Dopex is an Options project built on Arbitrum’s ecosystem. Options are considered one of the important pieces in Derivatives and are being built very strongly across the entire crypto market. Derivatives is one of the most invested segments on Arbitrum.

What is Dopex?

Dopex is a decentralized options trading platform built and developed on Arbitrum’s ecosystem. Dopex aims to minimize risks for Option Writers and maximize profits for Option Buyers.

The Dopex Difference

Some products that Dopex is providing

Dopex provides many pools with many different strategies (call/put) allowing users to earn passive income through providing idle assets to the pools. Currently, Dopex provides pools for various types of assets on Arbitrum such as GMX, DPX, rDPX, in addition to additional assets such as BTC, ETH, gOHM (Olympus DAO token brought from Ethereum) and Curve.

Users who provide their assets into the pool after each quarter will receive profits including revenues from insurance fees, project tokens from an incentive program that encourages users to participate in providing liquidity.

Dopex’s rewards are divided into two types: Action rewards and Function call rewards.

Dopex launches stabecoin DPXUSD

Overview of DPXUSD

All of rDPX’s key use cases will be built around a new native stablecoin, DPXUSD. DPXUSD is built based on the lessons that Dopex’s development team learned from Olympus DAO’s OHM stablecoin building model but with adjustments to suit the current market situation.

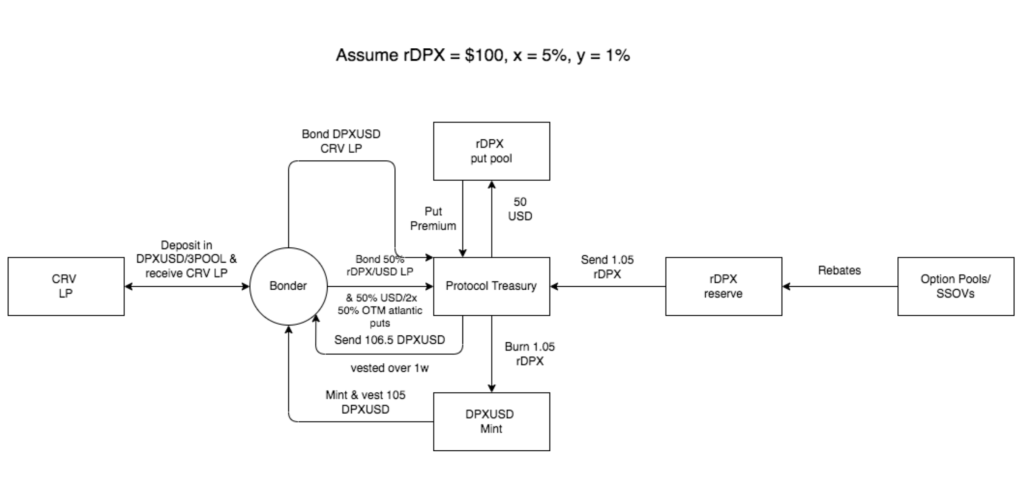

Working mechanism of DPXUSD

- Users will deposit their collateral into Tresury to be able to mint the stablecoin DPXUSD. Mortgaged assets are divided into 2 types as follows:

- 50% is LP token representing the liquidity pair of rDPX – USD that you provide on Curve Finance, besides 50% is USD. USD is stable coins such as USDT, USDC, DAI, MIM,…

- RDPX Atlantic OTM put option contract (Not touching the strike price) at a rate 2 times higher than depositing stablecoins according to case 1 above. These rDPX Atlantic put options contracts will be committed to being bought back in stablecoins by the Atlantic Put Pool, eliminating the risk of price drops or loss of liquidity.

- It can be seen that 75% of the total Tresury is USD (the major stablecoins in the market). These stablecoins will be brought to Curve Finance by the platform to provide yield-earning liquidity for Tresury. This strategy is similar to Olympus DAO with the popular term POL (Protocol-Own-Liquidity).

- Besides stablecoins, if the collateral is rDPX Atlantic OTM Put Options Contracts, premiums and profits will be earned from the Dopex platform.

- Tresury will have different strategies to generate maximum profits.

