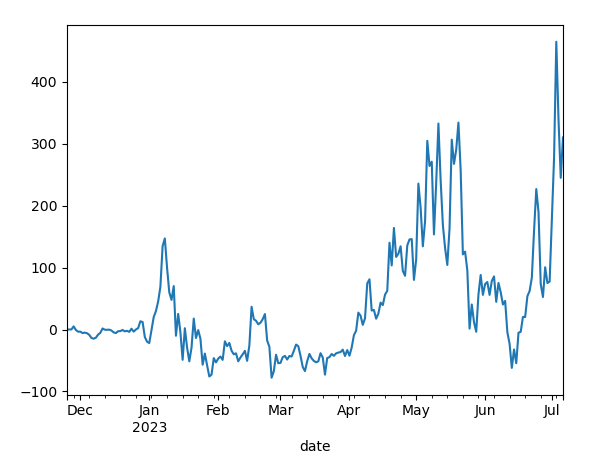

Traders mainly short sell (azuki & Apes Short OI > 99%) leading to currently significant unrecorded PnL. The amount of uPnL is shown in the figure below:

Unrecorded PnL of traders on NFTPerp

Not like the model Central Limit Order Book (CLOB) Requiring an equal number of long and short positions, the vAMM model realizes profits relative to the margin of open trades. In typical situations, long and short positions pay funding interest to each other. However, when unstable market conditions created an extreme imbalance between Long – Short order deviations leading to unrealized profit splitting.

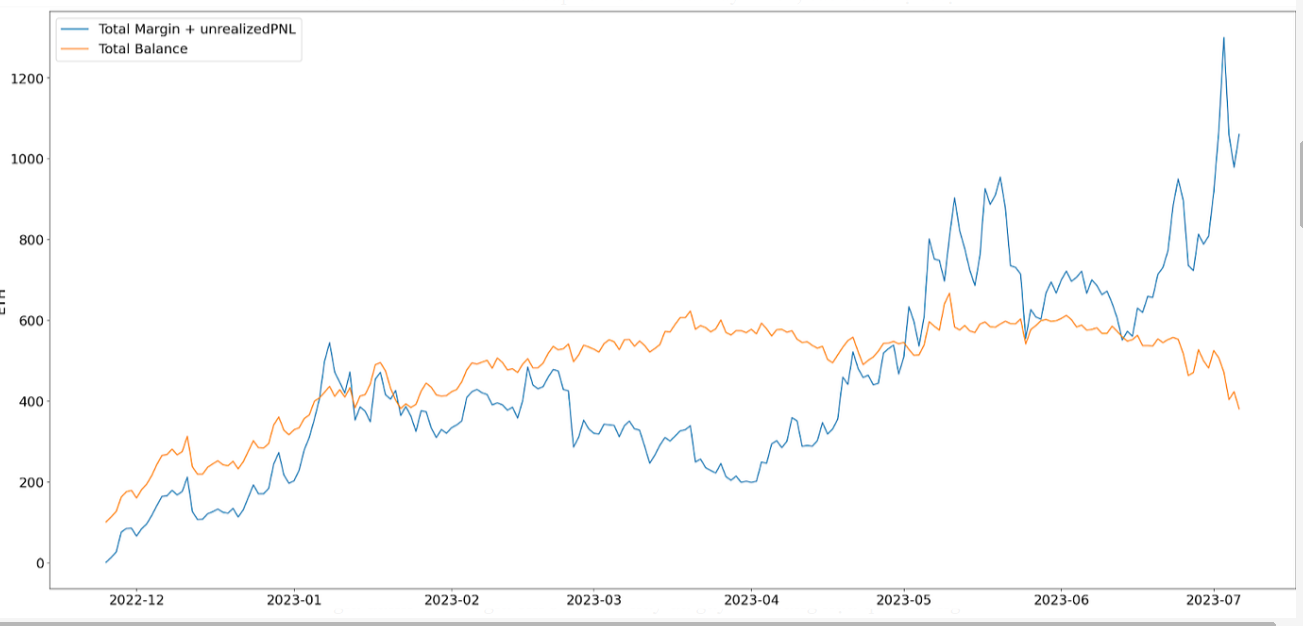

Total Margin + unrealizedPNL vs Total Balance

Aware of the limitations in its system, NFTPerp has made a concerted effort to ensure that the combined balance of the ClearingHouse and the Insurance Fund exceeds the total unrecorded PnL and margin of traders . However, the situation collapsed before NFTPerp could implement the revised solutions in NFTPerp V2. The cause of NFTPerp’s problem was unrealized profit segregation and a number of other issues also contributed.

- Before May 29, 2023, a position will be liquidated based on the tick price unless the tick index deviation is greater than 10%. On May 29, 2023, at block 95709527 NFTPerp updated the liquidation logic to include the mark price and index price. This caused unforeseen consequences when positions below the liquidation price could not be liquidated. Over the next few days, the volatility caused an accumulated bad debt of 46 ETH.

- On July 3, 2023, at block 107402794 NFTPerp deleted the Mark Price. This created a cluster of liquidations in Milady, and NFTPerp refunded those liquidations resulting in the insurance fund being depleted of 49 ETH.

The above problems were compounded by a shortfall caused by a sudden increase in unrealized profits due to sharp market volatility following Azuki’s collapse. This has caused the development team to decide to suspend the NFTPerp V1 version. This precaution is not only a response to current challenges but also a decisive action to avoid the risk of mass exits leading to traders ending up holding positions. Therefore, you will have to suffer a disproportionate profit difference.

uPnL Problem Solving For Traders

After an internal discussion within the Team, NFTPerp came up with some ideas for a compensation plan for traders with unrealized profits under the following two options:

- Option 1: Full compensation through vNFTP tokens (which will be converted to NFTP when NFTPerp releases the Token) at a discounted price of 0.053 USD – a 50% discount from NFTPerp’s current valuation. This would be equivalent to 1% of the total supply of NFTPerp if all users chose option 1.

- Option 2: 50% of the positive uPnL will be compensated to traders through the V2 insurance inflow and to ensure the insurance fund will have a positive growth rate, NFTPerp proposes to use only 10% of the inflow until the method Compensation under option 2 is completed.

One thing to note is that after consulting with community members who hold vNFTP Tokens and have supported NFTPerp since the early days, the development team has adjusted the vNFTP Token price of option 1 to 0.063 USD to maintain the trust of the community and investors in NFTPerp.

What’s Special about NFTPerp V2?

An important reason behind the problems of NFTPerp V1 is the lack of documented partners for conversion from uPnL to PnL. Ensuring this in vAMM requires a lot of conditions and can introduce many vulnerabilities later. Therefore, NFTPerp decided to completely remove Protocol-as-LP vAMM and switch to a Hybrid Protocol with the presence of Limit Order Books. This allows for design balance, less slippage, and guarantees for positions currently open on NFTPerp.

To ensure liquidity, NFTPerp has implemented an AMM and on-chain order matching engine to automatically split market orders into AMM and Limit order books. Additionally to ensure liquidity to the order book, NFTPerp created a Vault that LPs can deposit to provide liquidity to the order book.

summary

NFTPerp V2 was created to overcome the remaining shortcomings in version V1. Above is all the information that I want to introduce to everyone in this NFTPerp V2 review article. I hope everyone has received useful knowledge.