What is CPI? CPI stands for Consumer Price Index and is used to measure prices in areas such as housing, clothing, transportation, medical services, education, etc. So the CPI has an impact. Let’s find out about the economy together in the article below.

To better understand CPI, people can refer to some of the articles below:

- What is the FED? All About the US Federal Reserve FED

Overview of the CPI Index

What is CPI?

CPI stands for Consumer Price Index, which roughly translates to consumer price index, which is an index that measures the level of price change of a representative basket of consumer goods and services over time. CPI is calculated by dividing the total cost of the basket of goods and services in the current period by the total cost of the basket of goods and services in the base period, then multiplying by 100.

Some of the meanings of the CPI include:

- Measures of inflation and deflation: Inflation is the phenomenon of rising prices, while deflation is the phenomenon of falling prices. A rising CPI shows that inflation is taking place, while a falling CPI shows that deflation is taking place.

- Evaluate the purchasing power of money: When CPI increases, the purchasing power of money decreases, meaning people have to spend more money to buy a certain amount of goods and services.

- Basis for adjusting salaries, prices, taxes,…: When CPI increases, the Government often takes measures to control inflation, such as increasing interest rates, tightening credit,…

What is the formula to calculate the CPI index?

The consumer price index (CPI) is calculated using the following formula:

CPI = (Pt / Po) * 100

In there:

- Pt is the total cost of the basket of goods and services in the current period.

- Po is the total cost of the basket of goods and services in the base period.

Basket of goods and services is a collection of goods and services commonly consumed by people. The proportion of groups of goods and services in the consumer basket is determined based on the results of a survey on household spending. To calculate CPI, planners need to take the following steps:

- Collect data on prices of goods and services in consumer baskets.

- Calculate the total cost of the basket of goods and services for the current period.

- Calculate the total cost of the basket of goods and services in the base period.

- Calculate CPI using the formula above.

What are the factors that affect the CPI?

CPI is influenced by many factors, including:

- Prices of goods and services: Rising prices of goods and services will increase CPI.

- Proportion of groups of goods and services in the consumer basket: If the proportion of groups of goods and services with high prices in the consumer basket increases, CPI will also increase.

- People’s income: Increased people’s income will increase CPI.

- Government’s economic policies: The Government’s economic policies can impact the prices of goods and services, thereby affecting the CPI.

CPI is announced by whom and when?

The US consumer price index (CPI) is published by the US Bureau of Labor Statistics (BLS). BLS is an agency within the U.S. Department of Labor. US CPI is published monthly on the second Thursday of the month. However, there are still a few websites based on many different sources that allow investors to track CPI in real time such as:

- Bloomberg is a global financial information and data company. Bloomberg provides real-time CPI data from a variety of sources, including the U.S. Bureau of Labor Statistics (BLS), the U.S. Federal Reserve Bank (Fed), and private organizations.

- Yahoo Finance is a financial website that provides news, data, and analysis about the financial markets. Yahoo Finance provides real-time CPI data from the BLS.

Relationship between CPI and Inflation

Consumer price index (CPI) and inflation have a close relationship with each other. CPI is the official measure of inflation and deflation in many countries. Inflation is the phenomenon of rising prices, while deflation is the phenomenon of falling prices. The relationship between CPI and inflation is proportional. When CPI increases, inflation also increases. This is because when the CPI increases, the prices of consumer goods and services also increase.

However, the relationship between CPI and inflation is not absolutely absolute. There are some factors that can affect CPI but not inflation, such as changes in the quality of consumer goods and services.