- The DPXUSD minted by users will be discounted with a certain %, depending on the business situation of the protocol at the time of minting. DPXUSD will also be paid in 5-day installments. DPXUSD will also have many different use cases so that holders can generate more profits from DPXUSD.

We will go through two examples to understand the activities and operations of DPXUSD.

Mint DPXUSD using rDPX LP as collateral

- Let’s say rDPX price is at $100.

- A user deposits 1 LP token and 200 USD (can be USDT, USDC, MIM, DAI,… or any stablecoin agreed to be used in the protocol through community voting).

- 1 LP token will include an equal amount of rDPX and USDC. If 1 rDPX is at a price of $100 then the LP token will consist of 1 rDPX and 100 USD.

- In total, users deposited a total of $400 worth of Tresury assets including $100 in rDPX and the remaining $300 in stablecoins. Total user assets deposited into Tresury are equivalent to 4 rDPX.

- The protocol will offer a discount of x%, for example 5%.

- So from $400 equivalent to 4 rDPX with a discount of 5%, the user will receive 4.2 rDPX.

- The protocol will burn 4.2 rDPX and send the user 420 DPXUSD, but will be paid in installments over 5 days, equivalent to each day the user can request 84 DPXUSD.

Share revenue from holding DPXUSD Curve LP

- After the user successfully receives DPXUSD from Protocol Tresury, the user can bring DPXUSD to provide liquidity on Curve Finance to receive DPXUSD Curve LP.

- With DPXUSD Curve LP, users can choose 1 of 2 cases:

- Will merely hold.

- Continue to bring keys in Protocol Tresury.

Both cases receive a revenue share from Protocol Tresury, but locking liquidity in Protocol Tresury gives you more than double the revenue compared to holding it normally. However, this revenue will be paid in DPXUSD and paid in installments within 7 days.

Core Team

The team building Dopex includes @tztokchad, @witherblock – Development team leader and Anon Team. I couldn’t find too much information about this team, but mainly anonymous activities on twitter mainly talk about Dopex and partner projects.

Investor

The project is invested in by names such as Tetranode, DefiGod, Ledger Prime, Orca Traders Patter, etc. To say the least, the above VCs will definitely not be in Top Tier 1. Dopex’s Investor group is not really that outstanding. !

But if you look closely, there are many similarities between the investors of the Dopex project and GMX.