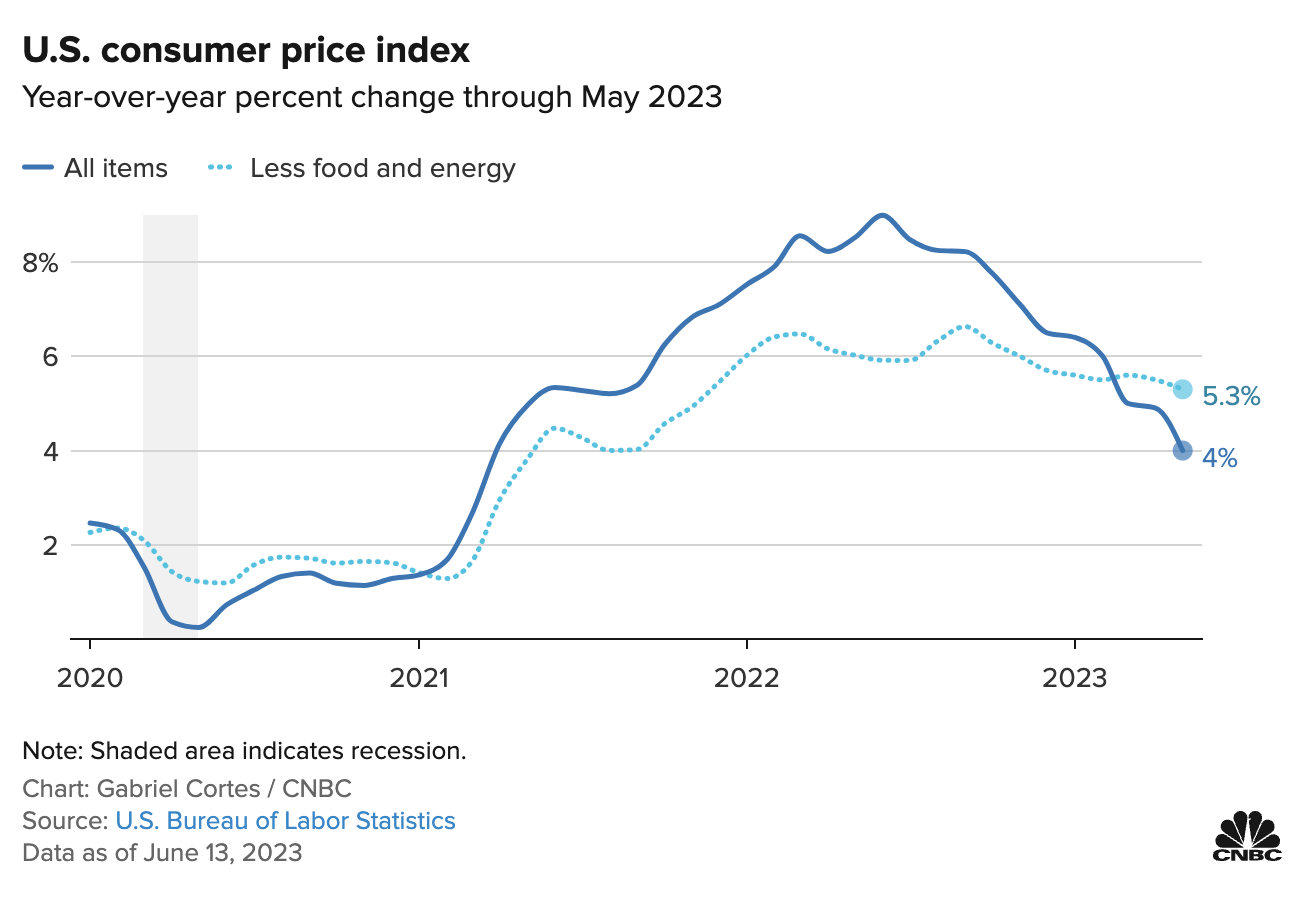

Difference between CPI and Core CPI in the US

Core Consumer Price Index, abbreviated as Core CPI, is an index that measures price changes of consumer goods and services, except food and energy. Core CPI is often used to measure core inflation, which is inflation excluding volatile factors such as food and energy.

Core CPI is calculated by dividing the total cost of the core basket of consumer goods and services by the total cost of the core basket of consumer goods and services in the base period, then multiplying by 100. Basket of goods and core consumer services are defined based on a basket of consumer goods and services, but do not include food and energy.

The main difference between CPI and Core CPI is that CPI includes both food and energy, while Core CPI only includes consumer goods and services other than food and energy.

|

Header

|

CPI |

Core CPI |

|---|---|---|

|

Define |

Index measures price changes of consumer goods and services, including food and energy |

The index measures price changes of consumer goods and services, excluding food and energy |

|

Ingredient |

Includes all types of consumer goods and services, including food and energy |

Food and energy are not included |

|

Purpose |

Measure general inflation |

Measuring core inflation |

|

Advantage |

Includes all factors that affect inflation |

Eliminates volatility factors, helping to measure long-term inflation trends |

|

Defect |

Easily affected by volatile factors |

Does not fully reflect the impact of inflation on consumers |

The Impact of CPI on the Economy

CPI index and the story about interest rates

Although the relationship between CPI and inflation rate is not 100% related, it is clearly closely tied. Today, most investors consider CPI to be the inflation rate and it is clear that the inflation rate will affect many issues such as:

- The increasing inflation rate causes interest rates to also be pushed higher to attract cheap money flow from the market.

- When deposit interest rates increase, lending interest rates must also increase, thereby creating pressure for businesses using bank loans.

- When lending interest rates are too high, it can lead to businesses going bankrupt, thereby pushing up the unemployment rate.

It can be seen that CPI has a very large degree of binding on the economy. In the US, CPI plays an important role in increasing and decreasing interest rates of the FED. Increasing or decreasing interest rates can lead to crisis or promote economic development. Therefore, in difficult days, investors often pay a lot of attention to this index.

It can be seen that CPI has a great influence on the economy through a direct impact on the increase or decrease of interest rates.

CPI index and life story

Certainly CPI will affect everyone’s lives, it just takes time and is not immediate like:

- Goods gradually increase in price. These days, companies follow the strategy of not increasing prices but reducing quantities. For example, $100 can buy a box of 100 packs of instant noodles, but now the box of instant noodles still costs $100 but only has 95 packs left.

- CPI can indirectly push unemployment to increase. Unemployment really leads to many consequences in life.

Summary

CPI is one of the important indicators in measuring the health of the economy. Hopefully through this article everyone can understand more about what CPI is?