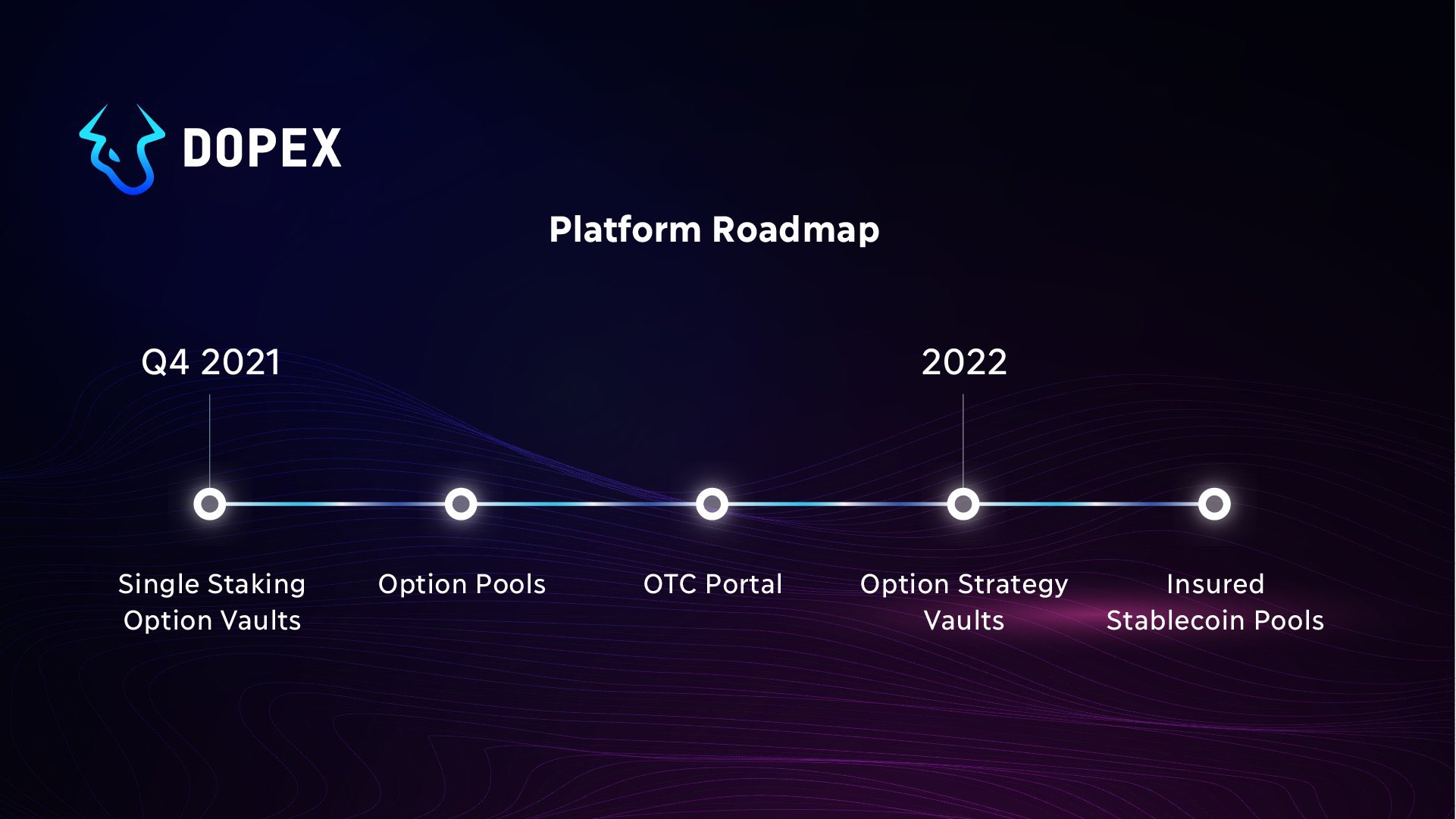

Development Roadmap

The project has announced tokenomics since Q4/2021 and by 2022, the project has now completed the first phase of 2022, a new type of vault, option Strategy Vaults.

Tokenomics

Basic information about DPX token

Total supply of 500,000 DPX tokens

- Token name: Dopex

- Code: DPX

- Blockchain: Arbitrum

- Token classification: ERC – 20

- Contract: 0xeec2be5c91ae7f8a338e1e5f3b5de49d07afdc81

- Total supply: 963,540,892

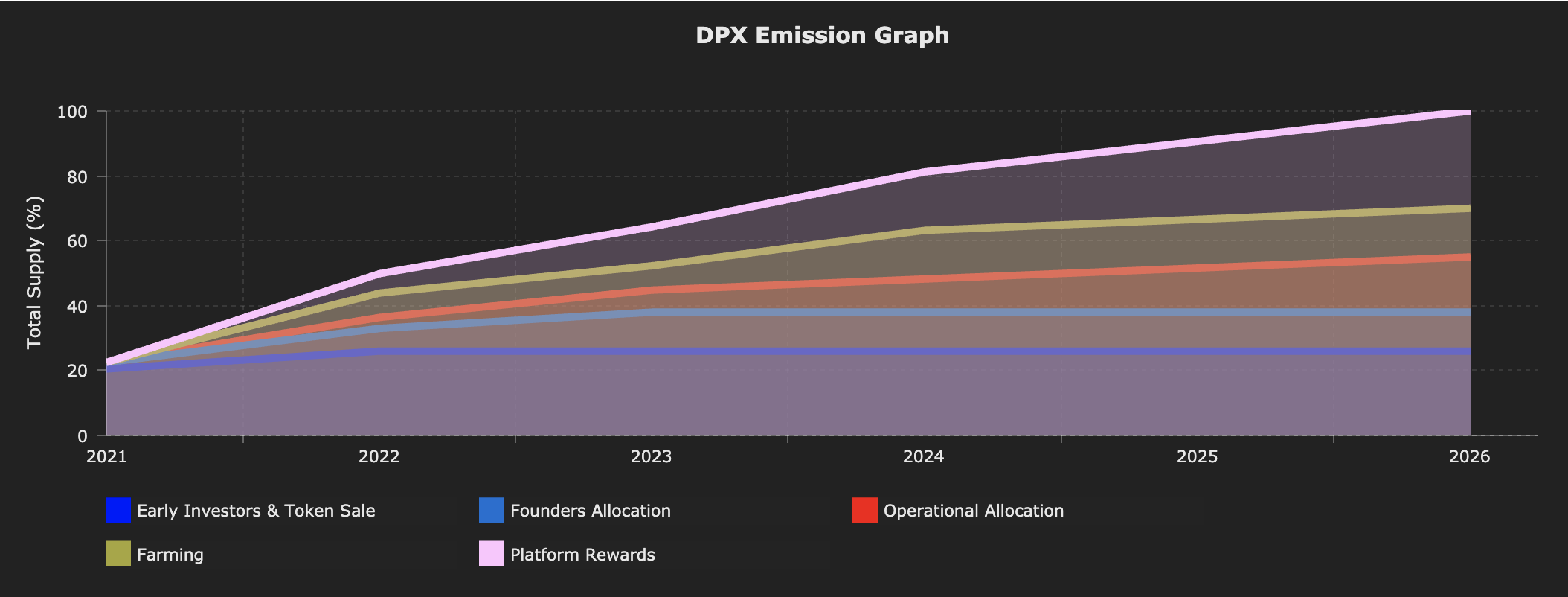

Token Allocation & Release

Core team: 12%. Of which the initial 20% will be available in the liquidity pool (the team can sell or farm), the remaining 80% will be paid in installments over 2 years.

Early investor (11%) & Token Sales (15%) with a total of 26%. Token Sales shares will be paid at TGE. As for Early Investors, 50% is paid immediately at TGE and the remaining vesting gradually over 6 months. According to my figure, by mid-2022, the project will have paid all to Early Investors. The remaining 50% of VCs are paid out at around $9xx and can be gradually liquidated to the current level of $2xx.

Liquidity Mining: 15% is paid in installments over 2 years and the large amount will be strongly bootstrapped in the first 4 weeks.

Platform Reward: 30% for organizing activities/events to attract users will be paid gradually over 5 years.

Operational: 17% paid in installments over 5 years. Used to encourage holders to participate in project governance.

Token Use Case

The highlight of the project’s tokenological design model lies in the use of the veToken model. Users can lock DPX into veDPX for up to 4 years (similar to Curve Finance’s model). So what do users get?

- Earn yield this is the inflation of DPX

- Earn protocol fees

- Voting. Voting will be similar to what Curve has deployed, in Dopex’s platform there will be many different Option Pools + DPX still has abundant supply to deploy Liquidity Mining + Arbitrum’s incentive in the future. So veDPX holders can vote to see which pool receives the most incentives.

The similarity here is that the players who want to hold a lot of veCRV are mainly projects and big players. Similarly, Option is also a product that mainly serves large organizations, so wars can happen here. The veDPX implementation wants to be efficient.

- The number of users must grow regularly => More transaction fees => Holder veDPX will also be more profitable.

- Incentive is reasonable to avoid DPX having large inflation and leading to liquidation + having an additional incentive from Arbitrum is best.

In addition to the interesting point in the veToken model, the project also deploys the dual Token model

- DPX: Governance token.

- rDPX: Tokens are minted to compensate for impermanent losses that protocol participants receive.

The dual token model helps participants, especially Option Writer, feel more comfortable but also does not cause the price of the project’s main token to be dumped. Dopex also created a number of use cases for rDPX that make it more valuable to users.

Currently, a platform built on the Convex idea, Plutus, has also been formed. Plutus is also actively collecting user DPX.

Exchanges

Update…

Dopex Information Channel

- Website: https://www.dopex.io/

- Twitter: https://twitter.com/dopex_io

- Blog: https://blog.dopex.io/

- Discord: https://discord.com/invite/dopex

summary

Options in general and Dopex in particular are still an extremely potential area of DeFi in the future and there are still many things that need to be resolved in the future.

The fact that Dopex can lead the Options segment on DeFi in general and the Arbitrum ecosystem in particular is also something many investors are interested in right now.